-

Posts

5,225 -

Joined

-

Last visited

-

Days Won

329

Everything posted by Abby Normal

-

The bill is just now going into reconciliation so anything is possible.

-

You should be able to efile almost any return, with very few exceptions.

-

It is. I kept looking for it to come down on a forms update, but it never showed. It just magically became available in forms.

-

Just pick your favorite 1099R and enter that EIN. If they don't fix this, I'll try linking the EIN from the 1st 1099R to the line 25 worksheet, just to avoid the annoyance.

-

Take the money and run, is my philosophy. It's too small of an amount for the IRS to be concerned about, especially as slammed as they are now.

-

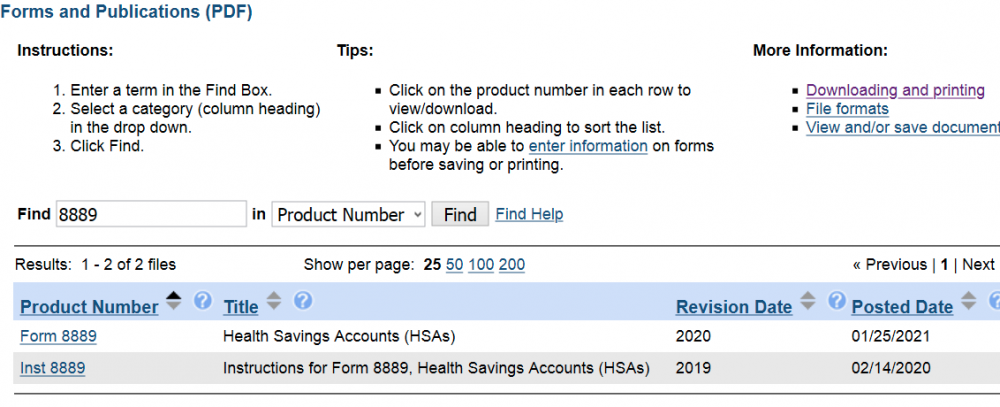

The IRS didn't release it until 1/25/21, so ATX could not have finalized it before then, but 3 weeks does seem like an inordinate amount of time for a form that likely has only minor changes. https://apps.irs.gov/app/picklist/list/formsPublications.html;jsessionid=OcZFnVYyW1B2OcLd-A1UPgSY.20?sortColumn=postedDate&indexOfFirstRow=0&value=&criteria=&resultsPerPage=25&isDescending=true

-

I think the proposed new Biden bill has a provision to make the additional unemployment not taxable, but until it is signed into law, we won't know for sure. Or maybe I'm confusing it with the proposed MD law to make it nontaxable. I've read so many things that they're becoming a swirl in my head!

-

Partnership Conversion to LLC - Client Created Mess

Abby Normal replied to gfizer's topic in General Chat

On a positive note, you get to bill them for two part-year returns, which should end up being about 3x your normal bill. If you're using ATX, you'll want to do a short year rollover in the 2020 software, after you've done the old partnership final short year. You do this on the month/quarter tab of the 2020 rollover screen. This will rollover all of your assets with the proper beginning accumulated depreciation, and it will calculate the correct short year depreciation for the new LLC's first short year. Make sure you enter fiscal year dates in the old 1065. Now here's where you get to be a hero. There will be late filing fees for the old 1065, but you can get them automatically removed either under first time forgiveness or by using this: Partnership Late Filing Penalty Relief Please remove the penalty for late filing of a partnership return under Rev. Proc. 84-35 and code section 6698(a). The partnership is a domestic partnership with 10 or fewer partners, each partner is a natural person or an estate, each partner’s share of each partnership item is the same as such partner’s share of every other item, the partnership has not elected to be subject to the consolidated audit procedures under IRC 6221 through IRC 6233, and all partners reported their share of all pass through items on timely filed individual returns. -

I don't get it either, unless ATX believes that anyone who needs estimates, doesn't even file before March 1st... which is like they case for my clients.

-

I don't think most of my clients would be capable of filing an FBAR. If I didn't have notes on how to do it, I'd be lost every year. The system is way too complicated, unclear and doesn't always work as you would think.

-

I only do a few but I never considered any liability in doing so.

-

Haven't seen any yet, but I imagine a lot of folks are going to get a surprise 1099-G for unemployment this year. These state agencies need to tighten up their scrutiny of whose bank account these funds are going into.

-

The IRS disagrees: https://www.irs.gov/coronavirus/second-eip-faqs#Eligibility If you died BEFORE 1/1/20 you don't get it.

-

No, I efiled mine right in QuickBooks. Enhanced payroll is the best 400$ I spend every year.

-

This sounds pretty clear that if you were alive for one day in 2020, you're entitled to the 2nd EIP. https://www.irs.gov/coronavirus/second-eip-faqs#Eligibility Will a deceased individual receive the payment? (added January 5, 2021) A payment won’t be issued to someone who has died before January 1, 2020. If you filed a joint return in 2019 and your spouse died before January 1, 2020, you won’t receive a $600 payment for your deceased spouse, but you’ll still be issued up to $600 for you and $600 for any qualifying children, if all other eligibility criteria are met. Regarding eligible individuals who died in 2020, the Recovery Rebate Credit may be claimed on line 30 of their 2020 tax return. Please refer to the instructions for the 2020 Form 1040 for more information.

-

ATX - Preferred Preference Options and Customize Form

Abby Normal replied to Yardley CPA's topic in General Chat

Preferences: Print return without zeros Don't autosave Client letter verbiage-will be efiled Uncheck sections of federal and state letters you don't want printed. Only print estimate dates & amounts, for example Disable Automatic calculations on Detail sheets (Saving recalculates) Don't update programs or forms when opening. Do it manually. My current form customization notes are attached. Customize Master Forms.rtf -

Transferring files to new computer/Possibly needing to merge files

Abby Normal replied to lndelro's topic in General Chat

This is the way. -

All credit returns get additional scrutiny. The IRS "hopes" to "start" sending refunds for returns with EIC and ACTC by the first week of March. People who prepare a lot of low income returns might want to turn their phones off for awhile.

-

Sure thing!

-

You can use the Get My Payment IRS page to see if the IRS sent it, but you can't see the amount. Seems to me you're far better off to take the Recovery Rebate Credit and have the IRS adjust it down, than to not claim it and hope the IRS adjusts it up.

-

Glad you got it figured out! This job is tough enough when the computers are working fine.

-

Mine does, so maybe it's time to reset your letters to default. You do that in an open return by editing the format and going to Tools, Restore. Then save it for all future returns. My state letter defaults to saying 'will be direct deposited' too but I still have to go into both fed and state and choose that on the payment/refund tab of efile Info form.