-

Posts

5,225 -

Joined

-

Last visited

-

Days Won

329

Everything posted by Abby Normal

-

Same. We added a text box with a signature line and a date line.

-

Me: You did get the refund, but you paid off another debt with it.

-

EFTPS might be too hard but Direct Pay is pretty darn easy.

-

These rules are going to change because it's unworkable as is.

-

So when you said he received a 1099PATR you really meant that the trust received a 1099PATR? And he got a K1 from the trust?

-

Same, and have been for at least a decade. Seen way to many problems with mailed in checks.

-

And make sure you don't include the charitable deductions paid with a QCD on Schedule A or the new charitable deductions line. They really didn't implement this in the best way and it's easy to double dip, unintentionally.

-

Is this an ATX glitch? form 8867 red efile error

Abby Normal replied to BulldogTom's topic in General Chat

Sounds like a plus, not having to file an 8867. -

This applies to clients as well. I had one client who wore too much of sickeningly sweet smelling perfume, and sometimes she's hug me and I'd smell her perfume until I went home and took my clothes off. Thank goodness for the pandemic and working from home!

-

I almost never use those lines because I like to see the totals on the 8949 Details tab. In the case of multiple brokerages, I would enter totals by brokerage by code. I would not add them together because it's easier to look at later and double check, if they're entered separately. But from a tax standpoint, you could add them up or do an Itemized List on Sch D, but at that point, you might as well enter them on 8949.

-

The worst is records from a smokers house. Smells awful and it makes me sneeze. Fortunately, there aren't many of those anymore. Also, I never see the hard copies of the records, just a PDF, so someone else has to deal with smelly records.

-

Same, but I like to input on the Details tab because it's like a spreadsheet and it has totals. You'll want to set the Preference to not calculate when working in Detail tabs because, for some unknown reason, it calculates really slowing in Detail tabs. But saving recalculates so enter a line and save, then check that the gain is correct. If there are wash sales, the code is MW, and multiple codes have to be alphabetical (BMOW). And, yes, I have used the BMOW code when a K1 sale is included on the 1099B.

-

Unless you have a home office and no other principal place of business.

-

I hate it when I screw up - with the most anal client I have

Abby Normal replied to BulldogTom's topic in General Chat

We've all done this, which is why I prefer to run it through the software to be certain of my answer, in some cases. -

It would be best to amend, although the IRS is probably just collecting info. I doubt they'd waste precious resources on something that has zero chance of generating revenue.

-

There is a statement built into ATX. Another preparer showed it to me, but I haven't gone looking for it.

-

Add a records processing fee.

-

That's why I hedged with 'might.' I suspect my credit union appreciates me saving them money and in turn, I appreciate them not charging me any fees, or very low fees, and giving me low interest rates on loans and credit cards.

-

Not I, but others on other forums report filing some. Does anyone really believe that someone opens up attachments to efiles at the IRS? You could attach any PDF and it will be fine.

-

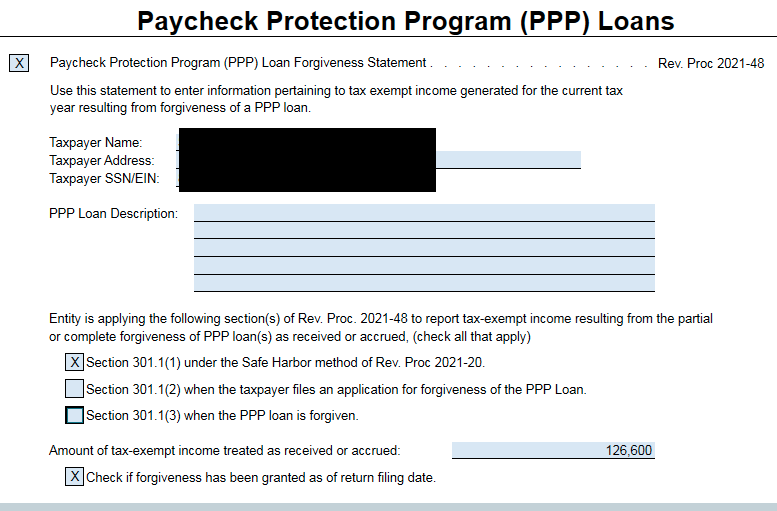

S-Corp Instructions 2021 Updates, PPP Forgiveness Reporting

Abby Normal replied to G2R's topic in General Chat

First off, basis can NEVER be negative. And distributions in excess of basis are capital gains to the shareholder. -

I never enter EINs for interest and dividends. If it's not required, I save the keystrokes.

-

Well, I much prefer downloading all of my documents for numerous reasons. It saves paper, ink, fuel and time. It's better for the environment. It saves me having to scan it and then shred it. A downloaded PDF is much preferable to a scanned PDF. I get my documents sooner and don't have to worry about them being delivered to the wrong address. I get neighbors mail from time to time. And I don't mind that it saves the company money, because that means they might not increase any fees they charge.

-

They're actually doing Emancipation Day of Friday the 15th of April in 2022, so it has no effect this year. I think if 4/16 was on Sunday, they would move it to Monday, and then tax season would end on Tuesday the 19th.

-

Maybe it was a DC holiday that sometimes falls on the Monday when tax season is supposed to end? And maybe they got rid of or moved that holiday? Just found it! Emancipation Day is April 16th, and sometimes that extends tax season by a day, when the 16th is a Sunday or a Monday. https://www.timeanddate.com/holidays/us/emancipation-day-dc

-

On Detail tab, click on the Name header to sort. Then at the top click on apply or whatever it says. I don't have ATX open right now.