Leaderboard

Popular Content

Showing content with the highest reputation on 04/08/2022 in all areas

-

Here's the FAQs revision notice with a link to the PDF: https://www.irs.gov/newsroom/irs-revises-frequently-asked-questions-on-2020-unemployment-compensation-exclusion Here's a state by state list of who to contact: https://www.dol.gov/agencies/eta/UIIDtheft3 points

-

The ATX community board is still there, but they pretty much hid it. https://support.atxinc.com/communities/index The alternative to the standard processing fee is that you pay for the software but you never get it. LOL3 points

-

I don't have a problem with EIC for a senior citizen under the new regs. I do have a problem with SS/Medicare withholding for clergy. Clergy are hybrid employees, employees for income tax purposes and self-employed for SS/Medicare AKA Self-Employment Tax purposes. Their returns typically include Schedules C and SE. This isn't my niche, so ask around and do your research. https://www.irs.gov/businesses/small-businesses-self-employed/members-of-the-clergy https://www.irs.gov/taxtopics/tc4172 points

-

Called an elder client yesterday who had a battle with cancer, chemo and radiation, and she told me that sendinc.com would not let her send me the documents I needed, but she couldn't tell me what the problem was. I think her brain is fried, which is completely understandable. Also, she was trying to use an ipad and an ancient computer. Sometimes, you just don't have the hardware it takes.2 points

-

Last year, I had a client who moved sold their house and bought a new house. so everything was handled via email. So I asked them for copies of their closing statements. They couldn't figure out what to send me. Finally I went online and found three different samples of what closing statements looked like and emailed those copies to to them. One spouse has a PHD and the other spouse has a MS, both Degrees in Education. Finally I received copies of the closing statements2 points

-

I swear, people are getting more stupid by the day, dumb as rocks, and wouldn't be able to find their way out of a paper bag! I've had to email a few long time clients re-instructing them again that I need the signature forms back before I can e-file. These are always on the outside of the folder, signature lines highlighted, and with a colored slip clipped to them on all of the ways the form(s) can be returned to me. One is a recent college grad and daughter of existing client is apparently just like her dad and only reads parts of the email. The part about signing the 8879 was in larger text and in bold. What did I get back? "Thank you for providing the document files." So I waited a couple of days before following up and the next response was "oh, I didn't know I had to sign anything."2 points

-

In many cases, or most, an employer paid disability coverage is taxable. If it was employee paid, then not taxable. It is something to consider if there is a choice, remembering the employer paid bene will be considered income.2 points

-

And, make sure you check out the separate TaxWise forum , or Drake forum, or whatever software you use forum, also, within this website. I don't use any of those, but I love the main forum - ATX Community - for tax help, practice help, help help, and good cheer. As well as putting up with my rants. With some of the best colleagues to ever meet around this virtual water cooler.1 point

-

1 point

-

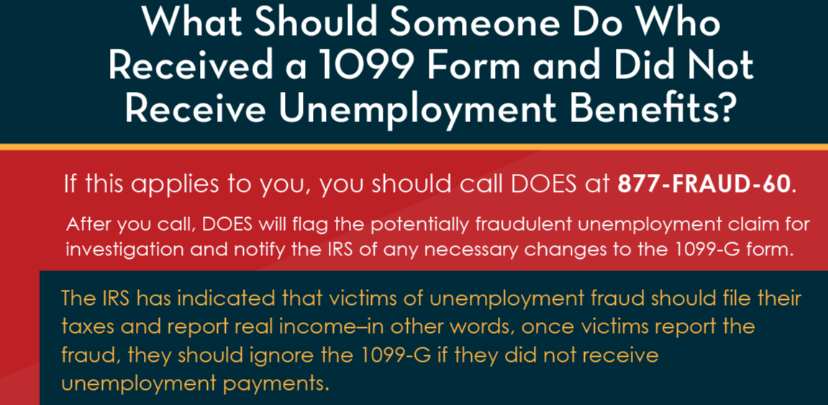

Two questions: Is the number listed on this notice a national number and good for any identity theft? Will the IRS guidance apply to any type of income reported by identity theft or this rule is only for unemployment and ONLY for this year? I have a client who worked all year and suddenly got a 1099-G for $20K and that bumps him out of EIC, making a huge difference on his refund (he owes). I am glad that the IRS will process these returns and deal with the other issue later.1 point

-

I efile the extension,leaving the payment line blank, then send the payment voucher to the client. It's up to them whether or not they remit the balance due for the extension request. I explain that an extension is for filing the paperwork, but not for paying the taxes due.1 point

-

At least it isn't mid-march but won't these folks ever learn that anytime before April 15 is not the best time to ask for renewal? My price for next year, with that whopping 12% discount is only about $30 more but what on earth is the option for "ATX Standard Processing Download Only" for $80.50? How is that different from anything we've had before once the discs were discontinued? We have to pay extra now to download the software and for standard processing? What is the alternative, I wonder? And whatever happened to the community board on ATX site? I didn't often use it but was looking for something last week and didn't see it. Does it go by another name? Also discontinued? My license expires the end of this year and I really don't want to quit yet but, at 76 and with these annoyances, my clients just may have to move along.1 point

-

Hopefully that will happen quickly with the IRS so that taxpayers with this situation won't have their EIC questioned or denied. That would be a mess to straighten out and with the possibility of it affecting their EIC for the following 2 years if the IRS has it flagged in its system.1 point

-

Should 1245 assets be included in the personal residence part? Do a bulk dispo for the house, land & any capital improvements. Check that its a personal residence. Do a second bulk dispo for the 1245 assets.1 point

-

IMHO the socalled commissions should be split between stock purchase price and non compete agreement, 80/20. The commission terminology is just a way of defining how much will be paid. Sometimes the purchase/sale of accounting/tax practices use % of retained fees as a way defining how much.1 point

-

I would treat that as an outright installment sale with the total purchase price of $120K broken down as sale of business $96K and noncompete of $24K. It's just that the yearly payments are based on what the purchaser is able to retain and collect.1 point

-

Judy, we all feel your pain because it is ours, too. I swear the electronic signature option, IF they can figure out how to access (what is my password? how do I find it?) at least the directions and CONFIRM with a click and moving to the next place is hard to overlook. How many times have we all gotten forms returned with those SIGN & DATE HERE arrows still stuck to blank areas? Shaking my head.....1 point

-

Yes, I have. Doesn't work because there's 1245 and 1250 property which can't be grouped in bulk dispo. Then, there's the division between land and building too. Thanks for the thought.1 point

-

Nah, the IRS knows that trusts and estates often don't file returns. I wouldn't file.1 point

-

Client is partially paralyzed and the IRS has flagged his return that he needs to be authenticated to get his refund (5071c letter). ID.me is next to impossible for him to sign up but he supposedly has but when he logs into the system, it's someone else's data. I have absolutely no clue how that's possible. When we call the number the IRS has on the letter they instruct him to visit the website and hang up. It's a wonderful system. Now I get to drive over to where he's living and see if this can be fixed together.0 points