Leaderboard

Popular Content

Showing content with the highest reputation since 06/30/2025 in all areas

-

Twitter was abuzz about that yesterday. Some guy was going on why if he won 400K but lost 500K why he now has to pay tax on the 40K. He didn't like my answer that it's a stupidity tax on people that throw away money gambling.8 points

-

Why didn't they just raise the $32K ($25K) used to determine if any of SS was taxable, and the $12K ($9K), used to determine how much was taxable? I have been preparing taxes for over 20 years and don't remember them ever being raised. Adjust these amounts for past inflation now, and then adjust yearly to avoid this issue in future years instead of using this band-aid approach.6 points

-

Once again, JOA has done a wonderful job of taking legislative text and turning it into real language. https://www.journalofaccountancy.com/news/2025/jun/tax-changes-in-senate-budget-reconciliation-bill/6 points

-

And just think of how many of us have clients whose tax returns from prior to 2000 are lying around with our social security numbers on them. (or tossed in the garbage when they did house cleaning or by their heirs)6 points

-

Yes; us - the good tax preparers. Not the fraudsters (taxpayers, cheats, or 'preparers' in it to cheat). They make it harder & harder for us to help taxpayers (which helps t/p's and the IRS - with the IRS probably coming out ahead in that one), then wonder why we get testy.6 points

-

I am just philosophically opposed to giving my face to a for profit company to add to their data base so I can continue to work in my chosen profession. I don't know what has gotten into the IRS that they think we are the problem. They know us. And the ones who are running Turdo out of the garage are not going to do this anyways? What in the world? Conspiracy theory Warning ****** The government promised to put as many people into ID.me when they signed the contract so ID.me would have a larger data base. End of theory***** How about requiring everyone to takes a tax credit to have an ID.me account and give their face to that company in order to get a tax break? I am so pissed I am not thinking straight. The IRS keeps shooting at the wrong targets. Tom Longview, TX6 points

-

Includes: "The new law includes a provision that eliminates federal income taxes on Social Security benefits for most beneficiaries, providing relief to individuals and couples. Additionally, it provides an enhanced deduction for taxpayers aged 65 and older, ensuring that retirees can keep more of what they have earned." Bad enough that we need to dispel the "somebody said" and FB garbage, now it's coming direct from federal agency. Shameful.5 points

-

So they have 6 months to reflect upon their bad choices and change their behavior before the new rules take effect?5 points

-

Yeah, in general people don't like truth that makes them question their poor choices.5 points

-

I still have, in deep files under lock & key, a set of tax forms sent to me in the mail - with the little sticker with my name, address, and ssn on it. Remember those? (That year I had moved so I did not use the sticker.)5 points

-

5 points

-

5 points

-

Exactly. If hackers can get into the Iranian equivalent of coinbase and make 90 million in digital assets fly into the ether, you think they can't get into ID.me? Tom Longview, TX5 points

-

5 points

-

I would also be lost without this board. Thank you to Eric for keeping us going, & to Judy for moderating. You can make your donation automatic - annual, quarterly, monthly. Check the Donate link!5 points

-

i have QB Pro 2019 on Win 11 with no problems. I use it only for my personal business accounting so cannot speak to any potential issues with payroll or other updates. In fact, I don't think it even updates any longer but it serves my purpose.5 points

-

I just got it. Sent an email to my Congressman telling him if the rule goes into effect on July 1, I will not vote for him again. Tom Longview, TX5 points

-

I don't judge my clients or their choices. I only recommend, advise and explain the law. They aren't going to stop gambling just because we tell them it is a bad choice. IMO4 points

-

If only that were the case. It goes much further both disqualifying some completely, making it harder and more burdensome to enroll and making it much more expensive. If this doesn't lead to universal healthcare, then there's no hope for us.4 points

-

I remember before ACA insurance premiums were 15% of my gross income. I remember rates increasing on average 10% a year. I remember calculating that at some point I wouldn't be able to continue paying them without taking money from retirement accounts. I remember researching putting assets in a trust so a prolonged hospital stay wouldn't wipe me out if I could no longer afford payments. So, instead of saying people should remember what "normal" ACA is, how about remembering what some of us went through before it was enacted? Would you like me to remember back further when my Dad had cancer and the small company Mom worked for changed carriers and they refused to enroll him?4 points

-

More details here: https://www.kff.org/policy-watch/how-will-the-2025-budget-reconciliation-affect-the-aca-medicaid-and-the-uninsured-rate/4 points

-

4 points

-

This is one HUGE step backwards. I was talking to a friend, with a family of 4 paying $400/month for a great plan. Now, she'll pay more for a less great plan, if she can even afford it all. She was opposed to Obamacare when it started but now she loves it. Or, should I say, loved it. A lot of people are going to feel a lot of pain.4 points

-

I'm well aware of the fact that the tax on SS benefits goes from general fund to trust funds. I'm just saying I can't find anything as to how they actually calculate the amount. The extra 6K doesn't affect how much is thrown into the taxable column since it's an after AGI adjustment. So, if they just use that amount times a rate nothing will change. I highly doubt they have the computers look at each return and say xx% of the actual tax on return was a result of SS benefits and then use that amount for reimbursement. Personally I've never understood why someone should have a higher standard deduction simply because of being 65. Most of us at that age should not have a mortgage or rent, yet we are allowed to pay less FIT than a young person trying to get a start making the same income. I was just livid about the email SSA sent out. Waaayyyy too political of a statement and extremely misleading coming directly from an agency that's supposed to be apolitical.4 points

-

Posting in case anyone here hasn't read the email saying that ID.me will be required to log in to the PTIN and other IRS services.4 points

-

If son qualifies as dependent, client may also qualify for HOH. No problem to amend back three years, just make sure you have done your due diligence for qualification.4 points

-

But are we solving a problem that doesn't exist? Have fraudsters been logging into PTIN accounts? Especially to renew them and pay the fee?4 points

-

Just saw that I can renew by mail. I think about 1 million people ought to renew by mail. That'll teach 'em. Then we can have all our clients opt out of efile and mail in returns with staples and staple checks to the returns and then send letters asking when the return will be processed and then send more letters asking for interest on the late refunds and swamp their whole system with mail. Not like I am being childish about this or anything.... Tom Longview, TX4 points

-

Which sums up why this is the last place you want to have your photo. Imagine how much more your valuable your data is to advertisers when they know, say, your skin tone or whether you wear glasses, a tie, have freckles, bad teeth, or whatever AI determines about you from your laugh lines or nose hairs.4 points

-

To be clear, the "ATX server" is a piece of software installed on your machines that needs to be running for the program to start. It has nothing to do with the term "server" used where hardware is designated as the server in networked installation (vs standalone). This is also different than the server at the processing center that the ATX program connects to via the internet.4 points

-

I am not a techy type, so take this with a grain of salt. But I have found that the issue when the software won't open is the database is not started, or it needs to be restarted. If you can get to your control panel, check the status of the database for the year in question and the year before the year in question (for some reason if the year before you want to use does not have a running database the year you want will sometimes give you trouble). If that does not work, ask @Abby Normal That is what I do when I need to confess my ignorance. Tom Longview, TX4 points

-

I'm using QB Premier Accountant 2017. I bought a new computer with Windows 11 in May and sent it and the old one to my IT guy to transfer everything. He struggled with my "real" software a LOT and I ended up on a call with Sage support last week because I couldn't access the payroll tax forms. There were quite a few questions when IT moved QB but he was able to make it happen and I've been using it daily for over a month with no issues.4 points

-

I just bought a new computer to run W11 and had the old hard drive cloned over. Quickbooks Desktop 2019 still works fine on it. But like Catherine, I kept my old W10 machine just in case any issues arise with any software in the future. I plan to run it about every week to keep it updated until Oct 2025 (and beyond if I decide to take advantage of the 1-year extension I keep hearing about) Then I will just run it offline if necessary.4 points

-

4 points

-

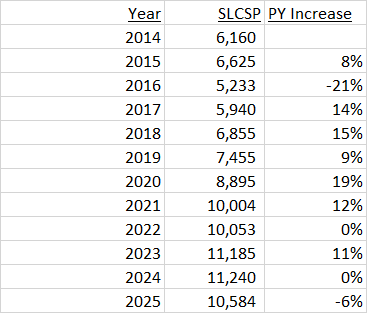

You are misinformed on so many levels. In 2004 I paid 2,740 for individual coverage for myself and teenage kid. By 2013 that had basically doubled to 5,335 for just myself. This is actual data for what SLCSP was for me. No annual 20% increases. Want to talk subsidies? How about subsidies for tax free employer coverage estimated at 300-350B a year. Medicare Part B is funded 25% from premiums and 75% from general funds. 6,660 per person times 66M people and you are talking about 435B annual. The only people not being subsidized were those of us with individual policies. According to KFF increase in spending is lower since ACA was enacted.3 points

-

3 points

-

From IRS 2022 published tax return data: 7.9M returns had PTC for a total cost of 54B which works out to 6,853 per return 594K returns with AGI over 1M, had a QBI deduction of 95B. Assuming a 35% rate, that's 33.3B of tax or 55,992 per return. Millionaires did fine before QBI. But they were the ones that needed "help".3 points

-

Depends on extensions and filing dates. If you filed 10/15/22 with an extension, the window is still open.3 points

-

Seriously wish people would stop equating the 6K deduction to taxes on SS benefits. 1. People who are age 65 but not drawing benefits get the deduction. 2. People under 65 with benefits will see no change. 3. Taxable income is taxable income. You could just as easy say they are receiving 6K of interest tax free. Or, 6K of wages. Or any other line item that makes up taxable income. 4. If it is reducing SS taxation, then it would have needed to be set up the the only way a person receives it is if there is taxable SS benefits and age would not matter.3 points

-

Garnishment is for those who have been overpaid - and there are several ways to get it waived or the payback rate lowered. https://www.fool.com/retirement/2025/07/04/social-security-garnishment-begin-july-24-avoid-it/ As for those who are delinquent on student loans, either cancel them all, or everyone has to pay them back. Picking & choosing winners & losers (who skates & who pays) sets up anger on all sides at all sides.3 points

-

It doesn't change the standard deduction, as it's a separate line item. Also available to those that itemize.3 points

-

Phaseout of the add'l 6K starts at 75K for S and HOH and 150K for MFJ. I have several clients that I give an amount to each year how much they can convert from Trad to Roth free of tax. I'm going to need to recalculate and contact those clients so they don't think they can just add the 6K amount and still pay zero FIT.3 points

-

3 points

-

The software should handle it, but: The recommended name is: PersonalRepresentativeCourtCertificate.pdf with a description of: Personal Representative Court Certificate https://www.irs.gov/tax-professionals/tax-year-2024-modernized-e-file-schema-and-business-rules-for-individual-tax-returns-and-extensions3 points

-

OK. Was just brainstorming. My wife and I have found that having one another's Durable Power of Attorney simplifies so many tasks for us in so many (but not all) situations.3 points

-

If you stick with W10, you will want to consider the Extended Security Updates (ESU), being offered by Microsoft. Looks like the paid version is $30 for one year for stand-alone computers - more for networks & multiple computers. There is speculation it will be extended beyond the one year, but nothing definite. (I plan to get the ESU for my old computer just to keep it safe if I need to use it with an online connection) But I wouldn't risk signing onto the internet with an unprotected W10 computer after Oct 13, 2025. Also, some software that's compatible with W11 may not work with W10. Lots of things to ponder here.3 points

-

Thanks all! It seems promising that it may work. My main concern was losing past data, so I'm downloading 25+ years of data to Excel in various formats so I should be able to find prior info if needed. I don't use QB for billing or AP, so going forward if it doesn't work, I should be able to find something simple that will. Basically just need ledgers for various financial accounts and expenses classified by category. I'm a creature of habit and prefer to stay with what I know rather than new programs. Definitely don't want or need all the silly graphics and charts that much of the new stuff uses.3 points

-

Tom this page should help. Also, did you write down or copy the recovery code at the bottom of the page during setup of the authenticator when you first paired your phone? CCH help says that is used to fix things when your phone is lost or stolen. You may have to go through the steps of unpairing, re-pairing. https://files.cchsfs.com/doc/atx/2024/Help/Content/Both-SSource/Login and Passwords/Manage Admin Authentication.htm3 points

-

But who knows - I may take this as impetus to update my probably 10 year old W10 laptop with the flaky "n" key and nearly-unusable space key! Hey, it works fine on vacation with the plug-in keyboard...3 points

-

I've got personal stuff on QB 2021 on a W10 machine. If it won't work on W11, then that machine will get kept on W10 and I just won't use it online.3 points