Leaderboard

Popular Content

Showing content with the highest reputation on 04/11/2025 in Posts

-

Could be bad advice from the preparer; could be bad listening by the taxpayer. Just recently I had a client call me about a transaction which we had discussed 3-4 months ago. At that time she told me what a friend had told her about the taxation of the capital gains. I explained to her why that advice from her friend was dead wrong and I then gave her the correct information. On this subsequent conversation she repeated the bad advice to me, and when I corrected her she said "But I remember you telling me that on our last conversation." Fortunately I had made notes and more-or-less read them back to her. Either I'm a very bad communicator, she's a very bad listener, or (most likely) she only remembers what she wanted to hear rather than what was said.6 points

-

I'm getting old and spicy, and now, when people tell me something preposterous (or give me some crazy tax rule they 'know'), I look them straight in the eye and say, 'Did your hairdresser tell you that'? Stops them cold. Literally. You should try it. They look at me dumbfounded for a minute, then they usually chuckle, and then they remember that it's a 'fantasy tax scenario', and we never speak of it again. You have to be over 50 to pull this off, but I've now made the cut, and I use it every time.5 points

-

4 points

-

A client walks through the livingroom to get to the OIH, but we can't use the sq' of the LR as part of OIH. Regular and exclusive. My clients can use my hall bath, but it's not part of my OIH, so I wouldn't allocate the bathroom part of my water to my OIH. I keep changing sides on this. Probably 'cause I'm too sleepy to read the code.3 points

-

3 points

-

If they are able to take their phone call about a 20 year old tax return - he's in hell.3 points

-

Pub 587 doesn't exclude it either. "Such as" means it's not an all inclusive list. Since it does include utilities, and water is a utility, it can be argued that the pub does include it. Water may not be deductible, but it cannot be logically concluded from the pub that the "bottom line, water is not a cost of using a OIH so it is not allocable". The OIH FAQ does include water, https://www.irs.gov/pub/irs-regs/office_in_the_home_faq%26av1.pdf Partially Deductible Real estate taxes Mortgage interest General repairs to home Water, sewer, garbage Home insurance Rent Depreciation on home Security system General repairs to home The FAQ doesn't include gas, electric, or utilities. If we go with the all inclusive view, then water, sewer, & garbage are the only OIH deductible utilities based on the FAQ. Thus we have conflicting guidance from the irs, neither of which is authoritative. So what do we do?3 points

-

3 points

-

The home is not livable without water. Water as a utility cost is allowable on Form 8829 as a utility cost, just like oil, gas, electricity.3 points

-

Without water, how does a client flush the toilet when they go to the restroom? Just asking for a friend. Tom Longview, TX2 points

-

But if the actual method is used in the first year, then the client must continue to use that and can't ever switch to cents-per-mile method.2 points

-

You could have used actual expenses - gas, maintenance, insurance, etc. This way it doesn't matter what the mileage was, if it was 100% farm use. Then tell the client to keep a log from here on.2 points

-

the balance due option (online) throws some folks because they don't see an amount even though they (recently) filed. I've had to reassure them that it's okay--the important thing is they've chosen the correct option (and not estimated taxes, which is now prefilled for 2025). Obviously in this case the amount due will be unknown by the IRS.2 points

-

But different in the case of an OIH. The wiring provides electricity which is an ordinary and necessary allocable expense. The water lines provide an expense which is most likely used 100% personal in the residence; and zero to the exclusive OIH portion.2 points

-

This. If someone needs to make a few payments to get paid up for the year and don't want to do an official payment plan, I give them a few blank 1040-V forms and they mail them in with payment. The IRS will eventually bill them for interest owed. It's never been a problem.2 points

-

Have one today who wants me to file an extension and the only contact we've ever had was 9 months ago a meeting about whether I could do their tax return. Haven't heard from them before today and she obviously doesn't comprehend what an extension means. She's wondering if it means she gets a 6 month extension on making estimated tax payments.2 points

-

They only time they remember something they do not want to hear is if their barber's wife's brother tells them!2 points

-

2 points

-

Who knew that whether or not water can be deducted with respect to "office in home" would be so entertaining2 points

-

That was not a conclusion based on the pub (which is not an authoritative cite) but on the code. FAQs are also not authority, and some have been proven wrong in the past. The average US household water usage is supposed to be about 300 gallons a day, how much of that is consumed in an an area dedicated 100% to an OIH as an ordinary and necessary business expense? For mine, I have to say about zero. Therefore it is not an allocable expense per the code. But that does not make it an ordinary and necessary business expense. And I am not worthy to cast the first stone in this case. We have a separate electric meter on our well. I have always included that as part of OIH utility cost; at least up until now. After reading the code and understanding the word "allocable" in accounting terms; and knowing our daily water use is about 100% personal for washing clothes, showers, watering lawns, washing vehicles ..etc, I cannot deduct it in good conscience. But as Sara pointed out, if we were running a daycare the cost of water would be an "allocable" expense.2 points

-

How does 280A (c)(1) indicate that water is not a deductible home office expense?2 points

-

I'd tell him that unless he has proof of the loss and also proof that it wasn't used up by capital gains in the interim, I can't deduct anything. I find it hard to believe that any preparer wouldn't be deducting that capital loss every year, and carrying it forward.2 points

-

Give them no-amount-printed payment coupons to mail with checks? Or use the "Balance Due" choice that should still exist?2 points

-

Yes, we all are amazed when we think we hear the "grand champion" idiocy from our clients. I've got to think hard to wonder if I've heard anything like this before... Client has a farm - has had for a few years. So this year he buys a 2024 FORD F450 truck. (Those of you who know anything about trucks know what a beast and expensive this thing is). Drives it 4000 miles for Farm Use only. This is not a 1975 Ford F150, or a hay truck with a long bed. It is a Ford F450. Brand new. Didn't keep a log because he thought Farm Use only means that he didn't have to keep one. Needless to say, I told him to take his taxes somewhere else.1 point

-

With all the poking and prodding going on in IRS systems, I'm afraid we may have another crash like 2018. Or even worse, they don't pick up the software generated withdrawal authorizations. I was planning on having everything submitted today but some clients can't seem to get their (*&^ together and get signed forms back.1 point

-

Who could imagine this would get into such detail? Thanks, Catherine, for providing this 'fun' diversion in these last grueling days of the season. It's certainly led us into some interesting rabbit holes (just in time for Easter)!1 point

-

Our clients can spend their money foolishly. But their record-keeping better be accurate and organized, so I can make sense of what's deductible.1 point

-

With low mileage and high vehicle cost, actual will likely be better until it's fully depreciated. But it's always a tough call.1 point

-

And I have been looking at this from the perspective of my personal OIH as well, and admit I have been doing it wrong. There is no way I can justify allocating a personal expense.1 point

-

1 point

-

I did say "most likely", which is the case of a traditional OIH, and yes I made that assumption from the OP, shame on me.1 point

-

This discussion is now to the point where I have a huge smile on my face1 point

-

Thanks everyone. I think he's out of luck at this point. He's in the 15% capital gains bracket, so he won't have a huge tax bill. He informed me this morning that he is out of the stock market as of last week, with a net loss this year, and isn't planning on getting back in. At $3,000 a year, it will take him about ten years to write off his current loss.1 point

-

Unlike electricity, gas, or heating oil, water is not allocable to an area used exclusively to the home office. There is direct benefit from the the utilities used to power, heat or cool the home office as ordinary and necessary expenses; the home office consumes a portion of those utilities and they are rightfully allocated per the code section. On the other hand, how much water is used as an ordinary and necessary expense in a home office? Notice that pub 587 does not include water as a utility allocable to a OIH: Utilities and services. Expenses for utilities and services, such as electricity, gas, trash removal, and cleaning services, are primarily personal expenses. However, if you use part of your home for business, you can deduct the business part of these expenses. Generally, the business percentage for utilities is the same as the percentage of your home used for business. Bottom line, water is not a cost of using a OIH so it is not allocable.1 point

-

1 point

-

Additional cost of heavier-gauge pipes was a couple hundred bucks over the many thousands of dollars in cost. The huge cost was the sideways drilling under the state highway without disturbing traffic or the roadbed. Plus, that heavier gauge is now required by code. Old pipes were very old, and might even have pre-dated the paving of that road decades ago.1 point

-

Copies of tax returns from the IRS are limited to 7 years. Might try contacting the retired preparer. My next door neighbor was a retired tax preparer and when he died all his old record were shredded. I don't know how far back they went, but the shredder truck was out in front of the house for the better part of the day. I doesn't hurt to ask.1 point

-

What Abby said, plus if prior preparer changed software providers without conversion, the LTCL c/o entry may have been missed.1 point

-

I guess I'm screwed now!1 point

-

I don't treat my clients kindly for what I can receive in return. I don't plan on having a funeral. I can say though that when I was very ill in July, some brought soup; some brought hot dishes. Many sent cards, etc. So, some do care about me.1 point

-

I tell clients who owned original AT&T stock and now own 28 companies that themselves have had mergers and splits to never sell. Just let their kids inherit the stock to save us all a lot of trouble!1 point

-

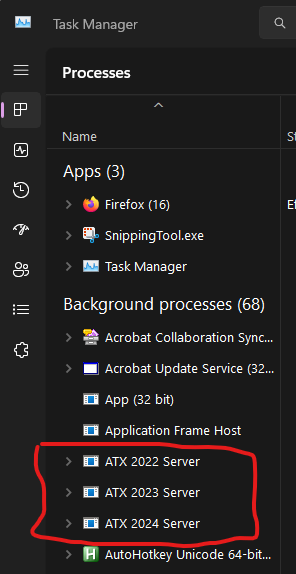

These are posts from Abby Normal as posted in another topic. First post: "Not having a full and complete backup of all of your files is foolish. In addition to backing up the entire Wolters Kluwer folder, you should at least backup your documents and many other things in your Users folder, plus anywhere else you keep important files. It's important that you end the ATX servers, all of them that are running, before backup up the Wolters Kluwer folder. Occasionally, I turn off all the ATX servers and copy the entire Wolters Kluwer folder to My Documents and then it gets backed up with all my other documents. I name the folder Wolters Kluwer yy-mm-dd and keep the latest 3." Second post - to turn off ATX Servers: Bring up Windows Task Manager and end the ATX Servers tasks. You end them by right clicking on them and choosing End task, or by selecting them and pressing the Delete key (DEL). Knowing how to end or restart tasks is an essential ATX skill. To start Task Manager, you can use the menu and type 'task' or right click the taskbar and choose Task Manger or my preferred method, Ctrl+Shift+Esc.1 point

-

Examples copied from Forbes: "The extension payment date for taxpayers who log into the IRS website is showing as incorrect. While payment should be made by April 15, 2025, taxpayers who log in to pay see an April 22, 2025, due date. The site says, "Your payment is due on April 22, 2025, regradless of filing for an extension." (Yes, the 'regradless' typo is on the IRS site, too)." "Errors appear in other spots on the website, too, including misidentifying the amended tax form as Form 104X (it's Form 1040X) that was recently “filled” instead of “filed.” "Account holders report that previously filed and processed tax forms (for tax years 2022 and 2023) are showing as now being processed even though those returns have already been processed. (I verified the errors by logging into my account.)" "One tax professional reported that the installment agreement option for making payments over five years (for a total of 60 months) only allowed taxpayers to make payments for five months." "The errors have been reported to the IRS. In a statement issued to Forbes, Scott Artman, CPA, the CEO of the National Association of Tax Professionals (NATP), the largest nonprofit organization that serves individuals specializing in tax preparation, noted, “Tax professionals rely on accurate, timely guidance from the IRS, especially in the final days leading up to the deadline. As soon as this issue was confirmed, we brought it to the IRS’s attention and have been assured that it has been communicated to the appropriate internal teams with a request for prompt resolution. We are hopeful the IRS will address the issue quickly to avoid any confusion for taxpayers and preparers." We already have enough chaos and uncertainty0 points

-

Definitely don't claim any loss without evidence. We had a client with a multi-million dollar loss that was used against gains on some of his other endeavors over the years. Boy was he upset when he had a huge gain and a huge tax bill. He still had that big loss in his mind and assumed he'd never have to pay taxes again.0 points

-

Mine is clients that make multiple times my income but complain they can't make ends meet. When I ask if they make a budget for expenses they look at me like I'm a space alien. Of course they never have the money to make estimates or adjust W2 withholding like I suggest. Yet they think they have the money to buy an expensive new car, live in a McMansion and take extravagant trips. Two of them just this week that look large 401K distributions in 2024 with no state tax withheld and only enough FIT to cover 10% penalty. Another one with a rather large inheritance held in a trust as apparently parent realized they can't handle money. Supposedly, EJ told him he doesn't pay tax on inheritance. He can't understand me telling him he's not paying tax on the inheritance but on what it earns as shown on K1. Since they know they owe I never see them until April when my tolerance level is below zero.0 points