Leaderboard

Popular Content

Showing content with the highest reputation on 01/24/2025 in all areas

-

Less than 30 % of the total filings expected by FinCen have filed. You really think the other 20 Million people that haven't file are trying to hide their ownership? I haven't filed yet for the same reason I don't have an ID.me account.4 points

-

I haven't filed because I didn't get around to it, and then when they said I didn't have to I thought maybe I would never have to and that would just be one less thing to do. Not that I care about reporting the information, I just get tired of filling out ridiculous government forms.3 points

-

Most of my clients have already filed. I filed mine a long time ago and don't remember giving any information that isn't readily available from other public sources. The only people I see this affecting are the ones trying to hide ownership through a series of holding and/or shell companies.3 points

-

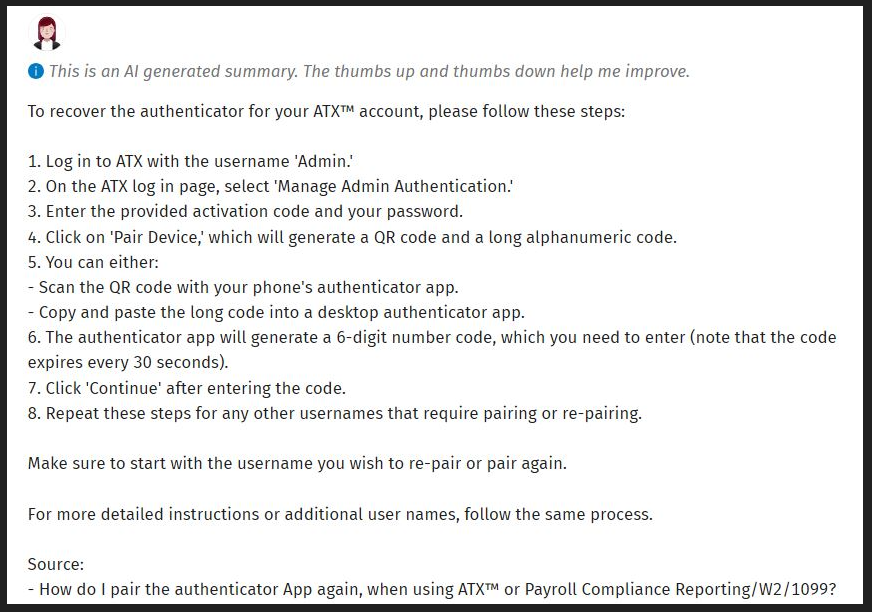

After losing a few more hairs, I’m sharing this because I KNOW this will be helpful to at least those with first-time authenticator experience. IMO, this desktop authenticator could as well be your only authenticator. #5 should read: “You can BOTH:” Because I did not save the long string of characters the first time, I needed to start anew. After selecting ‘Manage Admin Authentication’, I entered the ATX registration code and my existing password, clicked ‘pair device’, and, of necessity, created a new Authenticator account on my phone app (I used Microsoft Authenticator) this time also copying the long alphanumeric value...(I received an ATX shutdown error message which I simply closed and ignored) then pasted that value into Notepad (one could use Word). THEN… I found a simple desktop authenticator called Authme. Authme is a simple, cross-platform two-factor (2FA) authenticator app for desktop. It allows you to manage your 2FA codes directly from your computer, making it convenient to access and use them without needing your phone. I entered: https://authme.levminer.com into my desktop browser search bar and downloaded. It even placed a shortcut on the desktop! Once open, I clicked on the import icon, then the ‘Setup a key’ button. Required 2 entries: Name (ATX 2024 or such), and the long alphanumeric value which I saved. (I entered an email address in the third field not aware it was optional) Clicked ‘Confirm”. Done!!!! Beer time.2 points

-

More convenient and maybe OK for a desktop, but isn't it somewhat less secure to have it on the same machine if that machine is compromised. I also see this setup as less secure on a laptop that travels with the preparer. If the laptop is lost or stolen, the MFA is there on the same machine as the tax software, or whatever program or internet site the MFA is protecting.2 points

-

2 points

-

https://www.forbes.com/sites/jayadkisson/2025/01/23/us-supreme-court-allows-beneficial-ownership-interest-reporting-to-go-forward/1 point

-

True. I agree. One thing I'd wish for is if we could get rid of the program timing out and requiring us to log in again.1 point

-

No because you can't have two different authenticator setups. The last one you do will be the only one that works. But I do agree that a desktop authenticator is superior to a phone based one because you can copy/paste the 6 digit code into ATX.1 point

-

Nope! I, for one, am not going there. In a big enough state of confusion without all that.1 point

-

Copied from the FinCen website: " As a separate nationwide order issued by a different federal judge in Texas (Smith v. U.S. Department of the Treasury) still remains in place, reporting companies are not currently required to file beneficial ownership information with FinCEN despite the Supreme Court’s action in Texas Top Cop Shop. Reporting companies also are not subject to liability if they fail to file this information while the Smith order remains in force. However, reporting companies may continue to voluntarily submit beneficial ownership information reports." As a result BOI Reporting is still paused. Makes me think of a Three Stooges skit1 point

-

I think IRS goes by zip code and would be the reason you received that insert with the notice. I am curious though, did you indicate the disaster area and reason for the late filing and then IRS ignored that? If using Drake, that would be entered on the MISC screen.1 point

-

Here are 2 articles worth reading: https://www.thetaxadviser.com/issues/2022/oct/10-good-reasons-why-llcs-should-not-elect-s-corporations.html https://www.hinckleyallen.com/publications/converting-an-llc-to-an-s-corporation-a-mistake-waiting-to-happen/1 point

-

1 point

-

If I ever really give up on QB (which I may, as I keep threatening to), I'll definitely go to Medlin's accounting program.1 point

-

A lot of what you say is over my head when it comes to software issues, but I have learned from you anyway. Please don't go.1 point

-

We have all benefited from your participation here, and will miss you. I do hope you will reconsider, perhaps after taking a break. After all, Walter Cronkite came back the next evening.1 point

-

I cannot believe that you feel that way. Your assistance has been invaluable to me. Like others, I don't always agree, but I do bow to your knowledge and pass much of it on to my IT person. Please reconsider, if you have the time to spend with us.1 point

-

Ditto all the above! Don't always agree with you (but that's OK), and your use of abbreviations, (most times), leave me confused. But your insight, and especially your "view" from the other side of the table on employment issues, have been invaluable! This is 1 vote against you having "outlasted my welcome". Please reconsider.1 point

-

I don't know why you made your decision, but if you do come back, I will welcome you. I have enjoyed your company on this board. Tom Longview, TX1 point

-

You have a lot to offer from what I have read. I use your payroll program, have been for 30 years.. great program and you have great insight.1 point

-

0 points

-

Seems like I have outlasted my welcome. Not my sandbox, I get the hints. I appreciate all of the banter over the years, best wishes to all going forward. Those that have interacted with me in the past know how to reach me, if anyone wants to discuss payroll or accounting. I don't do any returns other than my own now, but I deal with many in other ways.0 points