Leaderboard

Popular Content

Showing content with the highest reputation on 12/28/2020 in all areas

-

Most of our handbell choir also sings in the chancel choir. In the olden days (pre Covid) handbells and chancel choir shared the choir loft so we could ring and sing. I haven't touched a handbell since March.6 points

-

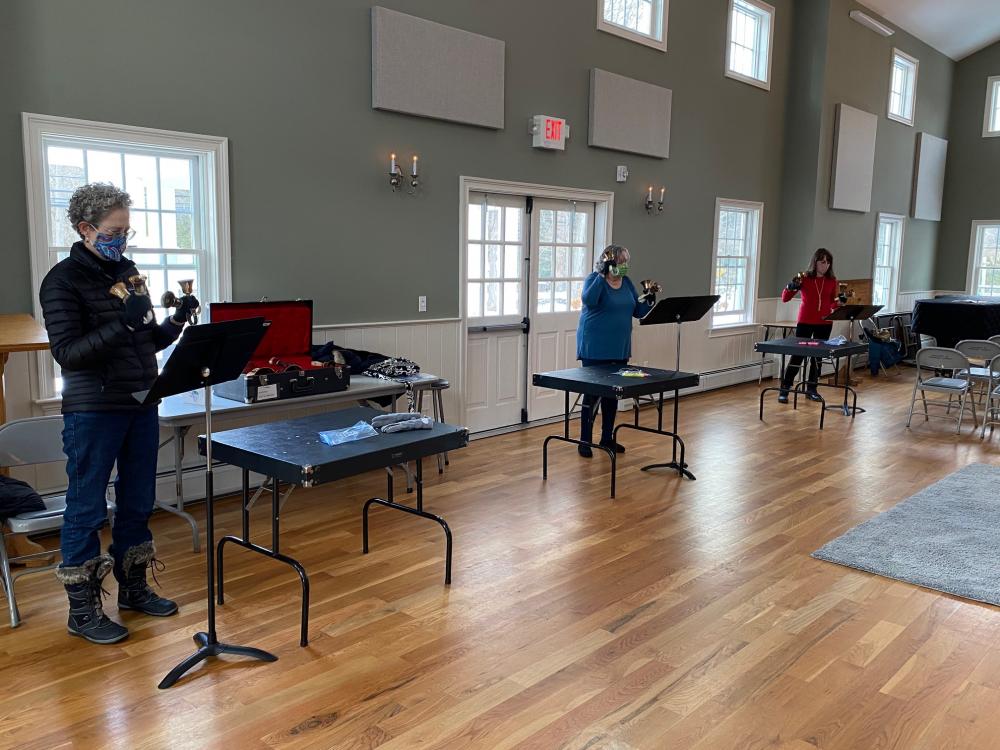

I'm the old lady in the middle. We're a tiny church in a tiny town, so don't have enough volunteers to ring handbells very often. I accuse my husband, the music director, of marrying me to make sure he has at least one handbell ringer for Christmas Eve! If this were a normal year with live choirs instead of pre-recorded music, the younger gal on the right would be singing in the choir and not available for handbells. I've done four-in-hand very, very seldom; three-in-hand a bit; and even that was more often needed to add a bell to a hand for a particular passage and then return to just one in that hand. Hubby Steve found handbell music that could use three, four, or five ringers with NO shared bells. We were close together for a minute for Steve to snap the pictures on his iPhone to pick one for the bulletin. Otherwise, we rehearsed 20+ feet apart, masked, with the windows/doors open, and for less than 30 minutes for about three rehearsals. We moved a bit closer as you see in the last picture for recording. We each had our own baggie with our gloves/markers/pencil/wipes. Our bells are old; two of us had a bell that needed to be in a precise position to ring, so we missed those a couple times when trying to ring softly as harmony but could bang them out when melody. We played something based on We Three Kings, so Steve will use the recording again in January. We're ALL ready to ring again sometime. The tall gal's husband would join us so we can have four, probably for Easter.6 points

-

I hope everyone had a very MERRY CHRISTMAS! I enjoyed my time "with" family and the time away from the office, and hope that you all did too.6 points

-

You have three ringers who can four-in-hand?!?!? I'm the only ringer in our bell choir who will even attempt it. (I like it. It's fun!)6 points

-

Excerpted from the Journal of Accountancy: https://www.journalofaccountancy.com/news/2020/dec/tax-provisions-in-covid-19-relief-bill-ppp-and-business-meal-deductibility.html?utm_source=mnl:alerts&utm_medium=email&utm_campaign=22Dec2020&utm_content=button Many tax provisions appear in year-end coronavirus relief bill By Alistair M. Nevius, J.D. December 27, 2020 CARES Act extensions and pandemic provisions Educator expenses for protective equipment: The bill requires Treasury to issue regulations or other guidance providing that the cost of personal protective equipment and other supplies used for the prevention of the spread of COVID-19 is treated as an eligible expense for purposes of the Sec. 62(a)(2)(D)(ii) educator expense deduction. The regulations or guidance will apply retroactively to March 12, 2020. Payroll tax credits: The bill extends the refundable payroll tax credits for paid sick and family leave, enacted in the Families First Coronavirus Response Act, P.L. 116-127, through the end of March 2021. It also modifies the payroll tax credits so that they apply as if the corresponding employer mandates were extended through March 31, 2021. The bill also allows individuals to elect to use their average daily self-employment income from 2019 rather than 2020 to compute the credit. Deferral of employees’ portion of payroll tax: In August, Under the memorandum, employers are required to increase withholding and pay the deferred amounts ratably from wages and compensation paid between Jan. 1, 2021, and April 30, 2021. The bill extends the repayment period through Dec. 31, 2021. Miscellaneous tax provisions Temporary allowance of full deduction for business meals: The bill temporarily allows a 100% business expense deduction for meals (rather than the current 50%) as long as the expense is for food or beverages provided by a restaurant. This provision is effective for expenses incurred after Dec. 31, 2020, and expires at the end of 2022. Certain charitable contributions deductible by nonitemizers: The bill extends and modifies the $300 charitable deduction for nonitemizers for 2021 and increases the maximum amount that may be deducted to $600 for married couples filing jointly. However, the Sec. 6662 penalty is increased from 20% to 50% of the underpayment for taxpayers who overstate this deduction. Education expenses: The bill repeals the Sec. 222 deduction for qualified tuition and related expenses but in its place increases the phaseout limits on the lifetime learning credit (so they match the phaseout limits for the American opportunity credit), effective for tax years beginning after Dec. 31, 2020. Depreciation of certain residential rental property over 30-year period: The bill provides that the recovery period applicable to residential rental property place in service before Jan. 1, 2018, and held by an electing real property trade or business is 30 years. Temporary special rule for determination of earned income: The bill allows taxpayers to refer to earned income from the immediately preceding tax year for purposes of determining the Sec. 32 earned income tax credit and the Sec. 24(d) additional child tax credit for tax year 2020. Modification of limitations on charitable contributions: This bill extends for one year (through 2021) the increased limit from the CARES Act on deductible charitable contributions for corporations and taxpayers who itemize. Disaster tax relief Qualified disaster-related personal casualty losses: The bill permits individuals who have a net disaster loss (as modified by the bill) to increase their standard deduction amount by the amount of the net disaster loss. Tax extenders The bill makes permanent the following provisions: Sec. 213(f) reduction in medical expense deduction floor, which allows individuals to deduct unreimbursed medical expenses that exceed 7.5% of adjusted gross income instead of 10%. The complete article is about 6 pages long, so I have excerpted the most common provisions. As usual their is very long list of tax extenders! Please copy and paste the above link for the complete article5 points

-

I missed most of the week leading up to the holiday and our first tiny live tree in years, but did finally have a nice Christmas after all. The previous Friday evening I started with a high fever of 103.5+ that Tylenol wasn't touching. I was isolated and alone in a spare bedroom and bathroom the whole week and worried the whole time of what I had and what illness I'd exposed my mom and husband to. The exception to my quarantine was for a Covid test on Tuesday afternoon where my husband and I drove in separate cars. Christmas Eve I got the best prezzie, a negative test result! My husband got his negative result on Christmas morning. Glad everyone else here is doing so well.5 points

-

I just don't want to do this again...... I haven't updated my software yet. I haven't sorted thru 1099 people yet. I haven't even purchased some jugs of water for the fountain. I don't have any motivation. I don't have a secretary - maybe that would help. This season is just going to stink!4 points

-

I love reading about this ringing and singing as I miss it soooo much! I'm in the choir and my husband and I are both ringers, for about 27 years now. But, like you folks, not since months ago. Only one can ring four in hand and it isn't me, alas. We are hoping to try again for Easter if weather permits. Several choir folks were brave enough to sing outdoors even into the 30's to be recorded for the virtual services. I wasn't one of them, too many negative factors. For sure missing the choir practices has been the hardest thing. Choir is a 'family' all its own, at least at our church, now 152 years old. This chat just warms me so much! Hoping you all stay well and healthy!4 points

-

Great minds can think alike! Our director also began Zoom choir about 3 months ago. It was so rewarding seeing so many folks including one who had to go back to another state when the university closed for classes. As she could teach online, she chose to be with her husband who teaches at a west coast school. Depending on when the numbers decrease and the weather increases, I am hoping to rejoin the outdoor vocal group. I think he's planning for bells again about February or March in the large Social Hall which has separate ventilation and lots of space. The College Conservatory of Music at University of Cincinnati has been using the space for rehearsals so installed the HEPA filters and upgraded the space. They do all the extra cleaning even though only they, so far, are the only users. But it is singing and even with masks a bit risky. Oh, this can't be over soon enough! On the other hand, having Bible study and prayer group online now has brought in many more folks who would not have otherwise participated due to driving distances and/or at night. So a few pros, not 100% cons.3 points

-

Hubby Steve is director of music, and his choir members were missing choir. He started doing Zoom Choir, preparing a theme each week (maybe Advent hymns or the history of some hymns or...) talking, playing through some things, then everyone else muting to sing along. The choir emailed him "topics" to cover. Steve has a free Zoom account with time limits and had enough "material" for 30 minutes, thinking that's all anyone would want to sit on Zoom, but his choir didn't want to stop until they were cut off at 40 minutes. Now he uses the church's paid Zoom account, because choir goes on for an hour or even longer. A former parishioner who moved away to CO joins the Zoom choir as does another who moved to the other end of CT and some who have work or family obligations that keep them out of "regular" choir/not available Thursday evenings at 7:30 normally. But, now they're not commuting home from NY or don't have to get a babysitter for kids or can even be preparing dinner or eating as they turn on Zoom. They love Zoom choir. And, Steve's been able to coax a few choir members into "leading" a hymn on Sunday/pre-recording it for him to insert into our Zoom church on Sundays.3 points

-

And no matter how quickly he gets his W2, e-filing is not open at the IRS right now, so he can't file. I dunno what happens if he and the baby mama both file so that their returns go in on opening day.3 points

-

It poured down rain, running through our garage but not flooding our basement. Washed away all the snow, though, and then turned bitter cold and icy. We had a nice Zoom church service Christmas Eve, and a few relatives from far and wide tuned in for a bit of it so got to see some faces, wave hello. FaceTimed with grandson/our "kids" yesterday. Still haven't heard from DIL when we can Messenger Live our granddaughters. They run an inn/restaurant in PA so were shut down by the governor and could only offer take-out for Christmas and New Year's. They aren't busy but are bored and depressed and broke. Plus son just had neck/back fusion and can't drive or work or pick up his daughters. One of their former employees has Covid; hasn't been an employee since last March, though. My ill/housebound sister in IL attended the National Cathedral's Zoom Blue Christmas service, so that tells you how she's doing. She hasn't been available yet for a phone call from us. All in all, hubby and I are having some relaxing holiday time with Stew Leonard's pick-up filet dinner with all the sides that's lasting us about three dinners and watching movies/Netflix/Prime and both of us getting some work done (he's teaching piano today via FaceTime, and I'm doing a few more hours of on-demand 2020 tax updates). We put up some decorations, received a photo book of our grandson's first year in the mail, a few presents. Hubby's director of music at our church, and I'm a frequent liturgical assistant and bell ringer, so Christmas is usually a frantic build-up. This year, Steve had all the music recorded ahead of time (including three bell-ringers with two bells in each hand) and I was reading the same Christmas readings and leading the prayers, but all sitting down at home with Steve (instead of him in the church balcony and me at the prayer desk) while he was the audio/visual guy pulling up the music and sharing his screen at the appropriate times. We got to have much more music than on recent Sundays, so that was festive. I miss hugging my grandchildren/seeing my grandchildren but overall the differences this year were positive: seeing relatives that are far away, less stress (especially since our "midnight" service was at 8 pm), self-quarantining with a husband I love, etc. Hope you all can have a Happy Holiday Season in a different way this year. After all, it's our pre-tax season, too!3 points

-

Hope everyone enjoyed their Christmas. I thought it was a great Christmas because we didn't have to spend hours in the car. We had a great zoom session with the kids and grandkids. Plus we had dusting of snow later in the day as we were watching the movie White Christmas! It was a very good a Christmas.3 points

-

3 points

-

2 points

-

I will join the chorus of those who miss the musical family at my church. We did have a very small bell choir for Christmas that taped a few songs, and we occasionally have the praise band play outdoors if we do services int he parking lot. But no chancel choir since last March. I think that is just another reason that I dread tax season - band and choir practice were my stress relief during tax season.2 points

-

It will happen the same thing that happens with any other return. The return that is processed .0000006 seconds before gets the deduction and the second return will be rejected because the dependents social security was already used. The second parent will have to paper file and the other will enjoy the money temporarily or permanently.2 points

-

2 points

-

Since today is December 24th, I will wish everyone a very Merry Christmas! Next week, I'll send wishes for 2021. We'll keep the two separate.2 points

-

My office is across the hallway from our HR manager. Employee comes in to the office today asking for his W2. Says he needs it right away so he can file before his baby-momma because she took the kids last year and he wants to file first. HR manager explains that the W2s will be coming out mid-January like always. Employee asks "Can I file with my last check stub?" HR manager replies "Yes". Here we go with the start of a new tax season. Tom Modesto, CA1 point

-

I am sorry to hear that you lost your day job - although I think the owner may be sorry too. It sounded like you were working way above your pay grade sometimes.1 point

-

Well, I believe HR block has its own direct efile with IRS. We send it to ATX, then it goes to a queue for the next batch. Even though the next batch is in the next 2 minutes, HR block's return would be filed when mine gets there.1 point

-

Our 176-year-old church has a small choir loft. We don't have enough bell ringers to ring with any frequency, so can end up ringing a descant or accompaniment to a choral anthem or even alternating verses with a hymn. The choir has a couple of volunteers who can ring and sing at the same time, but not more than a couple. If we have very many ringers at a time, the bell tables squish the choir up under the sloped roof &/or onto the stairs! As you say, no one has been in the choir loft since mid-March, except for Steve who does record preludes each week.1 point

-

The worksheet you speak of is used to determine if the taxpayer is due any additional impact payments based on what he/she has already received. I do have a few clients that never received their stimulus payments. This worksheet is used to obtain the payment they should have received but didn't1 point

-

Apply basic partnership tax rules: -Partners share of losses are limited to basis at the end of tax year, you do not go back and amend. -Reduction of partner's share of liabilities is treated the same as a cash distribution. (sec 752(b)). -Distributions in excess of basis are income to partner.1 point

-

In the past, a taxpayer could take their last paystub to H&R Block to qualify for a RAL or RAC. However, their return would not be e-filed until they returned with their W-2. (Full disclosure: I worked in a Premium office and don't think I ever did a RAL or RAC.) PS: After leaving Block, I make sure that I charge MORE than Block. I still do NOT do RALs or RACs or any other bank products.1 point

-

H & R Blocks advertises that people can bring their last paystub... I guess they use some sort of RALs. I guess the difference between H&R block and myself is that they are running a business like a business and make enough money to pay their executives much more money than what I make and they don't even prepare a return. In my case, I don't make enough money to pay someone to answer my phones. Perception is key and people rather pay double to H & R and the person who will prepare their taxes doesn't even know half of what I know.1 point

-

I hear you. I feel like I am not ready for anything this year. I have my software, that is a start. I am going to a Spidell webinar next week, hoping that gets the grey matter moving. 1099s and W2s are ordered but not here yet. I was just reading the article about all the tax law changes and I am thinking that I am woefully inadequate for preparing tax returns this year. I just know I am going to miss something and it will cost me clients. On the other hand, I just got fired from my day job today. I complained to much about taking a pay cut while taking on the extra work of laid off staff. The owner felt I should be grateful not to be on UI myself. I did not take kindly to that remark, and he did not take kindly to my characterization that he was preserving his wealth at the expense of my income. Case closed, owner wins that argument every time. So now I have lots of time to devote to tax season. But I still dread this year. Tom Modesto, CA0 points