-

Posts

5,225 -

Joined

-

Last visited

-

Days Won

329

Everything posted by Abby Normal

-

Tax payment AND filing dates BOTH now 7/15, 1Q estimate too

Abby Normal replied to Abby Normal's topic in COVID-19

-

Clients who scan or photograph their records...

Abby Normal replied to Abby Normal's topic in General Chat

We don't print, we convert to Pdf with a right click installed by Nuance. I can take 10 pics, select them all, right click and choose combine as one pdf. Then it gives me a chance to rearrange them if I need to. I usually rotate and crop them in my Pdf editor, Nuance. FYI Nuance is now Kofax. -

Tax payment AND filing dates BOTH now 7/15, 1Q estimate too

Abby Normal replied to Abby Normal's topic in COVID-19

The headline was just updated: Treasury and IRS to delay tax payment deadline by 90 days -

https://www.cnbc.com/2020/03/17/treasury-and-irs-to-delay-tax-deadline-by-90-days.html

-

Clients who scan or photograph their records...

Abby Normal replied to Abby Normal's topic in General Chat

Nice! Thanks for that, TaxCPANY! I'll be using this for taking pics of receipts for my own business. That is when the restaurants reopen. Governor ordered all bars and restaurants closed until further notice today. St Patrick's Day would likely have been infamous otherwise. -

Here's a visual aid to help you compare SARS, MERS and COVID-19. You might want to crack open a Corona or Dos Equis (Ambar is my preferred), first.

-

I love them for being remote and paperless, but when the W2 is almost 3 ft x 2 ft, it triggers my patience mantra.

-

Well, Tom, the problem is that very few have been tested, and that was intentional by those in charge. Partly because they knew how bad it would be for the stock market and hospitality industries, both of which a certain "person" is heavily invested in. The problem with that approach is you can't bulls4!t a virus. You can't bully a virus. You can't payoff a virus to keep quiet. You can't threaten it or ask it to "do you a favor, though". You can't impugn it's character with baseless charges. You can't fool it with talk about God or fluff news pieces.

-

Cancelled the few appointments I have left and I'm working from home. I'm in a high risk group and I already have an over-reactive respiratory system. Plus I've always been a 'better safe than sorry' kinda guy. I'm actually more productive at home, due to fewer interruptions and no phone ringing all day. Plus I save an hour a day on the road.

-

ATX gave me the full 500k exclusion (married) but it made part of the gain taxable, perhaps because it was a rental when it was sold?

-

Because prize drawings are not gambling. That's why it's not on a W2G.

-

So I got to do my first one of these, where the home was used for more than 2 of the past 5 years, but rented for less than 3 years when it was sold. First off, it was a bear getting ATX to magically show all of the hidden lines I needed, but after I figured it out, ATX wanted to make part of the gain, in addition to the depreciation amount, taxable. Is that right? I thought you just reduced the 250K per owner exclusion, which ATX did not do. The total gain was about 30k. The deprec was about 9k. ATX used the percent of non personal use over the entire ownership period of about 23% time the 30k gain, or about 7k, and added to that the deprec of 9k for a 16k reportable gain. Is ATX right?

-

Maybe you're wrong and it belongs on line 4.

-

If the gain(loss) is right, I don't worry about it.

-

It takes 15 seconds to close then restart ATX. Your choice: curse the darkness, or light a candle. Correction: 10 seconds.

-

Section 179 can only be used if your rental activities qualify as a business for tax purposes. You can’t use it if your rental activity is an investment, not a business. Owning rental property qualifies as a business if you do it to earn a profit and work at it regularly, systematically, and continuously—either by yourself or with the help of a manager, agent, or others. Rental ownership, on the other hand, is an investment, not a business, if you do it to earn a profit but don’t work at it regularly, systematically, and continuously. There is no set number of rental units you must own to qualify as a business. The courts have held that ownership of a single rental unit can be a business. https://www.nolo.com/legal-encyclopedia/section-179-expensing-rental-property-owners-deduct-long-term-asset.html

-

Treasury considering extending 4/15 tax deadline - coronavirus?

Abby Normal replied to ILLMAS's topic in COVID-19

I already have plans for the 16th thru the 19th. -

Treasury considering extending 4/15 tax deadline - coronavirus?

Abby Normal replied to ILLMAS's topic in COVID-19

Now we just need to lock our doors and have clients slip records through the mail slot, or do everything over the internet. -

Yep. We have to know the tax code and the software code.

-

Except, as jklcpa already noted, the Sec 121 exclusion maximum is reduced, depending on how many years it was used as a residence and how many years it was rented.

-

Please don't call. It's been this way for years, and will never be fixed. Leave the phone lines open for those who really need it.

-

The only time I have restart my computer is when the server computer has crashed. ATX works better with a fresh workstation restart after the server has been restarted.

-

Often, a revocable trust becomes irrevocable at death, but I've never obtained a new EIN for the trust. I think the lawyer screwed up and I would ignore or cancel that EIN. The EIN for the estate is the return that you will file and the trust will be a part of the estate. Be aware, you're supposed to calculate the DNI and income distributed separately, as if they were two separate returns. The only time the 645 election makes sense is when the estate is fiscal year, because then the beneficiaries get to defer income for a year. It also helps to match income with expenses and distributions in the fiscal year, so you don't have a lot of income but not expenses or distributions.

-

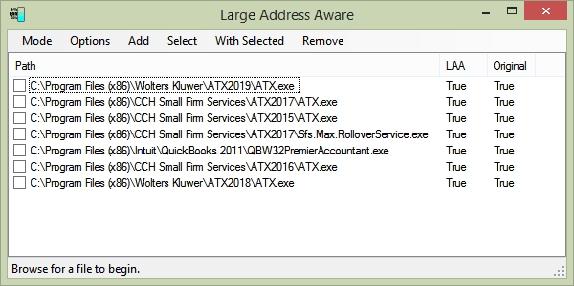

The solution is simple. Close and reopen ATX as soon as you notice a little slowing. I never work on one return for more than half an hour before I close that return and reopen that return (not the program). And I never work in ATX for more than two hours before I close and restart ATX. I would assume that ATX added the correct atx.exe files to Large Address Aware, but if I were you, I would run LAA and see what files are in there and if both columns (Advanced tab) are set to True.

-

This is my own personal experience.