Leaderboard

Popular Content

Showing content with the highest reputation on 12/10/2022 in all areas

-

I have this discussion with every new client, and then again when it comes up and they forgot the speech the first time. I will provide YOU with any tax documents I have, and YOU can forward them to whoever YOU want. I don't give nothin' to no one except YOU unless I am required by law to do so. Tom Longview, TX4 points

-

Make sure you track your business/personal usage so you only deduct the business use!!!3 points

-

2 points

-

Today the IRS CID and the Eugene Police Financial Crimes Unit visited an EA located several miles from me. Supposedly she had been taking funds from her payroll client's checking accounts, comingling the funds with her own money and spending it on personal expenses without making the payroll tax deposits for her payroll clients. Whenever I read stories like this, I am always amazed. How did they ever think they would get away with something as obvious as this ???1 point

-

1 point

-

My personal position would be I am not beholden to anyone other than my client, or a court I am subject to. Meaning, I would provide required and allowed things to my client, or to a court, and not to any third party, not even my client's attorney. What the client does with the information is up to them, and not "on" me. I actually get this all the time, when someone asks how to provide a pay stub to a lender. It is up to the employee to handle, no employer should be providing documents other than to the tax agencies, a court, or when required, to the employee.1 point

-

Thanks to everyone, just all be aware that I have not volunteered anything. I have no reason to keep data beyond the requirements mentioned above. However, with Drake, each year there is a document cabinet that is backed up and contains all the information used to prepare the return, copies of the signature forms, and copy of the actual return. Maybe I'm anal but I keep an archived backup of everything. In this case I can't provide everything the client wants because I don't have it. It's older than three years and not my problem. I've made that well known. The client seems to think that because he was/is the majority partner, he can give permission for everything. I told him I disagree. He thinks I'm being paranoid. Damned right, my license is on the line. I also told him I would not provide copies to his attorney of anything involving the spouse without her permission as well. Still waiting to hear from the attorney that I called.1 point

-

Thank you for the cite. In the OP, an issue with software availability was mentioned. If this covered a time within the retention period, the lack of ability to produce the recorder would require proactive notification to the IRS. Their rules for e records are draconian and not something most would want to be subject to.1 point

-

From IRB 2012-11 8. Retention of Records Proposed §1.6695-2(b)(4)(ii) required that a tax return preparer must retain the records described in §1.6695-2(b)(4)(i) for the period ending three years after the later of the date the tax return or claim for refund was due or the date it was filed. All tax returns for the LLC's should be kept by the company permanently, not by the preparer. You may not want to volunteer any additional information as others have mentioned.1 point

-

Is there a reason/rule which you are using to keep data from 7 years ago? I get it, tax data is different than what I deal with daily, but my philosophy is to not keep data longer than required since it cannot be used against you... Where I am going with the question is to try to separate client "want" from professional "required" to. I just find it odd when someone says I have my returns from 10 or 20 years ago, or all I have ever filed. My take on the OP is someone is fishing, maybe for helpful testimony in this case, but fishing is still fishing. I would make no response other than under the advice of my own representation.1 point

-

MFJ return - both spouses must authorize consent Partnership - I don't know but wonder if consent of the 'tax matters partner' is all that is required.1 point

-

1 point

-

Let the attorney (for whomever had the subpoena issued) know there will be a fee and present it to the attorney for payment. IMO it does not matter that your appearance is required by the court; you should be paid for your time and knowledge.1 point

-

My questions are the same as Tom's. If I'm subpoenaed, how can I charge when it is a court order to appear? i did not volunteer to be a witness or anything else. I was given a heads-up that the possibility exists, and the court date is set for February. I will do as Max said and get the copies of the circular 230 ready. I have been deposed before in a wrongful death claim for my father and hoped I would never have to go through that again. I can't testify to what the guy actually did with the insurance proceeds. All of this is to prove he replaced a multi-family rental unit that fell to a catastrophic loss (fire), that was part of a pre-nuptial agreement, with other property making other said properties part of the pre-nuptial agreement and not on the table for the divorce. I have nothing but worksheets and not even the tax returns as the transaction occurred in 2014. Because I had nothing to do with the bookkeeping, bank accounts, receipts or other records, I have no idea why this even involves me. For all I know he could have bought the other said properties with funds from who knows where. My personal take, there is significant real estate on the table, close to 30 properties, along with other assets, and it sounds like the soon to be ex-spouse is taking him to the cleaners. Another twist to add. The guy gave verbal permission for his attorney to contact me regarding any items he, the attorney, may need. Provided me the attorney's name and phone number as well. I wrote down nothing and did not agree to give out any information unless there was a signed disclosure statement. In this case, I think I will require the disclosure statement to be notarized.1 point

-

1 point

-

Before being called as a witness, you would either be deposed, or sent an interrogatory, or possibly both. Since thery are looking for documents, the interrogatory is what is usually used. It gives the person more time to dredge stuff up out of memory. However, in your case you had nothing to do with the documents, are not required to keep copies of clients records and not even required to keep copies of their tax returns. So, get out your copy of Circular 230 and dog ear the pages pertaining to the keeping of records and returns and highlight the pertinent phrases. This should be enough ammunition to send the attorneys looking elsewhere.1 point

-

Can you charge your time if you are subpoenaed to testify? If a judge orders you to testify you have to .... right? How would you be able to charge the client for that compelled testimony? Unless you volunteered to testify...which I don't think you would want to do. Would you? I don't think your E&O carrier would appreciate it if you volunteered to be deposed. Tom Longview, TX1 point

-

1 point

-

I would definitely contact my E & O Insurance Carrier. According to the AICPA's Insurance Carrier, Divorcing Clients are one of the leading causes of Legal Proceeding against CPAs. Being prepared is far better than being caught of guard by surprise.1 point

-

I got blue light blocking computer glasses a few years ago and they really help. But I never thought of deducting them as a biz expense! D’oh!1 point

-

I was in a class yesterday talking about the Jan. 15 loophole when another person in the class got an email: partnerships don’t need to send Jan. 15 letter, but S corps still do.1 point

-

1 point

-

I got the Foster Grant blue light computer glasses on sale. Reading magnification for those tiny numbers on W-2s at the bottom (1.25-1.5), computer distance in the middle, and distance at the top so I can see a client across my desk or look out my window. I don't have to take them off, can walk around in them, sometimes forget I have them on. Also have a lamp on my desk, as well as recessed lights in the ceiling, because good light helps, too. I have a pair on my desk, a pair in my briefcase for going to clients' sites, and a spare that are darker and show up well on Zoom, also. They were a real bargain on sale. Also, have an even cheaper Chinese pair on my bedside table for reading my Nook. By February, my eyes were burning. As soon as I put on the blue light multi-distance glasses, my eyes felt better. When I told my ophthalmologist, he said his own kids wear them. I did buy the three pairs I use for work from my business account as office supplies. Take good care of your eyes!1 point

-

I will have blue-light-blocking, thank you. kathyc2, I can't do the two different lenses because I only use one eye at a time. Hey, remember that I am 80 and probably won't be changing prescriptions again. At least I might be able to read the MTG without a magnifying glass.1 point

-

These glasses will live on my desk. He also prescribed progressive lenses in another pair for all around use. We shall see how it goes. Most of the time, I don't wear any or pick up a pair of cheaters. However, lately I have had issues with reading the documents to enter into the tax returns. I really have no qualms about deducting the expense. I am certainly not going to track time. It isn't that critical of a deal. Thanks for your comments. I already know that I will be sorry that I didn't have him put distance at the top because the bird feeders are right outside my office window. Also have wild turkeys and deer walking around the yard quite often.1 point

-

My current progressive bifocals have a magnification of 15 % above normal. It really helps.1 point

-

Get the blue-light-blocking computer glasses. Huge reduction in eye strain. Foster Grant has frequent sales if you don't need prescription (just reading, such as 1.50). Look for sale announcements on Facebook.1 point

-

1 point

-

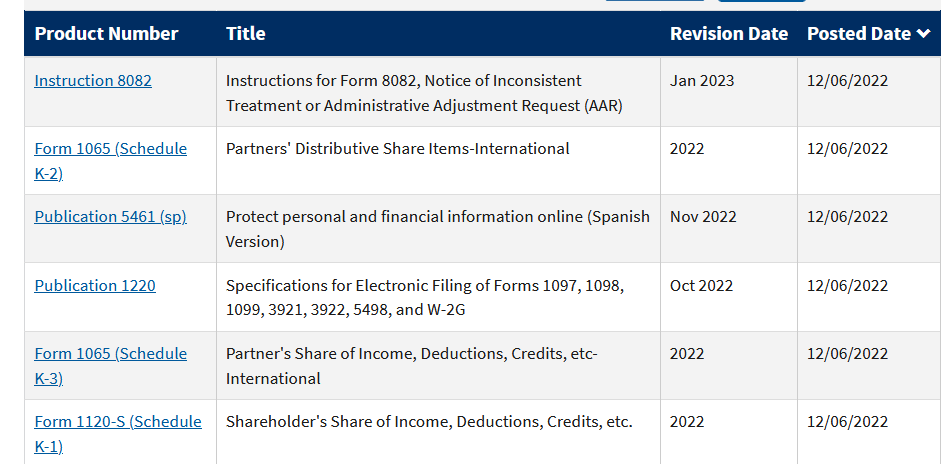

Second Draft of Form 1065 K-2, K-3 Instructions has some improvements: https://www.currentfederaltaxdevelopments.com/1 point

-

"Google researchers said on Wednesday they have linked a Barcelona, Spain-based IT company to the sale of advanced software frameworks that exploit vulnerabilities in Chrome, Firefox, and Windows Defender. Variston IT bills itself as a provider of tailor-made information security solutions, including: technology for embedded SCADA (supervisory control and data acquisition) and Internet of Things integrators; custom security patches for proprietary systems; tools for data discovery; security training; and the development of secure protocols for embedded devices. According to a report from Google’s Threat Analysis Group, Variston sells another product not mentioned on its website: software frameworks that provide everything a customer needs to surreptitiously install malware on devices they want to spy on!" In the world today, where everything is for sale including our personal data, I am not surprised. We are so far down a slippery slope, how do we recover? How do we fix this?1 point

-

I would probably keep the guides for the open years. I currently only have one, from 2011. Guess I can free up some shelf space. . . .1 point

-

Backup and restore WITHIN the software used to create the data, will always be the most reliable. Depending on any third party system is not the best idea. Not a repair shop, not the OS, not a “backup manager”, etc. Why? The software vendor knows darn well what to backup and restore, every time. As a for instance, I hear often from customers who are dealing with a repair person who failed to make the new computer have all data the old one had. With that said, I personally use a backup program as a secondary system, BUT it is a system where I manage what gets backed up, so I know what is backed up. “Default” settings will sometimes work, but just as often, will not backup what you really need.1 point

-

I kept the previous six for decades (long enough, I think). Cut down to three this year. I've only had one poor soul on whom they ever went back six years. His precedent was unprecedented. A preacher, for heaven's (and his) sake.1 point

-

I DO use it when the mud gets deep. It has given me the answer that I couldn't find anywhere else, every once in a while. That being said, I think 5 should be sufficient. We have an outdoor wood-burner; so mine are starting to turn to ashes. How much reference material can we keep for our heirs to throw out?1 point

-

Trader Joe's 1lb bag of frozen Brussels sprouts were $1 a year ago. Today they were $1.50. So I'm guessing a 50% increase would be fair.1 point