Leaderboard

Popular Content

Showing content with the highest reputation on 05/31/2016 in all areas

-

4 points

-

Catherine, you mention leaving behind a library -- that's another topic for discussion! The younger generation seems to have as much use for a printed book as they do for a butter churn. I plan to go through the books in my den and put some kind of sticker on the ones that they should be careful with after my journal has been posted to the great general ledger in the sky. I have some pretty rare and out-of-print books relating to history and collecting and these do not need to be discarded. I do plan to have my old "Package X" volumes buried with me, kind of like a Pharaoh.....4 points

-

4 points

-

Well, more new information. I didn't know about the Snipping Tool. Now I've already used it a couple of times. Anybody have suggestions for any more neat features?3 points

-

I think I'd prepare an amended return if you can get a copy of her original 2011 and the letter showing how IRS adjusted her 2011 return. The deadline to claim a refund has passed, but you're not doing that. I don't think there is a deadline to correct an incorrect return. I would correct the IRS adjustment. I would do whatever I would have done if I had dealt with the situation on the original return. Meaning, complete the Schedule / Form IRS wants to see (is it Sch C?), enter the income amount reported on the 1099 (is it 1099-Misc, box 7?). Then, subtract the amount with an explanation. Obviously get a POA in the meantime. Sometimes it's all about the paperwork. Give them some paperwork. I realize answering the notice would have been the thing to do, but I'd just do the amended return at this point.2 points

-

I have a Kindle Paperwhite and a Kindle Fire HD6. I use the fire when I'm away from the office to check my e-mail, and some internet browsing. Also, have a music app and use the fire with a bluetooth speaker when we're on vacation etc. The Paperwhite is exclusively for reading, if you have the Amazon kindle unlimited account, you can 'borrow' up to 10 books at a time. I love reading, slow times of the year I might read 3 or 4 books a week.2 points

-

Or for those who don't want to click, IRS Warns of Latest Scam Variation Involving Bogus “Federal Student Tax” IR-2016-81, May 27, 2016 Español WASHINGTON — The Internal Revenue Service today issued a warning to taxpayers about bogus phone calls from IRS impersonators demanding payment for a non-existent tax, the “Federal Student Tax.” Even though the tax deadline has come and gone, scammers continue to use varied strategies to trick people, in this case students. In this newest twist, they try to convince people to wire money immediately to the scammer. If the victim does not fall quickly enough for this fake “federal student tax”, the scammer threatens to report the student to the police. “These scams and schemes continue to evolve nationwide, and now they’re trying to trick students,” said IRS Commissioner John Koskinen. “Taxpayers should remain vigilant and not fall prey to these aggressive calls demanding immediate payment of a tax supposedly owed.” Scam artists frequently masquerade as being from the IRS, a tax company and sometimes even a state revenue department. Many scammers use threats to intimidate and bully people into paying a tax bill. They may even threaten to arrest, deport or revoke the driver’s license of their victim if they don’t get the money. Some examples of the varied tactics seen this year are: Demanding immediate tax payment for taxes owed on an iTunes gift card. Soliciting W-2 information from payroll and human resources professionals (IR-2016-34) “Verifying” tax return information over the phone (IR-2016-40) Pretending to be from the tax preparation industry (IR-2016-28) The IRS urges taxpayers to stay vigilant against these calls and to know the telltale signs of a scam demanding payment. The IRS Will Never: Call to demand immediate payment over the phone, nor will the agency call about taxes owed without first having mailed you a bill. Threaten to immediately bring in local police or other law-enforcement groups to have you arrested for not paying. Demand that you pay taxes without giving you the opportunity to question or appeal the amount they say you owe. Require you to use a specific payment method for your taxes, such as a prepaid debit card. Ask for credit or debit card numbers over the phone. If you get a phone call from someone claiming to be from the IRS and asking for money and you don’t owe taxes, here’s what you should do: Do not give out any information. Hang up immediately. Contact TIGTA to report the call. Use their IRS Impersonation Scam Reporting web page or call 800-366-4484. Report it to the Federal Trade Commission by visiting FTC.gov and clicking on “File a Consumer Complaint.” Please add “IRS Telephone Scam” in the notes. If you think you might owe taxes, call the IRS directly at 1-800-829-1040.2 points

-

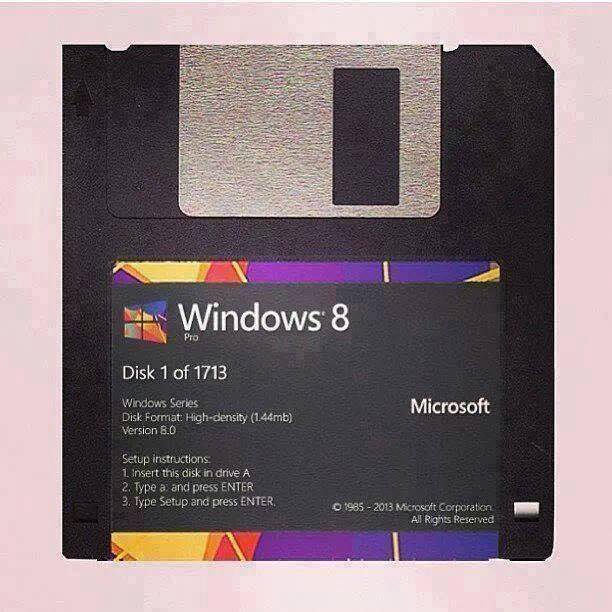

That's a lot of hours popping out and inserting next disk. I think I'd go buy a DVD drive.2 points

-

I love my (now ancient) Kindle Keyboard; wireless only. You can't beat the e-ink for reading even in bright light. It is *just* an e-reader; in theory it has a rudimentary browser in it but it is abysmally slow trying to do anything online. It does download books quickly. As it ages I have found the wireless gets flaky at times and forgets the password to our wireless network which I find annoying. I also wish there was an easier way (say, via the desktop application) to put books into collections. However, for reading I love it. You can still get them, and you can get the Kindle Unlimited which is like an online subscription library: read a book, return it, get another -- and unlimited means what it says. Then you have the option to purchase any book you want to keep, also to loan books you have purchased to others. They also have a discount program to buy paper copies of books you have on Kindle, should you wish. You can share Kindle books with all your electronic devices (computers, tablets, phones) should you wish. But Amazon retains ownership; once you are gone there is no library left behind for your family. That I don't like.2 points

-

JMO but if you aren't going to use it for the internet, get an e-ink version like the Paperwhite. Battery life lasts a really long time and the screen is far easier to read. Size of storage isn't important as a book is generally pretty tiny at around 1 MB. My wife purchased a Nook and while she'll say she reads with it all the time she hasn't touched it in 6 months. She gets books from the library and reads about 1 per week.2 points

-

I just ran the utility on my third computer and all went well. My IT guy and I thank you again.2 points

-

Also see this IRS page on the WOTC and additional requirements on the employer to verify that the employee is in one of the targeted groups: https://www.irs.gov/businesses/small-businesses-self-employed/work-opportunity-tax-credit-1 Because this was retroactively extended, there's transitional relief with extended dates for Form 8850 described in Notice 2016-22. Links to those are also on that IRS page. The deadlines differ by target group, but all are coming up in a couple of days or about a month depending on which group it is. Form 8850 is used by the employer to request certification from the state agency for each employee that certifies that the employee is a member of the targeted group.2 points

-

If Books and Pro are arguing over a sale price, the only thing that is important is the current fair market value. That would have nothing to do with old records. The succeeding accounting must any pertinent and timely information, not you. Your information is so old that it cannot still have any relevance. I would be very tempted to ignore everything about this unless served with a subpoena. If that were to happen, then I'd contact E&O. Please don't lose any sleep over this. The attorney fees start piling up and then 99.999% of the time they agree on some sort of settlement.2 points

-

This time the "Federal Student Tax" - see all the details on the IRS website: "Student Tax" scam1 point

-

Ah, even these, in this day and age. My mother in law had some rare (like, pristine first edition) books including Audubon bird books. None of the rare book dealers wanted them. We gave a lot of them to a library (and even they didn't really want them and had to be persuaded). The Gutenberg Project and Google Books has killed the rare book market. If you really want them to have good homes and you are done with them personally - sell 'em on AbeBooks before your AJE.1 point

-

My general procedure is to drown them in paperwork and assume I am explaining the situation to a 8th-grader who doesn't give a flip (make it simple, make it easy to agree with your position, give them all the backup they need if their supervisor asks questions). As a result, I have a high percentage of requests granted.1 point

-

1 point

-

Sticky Notes should run at start-up automatically. Snipping tool is on my Quick Launch toolbar. Microsoft likes to tell Quick Launch is no longer available, but it's there and I have 27 programs on it. And you can drag it so it fits under the pinned icons on your task bar. You may have to make your taskbar a little taller (or wider if you have it on the side like I do.).1 point

-

OH hilariously! Look at the comments, one actually seems to buy into the 'sovereign citizen' bunk.1 point

-

1 point

-

Probably will blow over, as BHoffman wisely stated, but never hurts to talk to your E&O anyway, just to get their take on what, if anything, you should say and/or do, as to contacts with the former clients. And as to your responsibility related to record retention.1 point

-

Too late for me. Happen on Friday, May 27th AM to my computer. And guess what, ATX support was closed on Friday, so I am waiting until Tuesday for the fix to the ATX software. Who knows how long the line is going to be for support.1 point

-

1 point

-

Today is Friday May 27. This morning when I came into work, I turned on my computer and began a normal day. But then as I visited this forum it occurred to me this could have been a very stressful & aggravating Friday. As I noted in my reply to your post on Monday of this week, since I had clicked the "x" on the Win10 installation window, the sneaky Win10 install had been scheduled for Thursday night without my knowledge. I only discovered this after running the utility you graciously provided the link for. Since I switch my computer off in the evening, I suspect that when I turned the computer on this morning the Win10 install would have been sitting there waiting to pounce. By the time I made coffee and started trying to work, I would have been bogged down in a frustrating cycle of "what's going on and why?" So again I just want to say "thanks" for the heads up you gave on Monday. Many thanks.1 point

-

Form 3800 employment credits. Specifically, work opportunity credits. Form 5884 that then flows to Form 3800. WOTC Chart Form 5884 at IRS site1 point

-

cPaperless's "Signature Flow" is excellent. Encrypts, confirms identity, e-signatures, then automatically returns to you all validated. Fee is only per-signature so it's worth signing up for even for 2-3 clients (unlike some services that charge a hefty monthly fee plus a per-signature fee). I have out-of-state clients, travelling clients, or folks who don't have convenient access to scanners or faxes so while they can *get* a file share document with no trouble, they can't send it back to me easily. I'd rather pay to have their sign's than have them go to a self-service fax place where the chip SAVES their confidential information (name & ssn) for heaven only knows how long and with heaven only knows who gets access.1 point