Leaderboard

Popular Content

Showing content with the highest reputation on 04/16/2016 in Posts

-

7 points

-

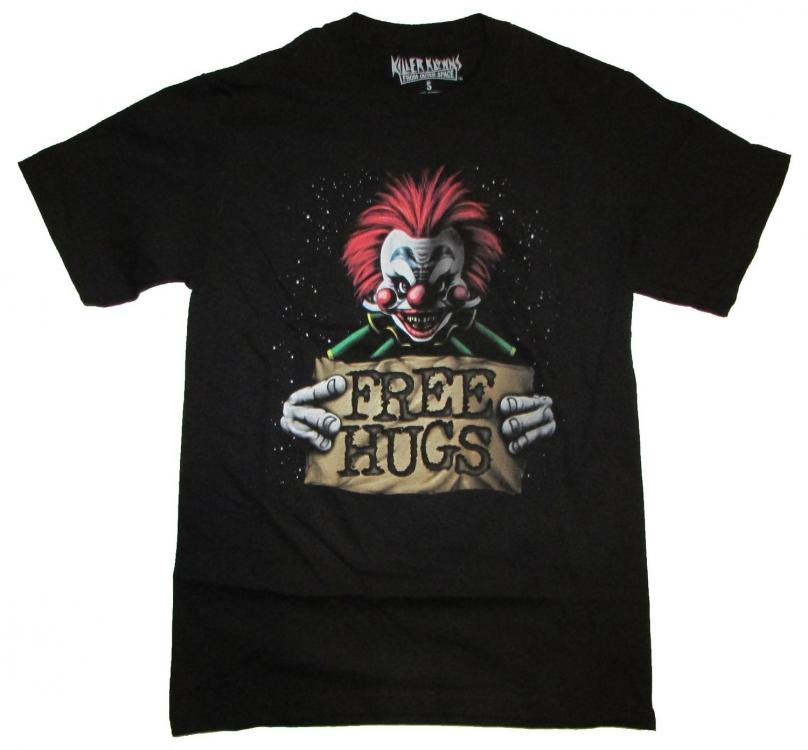

This evening for a return that was picked up last Friday: "Hi Joe, this is Judy. I'd like to have your signature forms back this weekend so that I'm not babysitting the tax program on Monday evening (this guy usually makes his drop offs on his way home from work). "Oh, you need those back, I thought that was a formality." This guy is not new to the party, and I do tell each client that they must return the forms before I'll e-file. Next year I'll explain it like this --> , or he'll get a Tennessee-style hug. I suspect it's that he was trying to delay my payment and was going to drop it all off at some later date.6 points

-

I could have slept in this morning, first Saturday no morning appointments. So what happens, I wake up early and can't get back to sleep! Oh well, at least it's nice and quiet.5 points

-

Sure there are. That is a specific uniform (to give him that "perfect" look), he had to travel to and from there so the entire cost of his vehicle and all the expenses of the vehicle are deductible because he only uses it for his hugs business, his gym membership to keep him looking like that, his haircuts and all the food he eats that is good for his body and looks. And don't forget the medicinal use of cannabis for stress relief after a long day of work. //s Tom Newark, CA5 points

-

I do not do that either. But I never miss an opportunity to let my clients know that they, each and everyone of them, is the reason I have a practice at all. Without them, my firm is not. And I do not hesitate to communicate that sentiment. It is just a fact! i do not have a great deal of client contact during tax season, but I do not miss the opportunity to look up from my work whenever a client comes or goes and shout out a thank you and use their first name. Found out this year, though, that I might need to rethink that. I called a client by the wrong name. My vision belied me.4 points

-

I have to stop myself when I know that I am either rushing or being careless. Filed a string of extensions tomorrow, but what is driving me crazy right now are the naggers who keep calling to see "how their return is looking". They interrupt and waste my time. This is the most frustrating and intense tax season that I can remember and I have decent help this year.4 points

-

It's a nice idea, but I don't want to do every year so I don't do stuff like that at all.3 points

-

If that's the case, just pretend she's a doctor! Seriously, I have several clients whose "signatures" are so bad you might think they were done by a two-year old scribbling. The key point is competence.3 points

-

stop taking calls when you are concentrating, except for a few Big clients, all my people know I return calls around 11 and again around 3.3 points

-

"...it is in process. Now it has been moved to the back/bottom of the work stack. Each time you call, this is what will happen." You may not really do that, but let the client think that you are.3 points

-

The coffee machine makes me recall something that happened many years ago when I was the young controller for a small ink manufacturing company. True story here: This was long before the days of cell phones - we had nothing but land lines. I lived about 20 minutes from the plant and the owner (Jack) live about 30 minutes away. We had a bookkeeper (Ginger) who was always the first person to work. Ginger was very talkative and always in a high state of excitement even on normal days. One morning as I arrived, Ginger met me at the door, very agitated because we'd had a break-in the night before. They took calculators, typewriters, petty cash from the vending area, etc. (didn't have computers at that time). She told me she had already called Jack at home, and she was especially upset because the only thing he seemed concerned about was the coffee pot. Jack arrived soon afterward, and we spent most of the day filing police reports, buying new office equipment, notifying our insurance company, and arranging for some security enhancements. When things settled down and Jack & I were sitting in his office reviewing the day's events, I told him I was puzzled over Ginger's comment about his concern over the coffee pot. He said -> "I knew you were probably on the way in and you'd take care of things. But I couldn't get Ginger off the phone so I could shower, get dressed, and come on in as well. She just kept telling me over & over again what all had been taken and yelling 'They took everything! Everything!'. So I finally asked her if they took the COFFEE POT. She said 'No, why?' I said 'Well make some #$%^% coffee and I'll be there in a half hour!' She needed something to do and I figured that would keep her occupied until you got in."3 points

-

Uninstall. That's what I did. I needed it for one support session; installed it just prior, uninstalled it right after.2 points

-

I saw on another website that they got into one of the CPA's computers through team viewer. I had no idea that it was running all of the time on my machine. I have it disabled now, but I have to do it every time that I reboot. I don't know how to completely stop it. She says that they changed her router and disabled the firewall, too. This just scares the crap out of me. How am I supposed to protect my business as a one person office, when huge companies and governments get hacked?2 points

-

When I really need to get stuff *done* without interruption, I turn the phone ringer off and close my email program. Sometimes all I need is a half-hour to concentrate on something gnarly, then I can reply to whomever. And I really like they "you're now at the bottom of the pile" tactic and will ponder using it.2 points

-

Even better, get them off the phone altogether. Migrate them over to email and texting. It forces them to be more precise and frees you up to address their questions when most convenient for you - in some cases during the 15 minutes between finishing one big project and before turning to the next. I return phone callls by the next business day. But I reply to emails and texts almost immediately. Sometimes the response is simply "I'll look into it and get back to you", but it satisfies the client to know I'm on it.2 points

-

LOL!!!!!!!!!!!!!!!!!!!!!!!!!! Elvis and I have been having a great time, guys. Seriously, I'm not on that much, taking care of Don is taking most all my time. But I still read the lists from time to time, even answer one now and then. I wish you all a wonderful tax season, even if the IRS is not making that so easy right now. I'll check in on the board now and then, if you guys really miss me that much.2 points

-

Apr 16 IRS Alert: New Tax Scam Targeting Tax Professionals Like - Click this link to Add this page to your bookmarks Share - Click this link to Share this page through email or social media Print - Click this link to Print this paApril 15, 2016 In advance of the tax deadline, the Internal Revenue Service today warned tax professionals of a new emerging scam in which cybercriminals obtain remote control of preparers’ computer systems, complete and file client tax returns and redirect refunds to thieves’ accounts. Although the IRS knows of a handful of cases to date, this scam has potential to impact the filing of fraudulent returns in advance of the April tax deadline and is yet another example of tax professionals being targeted by identity theft criminals. The IRS urges all tax preparers to take the following steps: Run a security “deep scan” to search for viruses and malware; Strengthen passwords for both computer access and software access; make sure your password is a minimum of 8 digits (more is better) with a mix of numbers, letters and special characters; Be alert for phishing scams: do not click on links or open attachments from unknown senders; Educate all staff members about the dangers of phishing scams in the form of emails, texts and calls; Review any software that your employees use to remotely access your network and/or your IT support vendor uses to remotely troubleshoot technical problems and support your systems. Remote access software is a potential target for bad actors to gain entry and take control of a machine. I am afraid it will get nothing but worse !1 point

-

Does anyone send out thank you cards or letters to the folks for whom you prepared returns for during the tax season? I was thinking this may be a good idea because I am adding a PO Box among other thing to provide my clients a better service and have been thinking of sending the thank you with the information.1 point

-

1 point

-

I don't, but it's a great idea. I am thinking about a PO Box up the street at the UPS Store to get my address off of my website and the IRS website. Although the IRS claims that they can't verify my professional status and may take my name down. Boo! Hoo! I think it's because I had to use my legal first name on my app years ago, and I use Bonnie for everything and always have. I faxed them everything that I had showing the current permit for myself and my corporation. I don't know what more they could want.1 point

-

Thanks Lee. I do most of the above on a regular basis since my EFIN was compromised before the season started. Everyone should pay special attention to what you are reporting.1 point

-

The last 7 returns I reviewed from my staff all got rejected by me. Careless errors and of course these are our most complicated returns with up to 50 k1's and multiple brokerage accounts. I just told everyone to just do extensions at this point, the returns can go out next week. Of course my partner who doesn't get involved in tax prep just wants to keep producing so he can keep billing.1 point

-

I usually return emails fast. Now, I'm returning emails really late at night before getting some sleep, and returning phone calls by email the same time. If I had all those minutes back from telling the naggers I'm filing extensions and then completing returns in the order received, I'd have another half dozen returns complete. But, I've had to put something in front of my phone to block the blinking light !!1 point

-

The attorney who prepared this POA has covered virtually everything. This POA literally allows me to act as though I am her and have control of virtually everything. We had a durable in place and changed it to the one we have now while she is still competent. The attorney required a medical evaluation and had her doctor complete a document attesting to her competency. Just to follow-up with what Judy said, she can make a mark but mostly a signature is really not legible anymore. For selfish reasons, it would be easier for me if I would just sign the return. Saves a lot of hassle.1 point

-

As an aside, is this a durable POA? (I am not practicing law here, just sharing an idea from my state knowledge). In PA, a POA unless "durable" can be invalid once the person cannot rescind the document themselves. The durability part can make it valid until death if need be.1 point

-

I sent her a chat message over on facebook. I hope she visits us here before some of our members are outta here now that the season is drawing to a close.1 point

-

1 point

-

She's vacationing at Farm Town. Seriously, I've seen her regularly on facebook, and I do hope she is well. When she visits here she's probably more focused on catching up through the multitude of posts and might not see a PM. That's happened with my PMs also.1 point

-

1 point

-

I think in those situations I would file extension and try to get some sort of exemption. I would not say they had it if you know they did not.1 point

-

1 point

-

May sound callous BUT tax question is were they covered ------ regardless of WHY ---- answer is NO. They need to fix and possibly get documents from INSURANCE side and then maybe discuss with tax people. Until then, the answer is NOT COVERED --- so do not lie and say "all year" coverage because the insurance people -- messed up - that was NOT the question ------ ARE, were you covered was the question ----- client needs to fix with INSURANCE people before tax can be anything else.1 point

-

I can understand the pressure when getting towards the end. With a small practice like mine just under 250 returns (just me and an admin assistant) I have the luxury of being done before the deadline, with only about 15 extensions. But when computer problems hit and giant returns trying to get completed and the clock ticking, it's just not worth the expense of things going wrong. I admire both of your decisions and glad I'm not in your shoes, because I would have probably shot myself by now, or start drinking....more that is.1 point

-

1 point

-

1 point

-

When I was in the marines, the warrant officer I worked for would write a letter and ask me to read it. He would then ask if I understood it, and if I said yes, he would say "good, then anyone will be able to understand it."1 point

-

Good to "see" you again, and we completely understand why you can't be with us as much as you used to. But please post something once in a while just so we can be sure that you are alive and well, and stiil the kc that we know. We miss you, and wish you and Don well. Love, Hugs, and Prayers.1 point