Leaderboard

Popular Content

Showing content with the highest reputation on 03/25/2025 in all areas

-

That would be maid service or daily cleaning of rooms/bathroom like provided by a motel/hotel. Providing for utilities doesn't count, and cleaning/changing linens between tenants doesn't count because it is only freshened for each tenant's arrival but not daily during the stay. It goes on Sch E as Abby & Dan already explained.4 points

-

Good input--I have a thick file in my tax library on this topic. Rentals are commonly handled incorrectly; combining the complexity with the explosion of AirBnB plus little IRS pushback--good formula for confusion.3 points

-

Correct. Reg. Section 1.1402(a)-4(c) As an activity with an average rental of sevens days or less, it does not qualify for the $25,000 passive loss allowance per Reg. Section 1.469-1T(e)(3)(ii)(A). In order to deduct the loss, the taxpayer must meet the material participation requirements of Reg. Section 1.469-5T(a).3 points

-

But they're not doing daily cleanings or providing other services like a hotel. I would go with sch E.3 points

-

You can be considered actively participating even if you use a management company, as long as you are involved in the operation of your rental and exercise independent judgment rather than simply ratifying decisions made by the manager, which doesn't appear to applicable in this case.2 points

-

If the taxpayer has access to their marketplace account online, they should be able to print the 1095A for 2019. I think that it goes back forever.2 points

-

I thought to be able to deduct the loss you only had to meet the active participation rules, not the material participation. If the average use is 7 days or less according to Section 1.469-1T(e)(3)(ii)(A), then it appears that it is not a rental activity. So would that not make it a sch. C activity, with no material participation on the part of the owner? But with all investment at risk? I am just asking - this is an interesting discussion. And I am also curious as to how the average is calculated. If 9 out of 10 tenants use if for 7 days or less, but the 10th tenant uses it for 6 months, is the average 7 days or less based on 90% of tenants use, or is it 24.5 days based on 9 x 7 plus 182 days, which equals 245 then divide by the 10 tenants.2 points

-

Because the law does not allow it. Seems obvious mom did not meet material participation rules.2 points

-

Schedule E and selected Vacation/Short Term Rental which seems to exactly describe the unit. No personal use, though. After wife passes, I don't know where it goes from her trust but am certain I will no longer be involved. It may be split between surviving daughters who are in tax brackets I could only dream about and they have 'their people.' The ailing, aging wife has had a special affinity for me for 25 years since I managed the business book for her software company. She is very special to me. I will miss her greatly.2 points

-

2 points

-

The $25,000 loss allowed for active participation does not apply where the average rental period is seven days or less, per the reg.2 points

-

The real question here is whether the source of the donated stock can be traced to taxable income and allowed as a deduction; or whether it came from corpus and not allowed as a deduction.2 points

-

The trust may have been closed on paper but not for tax purposes if it is still collecting income in its EIN. If the trust is closed and the money is going to the beneficiaries directly in their SS numbers, no trust return required. "$398K early distribution from IRA with NO tax withheld. They bought Bitcoin with the proceeds. You can't fix stupid." To use an interrobang, they did WHAT?! Or to borrow from Scarlett O'Hara, God's nightgown! Hope they are ready to sell a lot of that bitcoin to cover the immense tax bill. Reminds me of the client who took a lump sum for his wife's generous government pension that could have sustained them for life because he could do so much better investing it. (Said he, who already had $400k in long-term cap losses, being written off at $3k per year, evidence of his investing prowess.)2 points

-

Latest on the rules. Link, then text. https://tinyurl.com/xdstkvmz FinCEN Removes Beneficial Ownership Reporting Requirements for U.S. Companies and U.S. Persons, Sets New Deadlines for Foreign Companies Immediate Release March 21, 2025 WASHINGTON––Consistent with the U.S. Department of the Treasury’s March 2, 2025 announcement, the Financial Crimes Enforcement Network (FinCEN) is issuing an interim final rule that removes the requirement for U.S. companies and U.S. persons to report beneficial ownership information (BOI) to FinCEN under the Corporate Transparency Act. In that interim final rule, FinCEN revises the definition of “reporting company” in its implementing regulations to mean only those entities that are formed under the law of a foreign country and that have registered to do business in any U.S. State or Tribal jurisdiction by the filing of a document with a secretary of state or similar office (formerly known as “foreign reporting companies”). FinCEN also exempts entities previously known as “domestic reporting companies” from BOI reporting requirements. Thus, through this interim final rule, all entities created in the United States — including those previously known as “domestic reporting companies” — and their beneficial owners will be exempt from the requirement to report BOI to FinCEN. Foreign entities that meet the new definition of a “reporting company” and do not qualify for an exemption from the reporting requirements must report their BOI to FinCEN under new deadlines, detailed below. These foreign entities, however, will not be required to report any U.S. persons as beneficial owners, and U.S. persons will not be required to report BOI with respect to any such entity for which they are a beneficial owner. Upon the publication of the interim final rule, the following deadlines apply for foreign entities that are reporting companies: Reporting companies registered to do business in the United States before the date of publication of the IFR must file BOI reports no later than 30 days from that date. Reporting companies registered to do business in the United States on or after the date of publication of the IFR have 30 calendar days to file an initial BOI report after receiving notice that their registration is effective. FinCEN is accepting comments on this interim final rule and intends to finalize the rule this year. ###1 point

-

You do not report on C because your client is not providing services per the regs. You report on Schedule E as a rental activity even though is is not a passive rental activity per the regs. In other words, in this case it is reported as a rental on Schedule E; but for purposes of the passive activity rules it is not considered a rental per the regs. Therefore you do not apply the passive activity rules and the $25,000 allowable loss. The loss is not allowed unless the material participation rules are met per Reg. Section 1.469-5T(a).1 point

-

It is not a rental activity for the passive activity rules per Reg. Section 1.469-1T(e)(3)(ii)(A). You would only report it on Schedule C if services are provided and and subject to SE tax per Reg. Section 1.1402(a)-4(c)1 point

-

1 point

-

This is a good discussion and the client does not materially participate nor is an active participant, all is handled by a management company. I'm not worried about the losses, just wondering if they will offset future income. It doesn't sit right with me on Sch. C as I don't believe there is really a profit motive in the usual sense and it was used for strictly personal vacation time until the clients became too frail to travel. As it is in the trust and the surviving wife will not last more than a few months at most, and the Sch. E option seemed appropriate, I'm going with Sch. E and let the chips and losses fall where they may for 2025 when it becomes a trust asset.1 point

-

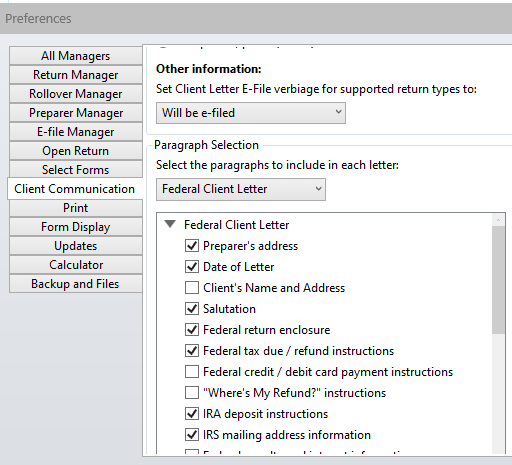

Yes, you can edit, add, subtract lots of things. Click on the client letter, Edit Formatting. Select the letter to edit and scroll to the place you would like that option to be included. The Save and you have the choice for only that client or all subsequent. I use this tool with some frequency, mostly to tailor for a specific client.1 point

-

No, not 49 days, 49 weeks with 38 different renters. It was a available for 49 weeks from Jan. 20 through year end and apparently was used the whole time through the end of the year. Most folks were for 1 week but several were for more than one week. The huge loss is because of depreciation of a unit valued at $880,500 ($30,685), high commissions ($11,066), and high real estate taxes ($14,421) as well as HOA fees of $7200 and a special assessment for insurance of $5148. This is Amelia Island FL. The total rent received was $50,500. I couldn't afford to stay there!1 point

-

Thanks to you both. I think the average rental would be 7 days or less as I counted 38 different rental payments for 49 weeks so math would support that average. When I selected Vacation/Short Term Rental I suppose the assumption is the average of 7 days or less. I did read up on this but just using belt and suspenders as I am fairly certain there will be push back on why no deduction. Is it correct, though, to assume that eventual net income will be offset by these carryover losses at least? Thanks again, as always, for the great support and insights here.1 point

-

This is why I never got involved. I sent an email to my clients in early December telling about it and giving them the FinCen website. They're on their own.1 point

-

When they had a $500/day penalty with no limit, I backed off, just as the malpractice insurance companies were telling us to do. I referred my clientele to corporate attorneys, and bailed out. I never looked back, and will not.1 point

-

1 point

-

Agree with that. If the amounts received match the amounts on the 1099 they need to report those amounts regardless.1 point

-

A trust can be simple one year and complex another, depending on what it did with its income that year. A simple trust has to pass through all income to the beneficiaries so it will have none of its own income to offset with a charitable donation. If the trust document allows and it made a charitable contribution out of its income, it will be a complex trust that year.1 point

-

It is not required for tax purposes. It is obvious taxpayer has not elected to use it and probably not practical for this business. That is only your opinion only, after the fact.1 point

-

So when the interim final rule is finalized, will it finally be the final rule? Or the interim/interim final rule? Or just "the rule"? Or something else?1 point

-

Whoa right there! Simple trust cannot have charitable distribution deduction.1 point

-

I don't see where it would make any difference.1 point

-

A trust does not pass through charitable contributions. The donations must be authorized by the trust instrument. The donation must be made from the trust’s gross taxable income, or traceable to gross taxable income. Therefore, if the stock was purchased with trust income it is deductible by the trust. If the stock was contributed to the trust, it is not deductible since it came out of corpus.1 point

-

When the amounts are this small, I tell the client to run any IRS letter by me first, to make sure it's correct. Then I can confirm for them to pay the additional tax requested. Way easier than amending, and the letters only come through about half the time. According to Eric Green (TaxRepNetwork; he has lots of contacts in the agency) they are concentrating enforcement in areas where they get a bigger bang for their effort-buck. The folks who owe $600, not $6. The non-filers with W2s in the 100's of thousands, not 24k.1 point

-

First, I'll say I'm over this tax season and I'm hoping it's my last. I have clients whose parents died in 2020. Part of what they left was an IRA a little over $200K which their financial advisor put into a "Beneficiary Designated IRA" in the name of the Trust. He told me today that was to mitigate tax impact to the beneficiaries - my clients. They need to take it within 10 years which has started. There are two 1099Rs for 2024, one for each child/beneficiary. The recipient on the form is the Trust. But the Trust was closed in 2022. The financial advisor and I disagree on this. He told me to just put it on their individual returns. I think IRS will be looking for a Trust return even though it was final in 2022. What say you? Then, just for fun, I'll tell you someone dropped off their documents today. $398K early distribution from IRA with NO tax withheld. They bought Bitcoin with the proceeds. You can't fix stupid.0 points