-

Posts

5,225 -

Joined

-

Last visited

-

Days Won

329

Everything posted by Abby Normal

-

This would only affect the state. I suppose if the state depreciation adjustment was more than the federal loss, you could combine them as a state adjustment only, but if it combines to a loss, then there'd be no state adjustment. I suppose, in an ideal world, we'd track the state carryover losses separately and have a state adjustment on disposition of the investment for the carryover losses allowed, the ordinary income portion, and for the gain/loss on disposal. But as Sara EA has already said, in practice, it all works out in the end. What we're essentially doing, is ignoring the state's decoupling rules, but mathematically it will be correct on disposition, in TOTAL. Fortunately, for most state returns, different types of income are all taxed at the same rate.

-

This is the page you want. https://support.atxinc.com/myinformation/MyProducts

-

Intuit is the one company I hate more than micro$oft.

-

Where did ATX hide the install file for 2013?

Abby Normal replied to Jack from Ohio's topic in General Chat

My poor car wouldn't know what hit it, if it got washed more than once or twice a year! -

Where did ATX hide the install file for 2013?

Abby Normal replied to Jack from Ohio's topic in General Chat

I have all the install files downloaded to our computer. This is true for all of our software. I'll upload it and post a link here, shortly. Here you go: https://drive.google.com/file/d/1tr9rbIIJzQmohLfpf9whDiAFq2Omq0tl/view?usp=sharing -

You can with some states but not with federal... unless it can be done with an amended return. I suggest IRS Direct Pay. Also, just because they had some unexpected income does not mean they need to make estimated payments. I usually recommend they earn some interest on the money and just pay on 4/15.

-

It should be 30 days, so you pay your taxes on 4/15 and pay your first estimate on 4/30, but it doesn't matter, because this will never pass. Some accountant will calculate how much interest it will cost the government to delay the 2nd and 3rd quarter payments by a month and it will be too large of a number. Abby Downer (wah wah)

-

And there's the problem. None of my few gamblers have any interest in keeping detailed logs.

-

Catherine would probably rather have a gun, anyway.

-

Yes, I saw yours and Eric's shields. Will all the shielded folks be in a group called something like Knights of the Computer Table?

- 32 replies

-

- 10

-

-

-

I suspect they'll just summarize annually, like brick and mortar casinos do, and the gambler needs to be the one keeping track of sessions.

-

Which portal are we talking about?

-

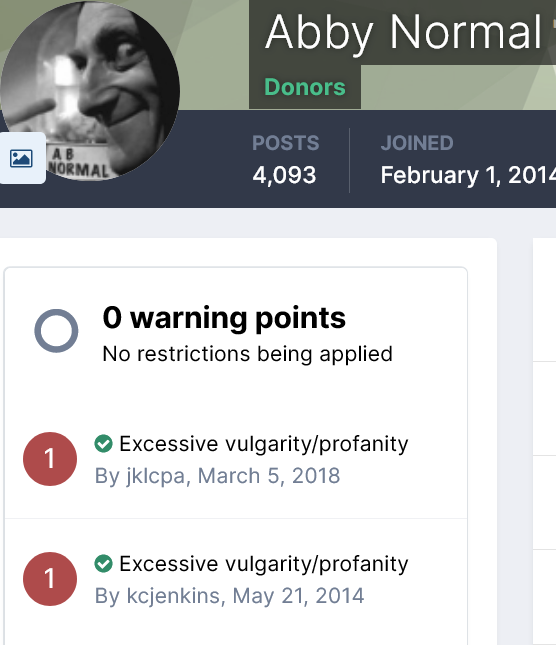

I don't see a shield but I do consider my two profanity warnings a badge of honor. Oh, and thanks, Eric! It seems I only cuss every 4 years, so look out 2022!

-

For now, at least, this is a one time deal for 2021, but I can see that some would like to make the child credit monthly payments permanent.

-

Wait 20 minutes or more then retrieve acks. If no luck, rehang again.

-

I have a client who wants to opt out in lieu of making estimated tax payments.

-

Every IRS communication I've ever seen abbreviates the street name suffixes. They also drop 'The' at the beginning of business names.

-

Was able to log in as Admin and reset our other accounts. It let me use my old password, so I'm not sure what happened.

-

If you can efile without the attachment, do it. Then mail the docs in.

-

Two of us tried and it just says 'login failed'. Before I reset my password I thought I'd better check to see if anyone else is having trouble logging in.

-

Are you saying there's a watermark saying "None" across the return when you're viewing it on screen?

-

It may have installed an add-on in Firefox or some program on your computer. Look in your firefox add-ons first, then run a good uninstaller program to see if you can find it. Also I'd look in programs that start automatically. I recently started playing around with Ultra Virus Killer and it has a lot of features to help in your quest. You might want to also upgrade your internet security and/or antivirus, since it didn't block this adware from installing. If all else fails, you can refresh your Firefox to create a new user profile. Good luck!

-

There's little sense in calling the IRS for late refunds, as long as the 'where's my refund' page says processing. MD has not processed my refund yet. It usually takes days but my return included the new 502LU form introduced mid-tax season, so I suspect they're giving extra scrutiny to any returns with the LU. Either that or they're programming for accepting LU forms was flawed.

-

Tangled up in Blue is one of my favorites. If you ever wondered what Bob Dylan songs would sound like with a singer who can really sing, check out one of my favorite band's albums that's all Dylan covers. http://www.davestruestory.com/music/dylan.html The music links on that page are broken, but you can find the songs on youtube.