Leaderboard

Popular Content

Showing content with the highest reputation on 01/17/2025 in Posts

-

One suggestion I saw from someone that was also having difficulty, specifically with the address, was to type it in all caps. As you already suggested, he should try again on another day. The only other way other than what you've already mentioned is to pay by same-day wire transfer that the TP's bank initiates. Scroll to the bottom of this IRS payments page and you should see a link to another page. That next page has a link to a payment information worksheet in pdf form for the TP or business to fill out and present to the bank. Hope it isn't an identity theft issue. Sorry he is having troubles.5 points

-

It is my understanding that codes can be reset if you lose your phone. Here is a brief video from the solution center. https://support.cch.com/oss/sfs/video/U7mpfMUm17s4 points

-

I got it !!! He had tried all caps. He has a PO Box, but we haven't used it on his returns, so I told him not to use the PO box, to make sure it's blank. He said it's on his IRS account, so he kept trying with the PO box only and PO box w/street address, and street address only. It did finally work for him: all caps, no PO box, and I forget which browser. Yay! Thanks everyone. I learned alot.4 points

-

We have all benefited from your participation here, and will miss you. I do hope you will reconsider, perhaps after taking a break. After all, Walter Cronkite came back the next evening.3 points

-

I know, it sounded ridiculous to me too but was passing on what worked for one person.3 points

-

I think one of Block's problems is being a publicly traded company, where 8%+ annual growth is a constant requirement. When production from the golden goose (refund anticipation loans) dropped and online filing took off, they felt compelled to squeeze more money out of fewer clients. Certainly got away from the founders' idea of helping folks file their taxes for a reasonable price.3 points

-

I used chat support today and the first tier joined the chat in less than 2 minutes. They quickly realized that my issue with a 1065 was beyond them and handed me off to a higher tier person, and we created a case in short order. I was able to override my way around the issue, which was good because the tech said it would take several days to resolve a 1065 calculation error. The error is on the 1065 K1 Cap Acct Summary tab. What it's doing is adding twice the amount of cash contributions entered on Sch K of the 1065 to current income instead of subtracting it once.3 points

-

@Lion EA Is the client trying to use Direct Pay as a guest where it doesn't require log in? You said the client was able to log in to his IRS account and check his address. Did he try to make the payment while logged in there? Sorry if I'm missing something there. I have an EFTPS account for this so haven't personally gone through all of those steps on that page.2 points

-

Forgot all about her. She was EVERYWHERE for about 2 years when I got into the business. Got pitched to invest in opening a tax office for her firm.2 points

-

Does anyone remember Roni Deutsch? Never saw as many litigious charges against a firm in my life. Deservedly so, if you believe the fallout. All industries have ethical concerns that can fall by the wayside in the light of enhancing revenue or puffing their wares. Bankers do not necessarily have your best interest at heart - in spite of any outward image. Life insurance industry, ditto. Stock brokerage firms as well.2 points

-

If you do right and act right, there will always be those that will disparage you. I myself have had times when I was not the most popular kid on the block. Once I went nearly 12 months without posting at all because some were indignant with my questions. There is a benefit to continue - to help others and receive help yourself. I don't know who or what has made you feel unwanted, but unless it is a substantial human element, there is no need to stop.2 points

-

2 points

-

I used it on Tuesday with no problems, Has he cleared his browser history and cookies?2 points

-

A lot of what you say is over my head when it comes to software issues, but I have learned from you anyway. Please don't go.1 point

-

And if you have a large practice, there are firms that when you check the 3rd party authorization box, will do weekly sweeps for you and alert you to upcoming IRS action (they claim something like a 6 month heads up on an audit).1 point

-

I have several years worth on one 8821, like 2020-2025 (you can go out 3 years on future returns). I pushed getting the authorization for a couple of years in the off season to my clients and about 80% eventually responded. Those who didn't, I encouraged them to set up their IRS account so they could take a peek at what was going on. I don't charge for it, to me it is priceless to find out about a client's problem before the IRS goes into action. Most 1099's, W2's are on a transcript before then, but there are K1's and whatnot that take awhile to show up. Look too early and something might not be there yet, but wait too long and you're past the extension deadline.1 point

-

I am retracting my previous post(s) after giving it some more thought. In my example the deferred gain would be $80,000, recognized gain $10,000 and basis in the new property $10,000. So it appears that in order to have zero basis in the new property the taxpayer would to have zero basis in the old property as Judy mentioned.1 point

-

I've offered this service for the past few years, although I wait until late September, early October to make sure the IRS has all the documents. I've caught many items, as well as seeing their 5498's and matching up 1099-R's to make sure an RMD was taken. Most recently, a client told me in February he only had a $2,000 IRA distribution plus his Social Security so no return was filed. I checked his transcript for 2023--it was about 90 pages long (turns out he has two brokerage accounts that were actively traded). When I told him he needed to file he said "But you told me I didn't need to!" I might add I don't require them to sign an 8821 to be a client, although I know preparers who do.1 point

-

I'd like to see those hints as I've missed them all and am willing to bet you're overreacting.1 point

-

1 point

-

1 point

-

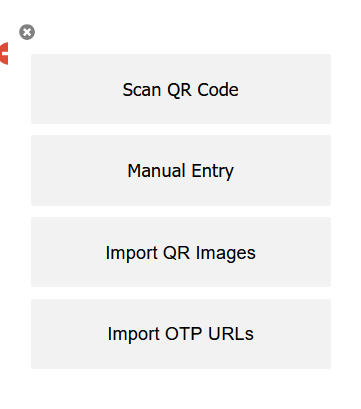

Here's the Firefox extension. https://addons.mozilla.org/en-US/firefox/addon/auth-helper/1 point

-

After I got the Authenticator.cc browser extension in Chrome pinned, I called ATX support to walk me through the process of connecting to ATX. Now it only takes three mouse clicks and I am in.1 point

-

Basis of property received is zero whenever FMV of property received is equal to or less then deferred gain. Or look at this way; basis in new equals basis in old less recognized gain. So in my example $10,000 less $10,000 = zero basis.1 point

-

Also, if there is deferred gain attributed to unrecaptured 1250, you should keep track of it for a potential 25% max capital gain rate if the property is sold.1 point

-

It is possible that the deferred gain was equal to the replacement property, and therefore zero basis. For example the fmv of property given up could have been $100,000 with a fully depreciated building (zero basis) and land with $10,000 basis = tentative gain of $90,000. If client received in exchange cash of $10,000 and property with FMV of $90,000, then deferred gain = $90,000 and basis in new = zero. The 8824 form year of sale will tell you what the basis should be. The zero basis should be listed in your asset detail and carried forward. I would put a description that indicates it was 1031 exchange property. Also I would scrutinize the 8824 to make sure the exchange was properly accounted for by prior tax preparer.1 point

-

Now, you lost me or I have just worked too many hours already today. I will be like Scarlett O"Hara and "think about it tomorrow"!1 point

-

The only time I have ever had an exception was in a case where the taxpayer moved more than 50 miles because of his job. We did considerable research that year so if you have a situation, be sure to read up on those exceptions. I agree that Taxman's client is not entitled to the exception.1 point

-

I had a thought on the land. Was this a condo where no amount was assigned to land? Other than that thought, concerning future sale and gain: as you know, the premise of the 1031 is that the basis of the new carries over from the old property given up so that any gain is deferred to the future, so -0- basis would be possible if every bit of the property given up has been depreciated, but there is still my question about the land. It is possible that the full amount of proceeds of a sale in future, net of exps of sale, would be the amount of gain from that future sale if the property truly has -0- basis. Then again, the TP will have additional basis for any capitalized costs incurred after the 1031 exchange occurred.1 point

-

That works really slick! Once you get it set up it only takes seconds to copy and paste, then you are good to go. No other devices needed. Thank you for the post!!!1 point

-

I cannot believe that you feel that way. Your assistance has been invaluable to me. Like others, I don't always agree, but I do bow to your knowledge and pass much of it on to my IT person. Please reconsider, if you have the time to spend with us.1 point

-

Ditto all the above! Don't always agree with you (but that's OK), and your use of abbreviations, (most times), leave me confused. But your insight, and especially your "view" from the other side of the table on employment issues, have been invaluable! This is 1 vote against you having "outlasted my welcome". Please reconsider.1 point

-

I don't know why you made your decision, but if you do come back, I will welcome you. I have enjoyed your company on this board. Tom Longview, TX1 point

-

You have a lot to offer from what I have read. I use your payroll program, have been for 30 years.. great program and you have great insight.1 point

-

Why not just play fair? Why build up a name and then drag it through the mud. Taxpayers need a place to go for honest help?1 point

-

1 point

-

That's the third time in the last 18 years that HRB has been fined by the FTC. They were also sued by the state of California, for which they had to pay $1.6 million.1 point

-

The purchaser has obligated him- or herself by paying the vendor with borrowed funds, so the deduction is when the charge occurs, not when the payment is made to the credit card company. Here are some references: Rev. Rul. 78-38 states that you may deduct a donation to a qualified charity via a charge to your bank credit card in the year the charge is made, regardless of when the bank is repaid Rev. Rul. 78-39 states the same rule for medical expenses. IRS Pub. 583, Starting a Business and Keeping Records (Rev. January 2007), p. 13, eludes to treatment of business expenses charged to a credit card using the transaction date for recording the deduction.1 point

-

I had a family friend/client for years that I believed to be single. We were close. My kids called him uncle Ronny. Only upon his death did I find out that he was married.1 point

-

To see if your S-corp election was approved. Clients never know. Paper gets lost. Why can't we just have a quick look up?1 point

-

Seems like I have outlasted my welcome. Not my sandbox, I get the hints. I appreciate all of the banter over the years, best wishes to all going forward. Those that have interacted with me in the past know how to reach me, if anyone wants to discuss payroll or accounting. I don't do any returns other than my own now, but I deal with many in other ways.0 points

-

Yes, i have all my codes still. I will try this. I called support ( what a joke) and was to receive a call back from tech support..... 48 hours and counting on that .0 points

-

Support has sucked the 24 years I've used this program. 20 years ago the tier 2 support was good once you were able to get transferred to them after 3 hours on hold or they called you back after 4 days, but the fact that you had to deal with tier 1 for an hour or two knowing full well they wouldn't be able to solve the problem was atrocious.0 points

-

0 points