-

Posts

5,225 -

Joined

-

Last visited

-

Days Won

329

Everything posted by Abby Normal

-

No, they are different versions. I've always just used laa_2_0_4.zip. I'll have to add that to my instructions. Thanks!

-

I had a couple of sharks sitting in my office, and I got so mad, I stood up, slammed my hand on the desk, and said, "Look. Pay me whatever you think is fair and get the F*** OUT OF MY OFFICE!" They silently laid a check on my desk and left without saying a word. My employee sitting at reception... her eyes were as wide as saucers. Felt good. Felt really good. Those sharks soon left town after wearing out their welcome with everyone, and almost bankrupting a local nonprofit they were 'managing'.

-

Is this just fantasy?

-

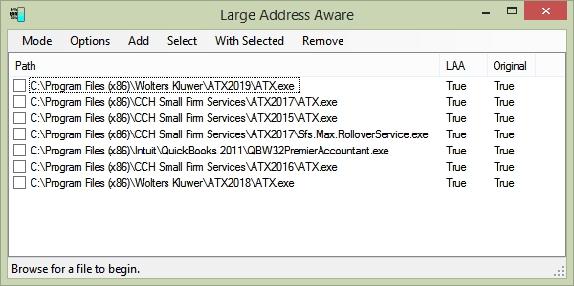

Large Address Aware (LAA) Utility Instructions Download site: https://www.techpowerup.com/forums/threads/large-address-aware.112556/ 1. Extract Large Address Aware.exe from zip file to a new folder under Program Files(x86) 2. Start LAA and switch into Advanced Mode 3. Add recent ATX.exe files (Add menu>Files) Browse to: C:\Program Files (x86)\CCH Small Firm Services\ATX2017\ATX.exe C:\Program Files (x86)\Wolters Kluwer\ATX2018\ATX.exe (Add as many prior years as you like.) 4. Check all boxes then using the 'With Selected' menu: Force Large Address Aware Set Original to True (if needed) Both columns should say 'True'

-

In Late Filing tab, set due date to 7/15/20. Do this for states, too. The above will show the payment due date as 7/15/20 for any balances due, or return due date if paper filing. Edit the estimate letter and replace the 1st qtr est due date variable with return due date variable. Save for future returns. Find or make a return with an IRA contribution. When the IRA section of the federal letter magically appears, replace the due date variable with the return due date variable. Save for future returns. You'll have to discard/re-add letters for all returns except new ones.

-

- 2

-

-

-

Yes, the rules for like kind exchanges are very strict. He must pay the taxes. Tell him that's his punishment for not calling you first. A 5 minute phone call could have saved him 20 grand!

-

They're 'mental health aids'.

-

Absolutely! Absolut-ly?

-

First, I think you care too much what the letter says. Like grandmabee, we print the letter, returns and efile forms before the client comes in to sign. Secondly, ATX has never been good at deciding. You see that 'paper filed' box? ATX added that after I bitched that it was too much trouble to get the paper filed letters to magically appear. So, if you want to say has been efiled, just check that box.

-

Turn off the ringers on your phones.

-

Wow. I've NEVER printed a return that large. In ATX, I pretty much just give the client forms and very few statements or worksheets. I PDF all of those for myself in a separate return. Having a slimmed down PDF for banks and other third parties, is also a good idea.

-

All income, tax and nontaxable, increases stock basis. All deductions, deductible and nondeductible, decrease basis, as do distributions, of course. Just not below zero.

-

Accountants and bookkeeper are considered essential, and liquor stores can make deliveries.

-

https://baltimore.cbslocal.com/2020/03/23/coronavirus-latest-maryland-governor-hogan-closes-all-non-essential-businesses/

-

Hogan just announce all non-essential business, groups and organizations closed, but stopped short of a shelter in place order. More aggressive policing of groups gathering in public has been ordered.

-

Tennessee is putting restrictions on business and gatherings. https://mobile.twitter.com/GovBillLee/status/1241757130090328064

-

You can edit the cover sheet (and any letter) to be however you want it. Do this in any open return, save it for all future returns, then just discard and re-add the cover sheet in all rolled over returns.

-

I gave myself a stay at home order over a week ago. I really like working from home because the phone's not ringing and people aren't interrupting me. Much less stressful. One employee will be in the office every day, but the door is locked and all documents must be dropped in our mail slot. I'm trying to get most clients to accept a PDF of their returns and efile signature forms. I also downloaded my bank's mobile app so I can deposit checks electronically. #BetterSafeThanSorry

-

I would've bet a thousand dollars that this was a whack job hawking questionable products and I would've won that bet. If you want 'real info, listen to Gaslit Nation.

-

This is a garage building for a residential property. I'm sticking with 27.5 years.

-

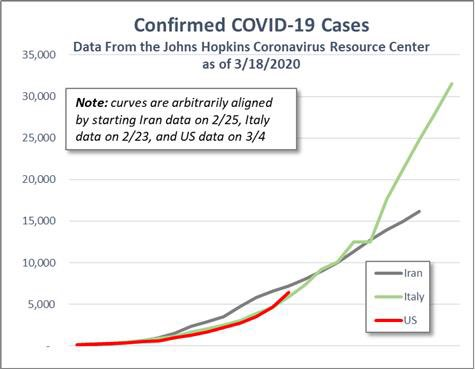

We're still on a similar track to Italy and Iran. Finally, the feds agreed to let local health dept's run their own tests. Why they were blocked for so long is anyone's guess.

-

What if it was just a space on a grass/dirt field? Joking aside, because it's a building, I would go with building at 27.5 years.

-

Following to see when @Jack from Ohio reports back in.