Leaderboard

Popular Content

Showing content with the highest reputation on 02/25/2018 in Posts

-

2 points

-

Same here. QB may have changed, but years ago, in the off months, if we didn't use it, they charged a $35 low usage fee! You wouldn't think it would cost them so much for me to not use it.2 points

-

2 points

-

Thanks for the reminder, cbslee. I'd posted that IRS release with the examples you are talking about, and the forum is so active now that it's already dropped in the postings. The pinned post at the top of general chat with resources on the JCTA now also contains a link to the IRS statement, and for those that don't trust links to the outside, I included a link to my earlier topic on this forum that has the entire text of the IRS release including the examples.2 points

-

I'm sorry you and the others had to deal with that. Our work is stressful enough without that kind of drama and worry.2 points

-

You should be proud of yourself for only one incident of excessive vulgarity/profanity. If it wasn't excessive it would just be routine and normal and not even get an honorable mention. Proud of you brother, keep up the good work!2 points

-

I agree in a general sense, but in the case Pacun described, he made it sound like the TP didn't lose employer coverage, but rather the TP chose to purchase on the Marketplace and is receiving the APTC. If this is the case and the TP was still eligible for the employer-sponsored plan, then unless the $800 cost to TP of employer's plan is unafforable, then wouldn't this person's repayment of APTC be the full amount without limitation, unless he can show that the $800 employer plan's premium is unafforable? We can't determine afforability because it wasn't stated whether the $800 monthly premium covered only the employee or if it included spouse or family also. Obviously, the extra $40K of 401K distribution to the wife, if I understood that correctly, changes the entire repayment scenario since there is no way that the couple's income wouldn't exceed the 400% FPL.1 point

-

Your cousin is NOT a related party. Your cousin is nothing more than your friend.1 point

-

One interesting wrinkle that I read about several days ago. Scenario: Two houses - First is the taxpayers home borrowed $500,000, second is a vacation home borrowed $250,000 so the combined amount is within the $750,000 limitation. 1. Taxpayer has a 1st mortgage of $500,000 secured by home # 1 and another 1st mortgage of $250,000 secured by home # 2 resulting in all mortgage interest being deductible. 2. Taxpayer has 1st mortgage of $500,000 secured by home # 1 and 2nd mortgage of $250,000 also secured by home # 1 but the proceeds were used to buy home # 2, in this case only the interest on the first mortgage is deductible because the 2nd mortgage proceeds used to buy home # 2 was not secured by home # 2.1 point

-

Thanks Judy. Even with your reply it took me a while to "wrap my head around" this. (senility is wonderful). Basically no grandfathered loans (just because money was allowed as a HELOC and deductible in the past --- does not mean now. I was trying to read into the new law that all prior to 2018 was allowed with the starting 2018 (new loans) being the only ones under the new law. Finally, I understood ----- basically the government even with what might be an implied contract (NOT POLITICAL -- ALL government) changed the "terms" in mid-stream (so no grandfathering) going forward to the terms they (government) wanted. MUST be nice to be the government and change what you want regardless of what was assumed. (I know what does "ass u me really mean. Thanks agin. cloud lifted and rant over. Be well, Ed. Appreciate the patience1 point

-

Oh heck, yes; perfectly nice agent promised me several years of transcripts yesterday morning, 7:20am -- had got into Practitioner's Hotline by 7:01am (with, yes, only a 1-minute wait). Last thing, last night I finally whinged to my spouse how disappointed I was; did the agent mis-transcribe my fax number (how come they seem never to read it off the 2848 or 8821)? Whom should I report my missing faxes to, too? Interestingly, I was resorting to PPS because e-Services had barred me for allegedly entering incorrect logins thrice, the day before. Well, even had I mis-typed the login the first time, I certainly hadn't, the second time. When I called that 'third strike' false to an e-Services Helper an hour later, he told me that e-Services recalls our errors for *weeks* now. And, yes, I had mis-typed a login some time ago in the misty past. (Sic)1 point

-

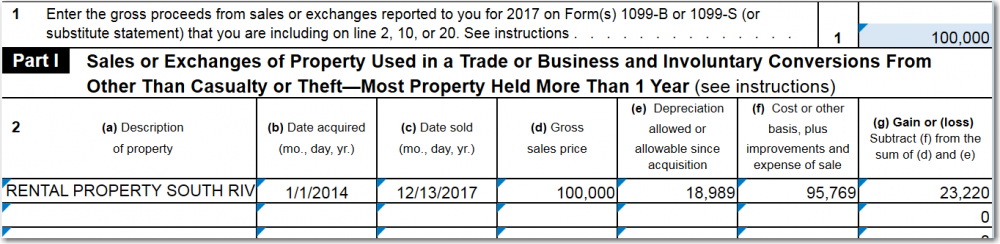

Not unusual at all. Be sure to allocate a portion of the selling expenses to each component included in the sale.1 point

-

I prorate the sale proceeds between building and land based on the same percentages they bear to total cost basis. If any furniture, fixtures, appliances were on the depreciation schedule, you have to deal with those too.1 point

-

I would break out land for part 1 and put house on part 3.1 point

-

A discount to a good tenant who won't trash the place can be allowed. True below market rent to a related party is simple personal use. Line 21 income, no expenses.1 point

-

Then, personal use rental, below FMR to a relative. Haven't done one of those for a long time. I don't think you depreciate....1 point

-

From that... to Tax Stud. What growth you have shown! LOL! Rich1 point

-

Hey, it was my first tax season with ATX. Swearing was the only way I could get through it. I had to enter all assets because none of them converted. And then the letters. Oh, the letters...1 point

-

1 point

-

1 point

-

1 point

-

I think you will to use Sch D but before that need to enter the basis of the property. Don't forget to include 1/3 of the land that was not depreciated.1 point

-

Golconda citadel and fort, near Hyderabad, India. It's a fascinating place with breathtaking views and a unique history dating back to the 1300-1400's A.D.1 point

-

1 point

-

Turned out that the problem was not with the EIC but the child tax credit. Any how I just moved everything to Schedule C-EZ and problem solved.1 point

-

1 point

-

It is a full year calculation. This is one of the pitfalls (critical oversights/flaws/stupid law crap) of the ACA. You have to estimate your future income, and the penalty for not knowing the future at the time you sign up can be financially devastating to the taxpayer. I am not being critical of the politics, just the actual law as it is written. It is unfair to the TP to make their estimate of income the determining factor in the amount of a tax credit that will need to be repaid if the estimate is incorrect. Getting off my soapbox now. Tom Modesto, CA1 point

-

So, yesterday, my husband and another attorney had to escort this client out of the office when he came in to pick up his tax documents. He told the guy to never step foot on the property again. What a pleasant way to start my afternoon!0 points