Leaderboard

Popular Content

Showing content with the highest reputation on 01/27/2021 in all areas

-

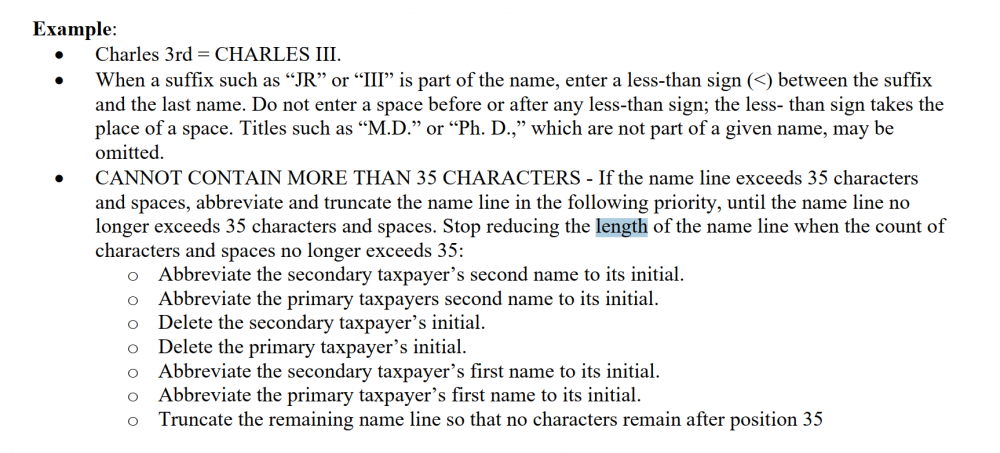

IRS uses the first 4 letters of the last name, so you can truncate it to allow the e-file to process. Just explain to your client the reason why.4 points

-

QB may not allow for a 2nd 1096/1099 set once processed, but an online provider should. For the out-of-state resident, if the income was earned in a state other than CT, you can fill in boxes 5 through 7, and it certainly wouldn't hurt to send it to CT anyway to document that that IC isn't subject to CT income tax or filing if that is the case. That being said, be sure that your client is in compliance with the other state in case the other state would consider that payment has doing business in the other state. Plus, I think Margaret gave the solution while I was slowly typing away! lol3 points

-

2 points

-

tax1099 has a default for each state. I think CT was e-filing over the threshold, with or without withholding. You can edit their defaults. AL will default to mailing. You are charged separately for the state. I don't think you can file the state only, but you can go back in (prior to actual filing) and add/delete states. tax1099 will file the states separately, but you have one group you export from QB. I did feel like I was going around in circles when I did my own company. (I haven't had an IC before, and QB does the W-2s from within and not exported to a 3rd party.) But I wanted to get through it with my one IC before I worked with this client's company today. I think there are steps where more thorough explanations would've been appreciated, but I did like that I don't have to retype information and that it seems to be updating state rules. And, a lot nicer than having to give paper copies to a client to sign and mail; contactless. It is an addon. But from my viewpoint as the customer, a price addon. I still give it my information in one file and either accept their defaults or edit for tax1099 to file the states. You guys are all great. Thank you for information and advice as I try something new to me.2 points

-

I went through the tax1099.com KBs re states. I had figured out from doing my one yesterday that the -NEC does NOT have the combined Fed/State filing, but that tax1099 had default info and options available by state. Finally dug deep enough to learn tax1099's default is to file (if filing fits their default criteria or you've edited) in the resident state (again, you can edit) which is what I need for all the ICs for this client. I now feel more comfortable filing from QB through tax1099 for the first year.2 points

-

Lion, I just took a quick look at their website and while tax1099.com does offer 1099 state filing, it does not appear to me that it is an integrated option. I may be wrong, but I get the distinct impression that their 1099 state filing is a standalone addon.2 points

-

To be clear for anyone else reading this that didn't see my other topic, the IRS still has the combined Fed/State filing in place for all the forms that it had in past years but has NOT included the 1099-NEC yet. So for anyone filing other 1099s, for example for INT, DIV or MISC, those would be transmitted to the state(s) if that state participates in the IRS combined filing program.2 points

-

I thought that it was acceptable to prepare more than one 1096 (with accompanying 1099's). I have done this in the past when getting the late arriving data from clients and never had any issues. Perhaps you could segregate the recipients into the respective states and process multiple times, one per state. Seems easy enough with using a third party issuer.2 points

-

In case anyone is not aware: the IRS has NOT included the 1099-NEC in the combined Fed/State filing program, meaning that a separate filing is needed to send these to the state(s). EDITED TO CLARIFY: In case anyone is not aware: the IRS has NOT included the 1099-NEC in the combined Fed/State filing program, so if your state requires these forms and your state participates in the combined filing program for other forms, a separate filing is needed to send these 1099-NECs to the state(s). You will have to check with your state(s) to verify what the acceptable method of transmission is.2 points

-

I usually take out the second or hyphenated last name... MAKE SURE you move your cursor away from that field and then try to create the efile file again. I keep cutting last name(S) until it works.1 point

-

If there is no combined Federal/State filing this year what difference does it make?1 point

-

1 point

-

That's brilliant, Margaret. Thank you. You're right about running more than one set/more than one 1096. I'm going to do just that by state.1 point

-

P. S. Y'all were absolutely correct. She draws his RRB benefit only Tier 1 and Tier 2. He got no increased RRB from the contributions he made to SS. Both SS reps and RRB reps disavowed any knowledge of the other systems functioning. While he was living she drew her portion of his RRB Tier 2 benefit and her own SS benefit which was greater than her portion of his RRB Tier 1 benefit she could draw. After his death his full RRB Tier 1 benefit was greater than her SS benefit so her SS benefit was discontinued. Both the RRB reps and the SS reps had no clue how or if his payments into SS could be added to his RRB contributions to increase the RRB. I knew the dual benefit status had been eliminated years ago as an Aunt had drawn both her husband's RRB benefit and her own SS benefit which she earned as a teacher but this was many years back. It's interesting to see how this finally worked out. Many thanks for your input.1 point

-

My mom got one but I never got a notice for either payments. Chances are good one was never sent.1 point

-

If logging in to the portal there is now a check box to trust this device. Selecting that by passes the second authentication. I believe this has just been added.1 point

-

I love Oregon. People there follow traffic rules and don't litter. And they grow all kinds of food, and make great cheese and wine.1 point

-

One thing to note, when you turn off 'Services' for ATX, if you don't complete the whole process in one sitting, 'Services' will be turned back on automatically when you restart your computer and another 'Server' folder will be added.1 point

-

You can always run the ATX Admin Console to see where your data and backups are being stored. Admin console is located here: C:\Program Files (x86)\Common Files\Wolters Kluwer\ATX 2019 Admin Console\Sfs.ServerHost.AdminConsole.exe C:\Program Files (x86)\Common Files\Wolters Kluwer\ATX 2020 Admin Console\Sfs.ServerHost.AdminConsole.exe Also, the default location for ATX data and backups is a hidden system folder called ProgramData. You might have to change windows view settings to see the folder. Alternately, you can type %programdata% into file explorer location bar to get to that folder.1 point