Leaderboard

Popular Content

Showing content with the highest reputation on 05/14/2015 in Posts

-

6 points

-

4 points

-

4 points

-

Karen Hawkins was one tough cookie. If you've ever seen her in person on watched one of her webinars, you couldn't help but feel that she didn't like you, didn't trust you, and was just waiting for you to do something wrong. Maybe it was just a personality thing where she came across that way, or maybe it was a power thing. I was shocked to read that she actually complimented tax pros in her farewell message, but even there she couldn't resist the parting shot by reminding us to stay on the straight and narrow. I am happy to see her and her attitude go. Hopefully she will be replaced by someone who treats us as stakeholders in tax administration, as valuable contributors to the IRS's work, instead of dishonest, incompetent cheats. Instead of supporting us in our role, Hawkins was just waiting for anyone to make a mistake so she could pounce.4 points

-

PURINA EMPLOYEE ARRESTED FOR STEALING AND EATING OVER $30,000 OF DOG BISCUITShttp://worldnewsdailyreport.com/purina-employee-arrested-for-stealing-and-eating-over-30000-of-dog-biscuits/3 points

-

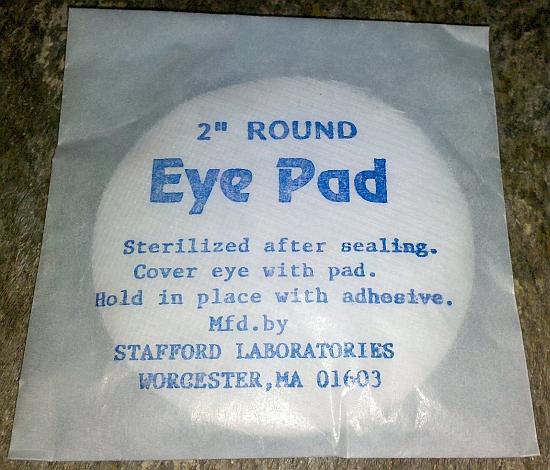

I have a 990 due on Friday. I did the 990 about 8 years ago until the org went in another direction. They have a new Director now. They sent a Request for Proposal to prepare the 990 for their fiscal year ending in June 2014 on 10 Feb 2015. They got no response. The new director called me, desperate, so I quoted a new price. And I let her know that the 990 is due on May 15th, if it has been properly extended.... Tuesday, she asks if we can meet *next* week. No, I am on vacation. Yesterday? She says can we meet sooner, but.... She just suffered a detached retina and will not be available... Sometimes, you just never know what might happen. Rich3 points

-

Talked to someone from another board right away. Might have some more questions but I hope to get it done tonight. Today was as bad as tax season, and it ain't over yet.3 points

-

3 points

-

core_emoticon_group_default That's... user friendly. I'll see what I can do about that.2 points

-

2 points

-

2 points

-

2 points

-

I posted on this topic numerous times, I would use a 1065, in almost every case I want the 1040 to be from flowthroughs. I might even give a spouse or child .0001% just to get it off of the 1040. High 1040's have a higher rate of audit, and an auditor will make you prove expenses aren't personal. Having it as a 1065 makes it easier down the road to add partners or transfer percentages each year to children. If any legal issues occur you only have to supply the 1065 to a tenant for example and not the whole 1040 which even though protected, shows all your other income or assets. When your loving couple gets divorced, its much easier to trace the distributions. Since the amount of accounting you would have to do is the same whether on an E or 1065, the only extra prep cost is the actual filing out of the form.2 points

-

Good Luck and Good Riddance. Don't let the door hit you in the arse on the way out. I can only hope that your time on the future federal retirement dole is short. Demonizing the work I do and trying to *always* lump me together with the criminals that your office did so little to pursue.... Just go. Rich2 points

-

1 point

-

Twenty-five 990s down, 5 extended and 2 to go. Like someone else said, this is as bad as April 14/15.1 point

-

You mean there's not some secret fraternity that I'm joining? I was hoping to at least get a decoder ring.1 point

-

I pulled this quote off the web. "The law itself asks the bureaucracies to do something that's basically impossible," said Holtz-Eakin. "Find every American, determine their income. Given their income, determine the subsidy for which they're eligible, send that subsidy in advance every month to the exchange in the state of their residence, and to the insurance plan of their choice." That says it all. Tom Newark, CA1 point

-

1 point

-

Joan - glad you got the help you needed. We're here if something else comes up - to commiserate if nothing else!1 point

-

thank you for taking my quick answer deeper, I agree with what you say.1 point

-

I heard that. I am on my third 990 of the week. All of them are due (un-extended) tomorrow. The first was a 990-EZ with UBI. The second was a clean (after I got the financials cleaned up) full 990 with no UBI. And the third I spend all day on yesterday putting the numbers together and will spend a half day today doing the same before I can even think about the 990. This is a bit more complicated 990 and I enjoy doing it every year. Post your questions if you can and I will see if I can help. I am not taking calls or talking to anyone until I get this one done, but I will be checking in here and will help if I can help.1 point

-

ROFL, someone buy Barry some Twinkies please! Fake story but still funny and so are the comments. There are some great stories on that site like this one about the investment banker devoured by vultures: http://worldnewsdailyreport.com/wall-street-banker-devoured-by-vultures-in-arizona-desert/1 point

-

I got the same feelings about her every time I saw her speak or looked at her actions toward us ethical preparers. She is leaving 3 years too late for my tastes. Good Riddance. Her "compliments" were political male bovine scat to cover her demonic backside as she goes out the door. I am Jack From Ohio and I approved this rant!1 point

-

I use NO software firewalls at all. Not necessary with a proper hardware firewall in your router. Problem solved.1 point

-

You make some very good points that I had not considered, Michael. i usually do a 1065 for partners, even husband and wife partners, just because that is correct. Now I have even more reasons to do that.1 point

-

Click the emoticon smiley on the toolbar and you should see 21 emoticons at that point. By clicking on "Categories" at the upper right corner of the popup box, you can then choose "core_emoticon_group_default" that will show all of the emoticons we had with the old version of the forum and still do.1 point

-

It's a debatable topic. I have several H/W LLCs that I disregard and put on Sch E. First off, it will not likely be raised on an audit. Second, the IRS has no tax to gain by moving it to a 1065. Third, we have automatic removal of late filed 1065s if all income is timely reported by partners. I'm not worried.1 point

-

You need to contact the EO Unit -877-829-5500. http://www.irs.gov/Charities-&-Non-Profits/About-IRS-Exempt-Organizations1 point

-

1 point

-

1 point

-

I think I will see more of my clients filing Tax Court Petitions in the future. As soon as I see the Notice of Deficiency, I will be recommending that they file the petition to get to some level of competency in the IRS. Of Course, that means the tax court will be overwhelmed and tax administration will grind to a halt. But I think it is the only way to get the IRS to come to the table to work out our client's issues with the tax agency. Nothing else will work. They have turned their back on tax professionals. The courts are going to be our only redress for our clients going forward. Tom Newark, CA1 point

-

The corporation, not the shareholders, will be the exchanger in the 1031 transaction. Do the bylaws require 100% shareholder approval? After the exchange, then what? You still have a C corporation owning low basis real estate. With LLPs as shareholders does the corporation even qualify for an S election? Since there is no corporate level capital gains rate, the option to sell stock at $2.5 might seem more attractive.1 point

-

There's a chunk of Latin filler text that's very commonly used in graphic design, called Lorem Ipsum. It visually flows like real copy would, better than a bunch of unnatural looking random character gibberish, but doesn't distract the viewer with unimportant (at that point in the design process) details/meaning. This is a variation on that called Bacon Ipsum--apparently it only satisfies the first requirement for good filler text but fails miserably for being a distraction. And now I'm hungry too.1 point