-

Posts

4,184 -

Joined

-

Last visited

-

Days Won

63

Everything posted by Margaret CPA in OH

-

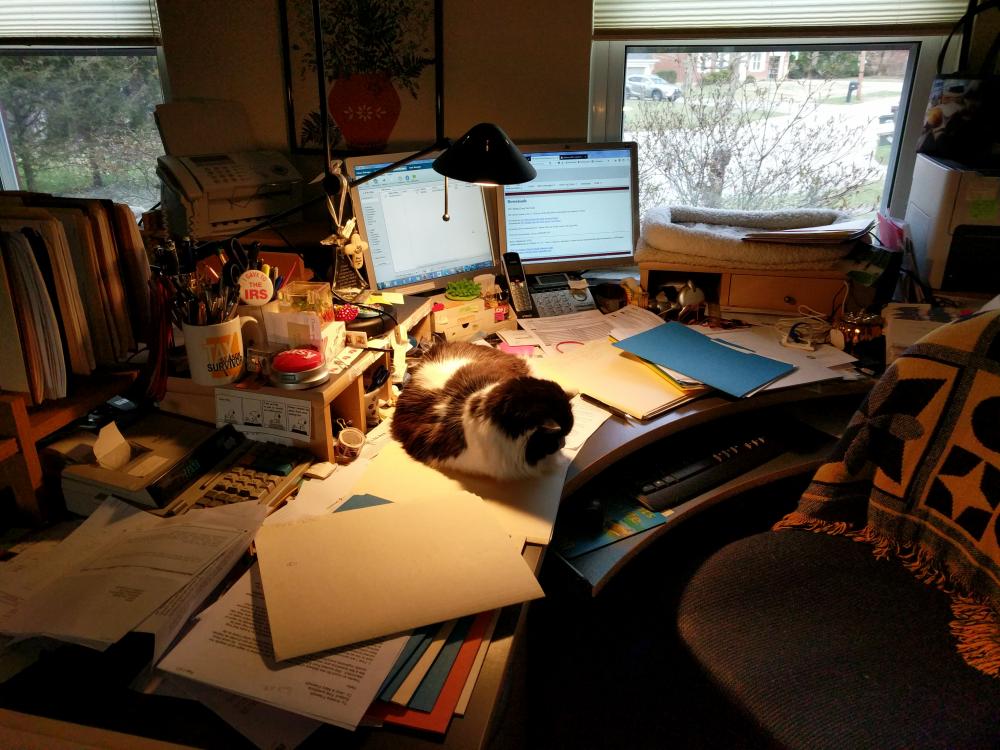

My very messy desk along with the primary cat (as in my avatar photo), calculator on the left (I trained myself to use the left hand so I wouldn't have to put down my pencil), little rolodex on the righ (shhh, all my logins and passwords).

-

Not to mention overloaded brains long 'bout now... It's a village here and we look out for each other, no worries!

-

RE taxes on jointly owned property

Margaret CPA in OH replied to Margaret CPA in OH's topic in General Chat

EITC has no place at all in this scenario. Both are retired and financially stable. I was just asking about proper assignment of real estate taxes paid. Thanks for all this input but I think we've come to a resolution, easier than I thought. Back to the really hard issues now - they always appear later in the season when we are crunched for time and brain power, right? -

RE taxes on jointly owned property

Margaret CPA in OH replied to Margaret CPA in OH's topic in General Chat

I just knew I should have written county auditor. Haste makes waste and a bit of humor here. -

Cursed blue triangle popups

Margaret CPA in OH replied to Margaret CPA in OH's topic in General Chat

I just discovered that I unchecked "Show popup tooltips..." NOT "Display Tax Research..." I happened to be on the phone with tech support about RITA 37 and a malfunction still and asked about the blue triangles. She directed me to the right place. Happy camper here -

Cursed blue triangle popups

Margaret CPA in OH replied to Margaret CPA in OH's topic in General Chat

Yes, I did. And I can't go back and redo because it is grayed out. I could only 'reinstate' what I thought I deleted to redelete. But that didn't work either. I've been using this program since 1997 so am sort of familiar with how things work although don't know everything - and there is always some new thing. Like now on Sch. A for Tax preparation fee, you can't just put in the number. There is a whole new link to billing. Yes, I can put in the number at the top but it is one more click I don't need. Rant over.... -

RE taxes on jointly owned property

Margaret CPA in OH replied to Margaret CPA in OH's topic in General Chat

Pacun, there is no 1098, no mortgage. I was asking about the real estate taxes paid directly to the auditor from a joint checking account. I split it. -

I'm not entirely sure about this situation. Unmarried couple have jointly owned condo and joint checking account. They file single but the one with little income wants the one with beau coup income to take entire re tax deduction. Fair? Proper? Legal? I can be persuaded either way (might have been a good debater, able to take either side ).

-

I deselected in Preferences Show popup tooltips in all managers and dialogs. I foolishly imagined that it might remain in those returns already rolled over but stop (please, God) in future rollovers. No such luck. I've checked and triple checked to be sure that it is deselected and STILL they appear. Suggestions - before I lose my remaining mind? Thanks!

-

Could it be the school address that is missing? I know there is a worksheet for lots of school related information such as EIN and address, I believe. Been a while for me, though.

-

Exemption from SS and MC is not required but is an option for ministers. They must meet 6 requirements and file timely Form 4361. It is quite possible this minister either does not qualify and/or failed to timely file the exemption certificate which certifies "I am conscientiously opposed to, or becausse of my religious principles I am opposed to, the acceptance ...of any public insurance..."

-

JB, me, too. And I wonder about future years. How long will we be required to change the password every 90 days? With the 3 year sol, we sometimes go back to prior years to amend or even prepare original returns. Frankly, I have my passwords on my desktop so I don't forget. It's just me here, home office, all alone...

-

I'm good for sporadic periods May-December. Have to figure in reunions, dive trip, senior olympics, etc. TN is driving distance for me; MA, not so much but I will be there sometime this year to visit best friend's new granddaughter (I'll visit my friend, too, I guess).

-

Thanks for all the sympathy with or without tea. My concern is that one filed AFTER 3 others was ack'ed within 2 days. I've had many years of efiling 1099's so am accustomed to waiting and waiting and waiting but not when acceptances were so out of order. I, too, have read the IRS info about the FIRE system as I receive virtually all the IRS notifications. As I wrote " Not really expecting answers, just want some understanding (sniff, sniff)." I have patience but not so much understanding...

-

I've already had the unsatisfactory email exchange with support and have looked multiple times at the efile status on the website but 3 of my 1099's efiled from Jan. 29 are still in transmitted status while one on Jan 30 was accepted Feb. 2 and one on Jan. 13 was accepted on Jan. 23. The message is IRS is slow and don't retransmit but why the disparity in these? Not really expecting answers, just want some understanding (sniff, sniff).

-

Anyone put the new Tax Planner through its paces yet?

Margaret CPA in OH replied to Abby Normal's topic in General Chat

I have it with the new program update in MAX and have tried it on a couple of simple returns. Are you sure you added the form to the return? It automatically updated for me. -

I could bring Cincinnati Chili! It's different.

-

One summary I have seen shows for aged or blind above the standard deduction for 2018 is $1300 and $1600 with a note that IRS Rev Proc 2017-58 (only for aged and blind as the tax act didn't change these amounts from 2017 either).

-

In the past, I have edited the Master Forms and selected a different font. Guess I got lazy because I just have the name printed now so am not sure that font change is still possible.

-

Corporation bought a jeep for the owners daughter...

Margaret CPA in OH replied to schirallicpa's topic in General Chat

"Most" of the issues may be resolved, true, but were any expenses (only insurance was mentioned) charged to the corp? What about the licensing and plates renewals? Maintenance such as gas? What is meant by the daughter using it 'in business?' Whose business? And there is still the gift return issue, I should think. I've had ugly situations before but this one is particularly, um, interesting! -

SSN masking on 1099-MISC

Margaret CPA in OH replied to Lynn EA USTCP in Louisiana's topic in General Chat

From ATX KB: How do I display the full Social Security Number on Form 109x in ATX™/TaxWise® W2/1099-Payroll Compliance? Do the following: Click the Payers Info tab. Unselect Check (X) to truncate EIN/SSN on Recipient copies check box.- 1 reply

-

- 2

-

-

-

I use Adobe Pro and encrypt at 256-bit level with a password with some parts known only between the recipient and me. This has worked for about 4-5 years now. I send an email ahead stating "(d)to advanced encryption required by IRS, you must now have Adobe Reader 10 or above. If you need to download a free version of Adobe Reader 10, 11 or DC go here <https://get.adobe.com/reader/> There are other pdf readers but you must have one compatible with 256-bit encryption. The files are password protected and the password is XXXXXX" My reading of IRS requirements tells me this meets the standard.

-

I have had a firefighter as a client for nearly 20 years who trusts me implicitly (after bailing her out of deep doo doo with a business misadventure). I had to prove to her with documentation about the disallowed deductions she had been taking and 'all the other guys take them' stories. I just told her, I wouldn't take them no matter what the others did or didn't do. She reluctantly agreed and no longer even tries that now.

-

Greed, on the parts of the preparers and taxpayers, is a powerful motivator. Sadly, our society has devolved and continues to do so into a strong consumerist and 'me' centric environment. It's sad to see the growth of me vs. us. There are times when I question clients about non-charitable deductions. When they have to put the value on that bag of clothes, I ask them to consider whether the intent of the contribution was charity or simply a tax deduction. Would the donation have been made without the tax benefit? It will be interesting to see how contributions compare with the new tax law.

-

Thanks, FDNY; I needed that as probably will anyone else who reads it. Great way to begin the year, with a smile on my face and a laugh out loud!