Leaderboard

Popular Content

Showing content with the highest reputation on 08/28/2018 in all areas

-

Umm! Jack, you do know that people learn by different means. You do know that, Jack, don't you.? There are four primary types of learning - visual, auditory, reading/writing, and kinesthetic. (the last one we can leave out). Some people do better with one than with another. Obviously, you do best with seminars. Others do better by other means. And a lot of people can not afford the time or expense of a seminar. I, for one, prefer self study to seminars. Seminars try to cover to much information so, that at the end, I doubt that anyone clearly remembers 20% of what was presented. With self-study you can go at your own pace. You can go over material until it is fully understood and you can save it for a reference. Now the initial question here, was about a course for TCJA. Jack do you really believe that if someone is interested in that subject, they are just doing it to "buy" credits? Are you serious? Did you even think about what you wrote, before you set yourself up as judge and jury? If someone wanted to buy credits they would take courses they had taken before and just retake them every year. The TCJA has to be studied and learned, so no "buying" here. The SequioaCPA isn't chosen for price. It was chosen because I think it is superior to several others I've tried. For example one company had a course on real estate and dedicated over 30 pages to history of RE tax legislation going back to the 1970's and other outdated material. They had other courses like that and I wrote them scathing reviews. Don't know if they ever changed. I'll leave it at that for now.7 points

-

I bought the CPE247 unlimited package on 12/31/17 that gives me unlimited CPE for one year. I've already taken 80 hours and plan on taking at least 40 more before the end of the year.4 points

-

I have been using Sequoia CPE for the last several years and recently downloaded their 300 page course on the TCJA. I like their methodology where questions are asked at the end of each of the 18 chapters, to which the answers are provided. A sample final exam is also included . You can check out the table of contents without having to log in. www.sequoiacpe.com/4 points

-

I wouldn't reach any conclusions until I had my client check to see how much was debited from their checking account.3 points

-

If your record shows you entered $4,700 into the ATX Program then something is obviously amiss. I'd call ATX and see what they say from their end before contacting the IRS on this. See if they can verify what you entered and what their system actually processed. If there is a difference they should provide some type of explanation as to why. This is good to know before connecting with the IRS. One more thing, verify with the client that their bank shows only $4,600 taken instead of the $4,700.3 points

-

Wow, I'm gonna say this at the risk of offending someone. The responses to this post have gone all around and away from the original question. Judy pretty much summed it up. If this property is personal then no loss. That was the only thing I was looking for. I initially took the wrong road and was not thinking about the character of this so called equipment. I do apologize for that bit of confusion So, I am at the point of saying that the day the scrap dealer picks up the junk or equipment or whatever it is, the price received is FMV because this is indeed personal property and therefore a wash. No gain and no loss. Plain and simple by the code, basis is FMV on inherited personal property at the date of death. I can't believe the trip this post had taken. It turned into various scenarios and ended being compared to logging transactions. I mean really, all of us, and me included should stay with the facts stated in the original or updated post to help the poster. Even if there appears to be missing information or more information needed, it is better to ask for the additional information than to put one's spin on it or making it a contest to prove one's position. I must say some of this was not helpful. Now, shoot me for my opinion. I'm trying my best here. I am not angry at anyone and if I come off that way, I apologize. I have been dealing with my identity being stolen for the 4th time in a year and a half. Dealing with Equifax is like dealing with 3 year old children. I don't think they have anyone located in the US answering the phones. When they do, if you can find a number, they're dumber than a dead rake. Experian, no problem, dispute settlement crap removed from my credit report. Transunion, no problem same as Experian. Equifax, don't ask. All I know is my credit is now frozen everywhere. One week and three days of dealing with idiots on the phone is mentally exhausting. I asked Equifax the magic question. It is MY credit, I cannot access it, get denied every time online. The so called security questions are wrong and bam I'm locked out. But.....the thieves can get it like nothing. I have better luck seeing a friend at the bank to get my credit report from Equifax. They can get it and I can't. Yes, I can get it in fifteen to 20 days. By that time the dispute clock will time out. I mean what the hell? I need to know if I can sue the crap out of Comcast for granting credit in my name when there was a 7 year fraud alert placed on my credit with all three bureaus, with a contact number to verify if the person applying for credit is actually me. No, they never contacted me. Just the collector did when the bill was never paid. I would think this activity would violate some fair credit reporting act or something. Probably another inside job. Here's the best part, Comcast doesn't even offer services where I live in NC. Okay rant over, I'm sorry to bore you all with this so I am going to bed now.3 points

-

Terry, if your decision is to treat this as personal use property I disagree. Did the heir use it for personal use or entertainment? I would treat it in the same manner as a personal residence that was inherited and put on the market without being used personally or as a rental. It has been held by case law that type of property is investment property.2 points

-

@Terry D I'm sorry to hear about all what you've been going through. Come here to vent any time to offload some of that stress if it will help. After all, who better to share with than a bunch of tax and financial nerds that would totally understand your frustration. Glad you got the answer to your question too.2 points

-

This is the off-season Terry, so things sometimes get hashed out in unusual ways. Sometimes the twists and turns help someone else out, and other times they are completely irrelevant. Sorry you're having trouble with the credit bureaus and ID theft. That has to be maddening. Personally, I'd at least run this by a lawyer to see if there's some sort of opportunity to get some satisfaction. Just remember, if it can't kill you and eat you for dinner, you can probably deal with it.2 points

-

I never believed the "charitable deduction" in lieu of property taxes would fly, but I think CT's entity tax might. The problem is that it was passed late in May and not announced until a couple of days before the second estimate was due. Therefore all partnerships and S corps are already behind in their estimates, which they never had to pay before and didn't find out about until it was too late. CT offered to waive interest and penalties if the members have been paying their own estimates and choose to assign those to the entities (no clue how they might do that). Otherwise interest and penalties apply to the entities for not paying estimates that didn't exist until late in the second payment cycle. Parties can appeal to the state legal dept, which never approves anything. The waiver should be automatic because of the late enactment, but now state taxpayers have to pay lawyers to review each instance. Absurd.2 points

-

Never, ever, EVER use their whole-disk encryption with partition software. Ask me how I know - closest I've ever come to a stress-induced heart attack/stroke/breakdown. EIGHT DAYS without a computer. In mid-March. Several years ago. I could still cower under my desk, just thinking about it... It works perfectly, until it doesn't. At which point you have a boat anchor instead of a computer.2 points

-

I have efiled about a half dozen 2015's in the last two months. They can be efiled up to mid-Nov when the IRS closes down efiling.2 points

-

How difficult was it to set up the bitlocker? I want to use it but I am so afraid of messing something up.1 point

-

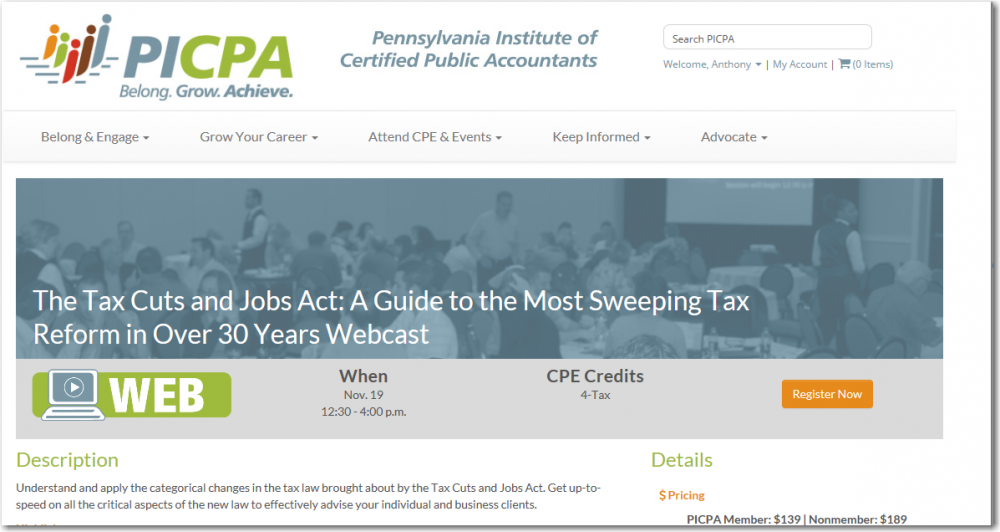

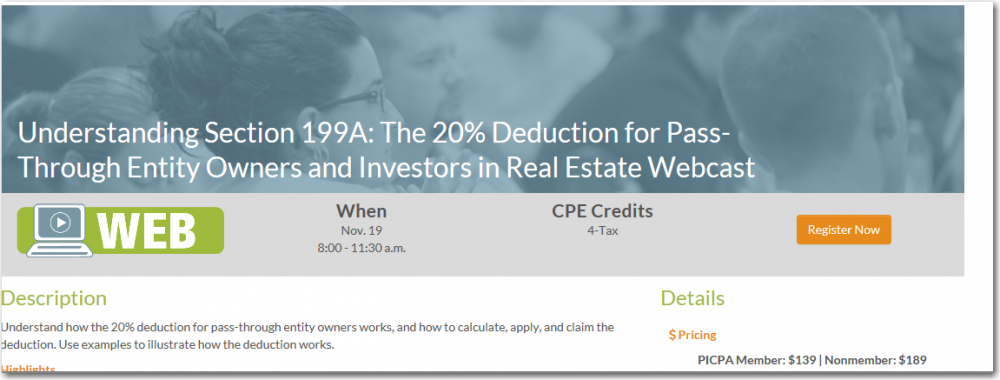

I suspect if we routinely took our CPE in a classroom setting we wouldn't wonder about these things. We'd also just "know".1 point

-

Finally back in! Got my new letter yesterday. For security purposes, every time you log in the IRS sends a text to your cellphone with a code you have to enter, to make sure it's you. Works for me! I have similar two-factor security set up with financial institutions and Google.1 point

-

I can't answer for you specifically. After the 2012 ATX problem, I got the Drake 2012 season free and went to one of their seminars. I purchased both ATX and Drake for 2013. My intention was to use both and compare the two. I got busy and lazy and ignored Drake. I again purchased both ATX and Drake for 2014. I wanted to give Drake an honest try. Again, I got busy and lazy and ignored Drake. ATX seemed to be working for me and I decided to stay with ATX and not pay for two programs (silly me). Drake users will tell you to go all in with Drake. All I can say is if you want to give it the honest try, go all in with Drake. Learn the program and make the comparison properly.1 point

-

Sounds like you rounded to 100 and the tax changed by a small amount, so the estimates changed. Did you print a PDF of the return at the time you created the efile? Did you later recreate the efile? I've had this happen.1 point

-

1 point

-

When I got my latest computer (W10), I called Symantec to see if they were up to date. They saw my version/build number and said their Encryption software was not yet ready for my computer. So I used BitLocker. I do have the Symantec software program though. I use it to shred individual files, especially on flashdrives and external HDs.1 point

-

@Terry D SO sorry to hear of your aggravating troubles! I do hope you can get through to an English-speaking grown-up at non-equitable f-x (see, I'm trying not to be foul-mouthed/typed) before your deadline. YES, there should be retribution from the company causing the problem. And I hope you get some good sleep! I think that at times we take an incident and then start exploring options - like an intellectual puzzle. That doesn't help the original poster, though. I've been on the receiving end of a few of those over the years, myself. Glad that you did get what you needed and I'm not surprised at all that it was from Judy.1 point

-

That's easy. If YOU didn't install it, it's not there. It does not come with your computer. That was a more general warning for others; sorry to have terrified you!1 point

-

Catherine, How do I know if I have partition software? I'm sorry to be such a dummy. I used to feel somewhat competant about my computers, but this is throwing me for a loop and I am petrified that this will happen again. I know that getting hacked is the worst thing that could ever happen to me, but I'm about ready for the good old days of 1979 when I was preparing returns in pencil before review.1 point

-

Trying not to be political....I just find it really strange that the Tax Pro community used to be the ones looking for loopholes in the tax law for our clients, now the states are getting into that business as well. What the heck is going on in this world. Tom Modesto, CA1 point

-

Been there and done that. I loved Symantec, but to be honest I am scared of it. I do plan on using the one that came with Windows 10 just as soon as I can get some help setting it up.1 point

-

Pacun, if you time it right, you can use the one the $149 payment for two years. When I renew, it is always in December, so I can use it for the current year and the following year, as long as it is done before the subscription expires. No, no newsletters of live seminars.1 point

-

1 point

-

1 year rule is under section 1014(e). That basically applies where property is gifted to donee and then donee bequest back to donor. That prevents the donor from receiving stepped up basis through death of donee. Section 2035(a) requires certain assets transferred within three years of death to be included in estate. Those assets include certain transfers with retained life estate, revocable transfers and certain transfers of life insurance policies.1 point

-

PSC C corps now pay the same rate of 21%. Some early proposals had the PSC rate at 25% but that didn't make it to the final legislation that was passed. PHC tax and accumulated earnings tax are both still in effect, rate unchanged at 20%.1 point

-

1 point

-

MeF accepts the current and prior 2 years, so the system is currently accepting 2015 through 2017 returns.1 point