Leaderboard

Popular Content

Showing content with the highest reputation on 02/24/2021 in Posts

-

But don't neglect those states that "decoupled" from TCJA such as New York, where a state-only 2106 can bolster itemized deductions even yet. And not just teachers; I've filed several clients who'd become remote-only employees last year and so, newly qualify for the office-in-home deduction. Asking whether such folks have upgraded their Internet and/or wifi and/or hardware, increased their bandwidth to accommodate more/faster video, simply bought a rug to improve acoustic, setc. has yielded more of a deduction, as well.6 points

-

You get a deduction for having a sexually transmitted disease? Is that for the porn industry?4 points

-

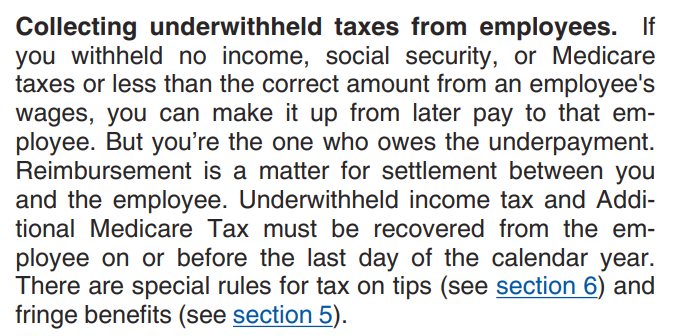

That is not true. 941x and W2c exist for many reasons. Per Pub 15, the employer is responsible for depositing both parts. This would cause the need for 941x. Employee does not have to agree to pay the employer back, so the employer would then issue a W2c, which would include the amount "withheld" (corrected), and increased wages (the amount the employer has to add to cover the employee amounts the employer had to pay).4 points

-

I set up my IRS Secure Access account several days ago. It took me about 10 minutes. It certainly was the most rigorous account set up that I have ever done. The simplest most direct link is irs.gov/account.3 points

-

"The latest scam email states it is from “IRS Tax E-Filing” and carries the subject line “Verifying your EFIN before e-filing." "Tax professionals who received the scam should save the email as a file and then send it as an attachment to [email protected]. They also should notify the Treasury Inspector General for Tax Administration at www.tigta.gov to report the IRS impersonation scam. Both TIGTA and the IRS Criminal Investigation division are aware of the scam."3 points

-

CA allows you to take the STD deduction on Fed and Itemize on CA. Because the STD deduction is so low in CA compared to the Fed, lots of my clients are itemizing only for CA. Tom Modesto, CA3 points

-

Creating a negative payroll check and entering a negative line on a data input worksheet for Sch A are worlds apart. Probably galaxies apart. There is no comparison. As you said, there is no such thing as a negative paycheck. Everyone who has passed Accounting 101 knows there are adjustments made on worksheets. That's what worksheets are for. This is typical ATX bullshit programming from people who have no idea how to operate a tax practice.3 points

-

3 points

-

I realize I live in an area that literally is called the Gold Coast, but I find it exceedingly rare for a recently graduated student to pay more than half his own support in his graduation year, even if he gets a Wall Street job, and especially if joining the military. Have the parents and child fill out the support worksheet, and keep a copy in your files for both sets of returns to have documentation for how the family files.2 points

-

eServices for the preparer to use to view client data with a POA on file for the client.2 points

-

"Secure Access" sometimes called "Online Account" does the following: "Online Account is an online system that allows you to securely access your individual account information. You can view: The amount you owe, updated for the current calendar day Your balance details by year Your payment history and any scheduled or pending payments Key information from your most recent tax return Payment plan details, if you have one Digital copies of select notices from the IRS Your Economic Impact Payments (EIP 1 and EIP 2), if any You can also: Make a payment online See payment plan options and request a plan via Online Payment Agreement Access your tax records via Get Transcript"2 points

-

Found AICPA charts called 2020-coronavirus-state-filing-relief and the 2021 version called coronavirus-state-filing-relief. They're big .pdf files with awkward formatting. You'll want the latest version, so do retrieve them from AICPA.org I'm guessing AICPA has similar charts specific to the states and TCJA like the above re The CARES Act, unless all state decoupling is summarized in the above charts.2 points

-

I accepted the defaults. But you can go to your account in AssureSign.net and upload a logo and do a lot of customization. I just changed the colors from blue to green.2 points

-

Same for CA. Put it on the 2106 and flow it through to the state. Tom Modesto, CA2 points

-

Yeah I have seen multiple articles. Generally I try to avoid discussing potential legislation unless it's fairly far along. This leigislation still has a long ways to go.2 points

-

All I heard after Technically was blah blah blah! Like the teacher on Charlie Brown!2 points

-

I believe you add [up to] 300 to Line 7 of the SS worksheet. Grace, I have overridden Line 7 on two or three (can’t remember) that have been accepted.2 points

-

I know discussing upcoming legislation is often an exercise in futility, but here's an interesting take on how filing early this year MIGHT be problematic for some people. (If you don't mind clicking a link) It applies to those taxpayers fortunate enough to have experienced an INCREASE in income in 2020 over 2019. Just wondering if anyone else has run across anything along these lines? https://currently.att.yahoo.com/att/lose-1-400-stimulus-check-210600457.html?.tsrc=daily_mail&uh_test=1_111 point

-

https://www.accountingtoday.com/news/lawmakers-ask-irs-to-extend-tax-season-until-july-15-due-to-covid?position=editorial_1&campaignname=LIVE_ACT_Weekly_IRS%20Watch%2020201110-02242021&utm_source=newsletter&utm_medium=email&utm_campaign=LIVE_ACT_Weekly_IRS+Watch+20201110%2B%27-%27%2B02242021&bt_ee=EQttwmVVkLPlw79kBJ9%2FRhR2GDhJQz0WvQJIEyObfE%2Fdl4BYt%2BQRvDMwV6r%2Fhf3s&bt_ts=16141860654061 point

-

Oh Bonnie, I'm sorry. May her memory be for a blessing. I'm sure your clients will continue to be understanding, if you have to go for extensions.1 point

-

And, to keep it separate from tax stuff... I'm very sorry you lost your mother and very glad you spent time with her. Do what you have to do. And, keep us in the loop. We all care for you and your health and your well-being during this very strange time for grieving. Prayers.1 point

-

I would welcome a 15 July deadline. It lets me work longer before I have to stop to prepare extensions.1 point

-

Bonnie, I am so very sorry to hear of this terrible loss. You do know that all of us here hold you in our hearts and prayers. Be sure to ask for any help we might give. Family is always first, period, so am grateful that you took the time you needed. It seems at least most of your clients understand. Those that don't are not really worth having. Take care of yourself, too. And lean on us.1 point

-

I get parents who want to claim kids that last year when the kids really DID support themselves. I have dropped the hammer on those more than once. This one really is a toss up. If this kid lived with his parents, he very likely wisely saved some money. These are great clients, and money-wise. Not wealthy, but good standards. Since it's a toss up, and he joined the military so young, I'll follow Medlin's advise. It's sound.1 point

-

Aha, right you are, Lion! Once you create the pdf and attach it, you can still leave the original 8915-E in the return without error. https://www.irs.gov/forms-pubs/alternative-filing-method-for-e-filed-returns-that-include-form-8915-e-and-form-7202 Because Forms 8915-E and 7202 are new and impacted by recent legislation, IRS has provided alternatives for these forms to be included with an e-filed return. Some software providers allow the forms to be attached as a pdf, others as a statement attached to the filing. As an alternative to attaching a PDF of Form 8915-E or 7202, to increase e-filing and reduce paper filing, software providers may instead include with the e-filed return a general dependency statement that includes all the information requested on Form 8915-E or 7202 if they are unable to attach a PDF of the form. Such a statement should look similar to the following for Form 8915-E, or correspondingly similar for Form 7202. Forms that have been typically filed as a PDF in the past, such as Form 8915-E, or other new forms not yet on XML, should still be sent in as a PDF.1 point

-

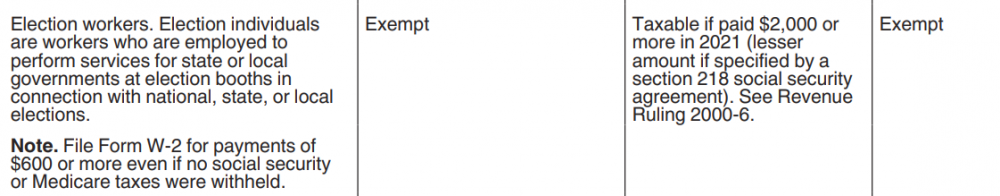

Correct! In the U.S., election workers are noted specifically in IRS Pub 15. They do get some possible exemptions, since the majority are one day workers, but once they reach a certain amount of earnings (as shown in Pub 15), their wages are subject to SS and Medicare. Yes, even government payroll personnel can make mistakes, such as issuing a 1099 for employee wages. (From 2012 Pub 15, Columns are: Type of employment, Federal WH, SS/Medi, FUTA)1 point

-

Likely separate, especially with the EIP differences. I would also wait until the EIP 3 is determined (or fails) because of the net income by proper timing as discussed in a different thread. Assuming no other items which would benefit parents by keeping, if allowed, as dependent.1 point

-

Is there a list of states that we can use this? I have just completed several CA returns and didn't know this. They wouldn't benefit from it anyway, as they don't itemize, but I might have some in the future.1 point

-

Yes, an interesting predicament. I'm just laying out the scenario where it applies and telling them to let me know whether they want to file a Federal extension or "just go for it" as things are right now. One thing I'm not going to do is hold onto the returns waiting for IRS or Congress to extend the filing date. If the client want to wait, then an extension goes out immediately. Once their info is in my hands, I either want it out the door on the first pass or send in an extension. (Less stressful for me that way).1 point

-

As part of best practices, each of us should check our EFIN to verify that the number of returns IRS reports as e-filed matches our records. So I'm curious about a couple of things. You already have your own clients on the side, and it sounds like this person that was fired also had clients on the side, and both of you were/are using boss firm's software remotely to prepare returns under boss firm's EFIN? Is that what you are doing? Or do you have your own EFIN and using the firm's software? Also, why you are asking about this and not your boss?1 point

-

1 point

-

1 point

-

1 point

-

Don't forget that in 2020, employers could opt to not withhold employee portion of FICA. They are supposed to make it up over 12 months in 2021, when your client is no longer working. Don't know what the consequence is in that case. It was somewhere in the IRS materials. Maybe someone knows.1 point

-

IMO, the W2 is not correct, not valid for the given employee, and should not be used as is. Reporting the amount as tips would not work for me either. The problem was caused by payroll, and that is where the solution comes from. The employee could choose another option, the form claiming the employer did something wrong, but that may bot be a comfortable way to go. I suspect, face to face (such as it is now) with a payroll manager at the county would get results. I suspect you could use it as is, and deal with the likely eventual W2c, but that could cost your client more money, and may not make them happy. The client has no responsibility, at present, to pay for the employer's mistake, which is why you cannot find a form to allow a W2 employee to pay their own SS and Medicare contributions.1 point

-

No unreimbursed employee expenses during TCJA. Accountable employee reimbursement plan. This is a reason teachers have union reps.1 point

-

1 point

-

The proposed EIP 3 may give an amount for dependents over 16yo, unlike EIP 1 and 2. Still speculation, but there is no point filing early and losing what may be a gain. Example: Parents and one adult dependent (for the sake of this example, a disabled adult) Parents: EIP 1 and EIP 2, nothing for adult dependent. Parents elect not to claim dependency for 2020 (-500 federal, and for sake of example, -300 state), making adult child eligible to file and receive EIP 1 and 2 (+1800). If EIP 3 passes as proposed (1400, adult dependents eligible): Wait to file until EIP 3 is paid. Parents receive their own, plus 1400 for the adult dependent from prior qualifying TY. Parents then file, without dependent, and because there is no claw or pay back requirement, keep the 1400. Adult (the parents child) files, and receives their EIP 1, EIP 2. Likely for 2021, the child files separately again, to get EIP 3. With the proposed EIP 3, the net: Parents, +1400 EIP 3 for 2019 adult dependent, less 1600 for loss of credits on their 20 and 21 returns. Child, +1800 for EIP 1 and 2 (20 return) and EIP 3 of 1400 on 21 return. Parents, - 200, Child +3200, net +3000. --- Disregarding EIP 3: Parents -800 (20), Child +1800 (20), net +10001 point

-

1 point

-

Timing is always an issue to be reviewed. In the case of the EIP's, there is timing to maximize, such as what is popular in the media, and items not so popular, such as an adult child not being a dependent for 2020 (but not filing until potential EIP 3 is paid, so the parents get the "dependent" amount, which does not have to be paid back, then the adult child files to get their EIP 1, 2, and eventually 3). No moral issues, as it is something done all the time, like bundling income and/or expenses for the best benefit.1 point

-

I can see this as a new revenue stream for Pacon: bookkeeping and tax preparation for casual gamblers. Flat fee plus % of winnings plus all the food and drink you want. Go for it !!1 point

-

I put negative adjustments in all the time and not a single one of them was a refund of prior year amounts. This is another typical bullshit move on the programmers part.1 point

-

As long as totals for LY are correct, print to pdf and use the typewriter function to add the details where you want them. Adobe Acrobat has that capability, and other pdf programs may have something similar. Many times I want use the comparison form to review the return results with the client, and I'll use the pdf typewriter to add some brief notes next to figures I want to highlight in my discussion.1 point

-

I agree - I hate it!! but in most cells - if you go to itemized list, you can usually do a negative1 point