Leaderboard

Popular Content

Showing content with the highest reputation on 08/05/2019 in Posts

-

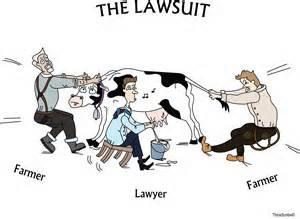

Does Staples offer large format printing? I want to hang this on the wall for all our clients to see.7 points

-

TAS has issued a schematic diagram, resembling the London Underground Maps, that traces the various paths the tax return takes, starting with pre-preparation and then through the IRS system of screening, processing, refunds, collections, appeals, litigation and alternatives. Although. I think the intentions were good, designed to help the taxpayers understand the complexity of how their return is handle, I doubt that many would take the time to work their way through any of the labrynthine schematics, or that any would even be interested. On the other hand, it might help su explain to clients what is happening with their return. https://www.irs.gov/pub/irs-pdf/p5341.pdf5 points

-

5 points

-

3 points

-

After seeing this, clients shouldn't complain about their fees. Who am I kidding, they'll still complain.3 points

-

Some clients would watch my employer, who was a CPA, rapidly punch in data and remark "you sure are good at math." He would say, "No, I'm terrible at math" and watch their faces.3 points

-

Well y'all have once again relieved me of another problem. I was unaware I had to love math to prepare taxes. An appraisal of the property by the executor ? The sucker was unaware he was an executor ! This is one of those little details he will now have to become familiar with.2 points

-

Some of you may have seen in the news recently the announcement of the Equifax Breach Settlement, which has its own website, https://www.equifaxbreachsettlement.com/ The website allows you to check whether your information was exposed and if it was to file a claim. It is important that everyone check because the Equifax site which was set up back in the fall of 2017 did not work well and was very inaccurate. I have checked my family members so far and I plan to check all of my long established clients. So far my wife and my information was not exposed. However all 3 of my daughter's and one of my son in law's information was exposed. At the very least you should send an email to all of your clients urging them to go to this website and check, because if your clients are like mine, many of them are not as security conscious as they should be !1 point

-

With the exception of two HP computers (for which I will never go back to HP), I have always used Dells, both desktop and laptops. I am currently looking at Dell for a new laptop as mine is over 7 years old with Window 7 in it and I will have to upgrade in January due to 7 not being supported any longer. I can not say enough good about Dell. My desktop is 2 years old and I have to say that the only problem I have had was due to a software conflict. I had encrypted my hard drive using Symantec and Windows 10 did not like it on the larger updates. The problem got so bad that Symantec or Windows locked me out of my own computer. I spent tons of money to get my computer back up and running, only to find out by researching that the problem was with Symantec's. Windows 10 pro has it's own encryption and that seems to have solved my problems. Like I mentioned, I am currently looking to replace my laptop, and I won't consider anything but a Dell. If you can find the configuration that you are looking for at Costco or even Sam's Club, they have the best return policy around. Mine however can not be found there so I am going to order directly from Dell, which I have also done in the past without any problems. Hope this helps. Deb1 point

-

I have been presented with a wonderful golden opportunity to file tax returns for a physician from 2011-2018. Anyone else chomping at the bit to do this? For some reason, I seem to get asked once a year for backfiling such as this. Sometimes I have been able to help - sometimes it is useless. Often I get told they had an accountant who has been fired - more often than not it is the former accountant who has "fired" them. Specific questions: How far back are IRS records available? and what is the best procedure to order them? A little more interesting information: High income physician purchased a farm and claimed $1500 in revenue in 2010. Claimed a $275,000 loss on his tax return. He told me this provoked an audit and almost all of this loss was disallowed. Imagine that!! Thanks in advance - Ron J.1 point

-

I did not say that SFR returns could not be amended, because you did not mention them. It seemed as if you were talking about unfiled years. So, if 2011, 2012 were SFR'd, they can be amended as is any year that has a balance due, no matter how far back. However BTW, I have noticed a loophole in the treatment of unfiled returns. I do not think I have ever encountered a SFR if an extension had been filed for that year, even if subsequently the return never got filed. I think we are going to be seeing far fewer SFR's. In 2017, the ASFR unit was scaled back to shift more resources to the Refund Hold program. TIGTA was not in agreement with that decision. https://www.treasury.gov/tigta/press/press_tigta-2017-27.htm1 point

-

The widow gets 3/4 of the property at stepped-up basis. Forget depreciation, basis of the inherited portion is FMV on date of death. For her 1/4, basis is her original share of purchase price less 1/4 of the depreciation taken over the years. Hey, you're in this business because you love math, right?1 point

-

Subaru checked our credit when we bought a car, even though using separate funds. I asked which company and unfroze that one only for the day. When clients were going to rent a storefront for their bakery, they had to unfreeze for a day; but they were committing to monthly payments for a year, so I can see why the landlord wanted to do a credit check.1 point

-

According to the IRS, once the ITIN is renewed, "any exemptions and credits will be repaid" See Q15 https://www.irs.gov/individuals/itin-expiration-faqs1 point

-

Also, some insurance companies check your credit, which they might use to calculate a quote for car insurance for example.1 point

-

1 point

-

1 point

-

cbslee, the situation is under control. The only way this happened was thru freezing the credit. The best news is that I was not hurt financially and my credit scores were restored. However, I was advised that my SS# has made it to the black market, whatever that may be, by Experian. I have all the monitoring services available. It is still a PITA because I cannot buy anything without un freezing my credit. A lot of services tap your credit for information for identification purposes, I can't use those either. Once I complete the claim form, I wonder if I can claim time spent preparing the claim???1 point

-

I just had a neighbor that my former partner let go after preparing the 2009 return come to me because his kid needed 2017 filed for higher education purposes: I know I'm a mess, the EA who's been doing my return is mean, will you please help me? Yes, as a matter of fact, it's July, and I like to eat, wear clothes, and live indoors. Let's see if we can regroup. LOL. It went very well. A lot of times it works out.1 point

-

You know, I personally was a victim of identify theft three times in less than two years as a result of this breach. My credit is frozen and I have a 2' thick file of credit reports, documents, police reports an so on to support all of this. I do see you can order a form to file a claim online but am a little gun shy to expose all of this online or trust it to get to the right folks to handle the claim. Personally, the $125.00 is a slap in the face. Offer credit monitoring services from Equifax where the breach occurred?? Equifax is the worst and I mean absolute worse of the three credit reporting agencies to deal with and I would never opt for their credit monitoring services. My credit is frozen. I will suggest that if you have been a victim and placing a 7 year fraud alert will not help. My credit was stolen while the fraud alert was in place. That was done by Comcast who quickly (within a week) rectified things after being threated with a sever law suit for violating fair credit reporting laws. I want to know what the criteria is for the 20K? Take notice that nothing I read indicates if and when the claim will be paid. Don't really know what to do.1 point

-

I always start with the IRS letters. There should be some. Figure out how aggressive they are in the collections process. From that information, you will get an idea of what years the IRS is looking at. Then call the IRS and let them know the guy is coming clean and will be filing his returns. Ask them which years they want. One time, IRS asked for 7 years, knowing that the taxpayer had lower income and withholding during most of the years. They did not seem to care about the other 4 years. Another time the client was a tax protester, and they wanted every single year, all 10 of them, as they were actively collecting on all of them. In both cases, they stopped collections and gave me time to prepare the returns. PPS can be your friend on this. Use them. Tom Modesto, CA1 point

-

You can get IRS transcripts quite a ways back. I recently downloaded 2009-2017 for a self-preparer who hadn't been carrying forward his NOL. Still waiting for the IRS to get around to processing this. It's been over 6 months.1 point

-

I hate it when high income people show up at my office wanting to pay me to work. As a small business owner it's sort of a nightmare scenario to be paid.1 point

-

Mine was exposed but my wife's wasn't. I claimed my allotment last Thursday. I highly recommend you put a freeze on your credit reports. It takes a little while and may be an inconvenience if you need to open new credit but it is a really good idea and free. KEEP THE PIN THEY GIVE YOU to unfreeze later. It's highly unlikely your ID will be stolen if your credit accounts are frozen. Capital One Credit Cards was hacked and 100 million people had their information leaked. This is not going away anytime soon. Your data is likely >90% to be available for purchase on the dark webs.1 point

-

1 point

-

And with tracing rules, the source of the debt or the asset used as collateral doesn't really matter & it can be deducted on Schedule C also. As you say & I said - don't co-mingle a HELOC with personal funds if you want to do this. If you take a cash advance on your credit card - it can be claimed to be a business debt if done properly. You had better show it properly and clearly in the accounting.1 point

-

Yes, this is correct that it can be deductible on Schedule E. The default is that this borrowing would be considered "home equity debt" but may be uncoupled from that definition by "electing" to use the interest tracing rules. That election is made by reporting it on Schedule E. I would strongly advise to NOT comingle the loan proceeds with other personal funds so to have a clear and unambiguous trail of use. Reference is §1.163-10T(o)1 point

-

Yes you can use a HELOC as a business loan and it happens ALL THE TIME. When you do the first tax return with the debt, put a declaration in the interest paid showing exactly what you've done and make sure it is a loan on the books of the company. Tell the client to not mix the HELOC with personal funds. Also make sure the client realizes (I'm sure they do) that the loan is their personal responsibility in the end regardless of how they document it. Corporate bankruptcy doesn't get rid of the loan. Many people (like me) use a cash out mortgage on their primary home to buy a rental property and then have the business pay off the mortgage. This has been talked about several times on this board over the years. The interest is then deducted on the Schedule E.1 point