Medlin Software, Dennis

Donors-

Posts

1,813 -

Joined

-

Last visited

-

Days Won

83

Everything posted by Medlin Software, Dennis

-

"We know what the result should be, and if the" (result) "doesn't match our expectations we have to figure out how to tell it" (the software) "what to do." I should save this for my potential customers who expect obtaining and using software will make them competent. My usual example is obtaining an MD's travel bag and contents does not make them an MD, but I like this one better. Experience, training, and (what used to be) common sense are always in demand.

-

Assuming the message is shown "by" ATX, it is likely their fail safe error, triggered by something they do nto plan for (handle gracefully). Hard to say. I would view the details, then ask ATX for an explanation. If you can trigger the error by exact repeatable steps, then send ATX those steps.

-

Appropriate to contact clients?

Medlin Software, Dennis replied to Margaret CPA in OH's topic in General Chat

If you don't ask for the sale... While my situation is different, I do ask, several times, if someone is late in ordering. Every message has instructions for opting out I also send out order messages in batches, to somewhat control the number which come in at the same time. I can also send reminders based on the date of prior order if needed. Example: First reminders to customers who regularly order early. Next batch to those who sometimes order early, but are usually in the second wave. Next to those who order at the last minute. -

I saw a great article on this. The article said, for someone who wants to keep their earnings from the same company (not get fired), accept the 1099 and report accordingly. But, when they leave, amend as far back as allowed, claiming employee status, and fight for a refund of the employer amounts. Same if fired, go for UI, or injured, fight for WC.

-

I am not doing the math... how would forensically changing the distributions to payroll, with the fees you would charge, along with the penalties, interest, and other costs, compare to obtaining the QBI? This assumes the forensic payroll correction would be 100% clean, with regular payrolls meeting the freq for the state (not just a check in Dec), reasonable comp, recording of all time worked (this applies even to salaried employees in many jurisdictions). etc. This is what "gets" me... as when my customers ask for anything similar, they always want just one check in December, which does not "fly" for me. Just because an owner/shareholder is also an employee does not mean the company can treat the employee any differently as a stranger employee. No stranger employee would perform services all year for one check in Dec, even if the law allowed it.

-

Nice to see at least one state accepts and easily handles seasonal or unequal liability. For my W2 wages, I typically pay the bulk of my required WH in Dec, since the bulk of my income comes in Dec. For employees, as long as they do not get into under withholding penalty for the entire year, it is acceptable to have zero WH, and either manually deposit before the deadline, or have a large WH in Dec. (Provides a valid W4 is in place limiting the WH.) I inadvertently tested this some years ago when the lock in letters started. The initial lock in letter algorithm included me, as I had zero WH for Q1, yet a fair liability for the prior year. A phone call, and the agent reviewing my history removed the lock in. As I move to an owner/employee role, I'll likely be able to continue my process, since my distro amount will likely be in Dec., since I will maintain more than reasonable comp for my employee "self" (keeping my SS wages up, as our daughter's future disability bene (based on me) grows a good amount each year until my FRA. I have a note to look into CA and Fed deposit requirements for owners who have unequal distributions... which is why this thread caught my eye.

-

Proof again not all are compliant with reporting income based on employment as wages. The Catcjh-22 is the same as always. Report it properly as wages and the employer may be upset. Report it as not wages and the employee ends up paring the employer part of the taxes, and may not have received full benefit of the wage amount, such as when retirement is a percentage of pay, and there is an employer match, proper accounting for UI wages, proper WC wages, etc. If employers would accept the fact that all tangible items given to an employee is W2... since the tangible item would not have been given if the person was not their employee.

-

"conceivably can create a payroll for 2019 paying himself $128,000 in December" To be blunt, impossible to do legally, even though MANY do so every following Q1. Come Q1 every year, I get inquiries regarding creating improper payrolls for the year already ended. I decline to help, and try to educate, which usually results in a no sale or a refund, since I will not help fake a payroll. This is one of the issues which shifted me, over the decades, to mainly written communication (evidence trail) rather than offering advice in a verbal form, since we are in a generation or three of "who can I offset the blame for my error" society. QBI has likely made this type of inquiry more common, but I do not ask the reason. I suppose QBI has also assisted with reasonable compensation compliance, as well as provided some consultation work when a business has enough income to be able to optimize for QBI.

-

Programming for unexpected data entry is a huge chunk of time... and sometimes gets overlooked. Then again, one can program for expected input, then find the wonks who make the rules allow something other than what the forms shows on its face! 2020 W4, step 3 for example...

-

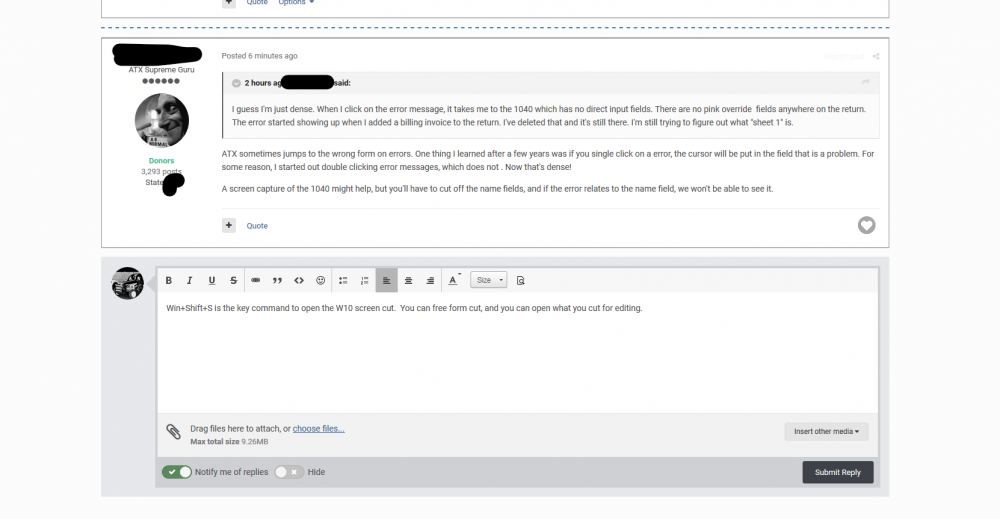

Win+Shift+S is the key command to open the W10 screen cut. You can free form cut, and you can open, in the clipboard, what you cut for editing. (Nothing personal implied by what I shaded in my paste, just showing an example of the capabilities.)

-

Every time I think about griping about the 4 (at present) school bonds collected via property tax in my county (the money has to come from somewhere, and our 'Prop 13' severely restricts property tax increases, so we get endless bond measures to vote on), I think about OH and PA. IIRC, PA finally came up with a unified collection and reporting method a few years back.

-

(Maybe something here will trigger you to find the issue...) What Pacun said. As a programmer, the message looks like an issue with some sort of entry. I would have expected double quotes, with the the quotes containing the incorrect/invalid data. However, it could be the error message cannot make sense out of the invalid/incorrect data, a piece of data is blank, or the piece of data has an invalid character. Since the message used apostrophe's around the sheet number, maybe the programmer does not use quotes in error messages (which can be a good thing, as quotes can sometimes get interpreted strangely and displayed strangely) and the actual bad data is a field containing a quote or double apostrophe... I will sometimes type a quote or apostrophe by mistake, since it is next to the enter/return key on my keyboard. I don't use ATX, but I have seen here it is spreadsheet based, so maybe the error could be fairly low level, referring to a "sheet" used to store the data? If the billing invoice is the last thing you added, review it, and remove any/all punctuation. When posting or sharing error messages, with anyone, make use of screen capture (or cell phone picture app) and supply an image of the entire message. (W10 has a great screen capture function, which allows highlighting!). At least for me, every error message has unique text describing the error, so I can easily search for and find the spot in the code where the error was shown.

-

Personally, unless there were real payroll actions taken before Dec 31, I would not create a payroll now.

-

Like tax prep, payroll providers are often asked (appropriately or not) for advice and to share expertise, not just bang on a keyboard and produce paper. If I were still processing for others for pay, I would have some sort of flat rate per month, rather than a fee per sheet of paper/check. Helps cover those 8pm calls about firing someone (which in our state, requires instant payment), or their power's out, how can I get people paid, etc. I would charge monthly, even if seasonal, as reports, inquiries, worker's comp audits, etc., do not take the winter off.

-

Printers won't print from ATX program

Medlin Software, Dennis replied to neilbrink's topic in General Chat

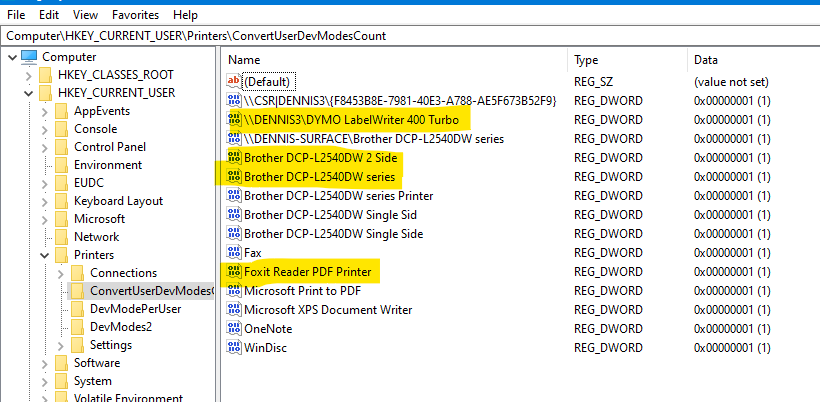

I would search through the Windows registry and remove all printer references, then reinstall the printer(s). You will likely find many printer "artifacts" in the registry, which can sometimes cause issues. Here is an example of one section off my computer. Only the highlighted ones are actually "installed" and used. Some are misspelled "copies", and some are the defaults which come with WIndows, and were not "cealred" even though I uninstalled those items. There are other areas of the registry to search. For instance, if you have has HP printer installed, search for HP and Hewlett. Canon, Brother, Epson, whatever brand name you wish to search for. When you find something with the search name, look for any other entries which relate to printers, and note them for a separate search. While it is not suggested to randomly delete things from the registry, deleting printer references is relatively safe, since you can reinstall and setup the desired printer(s) later. The advice about using only drivers which download from Microsoft is a good. Printer manufacturer's farm out coding of their drivers and other software (in most cases). Using something which has at least been moderatly tested by MS is much safer. You may not get the absolute latest feature our of the printer, but you probably are not looking for such features anyway. If you have to use the manufacturer's drivers, start with the latest one on their web site, and work backwards if needed. Do not bother with any driver included in the box, as it is months old already... -

Looking at the image, it appears ATX has a permission issue relating to bank products (likely a file or folder permission is incorrect). The next line indicates no enrollment data was updates (likely because of the error). I would opine as long as the return is not using bank products, there will be no issues.

-

I don't know the university's inner workings. If it is accountable reimbursement, it is not taxable, nor does it need to be on a 1099. If not accountable, or if it is participation compensation, then if over 600 calendar, likely needs a 1099. The rare disease ruling allows up to 2k (non accountable reimbursement or participation compensation) to not be considered for things like SSI, but does not change tax liability. I have not researched this recently, but that is my memory based on another child being considered for a long term study.

-

I remember seeing something about leased employees still being allowed to be considered employees of the business doing the leasing. Sounds like this could be a case of unintentional leasing, unless the third party has some way to actually save money with a lease arrangement.

-

One of my kids manages trials at a university. Interesting field, and not what I would have expected. Most of the work is with new ways to use existing meds/treatments in a different way. One of the more fascinating was a blood prick test to rule "in" likely concussions. The goal was to have the test available even at youth sports level. He says most of his patients/clients are not repeat participants, as the testing is very specific with criteria. The payout, when there is any, are constructed to be expense reimbursements only.

-

Confidentiality boo boo?

Medlin Software, Dennis replied to Margaret CPA in OH's topic in General Chat

Those that notice, and who you do not contact to apologize, may think you did not see the error were trying to hide the error, etc. Those that did not notice will see you are a straight shooter, and own your actions no matter what. Honesty always wins long term. I would not send the apology the same way, as there is no need to repeat the same mistake. The apology email should be sent individually as the first one was meant to have been. Over the years, I have sent messages proving my human-ness, and the usual response is positive. -

Confidentiality boo boo?

Medlin Software, Dennis replied to Margaret CPA in OH's topic in General Chat

Things happen. I get this via school and other non work "groups" every now and again. I usually let the sender know of their boo boo. The majority will never notice the mistake, and it is very rare when someone would try to do anything with the list of valid emails they were accidentally sent. Personally, I ignore any such confidentiality notice. Why? If sent via a regular email, the sender already knows the message cannot possibly be considered confidential, making the notice moot and a WOBW (waste of bandwidth). If the message might actually be confidential, then regular email should absolutely not be used to send. -

A multi state employer that looks to be properly reporting! It would be interesting, to me, to know if the employer is profitable enough in the "other" states, to make it worthwhile to have employees and filing obligations in those states. I once used a real address by mistake in sample data for a NYS45 paper form (to get approved to print on plain paper). It took about a year to prove to NY that I was not a NY employer. The sample form was sent to their forms approval department, not their processing department, yet they still elected to try to ding me.

-

I made it to itemize this year because of charitable bundling (which I have selected odd years). SALT limit is also a factor this one last year (making some changes for 2020).

-

California person who works in Texas

Medlin Software, Dennis replied to Tax Prep by Deb's topic in General Chat

Certain RV groups have good information on domicile selection and support, for the layperson. Escapees is probably a good single source, and IIRC, does not require a fee to read their documents. Escaping CA, NY, and more and more states, requires "real" planning and effort, as any crumb and the "former" state will claw back taxes easily. If one has the ability to choose, there are three usually better than the rest choices, TX, SD, and FL The first item to consider is medical coverage. If on Medicare, then any of the three is fine. If not yet to Medicare, then, if "mobile", there may be certain locations with better out of state coverage. https://www.escapees.com/education/domicile/ For the OP, TX is a good choice, but will require family moving as CA will "win" a domicile case if the TP leaves CA yet leaves spouse and children in CA. -

If you or the client is more comfortable with the former "allowances", the new calculations have "implied" allowances. Married filing jointly is similar to the former married/3. The two job settings, besides having a different set of calculations, has no implied allowances. All other status choices have two implied allowances. This was more talked about at the end of 2018, before they delayed the implementation to 2020...