-

Posts

5,217 -

Joined

-

Last visited

-

Days Won

328

Everything posted by Abby Normal

-

We double duty our 2nd line as a fax line. We don't answer line 2 unless it's a rollover and we know it's not a fax. We can actually receive a fax on both of our lines, which is helpful when clients dial the wrong number. Both lines forward to efax if we don't answer.

-

Paper faxes? Or does it save to PDF?

-

But I didn't take any money out of the brokerage account so it's not income, right?

-

With the new higher standard deduction, this is becoming more routine for us.

-

It doesn't have an option to just save the PDF to your computer? Seems odd that it has to be emailed.

-

My efax number is long distance, but people just call my local number and if I don't answer (or if all lines are busy), it forwards to my efax number which can handle both voice mail and faxes. I got a special price because the service I was with (MaxEmail) got bought out by efax. I think I'm paying 64/yr. There's nothing out there that I've seen in that price range.

-

I've had the IRS ask if I had the fax machine nearby so it was secure. I just lie and say yes. It's a little awkward when they ask if the fax is coming through and I have to go check my efax site. I just put them on hold. But I've had zero success with the IRS faxing me anything. My phone doesn't even ring. They end up mailing it to me every time.

-

The 8919 also saves the employee one half of the SE tax.

-

Let 'em rip. I did and they all went through. The hung ones said they were at EFC which is ATX.

-

What kind of trust was it? What happened to the trust at date of death, if anything.

-

8919 code H

-

If shareholder has wages from S corp, enter wages on the appropriate line of the worksheet.

-

Acks are flowing like sweet, sweet wine!

-

I keep having to uncheck the exclude box next to my assets in that worksheet. WTF?

-

Noon tomorrow.

-

Yes, it needs to be a PDF. Use the efile menu to attach PDFs to a return. Or just skip it. No one at the IRS is ever going to look at your PDF. Plus the PDF may be so large you'll have problem efiling it.

-

No problems here!

-

Yes, notes are assigned to a field. We use the date field at the top of page 1 on all returns for our general notes, since it's convenient and a field we almost never use. Review type notes should be in the field or form they are related to. Some users add the Permanent File form and type notes on one of the blank pages, or a blank statement page of the Elections form, but notes show up when you review a return and to me are the preferable way to go.

-

You enter the excess distributions in 4th column 'Differences' as a positive number.

-

Yes. There are permanent notes where we keep extensive info on the client, from the trivial (nicknames) to the crucial (don't forget state subtraction for ...). And there are review notes that must be cleared before you can finalize a return. We print the permanent notes to the back of our 'job sheet' for each return and check them off as we do them.

-

-

-

Click on the distributions line of M2 and press F6 to jump to the reconciliation. The tab is called Sch M-2 (1120S) - Retained Earnings.

-

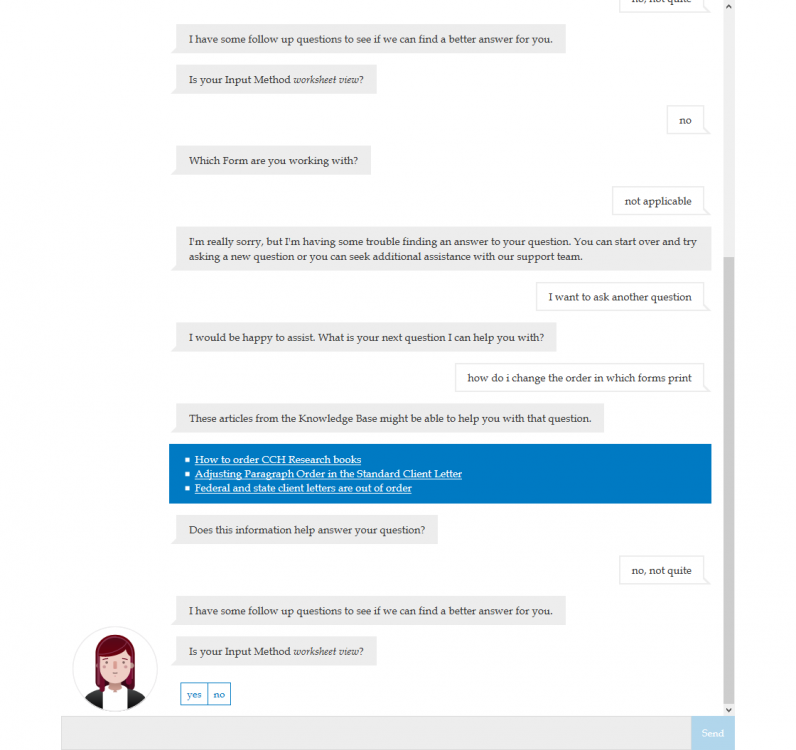

Changing form order for pdf printing

Abby Normal replied to Margaret CPA in OH's topic in General Chat

Highlight the form you want to move and press Ctrl+ up or down arrow. You can permanently do this in print packet edit as well, but that only helps new returns... unless you uncheck remember, print, close, re-open and print again (check remember at this point). -

Can this be translated for me, please?