Leaderboard

Popular Content

Showing content with the highest reputation on 03/02/2019 in Posts

-

Okay, you derailers; if you don't want to discuss my wardrobe, I'll go with you. My cutoff date is April 15th. All documents must be in house by no later than 5 P.M. that afternoon (not that I'm desperate for trade or anything).5 points

-

5 points

-

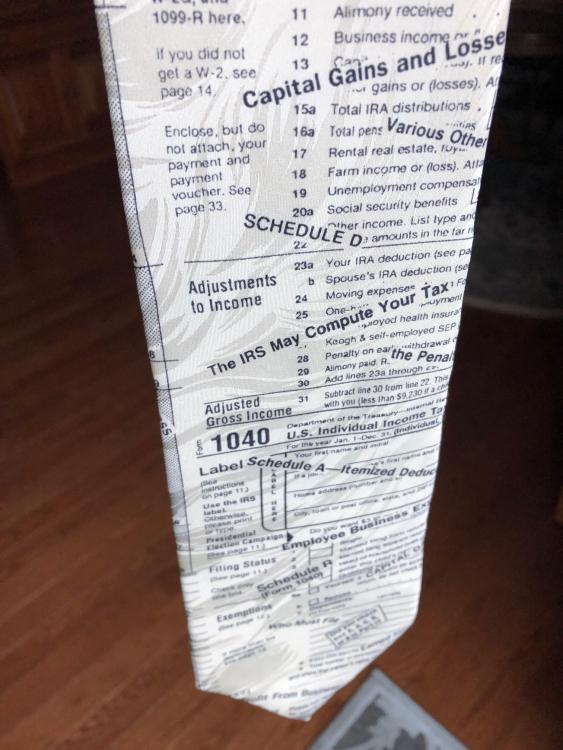

It's more like a combo of the (old) tie and a new-not-improved big giant clown bow tie with the expansion to include up to six schedules. lol4 points

-

Especially for clients who don't even have brokerage 1099s until March 15th or K1s until April 1st.4 points

-

4 points

-

Yeah, I don't start one if I know something is missing, but it seems like every other one I pick up, something is missing. Today: Me: Your Composite Statement from LPL Financial is missing. Lady who actually tried to get me to put a value on empty peanut butter jars she donated to Bible School project: Are you sure? I thought I put that in there. Every. Single. Time.4 points

-

March 1st. Time to check the closet and extract my collection of spiffy, if somewhat threadbare, ties. The heavy-duty, industrial-strength cases that start drifting in 'bout now expect a little klass for their kale. So, I am in compliance with professional social norms (I've really got to get these dang things dry-cleaned someday - several years of gravy-stain show through here and there). I've been doin' this so long that most clients have stopped asking "Is there a funeral today?" Casual, but with shoes (my usual dress code), is fine too, but this is the one time of year I feel legitimately entitled to pomp it up a bit. Cheers. _____________________________________________________________ To make a fine gentleman, several trades are required, but chiefly a barber. ---- Goldsmith3 points

-

Thanks, all. I was hoping against hope that SOMEONE had a magic wand that would get me out of the 3115 (which I really do NOT feel like doing for this client). Sigh; there's no way out of it. Even if the rental was fully depreciated (not quite; 20 years not 27.5), there were renovations plus the personal unit was rented out for a year and a half. Blarg. This is going to be one nasty long slog, but hey - that's why I get the small bucks, right? Whimper.3 points

-

I doubt they are concerned about the extra work they cause. I am certain they are far more concerned about the pressure they are receiving from the lobbyists of the 50 Industry groups that are pushing hard for this bill to be passed!3 points

-

3 points

-

I set mine up early on and put it into my letter as March 8. I am sick of killing myself for people that just are not in a hurry about my time. The later they are, the more they call and bug me.3 points

-

I've been doing something pretty close to 1 March each year. Now some simpler ones come in after that and get prepared, but I don't announce that. I think I'm stopping with what I have right now. As it is, I have a 2017 that I promised, partnerships and S-corporations with 15 March deadlines, and a taller than normal stack that arrived as early as 1 February. That's right, I'm a month behind already. My usual flurry is 22 February when a dozen arrive in a day, 20 in a week, leaving me weeks behind suddenly. This year the flurry arrived 12 February, and I've been buried every since. I'm making sure that everyone knows from now on that they ARE going on extension. I don't care if they upload or drop through my mailslot and run, I'm tracking them down to tell them they are on extension. (Well, I do have a couple of March appointments that I rescheduled from February that I guess I have to prepare on time.) The problem clients are the ones that remember dropping off in February and don't remember bringing me more stuff in March; they complain that it takes me three months to prepare their returns.) I answered the door this week in my pajamas to a client dropping off. Well, leggings, tee, and fleece top, with fuzzy slippers. That's how I work when no clients are due. With clients, I still go for comfort: leggings, long-sleeved tee, long vest or sweater, but with actual shoes and socks. I might wear jeans. I might even wear dress slacks. But, I've really lived in leggings since my hip replacement. No tie and blazer, but the long vest or sweater does tie the outfit together a bit.2 points

-

No imputed interest BS. No gain on repayment if loan basis used to deduct losses. Smaller bill from me. And we're talking about S corps, not C. I think I only have one C corp left.2 points

-

Not abandoned since they transferred title. How much debt was relieved? Would probably report on 4797 with debt relieved as consideration.2 points

-

I have reported like that without receiving a cp 2000, maybe just by luck. I would deal with it when it comes after tax season instead of spending time and billing client on it now2 points

-

Do any policymakers of either party have a clue about how much work they cause everyone by spending their time playing politics instead of doing actual work? They love to change the tax code on the last days of December so IRS employees have to scramble to update software, forms, pubs, etc. Last year they passed the extender bill in mid-February, when lots of returns had already been filed. This caused many banks that left PMI off their 1098s to pay for printing and mailing new forms, many tax pros to sift through completed returns that needed amending and then amending them, the IRS to have people hand process all those amendments. I've noticed this year that the banks are including PMI on the 1098s even though it doesn't count (yet). I have been keeping a list of clients who have PMI, might benefit from the tuition and fees deduction, etc. so I don't have to comb through my list of completed returns to try to remember who might benefit. The policymakers make it sound like (and may believe) they are helping people by doing things like the extenders, but they are actually creating havoc everywhere.2 points

-

Hey, anybody set their cutoff date yet as when 4868 comes into play. I have an awful lot of TP just now getting some things.2 points

-

Relief from a partnership liability is considered a deemed distribution and treated the same as cash received in liquidation would be.1 point

-

1 point

-

Best tax treatment might be abandonment of property or of partnership interest depending on facts and circumstances. Unfortunately they did not get tax advice before they signed the $1 deal, although that is not the final determining factor. That $1 might have been the most they could get out of the deal so maybe no gifting here. As Lion pointed out, was there any relief of liabilities?1 point

-

Were your clients relieved of any mortgage or other debt? Did they sell their share of a rental home? Or did they sell their partnership interests? What do their Form K-1 look like? You're preparing their joint 1040, right? Or, the 1065? Or, both? Yeah, gifting...1 point

-

Looks like you might have some gifting going on.1 point

-

I've already filed some extensions. Planning to get my own handled first of the week. Everything after March 8 will automatically go on extension unless it's an obvious slam dunk on the first pass. No exceptions.1 point

-

1 point

-

I always have a few in the racks waiting for that last piece of info. I will harass them until they get off their butts and shake a leg. It's funny, I always say I won't start a return until I have everything, but that never works as I feel a need to keep moving. Too bad clients don't feel that way.1 point

-

Under the uniform of basis rules, you will teat the property the same whether from a trust or estate. Your client's basis is the adjusted basis on the final depreciation schedule for the 1041. In regards to you first question, I don't see the point in claiming depreciation for a 2 week period if allowable or not.1 point

-

1 point

-

@jklcpa I think we need to ask Eric for a section in the site that allows for these questions to be answered for a fee. When these non-professionals come to the site, they could be required to put up a credit card, and then we could generate revenue for the site by answering questions. We could do bids to see who will do it for the least amount. Nice way to fund the site? What do you think? Oh, unodish, in about 20 minutes the moderator is going to post the terms of the site you agreed to and lock the thread. We are not a free advice service. This is a site for professionals who help each other, not the general public. You need a tax professional to answer your question. Tom Modesto, CA1 point

-

Yeah, I had to do one of these last year. Sent in the 5498 from 2018 and the 1099R from 2017. Wrote a letter giving the date of the withdrawal and the date of the deposit into the new account. No change letter showed up about 3 months later. Even though the "Rollover" was on the tax return we still got the CP 2000. Tom Modesto, CA1 point

-

Code 7 doesn't matter. It would't be a G because it wasn't done as a trustee-to-trustee transfer. The software should print ROLLOVER to the left of the IRA/Pension line, but I've seen where that didn't stop the CP2000.1 point

-

A better example quite common in the western U S: Well is drilled intended to supply the whole property, subsequently goes dry and has to be filled in. Another deeper well is drilled which is successful. All costs added to basis.1 point

-

I would apportion it to the entire 15 acres, because at the time the improvement was done it benefitted the entire property.1 point