Leaderboard

Popular Content

Showing content with the highest reputation on 04/24/2021 in Posts

-

3 points

-

There are several place in Windows that you can see some of the auto start programs (not services). One of them is the Task Manager Startup tab, but you won't ATX Services there, but you may find some other things to disable. And there are plenty of 3rd party apps for autostart management. The best one I've found is called Autoruns which you can find on Microsoft's site here: https://docs.microsoft.com/en-us/sysinternals/downloads/autoruns. In Autoruns you can find the services under Sfs.server..., but I don't recommend do this. For services like the ATX servers, you'll want to go to Windows Services. Probably the easiest way to get there is to start with Task Manager, click on the Services tab then click on the Open Services link at the bottom. Once in the Services manager, sort by name, if not already sorted. The services all start with ATX followed the year then 'Service' (e.g., ATX 2013 Service) Right click each one and choose properties. Change Automatic to Manual so you can start them if you ever need to. Just starting ATX should start the service, or you can run the Admin Tool for that year. or manually start them in Services if all else fails. While you're in services, right click again on each one you don't want running and choose Stop. Next time you reboot your computer, bring up task manager and make sure the services aren't running. Easy peasy.3 points

-

Thanks guys. Un-installed my virus software, restarted the services on all ATX software and the problem went away. Going to see what happens when I re-install my antivirus software. Did not use Abby's repair batch files, but I will keep this in mind. Appreciate you all. Tom Modesto, CA2 points

-

I have a couple clients who come in every three years. Luckily, they came in prior to the pandemic, or else some of their returns would be sitting with millions of other returns. And, a woman who'd been out of the country, house broken into, severe illness, and eye surgery so she can see again now brought in some old years. I'm holding the ones that need paper filing. 29 million!2 points

-

Government crippling itself, let alone the collateral damage done to tax pros.2 points

-

NY has a DOC ID on the license which changes with each renewal. The first 3 characters of this 10 character field are a requirement for NY efile.2 points

-

I have been telling my clients there is no rhyme or reason why things are happening with the IRS as they are. Back log, under staffed, utter craziness and you name it. I have been advising the direct draft as the best vehicle for paying a balance due and that went south for a while. So, put all the excuses in a jar under the desk, reach in and pull one out and say this might be it but it is a crap shoot at best. Seriously, I see it taking a few years for the IRS to get back to anything we used to call normal. This goes for some of the states as well.2 points

-

See Pub 946 - Since the GVW of an F550 is over 6,000, it is not listed property and 280F limitations do not apply - 5 year life.2 points

-

I was looking at the TOTAL adjustments before. Sorry. That was inflated for half of SE Tax. The SEHI total for both is $15,319. It includes Medicare, Medigap, Long term care, dental and Part D.1 point

-

Re-installed the Anti-Virus and ATX is still working. Thanks again. You guys are the best! Tom Modesto, CA1 point

-

When I still used ATX, I always excluded the ATX Program and all related files from the scrutiny of my firewall and my antivirus program,1 point

-

Out "server" is just a regular computer that no one uses (it's in a closet) because we didn't want to mess with a special server version of windows. We just put one main data folder on the server and shared that folder. Underneath that folder are client name folders with myriad subfolders so everything for that client is in one place. The server gets backed up constantly using backblaze just as every other computer in the office does. There are always going to be some files kept on each workstation like emails or CPE materials, etc. The server also gets cloned every night when no one is working and we keep the last 4 versions of the clone. We haven't figured a way to send it offsite because our upload internet speed is too low for such a large file.1 point

-

I have not done in ATX but I have done it in proseries. You have your data on a shared drive, let's say, on the "server" computer, which in turn is your current computer. You install ATX and use the "server" option to install and point it to the shared drive to get the data and to save the data to. After that, you follow the instruction and install on the other computer using the workstation option. For proseries, once you install the server portion, it creates an installation file for all workstation and you only click on "set up" on the shared drive and installs. As you know, your computer MUST be up and running in order for the workstation computer to have access to the taxpayers information. Also, any updates need to be run on the "server" computer and the updates will be distributed to the work station computer. For QB, you save the data on another folder on the shared drive (on your computer) and you install QB on each computer individually or as network if you have paid for it. In the simplest way... only one person can work on a QB client at a time. Again your computer needs to be on in order for the data to be available. So, no need for extra equipment if you have two computers and a router.1 point

-

I am not sure that I understand what you are asking. Sales taxes are based on sales, not payroll, so it should not matter that your client is using the same FEIN for both businesses - just what the sales are in Virginia. If they buy anything that they don't pay sales tax on in business number 1 that could be an issue if a sales tax audit is conducted because of business #2, but payroll should not be.1 point

-

Apparently this did not happen in NC. They would have lost the payment (sarcasm). I have dealt with a few lost payments by NC this year, including my own 2019 payment. That was a fiasco that I won't go into here. Just know, paid on time as required, payment got lost and I made history being one of the first to get thrown into collections without being afforded a bill. Started collections on me three weeks after they cashed the check. Nice huh?1 point

-

I just complete the forgiveness application for one of my clients. We're still waiting on the outcome. I hope I can celebrate with you.1 point

-

This is probably obvious but I just had to share it. In February 2013 I bought a new Dell Optiplex 9010 because my few years old at the time Dell could not handle ATX 2012 as we all remember that debacle. The 9010 had 2012-2019 ATX on it, and performed well, but slowed the last year. While doing a 2019 amended return I got a black screen of death. Was able to resurrect it but it kept happening. So my next thought (before reaching out to everyone here) was to get rid of ATX 2012-2016, services and all, since it's not really needed any more. Now the computer works great, ATX loads in seconds instead of minutes. This year I purchased an Optiplex 7070 Micro which is about the size of what my wife calls "a Billy Sandwich." At least something good happened to me this tax season.1 point

-

I am still wondering how many 2016,2017,2018 returns are in the hopper waiting. I know I have several.1 point

-

For this problem I have always used Abby’s first link above. Control Panel > Administrative Tools > Services then restart 2020 but sometimes I would need to close then start the service. If you have previous years you may have to restart all of them. It’s a fickle program at times but rarely happens now.1 point

-

1 point

-

I never thought of that. I should have come here first. I do have all those past years on a newer laptop that works fine but will stop the services, after you tell Yardley how to do it.1 point

-

Always suspect your security software first. Turn it all off and see if the problem persists. Some security software is hard to turn off but they usually have a pause feature. Or you can try killing the tasks in Task Manager. Have you tried (or even heard of) the ATX Database Repair batch files? https://support.cch.com/kb/solution/000048310/15000 https://support.cch.com/sfs/solution/000041746/0000417461 point

-

I have had that happen on occasion with M/L, M/S and E Jones. One is not aware of the problem until the page is printed, so a lot of toner gets wasted.1 point

-

But all my NY commuters are required to have DLs to e-file, so CT requires me to re-confirm it each year. Yeah, they ask for all this stuff to CYA when we're the ones that know whether a client is new to us or known for decades. It's as much a waste of time as all those codes I have to get on my cell and enter all day long, even though it's just me in my home office in a locked house on a desktop system that'd be hard to lug away. I agree, just because they can.1 point

-

I think the license info doesn't roll over because we are supposed to ID everybody every year. I have also noticed that university information must be entered every year by IRS requirements and they don't roll over anymore. For my practice and taste, ATX is the best in the market. Stand alone installation, who opens the program knows what forms and what questions to ask (at least that's what I believe), interface and price look good.1 point

-

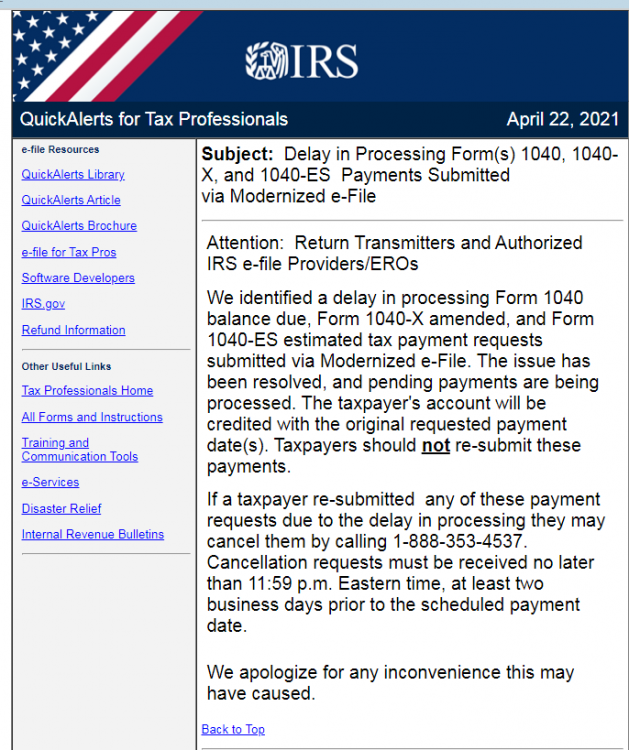

I try to keep the ball in the client's court for this very reason. I give them Forms 1040-ES and tell them to write checks. I have a handful that want me to have IRS directly debit their account when I submit the e-file. I'm sure that handful of people now think I screwed something up. They'll be sweet about, but I know what they're thinking, and I know I'll be dealing with their phone calls this week. Got a text Friday, in fact. I'm just glad 95% of my people who owe at filing pay with 1040-Vs and checks because they don't want IRS knowing their bank account information. /s1 point