-

Posts

5,225 -

Joined

-

Last visited

-

Days Won

329

Everything posted by Abby Normal

-

Anybody using ATX over a VPN for Multiple Offices?

Abby Normal replied to Richcpaman's topic in General Chat

That is not a VPN. That is Windows Remote Access. A VPN is a remote drive that just has the data on it. You use QB locally and access the remote drive just like any other drive on your network except it goes over the internet. -

I never see the CAPTCHAs when logging in. Your browser might be clearing your cookies and saved logins. The new two-factor login is a new cookie from cchaxcess.com. I don't find this type of two-factor security very secure. I prefer the ones that text my phone. I will likely turn this off.

-

NT-QuickBooks stopped working after a Windows 7 update-

Abby Normal replied to NECPA in NEBRASKA's topic in General Chat

Did you get an error message? I've had good luck googling the error. I remember deleting some files was the fix for one QB not starting error. -

10 is largely based on 8.

-

My first reaction is Sch D capital loss on the loan. I'm guessing the loan was not secured by the property.

-

I'm not familiar with AMD chips but it appears it does run 8: https://www.amazon.com/Gateway-E1-1200-Windows-Desktop-SX2110G-UW308/dp/B00AQYSPA2

-

I upgraded to Windows 8 in December 2012 and it's been a very positive experience. Like you, I'm not touching 10 until I'm absolutely forced to. Not a week goes by that I don't see an article or two reporting on windows 10 troubles. And Windows 8 will get you more used to a Windows 10 like interface. Do you know which generation processor you have? Newer processors won't allow you to update either 8 or 7. I just had to replace a motherboard and had to make sure we got an older processor, and that limited our motherboard choices.

-

It's only for new or modified divorce agreements after 12/31/18 and the fact the recipient is getting it tax free should be factored into the payment amount.

-

I always highly customize the questions and get rid of the ones that are way too obscure. Always tweaking my wording when I see too many clients misinterpreting the question. I don't like to send them until after the new year. I like to let people enjoy their holidays without having to think about taxes.

-

Thank you, @DANRVAN!

-

Capital gain income is not automatically distributed so the estate pays the tax on that. Main exception is final return, when everything passes out.

-

QuickBooks all the way. We pay for the Enhanced Accountant Payroll package from Intuit and efile all W2s right inside QB. We still paper file 1099s because Intuit wants to charge us for those. It makes no sense to me to print these to a PDF and import them into ATX. Seems like way too much work.

-

Rollover estate return in ATX - final short year & carryover

Abby Normal replied to Randall's topic in General Chat

You use the 2017 forms to do a short year 2018 return and enter the fiscal year dates at the top. If the year end is late enough in the year and the extended date falls late enough in tax season that ATX will have the business forms ready, then you can wait for the 2018 forms. -

Rollover estate return in ATX - final short year & carryover

Abby Normal replied to Randall's topic in General Chat

Go into rollover manager and click on the poorly named Last Month/Quarter tab. That lets you roll over 2017 returns to a short year 2018 return. -

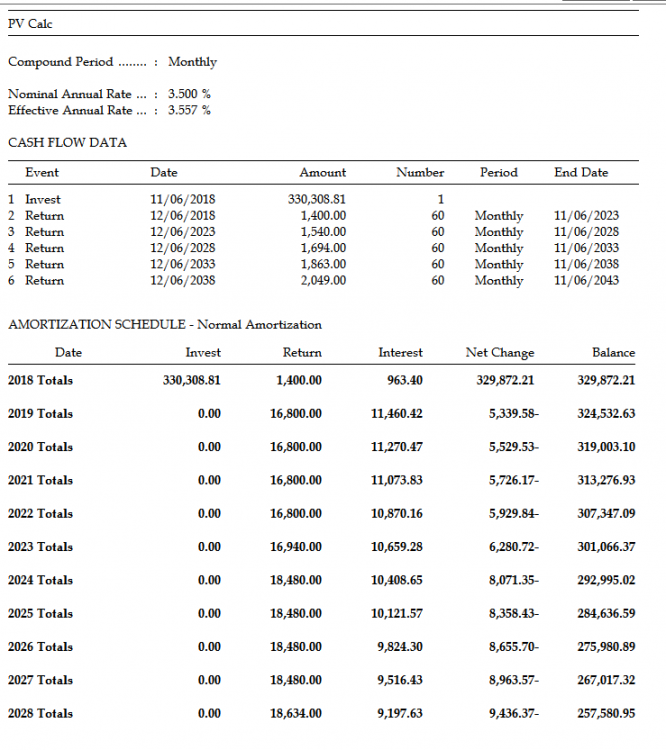

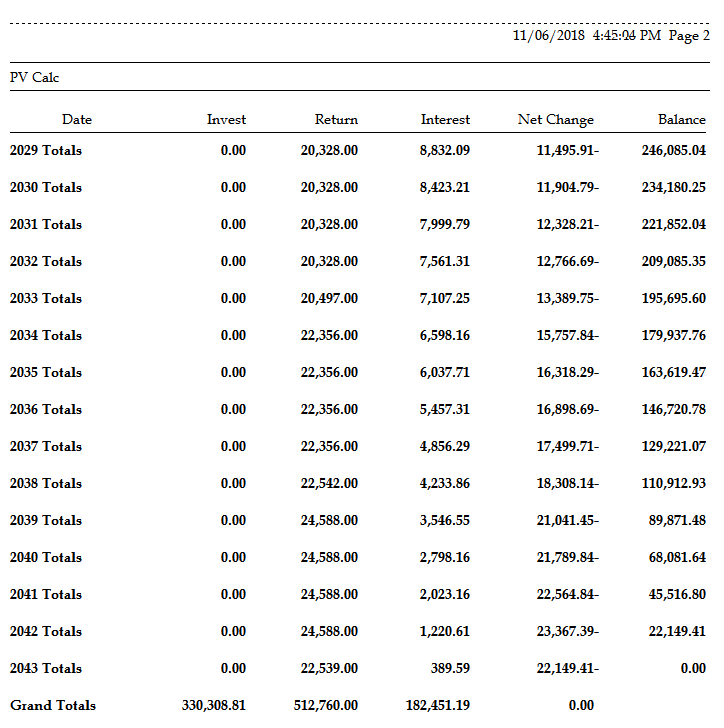

any math wizards out there - I have a PV problem

Abby Normal replied to schirallicpa's topic in General Chat

This is why we have computers and software. We couldn't really do tax returns without a computer anymore. -

Thanks, @mwrightea!

-

any math wizards out there - I have a PV problem

Abby Normal replied to schirallicpa's topic in General Chat

-

any math wizards out there - I have a PV problem

Abby Normal replied to schirallicpa's topic in General Chat

Yep. You can't find PV without an assumed rate. -

CAN YOU HEAR ME NOW?!

-

Isn't that just a checkbox on the 1120 and add a form 851 (which ATX has)? Or is this an S corp? Here's the knowledge Base article: https://support.cch.com/sfs/solution/How-do-I-consolidate-a-corporate-return-in-ATX?q=WKArticleType__kav You'd have to do the consolidating in an excel spreadsheet, if the accounting for each entity is separate.

-

Thanks! This has made me think about who will be on this forum in 10 years. Young'uns like @RitaB and @Possi will be, but a lot of you are older than I am.

-

I probably am too young to retire and may work part-time for Accountemps or some CPA firm when I finally move far enough away that I don't violate my non-compete. But I only want to work 2-3 days per week with large blocks of time off to travel... before we get too old to enjoy it or even do it.

-

Love the Stooges.

-

Just donated blood and my BP was 122/74, the lowest it's been in over a decade. Coincidence? I think not!

-

Thank you, Judy!