Leaderboard

Popular Content

Showing content with the highest reputation on 04/14/2023 in all areas

-

Yes she gets step up. If the stock was held only in his name, she gets full step up, if held jointly only half step up. Inherited property is automatically long term. When you enter inherited as the transaction type, ATX will fill in long term for you. Tom Longview, TX4 points

-

ignore the term, all inherited stock sales are considered LONG TERM4 points

-

She has a duty to file the final tax return and pay the taxes for the decedent; whether she files jointly or separately.3 points

-

Direct pay also puts the responsibility for payment back on the taxpayer instead of the preparer.3 points

-

I prefer the Direct Pay option, because if the efile is rejected the Direct Debit will be late.3 points

-

3 points

-

Post your solution for other sleep-deprived, stressed, rushed tax pros who can't possibly remember every thing they need to remember at the exact moment they need it.2 points

-

Because programmers don't prepare taxes for a living, so they don't truly understand our processes. I've complained about these kinds of things on extensions for years, with both ATX and the last tax software I used.2 points

-

2 points

-

I've given up on the ATX software and started filing the RITA returns for my clients online (I'm in KS so only a handful of OH clients). It's pretty straightforward on the RITA website. Wish I had thought of doing it that way years ago ... it would have saved me hours.2 points

-

I served for several years on the council of the small burg where I used to live in. The OH legislature has repeatedly cut taxes over the past several years (yay!) but a major part of what they cut to pay for the tax cut was funding to municipal governments. Now, the muni's are having to raise taxes to survive. Everyone loves a tax cut...until the services they rely on are cut as a result. Deep sigh. My last vote before resigning when I moved one town over was to enact a local tax. Made me sick having to do it but we were the last muni in our county to enact a local tax (1%) and we would have been bankrupt without it.2 points

-

2 points

-

Catherine- if the IRS would just use words like "poof" we would be able to do our research a little more efficiently!2 points

-

I don't think that strategy will work if she ended up with the funds at the end of the probate. I can't remember specifically now, but I thought I read a case similar to this one where the spouse could not be relieved of the tax burden because she had the benefit of the funds in the marriage unit. Kinda like substance over form doctrine. Tom Longview, TX2 points

-

I never use direct debit. I kid you not, I've had the IRS 'double dip' and take clients' money twice on 2 different occasions. I call, hold forever, yes, we took it twice, blah blah blah, we'll return it in 10 weeks. TEN WEEKS! No way. I just refuse to do it. Direct pay all the way. I even made an instruction sheet for clients re: the same ;).1 point

-

I have no idea, but probably because the IRS told them to program it that way.... Tom Longview, TX1 point

-

Or PA, NJ or NY. But yeah, Ohio is the worst. My first Ohio was a part-year moved to MD. I ended up doing 4 separate OH returns.1 point

-

If the stock was 100% owned by the husband. How was the brokerage account set up originally? With the quick sale after his death, would think it was a joint account with right of survivorship or maybe transfer on death (TOD)?1 point

-

Yes, from the "Setup" drop down menu: Choose Communications Editor,then on the left side, click the + to the left of Federal Return Paragraphs that will open up all the available places you are able to modify. Double click on Federal Balance Due paragraph, and more options will appear to the right side, On the right side, click the + next to Federal Results Section if it isn't already expanded Doubleclick the selection that says "Federal Balance Due Paragraph" and the editor will open the editor where you will be able to modify any of the payment option paragraphs that Drake uses.1 point

-

RITA administers city tax for hundreds of municipalities. As a result, the RITA return is somewhat convoluted. Drake handles RITA reasonably well for straightforward returns but can get squirrely in special circumstances like part year situations. I suggest you check the results carefully to make sure it produces what is expected. You can also call Drake and get some help. They have access to some instructions/cheat sheets that are not available to us in the field. FWIW, about half my calls to tech support each year are special situation RITA issues. They typically find some obscure check box in a place no one would ever think to look (sometimes not even in the RITA section).1 point

-

1 point

-

I have to agree. He died leaving an estate which will require the listing of those assets and creates the liability of his estate to pay his debts. He placed the funds in a savings account titled in his name so guess who they will sue if the estate does not pony up. His wife the appointed executrix.1 point

-

I thought about that too, but VA is NOT a CP state. There may be some nuance to this, but I still think if she ended up with the cash, she is going to have to pay the bill, and like @cbslee said it will either be her personally or his estate that is on the hook for it. Tom Longview, TX1 point

-

Yes, with the proviso that the return is accepted. Better in my opinion to file now and date the direct debit 4/18 to give a cushion. Or use Direct Pay at irs.gov1 point

-

Alas, a Columbus return is required. Gambling winnings are taxable in Cbus as 'other compensation,' and gambling losses cannot be used to offset winnings. File Form IR-25 or the Ohio generic municipal tax return.1 point

-

1 point

-

1st city (no income) I would look to see IF there is a filing requirement. Some only have a filing requirement IF there is TAXABLE income. (My local put in a requirement for everyone. They quickly learned that move more than tripled their workload with no increase in revenue. Then they offered a one-time waiver for retirees.) 2nd city (income) all earnings, whether in city or out, is most likely taxable.1 point

-

Thats what I thought too and without a reference. Client inherits the property at FMV date of death. That's their basis and start over.1 point

-

You can change from MFS to MFJ any time under normal amendment timeframe. Changing from MFJ to MFS has to be done before due date.1 point

-

How is the saving account he parked the money in titled? If with rights to survivorship, I believe it passes to her regardless of not having a will. If the income between the 2 was significantly different, MFS will more than likely produce higher overall tax, especially if one or both receive SS.1 point

-

1 point

-

If they have no other assets, I could see MFS being a good route to take. Otherwise I think the debt is going to have to be paid from assets of the estate.1 point

-

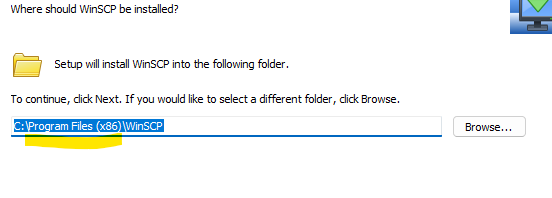

Unless (and it is rare), the software has no selection of installation, you can overtype or select a different folder other than the default. One exception is if you are installing something which is already installed, the dev may allow the setup to just "go" to the same location with no option to change. What I am suggesting is to change the program file section to something else. In this case, I had to select "custom" install to see/alter the installation location. Since the app is 32 bit, it defaults to the x86 program file folder. I replaced the section marked above the yellow with my own folder (Other Apps). I am suggesting nothing be in the program file folders other than what the OS puts there when the OS is installed. This ISOLATES the apps from the OS better, which can pay off for cases where the OS is stuck, such as a failed upgrade, or user error, and the OS needs to be reinstalled or recovered.1 point

-

Poof. New owner, new basis. Start from scratch. You will have some depreciation if it is continued as a rental. Tom Longview, TX1 point

-

Horrible year personally but the work was OK. Everything is worked on and out. I try to aim for around the 10th or 12th to get most done and give myself a cushion of time. I have one client meeting today for pickup, and then I'm waiting on signature forms for the rest. I will have only 3 extensions, all for one client for his personal and 2 little partnerships. I took yesterday off! I've been taking care of mom full-time for the last 5 years with increasing demands the last year or so. Now at 96+ yrs old, early dementia and was still living at home until a fall in late March. She was unhurt, but it landed her in rehab. Three days in she, I, and my husband all got a nasty GI virus circulating in that facility. I was completely down for a few days and feeling sick most of a week. Then a second hospital trip with her last weekend and another night with no sleep because rehab made a bad call on when in actuality she had lower rib and hip pain radiating. After all night in the ER told me to give her some extra strength Tylenol and that transport would be another 6-7 wait. No way! I drove home for her van and took her back to rehab myself at 4-something in the morning! In the next few weeks I have to find permanent placement for her somewhere and begin to clean out the family home that she has lived in for more than 70 years. Because of mom's needs, I haven't taken any new clients in these last 5 years and most of my business clients got old, retired, and/or sold their businesses. My workload is much lighter than it should be now when I should have been building my practice and couldn't. That is some of the reason I've had some extra time in the past few years to answer lots of questions here, away from the office and the internet to fill up time. Husband is doing well with fighting the bladder cancer, the prostate cancer is treated and gone, and other issues were fixed in '21 that were heart ablation and AAA repair. When a SIL passed suddenly last June, I started walking with my brother in the very early morning and have gotten more fit again. I'd walk anywhere from 3-5 miles every morning until the time changed and everything fell apart with mom. I wanted to walk last week but in the turmoil I ended up with a twisted or sprained ankle that I'm babying at the moment. I don't know how that happened but it's getting better. Also thanks to two brothers, my husband and I have taken up shooting sporting clays, or some may still call them clay pigeons. They are all excellent marksmen, so I have lots to learn and catch up on. I love the outdoors and all kinds of activities, and this is the latest and one I never dreamed of trying. I bought a shotgun of my own. We took advantage of yesterday's beautiful weather, went shooting, and got away from all the pressure for the afternoon. I'm slowly improving and was pleased with my progress on a more difficult and new-to-us course. If you made it through all of that, thanks for reading!1 point

-

And to make matters worse, my Apple Watch just buzzed my arm with a notification that says 'tracking is the most important part of weight loss ... don't give up'. I'm not tracking/using any type of weight loss app. My watch just decided I need to slim down. Turtle poop, Cow flop, Donkey dung, and all the rest!!1 point

-

I've never signed one in 25 years. I just have ATX 'electronically sign' it for me. I've also never had the IRS ask for my 8879s.1 point

-

We recommend Genius Scan (free) app. Only because that is the only app I know that is free that I have actually used. It is OK. Did I mention it is free? I still get jpeg files and it sucks. Tom Longview, TX1 point

-

The TCJA eliminated NOL carrybacks and permitted NOLs to be carried forward indefinitely. The CARES Act changes those rules temporarily by permitting NOLs incurred in 2018, 2019, or 2020 to be carried back for five years to the earliest year first and suspending the 80% taxable income limitation through 2020. This is all spelled out in section 172. There are special rules for farming.1 point