-

Posts

5,223 -

Joined

-

Last visited

-

Days Won

328

Everything posted by Abby Normal

-

Sleeping dogs...

-

There are a lot of advanced search features. One I use is to exclude things with a minus sign, like -pinterest or -pdf. Also, there's a page for that you should bookmark: https://www.google.com/advanced_search And a useful list of operators for Google search: https://ahrefs.com/blog/google-advanced-search-operators/

-

All the best to you, my friend!

-

Just because someone is bad with computers is no reason to not use a service. I have shared files and received shared files from Sheets for almost 20 years and never seen the mistake made of sharing the entire Drive or even a folder.

-

This is why I recommend that everyone take their RMD no later than September, so that there is time to take any needed RMD by 12/31. I learned this after a client died late in the year and normally took their RMD in December, and it was not possible to get the RMD out on time.

-

I use ATX1040 package to do about 10 returns. Half were mine or close family that were not billed but the other 5 more than paid for the software (1k).

-

Often churches fall under the tax exemption of a regional group or diocese that has a TE status. There is a Quaker (Religious Society of Friends) meeting in a nearby town that is part of the Philadelphia Quaker group (Philadelphia Yearly Meeting). An IRS agent drove by and ended up investigating the meeting, mostly because he'd never heard of Quakers. Ridiculously, it took the meeting more than a year to get the IRS off their case, even though the IRS is right there in Philadelphia and surely someone has heard of the Quakers. The Quaker organizations are usually set up as monthly meetings, quarterly meetings and yearly meetings, but that's a carryover from early days.

-

Maryland hasn't had the unemployment rates ready for the first payroll of the new year, in many years. They used to get it out on time, but I guess the computers are slowing them down.

-

It is well worth 20 minutes of my day to provide input to the IRS. I'm a big believer in data acquisition, and I still hang onto what little hope I have left, because being hopeless is not an option.

-

2023 tax year software codes

Abby Normal replied to Lynn EA USTCP in Louisiana's topic in General Chat

No trouble logging in for the past few years. Yes, they make you change your password sometimes, but that's been working smoothly for awhile. Although ATX blocks your browser from automatically saving the new password, so you have to go into your saved passwords and update it manually. -

E-File an extension for trust with end date of Aug 2023?

Abby Normal replied to MaryNoe's topic in E-File

Yes, fiscal year returns and extensions are on the prior year form because 2023 forms are not ready yet. Just make sure you have the fiscal year dates correct in the return before efiling the extension. -

ATX does not even have a MD Efile info form, and I doubt ATX will ever bother to add it.

- 1 reply

-

- 1

-

-

Sounds like a candidate for uncollectible status. I've used this before in these situations. https://www.taxpayeradvocate.irs.gov/get-help/paying-taxes/currently-not-collectible/

-

But, in this case, it's not CA capital gain. If the cap gain was on the K1 as being incurred by the S corp, then yes, it would be taxable in CA. But this is the shareholder's personal capital gain. It's hard to imagine the K1 not showing some income, loss or deductions for CA.

-

Probably about a month. They can keep checking the installment agreement IRS site and one day it will show a balance due.

-

The CPI-U and CPI-W, on the other hand, are biennial chained price indexes where their expenditure weights are updated every two years, not monthly like C-CPI-U. So they are all chained, it's just a matter of frequency. https://www.bls.gov/cpi/additional-resources/chained-cpi-questions-and-answers.htm

-

Both main CPI calculations (W & U) are "chained" which results in a lower percentage increase. So when consumers switch to cheaper products because they can no longer afford what they used to buy, this becomes part of the calculation by swapping in cheaper goods for what we used to be able to buy. It's a death spiral of poverty, brought to you by the millionaires in congress and their wealthy owners.

-

why can't I efile a state without the federal

Abby Normal replied to schirallicpa's topic in General Chat

Creating the federal efile is not necessary and can't be done in many cases (red error). -

why can't I efile a state without the federal

Abby Normal replied to schirallicpa's topic in General Chat

On the state efile info form, there should be a box to disconnect the state return from the federal modernized efile (MeF) system. -

Six months won't do it, it has to be all year, from what I'm reading. https://www.irs.gov/publications/p501#en_US_2022_publink1000220954

-

I see a paper copy of the notice is arriving today. That's probably for the best or even required by law, but I've already handled it, so I can just shred the notice.

-

Also, the bank account used in 2023 is in the corporation's name so all activity goes on the 1120S. We account for what happened, not what we wish had happened. Shoot for dissolution on 12/31/23 to avoid short year calcs.

-

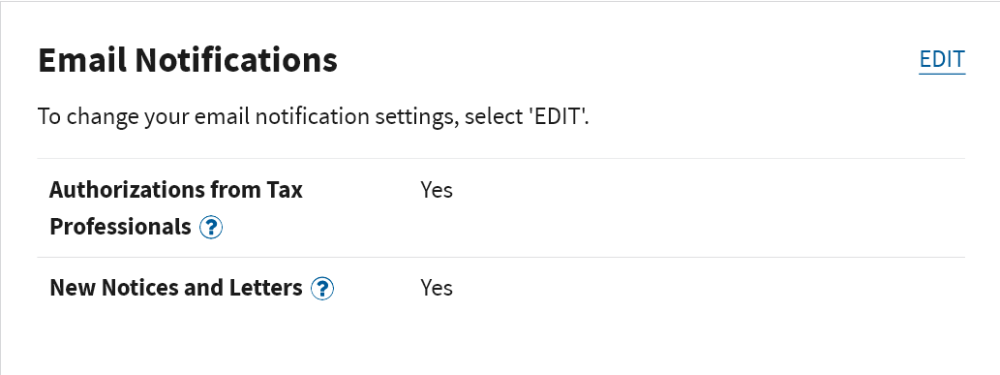

It was for me personally, but I think you might be right that it's because I'm also a pro. https://www.irs.gov/payments/your-online-account Access Tax Records View key data from your most recently filed tax return, including your adjusted gross income, and access transcripts View information about your Economic Impact Payments View information about your advance Child Tax Credit payments View digital copies of certain notices from the IRS Here is the setting in my IRS account: