-

Posts

5,223 -

Joined

-

Last visited

-

Days Won

328

Everything posted by Abby Normal

-

Sch B. 1099-INT.

-

Option 2 so you don't get a matching notice on the 1099-S. 8949 Code N-Nominee adjustment

-

Do the people who send out these tiny booklets really think they're of any use to anyone? I guess they're just trying to reduce their paper, toner and postage costs, but, seriously, I could probably read this in my 20s, but now? Ha!

- 1 reply

-

- 6

-

-

-

I've got my clients trained pretty well to not use staples. I have a sentence in bold in my organizer letter that asks them not to use staples. It's cut way down on the stapled documents we receive.

-

Social Security Income - Part C Medicare Advantage Deduction

Abby Normal replied to Yardley CPA's topic in General Chat

We enter all medicare premiums directly on Sch A and label them as such to avoid confusion on the organizer next year. -

-

Close ATX before every big print job. I do this on my large returns because, even though I've never had it crash while printing, the printing is really slow on large returns if I've been working in ATX for awhile.

-

You will need more than one bulk sale because you can't mix 1245 and 1250 assets, and land has to be sold separately, so you'll need to allocate sales proceeds and selling costs.

-

The extenders have been a thorn in our sides for too long. Let them die or make them a permanent part of the next tax legislation.

-

I'd give the client a list of returns and worksheets that I need from the prior preparer and that I can't proceed without these documents, unless they want to pay me an extra grand or so.

-

There's a worksheet for telling the IRS how to divide estimated taxes. Ln 66s, Sch 5 Est Tax Div Stmt. I've never had to use it.

-

I never enter C or DD either. Just the retirement and HSA codes.

-

Pffft. We don't call them until August or September. Ain't nobody got time for that!

-

Try deleting the sfs.cache folder in your user folder under AppData (hidden) Local Temp. I have a shortcut to it on my desktop: C:\Users\Abby Normal\AppData\Local\Temp\Sfs.Cache

-

Or just print everything to PDF. An added bonus is that you'll use less toner. When I printed a few forms directly from ATX, I noticed that everything was much darker and heavier than when I print from PDF. Also, the PDF gives you a way to review what's going to print before you print it.

-

You can delete the newly created ones from your efile manager. They are duplicates and are not needed.

-

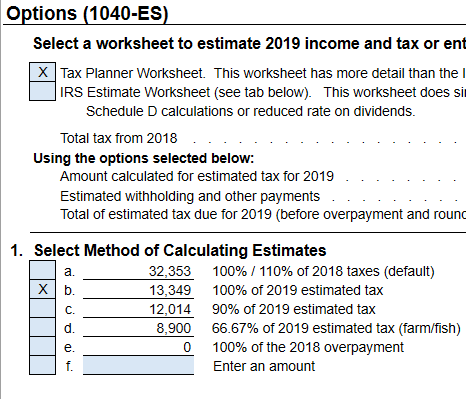

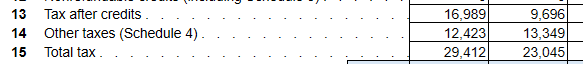

When you base estimates on the planner, 1040-ES is getting line 14 from the planner instead of line 15 total tax. In the example below, line b should be 23,045, not 13,349. You can fix this with a link in customize master forms.

-

- 1

-

-

Inherited 401k's don't have special rules AFAIK.

-

Yes, thanks! This has been very informative.

-

Well, . Good thing it's still sitting here! Thanks!

-

Small business taxpayer. A small business taxpayer is not subject to the section 163(j) limitation and is generally not required to file Form 8990. A small business taxpayer is a taxpayer that is not a tax shelter (as defined in section 448(d)(3)) and has average annual gross receipts of $25 million or less for the 3 prior tax years under the gross receipts test of section 448(c). A pass-through entity that is a small business taxpayer does not allocate excess taxable income, excess business interest income, or excess business interest to its owners.

-

When 17 was filed, taxpayer had not yet decided if they wanted to leave it as a nondeductible or convert it to Roth. Unfortunately, they also had other traditional IRAs, so a good portion of the conversion ended up being taxable, and they still have nondeductible basis left.

-

You can add a note to any field with Ctrl+T. Or use right-click menu or Edit menu.

-

https://www.accountingtoday.com/news/irs-expands-underpayment-and-underwithholding-relief-for-more-taxpayers-to-80-threshold?feed=00000158-20c2-d6a2-adfb-70eb85460000

- 1 reply

-

- 2

-