Leaderboard

Popular Content

Showing content with the highest reputation on 03/24/2019 in all areas

-

If he is an employee, home office expenses used to go on Sch A under the 2% miscellaneous. That section of Sch A has been deleted, so no where for an employee to claim a home office. If he is a 1099-Misc worker, he can claim home office on Form 8829, provided it is used regularly and exclusively for business.3 points

-

Probably not as permanently disabled but they qualify for Qualifying Relatives. They would have had to lived there all year. Your client will be bankrupted by rehab costs, I've seen it happen too many times.2 points

-

Whoever changed the title on this post... THANK YOU. Very helpful!!!!2 points

-

I meant to say this and I forgot. Thank you Lion. DO NOT prepare the two returns and see who gets more benefit. START by determining who can claim the "exemption" for the student. If the rightly owner of the "exemption" doesn't not claim it, NO ONE can claim the "exemption" of the student and REMEMBER that the refundable credit follows the "Exemption". I was hoping Lion was going to say if a student with living parents, single 19 years old, who provided more than 50% towards his own support qualified for the refundable portion. My clients (sorry to say... latinos like me), seem to qualify for the refundable credit as long as they provide more than 50% towards their own support.2 points

-

I don't think there is anything you can do. If business return, they will apply to back business taxes and then to employment taxes. If 1040 overpayment, they will apply to back 1040 taxes and then to trust fund penalties...1 point

-

1 point

-

If it was a trustee-to-trustee rollover from same kind to same kind of retirement plan, then you won't see any paperwork at all, most of the time. Ask some questions, such as, was that a traditional IRA going into a traditional IRA?, so you can make sure it was actually rolled over in the timeframe, doesn't need to be taxed (think TIRA to Roth IRA), etc. From where and to where was she moving such a small amount of funds, relative to her FMV and usual distribution amounts, anyway?1 point

-

Yep, multiple items to tick off to qualify to claim own exemption OR to claim AOC if could be claimed by someone else as a dependent OR to claim refundable credit OR.... I sometimes latch onto the ONE item that's the sticking point in one particular situation and don't enumerate all the other points that have to be met. Sometimes, I'm focusing on what I find difficult in the situation and not necessarily the issue the OP wants clarification for.1 point

-

1 point

-

if they are living with a parent. then at least one parent is alive SO NO refundable credit (see above and Pub 970)1 point

-

If the parent(s) could claim the student but do not, the student still cannot claim himself but can claim the nonrefundable AOC. He cannot claim the refundable credit until he qualifies to claim his own exemption.1 point

-

ATX just answered my question. On their checklist, a notice says that both boxes should be checked if it is an inherited IRA.1 point

-

Filing a return is a different story. Yes, ANYONE is required to file a return if you have a 1099-misc filed correctly. That by itself doesn't change the rules of AOC. I start to understand why we have different answers. In my case both parents and students have W-2 and that's it and their livings standards are not of the Pacun tower. If you want to be more technically, ATX always want you to make the scholarships taxable so the student can take the refundable credit.1 point

-

it is not just providing 50% of support. The greater than 50% of support must be earned income. .... and having a living parent factors in: You don't qualify for a refund if items 1 (a, b, or c), 2, and 3 below apply to you.1.You were:a.Under age 18 at the end of 2018, orb.Age 18 at the end of 2018 and your earned in-come (defined below) was less than one-half of your support (defined below), orc.Over age 18 and under age 24 at the end of 2018 and a full-time student (defined below) and your earned income (defined below) was less than one-half of your support (defined below).2.At least one of your parents was alive at the end of 2018.3.You are filing a return as single, head of household, qualifying widow(er), or married filing separately for 2018.Earned income.1 point

-

Thank you for all the explanations. I have seen this post and I didn't bother to read before. Today I felt bored and I decided to read and to my surprised, I have a client exactly in the same situation. I am glad I read this because I was second guessing myself and I have an appointment with the client tomorrow. I am surprised that my client's 1099-R doesn't show the contribution amount since they have had this account since its inception. If the title on this posting would read something like "How do I report this Roth IRA transaction", I would have read it a while ago.1 point

-

If you follow the instructions, a child who provided more than 50% of his/her support qualifies for REFUNDABLE AOC as long as he/she was over 18 years and 0 days by the end of tax year. ALL THREE have to match for the student not to claim the refundable part. I should add, provided he is not filing a joint return. Keep in mind that AOC follows the "exemption" (if you will).1 point

-

I think you are getting confused as to who can claim the AOC. The student cannot claim any part of the AOC if they meet the conditions below. However, the parents can claim the credit for both non-refundable and the refundable portion. There are other conditions for students over 25 who are part-time that can claim the refundable portion of the AOC. All of this stems on the condition that the credit has not been claimed for four years. Yes, the parents can take the AOC if they are claiming their child as a dependent. Usually, income earned by the student doesn't come into play when they are under 24 and still attending college for dependency purposes. In your situation, you have to determine if the student is better off to claim themselves or the parents. If the student's income is below the filing requirement and there are withholdings then it is a no brainer. Student files a return to get the withholdings back and parents claim the dependency to get the education credits. Below is a blurb from the IRS instructions for the AOC. If you were under age 24 at the end of 2018 and the conditions listed below apply to you, you cannot claim any part of the American opportunity credit as a refundable credit on your tax return. Instead, you can claim your allowed credit, figured in Part II, only as a nonrefundable credit to reduce your tax. You don't qualify for a refundable American opportunity credit if 1 (a, b, or c), 2, and 3 below apply to you. 1. You were: a. Under age 18 at the end of 2018, or b. Age 18 at the end of 2018 and your earned income (defined later) was less than one-half of your support (defined later), or c. Over age 18 and under age 24 at the end of 2018 and a full-time student (defined later) and your earned income (defined later) was less than one-half of your support (defined later). 2. At least one of your parents was alive at the end of 2018. 3. You're not filing a joint return for 2018.1 point

-

The only reason I can see here is the 2106 unreimbursed employee expense has been eliminated. So, if he is indeed an employee and not a sub contractor, then I agree he cannot use the home office expense as the 2106 was used for such expenses.1 point

-

Quite a lot of the new 1040 doesn't make sense the way we are used to looking at it. DO NOT try to change things to make it make sense. The pension/IRA line is just one of the line that don't 'compute' in the way we are used to thinking of them.1 point

-

But do you think that might be a problem if there is an RMD and you are not marking it as an IRA?1 point

-

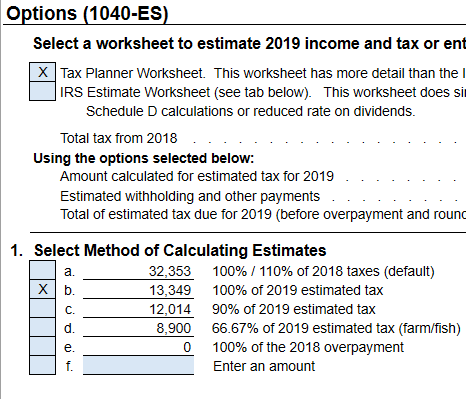

https://www.accountingtoday.com/news/irs-expands-underpayment-and-underwithholding-relief-for-more-taxpayers-to-80-threshold?feed=00000158-20c2-d6a2-adfb-70eb854600001 point

-

1 point

-

Posted on official ATX chat: For ALL: Please note that the rules for reporting gross and taxable amounts for the IRAs and Pensions have not changed from 2017 in the IRS Form 1040 instructions and the requirements for Form 8606...For IRAs if you only have 1 IRA distribution then the gross amount will be -0- and the taxable amount will be displayed. Pretty much the same goes for the Pensions, if the gross and taxable amounts for pensions are the same, then only the taxable amount will be displayed There are 4 exceptions under IRA reporting in the 1040 instructions that you should review. In addition, we split the gross amounts for the IRA and Pensions on the Form 1040 AGI wkst so you will see the split and totals for each since the IRS has made the amounts for 4a and 4b more difficult to follow when combined. See if 2017 return matches when using your 2018 amounts. If you still feel that the results are not correct please contact support to send us your return. Since people still complained it was wrong, I added this: I believe what is happening is that when the IRS combined the pension & IRA lines, the grounds for reporting each did not change. So imagine there were still 2 lines: the IRA line would have zero in line a and the total distributed on line b. The pension, since the distribution is only partially taxable, would have amounts on lines a & b. Mush the 2 together and you have the weird situation where the IRA amount is not reported on line a but the pension is.1 point