Leaderboard

Popular Content

Showing content with the highest reputation on 03/17/2023 in Posts

-

I'm sticking with the desktop version and never moving to the subscription model. I'll go back to green ledger paper first.5 points

-

I'm with you Catherine. My data is my data. But QB is getting squirellier & squirellier. (I think that's a word!). I am now using a client's extra user for their stuff and my own.3 points

-

Yup, and I'm going to make sure I have the last non-subscription version and then turn off all updates. If need be, I'll move to Medlin Accounting or even green ledger sheets. If I have to pay monthly for access to my own data, it's not mine. Ain't happenin' but that's me. You decide what's best for you.3 points

-

Trust me, economists have LESS personality than accountants. They don't call it the Dismal Science for no reason.2 points

-

It is a little more nuanced than that. The trust instrument should define income. If the instrument does not, then the rules fall back to state law for computing income. Most states define Capital Gains as corpus. Most trust instruments allow the trustee to distribute corpus for various reasons, or in your case, require 10% of the corpus to be distributed. What the IRS is looking for (IMHO) is distributions of CG to low income beneficiaries to escape trust taxation. I believe that so long as you have a viable reason for the distribution of CG, that is NOT lowering tax, and is within the authority of the trust instrument, you are in good shape. Margaret always distributes, so again, no issues with the service because it is a uniform application. If Margaret was distributing CG to low income beneficiaries and other income to high income beneficiaries, then she might have a problem with the service. Tom Longview, TX2 points

-

For storage (such as retirement) paper rules (or failing paper, PDF's on multiple machines/storage methods). Computers fail. Internet connections fail. Servers fail. You cannot meet the IRS regs by "hoping" you can access the needed data. It is interesting to discuss the "ownership" of things. I agree, the data is the property of whomever created it. It should be something the creator has ability to retain. Thus, printing (or creating PDF) records is suggested, since there is no way to guarantee electronic data can be "used" by other software. The software and resources which can be used to manipulate said data? That is usually licensed for use, with no transfer of ownership. Even if the licensee wants to allow others to use their license "just to view" the data, the other party, such as an accountant, is likely going to need a license of their own, since they are benefiting from the software - even though they are not manipulating the data. I actually get this type of question often. Such as "I am the only one using the software so I want to install it on every machine I own" (did the computer company give you each machine?). Or even more applicable, "Can my accountant use my license?" (The accountant, unless manipulating the data, needs your reports, not the software". Going back to the beginning, software was ruled to be copyrighted, in the same manner as a book. Meaning copies (yes kids, software was formerly distributed on hard media!) were not allowed unless the copyright holder gave permission. In my case, our model for our non payroll programs has recently changed to buy once. No ongoing support is included, but is available on a pay per use basis. No one has needed to pay for support yet, but we have been doing this for 40 years, so the software does self support... We do watch for multiple installs, and do terminate licenses for those who fail to comply after several gentle reminders. For Payroll, it is an annual license. When the license expires, no more new data can be entered, but access to existing data is not stopped. Same as above, we can catch those who "share" their license.2 points

-

I hate it, because now I worry that I won't have access to it after I retire the end of 2024. I have the Pro Advisor Accountant's version.2 points

-

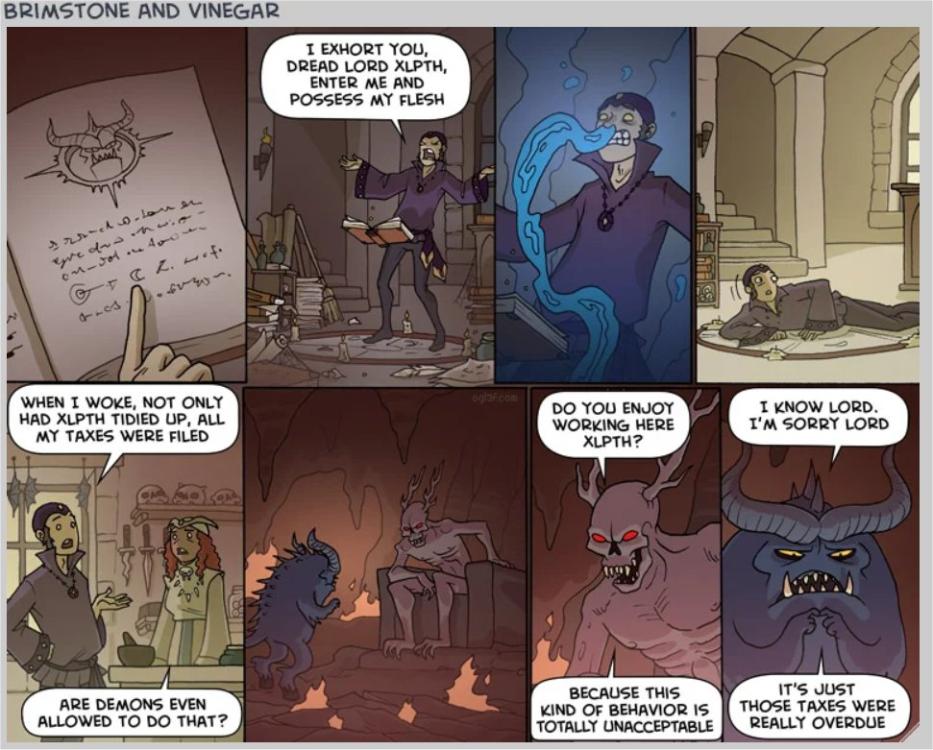

We come into the mix at about 45 seconds, but watch the whole two minutes.1 point

-

Actuaries are the math people without the personality to be economists. Or even undertakers!1 point

-

I once heard us described as math people without enough personality to be economists. Not sure I've ever met an economist, so I can't vouch for accuracy.1 point

-

From what I understand, that rule applies if the property was not previously used in a trade or business. Per reg 1.167(g)-1 In the case of property which has not been used in the trade or business or held for the production of income and which is thereafter converted to such use, the fair market value on the date of such conversion, if less than the adjusted basis of the property at that time, is the basis for computing depreciation.1 point

-

My daughter (11) is a fan of Vihart's videos. She let me know on the 14th that Phi is much cooler than Pi. Then I called her a nerd.1 point

-

Catherine, On the "A" screen in Drake, the lower right hand of the window contains state only information. The 2106 form is highlighted in blue. When you click on the 2106 it opens and you can choose the state at the top. I would think the information should flow from there. I just saw Max basically posted the same thing.1 point

-

What I have done in cases like this is to indicate that the EIP pmts were NOT received. The IRS will review the return and adjust it accordingly, if the EIP was paid, without penalty. It does lengthen the processing of the return to about 10 weeks. I don't understand what you mean "He leaves his refunds on file". Are you saying that each year his returns have the refunds carried over to the next year?1 point

-

On the Federal Sch A screen, the lower right side is dedicated to state deductions. Everything should be clear from there. The deductions will show up on the CA CA form and a copy of the Sch A is generated ith the other state forms.1 point

-

The EIP payments 1 & 2 were advances of the recovery rebate credit that could be claimed on the 2020 return, and any advances received were treated as a reconciling item of that credit. The credit is still available to the taxpayer. The credit for 2021 is handled in a similar manner. This page should answer: https://www.irs.gov/newsroom/recovery-rebate-credit1 point

-

Catherine, just so you know Intuit is moving the desktop version to a annual subscription.1 point

-

@Catherine I know this is not a big help since I use ATX. But in ATX you would use a business use of the home linked to a CA only 2106 that would populate page 6 of the 540 CA form. At the end of the day, it is going to end up on page 6 of the California Adjustments form in Drake. How you get there I can't help with. Tom Longview, TX1 point

-

From what I recall, I would think the depreciable basis would be the lesser of the adjusted basis in the house (cost + improvements - previous depreciation) or the fair market value at the time placed in service. Not sure about the depreciable life. My guess would be that would also start over if FMV is less than adjusted basis.1 point

-

Read the Ringers "Splitting Nails" thread stared March 1st. You will see differing opinions of whether to amend or not. Personally I lean toward just adjusting the carryforward numbers. However if it was much bigger adjustment I would lean toward amending.1 point

-

I am on that group but I haven't been paying much attention to it. I should start to look at the postings more. Thanks.1 point

-

I don’t think there is any authoritative answer to your question, but I believe you should pick up where you left off in the past; including cost and accumulated depreciation. That way you will have a record of accumulated depreciation if the property is sold in the future. By using the remaining depreciation life, your client will receive a larger deduction per year than if you start over with 27.5 years. As for as the improvements go, I would list them separately and begin depreciation on the date the house was put back in service as a rental.1 point

-

1 point

-

It sounds like they are qualified non personal use vehicles. Any vehicle that is “not likely to use more than a de minimus amount for personal purposes.” Because of its design. They are exempt from substantiation requirements but can only use actual expenses for a deduction.1 point

-

I picked up a client some years ago that had prepared his own returns in TT for years. He had an S-corp and three rental properties. Some years, the rentals were reported in the S-corp. Some years on the 1040. One property was a historic building and had carryover business credits. Oh, and he was a real estate professional too. It was approximately 15 years of screwed up returns. I prepared a disclosure with calculations showing for regular tax and AMT, what the NOLs, credit carryovers, etc. etc. what they should have been for each year and the correct figures for the year. And didn’t amend.1 point

-

Sounds like the son knows more about taxes than you do. I'd give the info back to him with a suggestion that he employ his expertise and prepare the return himself.1 point

-

Well, my client told the auditor that he took his vans to a friend mechanic that didn't give him a receipt. When the auditor left, I told him "you should at least use Jiffy Lube because they write down the mileage when doing oil changes". He said, the vans don't fit in their installations, which I didn't know. But I have seen his van and they are tall and all of them have 2-4 ladders on top. Another interesting thing that I noticed in this audit, is that the auditor has access to all years. I thought they only had access to the year in question and then they requested access for the adjacent year but I was wrong. I believe that the IRS will have to accept actual expenses in a review. This client was audited in 2008 but during that visit, the auditor said that he was within the industry's mileage allowance or something like that. Thank you to all of you who have replied to this post.1 point

-

Oil change records record mileage and may help here. I was at a liaison meeting once when the IRS person presenting said the only vehicle IRS believes has no personal use is a cement mixer. The workers may take the vehicles home at night, out to lunch, to the bank, etc.1 point

-

Some years ago at a CPE Class, I was talking to another EA who had a good sized construction client with a number of vehicles. His client ended up in a very nasty audit where his client made no attempt to keep any mileage records and decided not to make any attempt at reconstruction. The auditor denied all vehicle related deductions and made it stick. It cost his client in the high 5 digits in additional taxes.1 point