Leaderboard

Popular Content

Showing content with the highest reputation on 04/08/2023 in all areas

-

The Basis is the value of the Home on the Date of Death. If the client did not get an appraisal and the sale happened very close to the Date of Death (like within 90 days - my suggestion, not IRS rule) you probably can get away with the sale price as the DOD valuation. If the sale is further out than 90 days, you should have an appraisal done for DOD valuation. Tom Longview, TX6 points

-

The fact that our efiles now go stale after 5 days drives me nuts. I always create the efile when I do the return so I make sure I've got all my errors fixed and so it gets into the efile menu and isn't forgotten. And lo and behold my client comes in on day 6. And then I even like to wait another day so I don't get the "oh i forgot to tell you" phone call. I waste so much time re-opening and re-creating. GRRRRR grumble mumble.......grumble mumble.....4 points

-

Agree with Tom. If you mean county property tax assessment value, that's not particularly accurate here.3 points

-

I recall you saying one time we were in the "softly whimpering" stage of tax season. LOL. Thanks for a pithy one liner I have remembered every year since. I am also frequently heard saying: "This is too stupid to be real."3 points

-

Ha, my sophomore HS English class, we had to recite Marc Anthony's speech. Friends, Romans, Countrymen, Lend me your ears.3 points

-

Back when the K-2 and K-3 first came out and I was trying to explain to a client, a summer theater actress, but lapsed into a Dr. Seuss-like poem re K-2 and K-3... she emailed back: That's the difference between us - you think Dr. Seuss and I immediately go into dirty limerick mode. When deciding who next they should screw, The IRS knew what to do. They designed with some glee New K-2 and K-3 Nailing client and accountant, too!3 points

-

"Scholars, policymakers, and taxpayers themselves often cite complexity as one of the worst problems plaguing the tax system. Complaints include, among other things, that the Internal Revenue Code (the “Code”) is too long, too difficult to read, very complicated, and, often, unclear. Among the many costs of tax complexity are (1) billions of hours of paperwork and stress that taxpayers face each year, (2) monetary costs that taxpayers bear when they hire advisors and purchase software to report their tax liability and file their tax returns, (3) difficulty that taxpayers encounter when attempting to claim tax credits and other benefits, and (4) challenges the IRS confronts when attempting to deter tax avoidance and evasion opportunities that tax complexity often creates. As we have discussed extensively, one way in which the IRS manages tax law complexity is through a phenomenon we have called “simplexity” – the presentation of complex law to the public as if it is simple, without actual simplification of the underlying tax law. The IRS relies on simplexity in many plain language explanations of the tax law, such as IRS Publications and automated legal guidance (in the form of the Interactive Tax Assistant). Simplexity enables the IRS to explain the tax law in ways the public is more likely to understand, thereby fulfilling the IRS’s duty to help taxpayers comply with the tax law. However, simplexity has its own problems, including oversimplifying the tax law, and, ultimately creating a two-tier system, whereby sophisticated parties enjoy benefits from the underlying, complex law, which benefits are not available to the general public." This is a great explanation of our convoluted tax system. It does give us "job security" but even at our level of knowledge we don't have the depth of expertise to exploit the loopholes buried deep in the code.2 points

-

2 points

-

2 points

-

Loved it! But it also brought a momentary horrific flashback to freshman English when I had recite the original soliloquy in front of the class. Even all these years later... I shuddered!2 points

-

OP here. I had one last month. IRS rep called me on Mar 2 and said I had been selected at random for a compliance audit. Said she'd be here on Mar 16. Great timing--right in the thick of tax season. She spent about half the time she was here checking 8879 signature dates vs e-filing dates. We passed with flying colors, but that's why I'm now a bit paranoid!2 points

-

I remember you posting about this family. I would keep any explanations very short and to the point. Don't make any excuses or point any fingers. Just say you have decided to work by yourself and leave it at that. The more you say the longer the conversation will get. Good luck2 points

-

I prepped a return a week or so ago. After it was done I ran the MFS comparison routine. It came back saying MFS was better by about $600 so I split the return. I wasn't paying close enough attention. The spouse's return came out exactly as expected. The taxpayer's did not. When I prepared the original return Drake defaulted to taking bonus depreciation on some new farm equipment. TP did not want the bonus depreciation so we overrode it with SL depreciation. When I ran Drake the MFS comparison, the software again used the bonus depreciation to determine MFS was the better option. However, when it printed the returns, it reverted to taking the SL depreciation I had entered. That changed everything. It made MFS significantly worse. Neither I nor the client noticed it until moments after the return was e-filed. Now I have to go back and amend the return to restore MFJ. Just a quick heads up that when Drake does the MFS comparison, it does not take into account any overrides you make on the original return.1 point

-

I don't know how they can check dates as long as the signed date is prior to efiling. I have had clients sign 8879 and then mail it a week later.1 point

-

I understand completely - but sometimes not having the confrontation is far more destructive. Talk to your dad, then listen to his advice.1 point

-

At some point I wonder if they have to show they did something, to justify being paid to harass innocent taxpayers instead of chasing down the true scofflaws.1 point

-

I think you can use the basis: FMV at the time of death or an appraisal 6 month later. If you sell it within those 6 months, you can use the selling price as the basis if it is sold to a non-related person.1 point

-

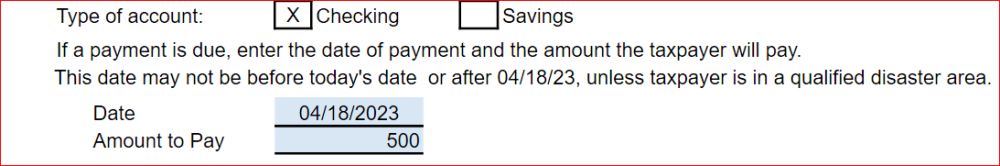

Oh, thanks, I don't use ATX, so data entry is different. And, I just found the latest (I think) IRS notice that states the only CA counties NOT qualified are Lassen, Modoc, and Shasta. Now I need to check addresses of my clients. Happy Easter/Passover/Ramadan/Spring/Tax Season!1 point

-

1 point

-

Taxpayers sold a 1065 business in 2022 and part of the monies was a "covenant not to compete". Total business purchase price (including non compete money) is on an installment sale for 5 years. The taxpayers "current preparer" says all of the "non compete" monies has to be claimed in 2022. Even though the non compete monies is being paid over 5 years ? I've searched and found nothing that says it all has to be all claimed the year of the sale. Thats taxing monies they have not received yet. I say spread it over 5 years as Cap. Gains. Am I wrong ?1 point

-

Kind of. I surely do not want them to jump from current preparer to us, friends or not. We are trying to downsize and get away from these type of returns. And they know that we wouldn't take them on. Been a mentally and physically tiresome year and we are not getting younger. Need my Dr. to prescribe some Valium !!1 point

-

Have him ask for the code section or authoritative source, or ask how section 453(b)(2) applies in his situation. Looks to me like $20,000 (1/5) would be reported in 2022.1 point

-

Frankly, this isn't encouraging. If I had been advising a seller in a similar situation I would have insisted on a separate written covenant non compete agreement with a separate 5 year payment structure clearly spelling that each year's payment was specifically related to the same year's non compete.1 point

-

The NOL of the earliest year is used first until exhausted, and then the next most recent year, and so on. For your client, it sounds like the NOL from only the 2015 tax year will be used.1 point

-

Actually, the return was too much for the auditor and the manager was at our last meeting. The manager knows about taxes and my clients situation and she didn't question the mileage and understood that the vans were not personal vehicles and was easier to deal with her. I am glad she came to the meeting and show the auditor how to conduct the interview. She was happy with what we showed her and we are moving along. Of course there were some items that will be taken out but she will be add some deductions that were not included.1 point

-

Do they each have their own policy? FSA isn't reported on return. As long as wife's policy is HSA qualified there shouldn't be a problem. Of course she will be limited to the self only contribution.1 point

-

1 point

-

Honestly, you wouldn't believe the drama this family is about if I told you (really it's just the wife and son). I'm just guessing but I'd say the sole purpose of this meeting is to show how important the son is and exert his authority (which he literally has none) and put his sister and the father in their place as he takes complete control. I posted it on here previously, he has an ivy league education and couldn't figure out why his father's gross income on his W2 didn't match his net paychecks and he made accusations about it. It's that level of idiocy, I called him out on it and now he's been slighted and needs to put me in my place. (the co-worker is OLD and doesn't actually work - he just likes being able to say he still works and collect a small check)1 point

-

1 point

-

Go ahead and share it, and attribution is fine. Yes, on occasion, the muse strikes, and it all just flows without effort. It struck this morning and off I went!1 point

-

Yes Catherine, you have a real talent, perhaps there is another career in your future.1 point

-

This is fantastic, Catherine! It means you either have too much time on your hands at the moment or the muse struck you and resistance was futile. I hope you don't mind that I share this, with attribution, of course!1 point

-

Sent the above to a local colleague, who replied, " Simplexity or Complexity? To be or not to be" To which, in a fit of poetical contemplation and with deep apologies to old Will, I responded: "To be, or not to be, that is the question; Whether 'tis nobler in the mind to suffer The slings and arrows of contradictory tax laws, Or to take arms against a sea of IRS auditors And by opposing, end them. To file - to comply, No more; and by comply to say we end The heartache and the thousand natural shocks That 1040 presentations are heir to: 'tis a consummation Devoutly to be wish'd. To file, to comply; To comply, perchance to amend - ay, there's the rub: For in that compliance of amending what penalties may come, When we have shuffled off this tax filing season Must give us pause - there's the respect That makes calamity of so long a career."1 point