-

Posts

5,225 -

Joined

-

Last visited

-

Days Won

329

Everything posted by Abby Normal

-

We never gave out our actual efax number, we just had our fax line forward to the efax number, if we didn't answer.

-

You can get a fax modem and send faxes for free with windows built-in MSFax. You can also use it to receive faxes, but we always used a fax service for incoming so everyone could easily see all the faxes that came in. If you're a small shop with a dedicated fax line, you can set MSFax to answer automatically.

-

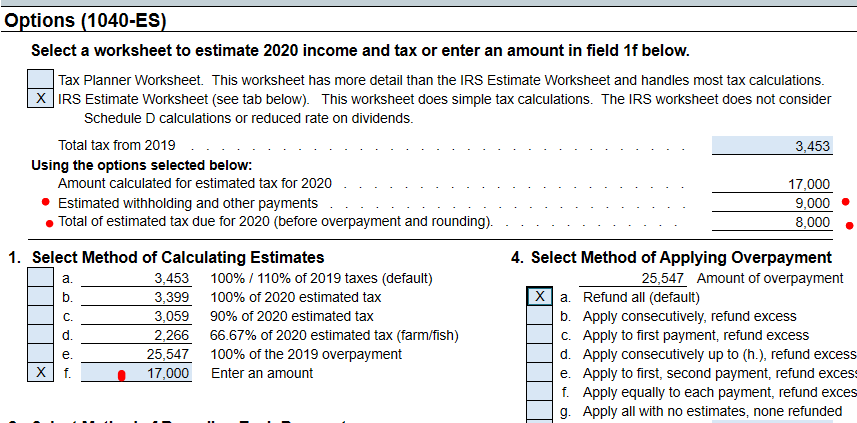

There are at least 3 ways to make this happen. I went with down and dirty, but yes, using the planner is the most elegant way. The 3rd way is to use the estimate worksheet.

-

You have to enter an amount on line 1f that is larger the the Estimated withholding and other payments at the top, by the amount you want the total estimates to be.

-

Print attachment to a PDF. Go to efile menu and choose attach file.

-

Idle Property Continue to claim a deduction for depreciation on property used in your rental activity even if it is temporarily idle (not in use). For example, if you must make repairs after a tenant moves out, you still depreciate the rental property during the time it isn’t available for rent. Of course, the follow up question is, how long is temporary. And I doubt the code spells it out, and makes it a 'facts & circumstances' situation (i.e., gray area). (You'll have to scroll up a bit, when you click that line. Those IRS links always seem to be off by a bit.)

-

You don't have to take rentals off of depreciation for extended repairs. They are still 'in service' as a rental.

-

When your printers were installed, was any software installed with them? If so, uninstall it. The instructions for printers always tell you to not connect the printer until you've installed the crappy software that comes with them, but you're much, much better off to just connect the printer and let windows install just the driver it needs. Do you know if your printers are using a standard windows driver or one provided by the printer manufacturer?

-

I always print EVERTTHING to PDF first and then send to the printer. I often find things missing or pages I didn't want to print, plus it gives me a copy of everything that leaves my office, that I can refer to or email/fax as needed.

-

Wow, you must be really hard on your printers. I've never destroyed one in 30 years in business. I usually replace them when they need a drum, and the drum costs more than a new printer. And, yes, I've tried low cost drums with poor results.

-

It's not in ours. Ours is mostly generic boiler plate, but it's almost 3 pages long.

-

Proceeds from Boker and Barter Exhance Transaction

Abby Normal replied to Yardley CPA's topic in General Chat

I've rarely done this in the past, but I've already done this twice this year. But if they also have any other codes, or multiple brokerage accounts, I put them ALL on 8949 so I can match totals on the Detail tab. -

We almost always take mileage the first year to keep our options open. This requires you to use SL in any years of actual. One thing really nice that ATX does is calculate the depreciation component of standard mileage. So at disposition, you have the correct depreciation, even if you used actual some years and mileage in other years. Mileage doesn't decrease when the vehicle is fully depreciated, so on a cheaper vehicle that you keep a long time, you can get something for nothing.

-

Tell them it's not reasonable and send them this link: https://satruck.org/Home/DonationValueGuide They can use the high column if they feel it's appropriate. I had to do the same thing last year, and my guys have been doing this for years, before they came to me. I told them I was trying to protect them from being audited. But at least they gave me an itemized list. I did a spreadsheet and came up with a % to reduce their numbers by. It doesn't matter that it was expensive to begin with. Thrift store value is market price.

-

AMT is essentially dead (for now). I have not had a client hit AMT since 2017. Not sure what caused the difference, unless it was depreciation.

-

You mean an engagement letter?

-

Having the final paystub every year is always a good idea. I'll have to add it to my organizer questions.

-

I thought you had to do calculations for life estate based on parent's age at time the life estate is established, and you end up with part carryover basis and part stepped up basis. Each year the kids own a larger % of the home. No? Carry on.

-

have you seen this? Farmer stands his ground

Abby Normal replied to schirallicpa's topic in General Chat

I've seen some "full" fireproof safes. -

have you seen this? Farmer stands his ground

Abby Normal replied to schirallicpa's topic in General Chat

The banker should not have been lazy and just filled out the form. It looks more suspicious to deposit less than 10k repeatedly than to just deposit what you actually made. -

This is why we scan all the documents as soon as they are received. If they're ever lost, we still have them electronically, but we've never lost any that I know of. We put them in a clear plastic expanding folders with a sticky note with the client's name and log #. Then match the records up with the return when assembled. But I love my out of state clients that are totally paperless, both ways.

-

It works.

-

It's hard to feel bad for a child who is given a house, but they will have a heck of time coming up with dad's basis when they sell the house. It's best to file the gift tax return because we don't know what the estate tax laws will be when he dies, but gift tax returns can be done after he dies, if needed and there's no penalty. Papers? What papers? I don't recall any papers.

-

I used to file my MD residents with one spouse working in DE as separate for DE, until I realized that it only changed the allocation of state taxes between MD & DE. The total state tax paid remained the same, because MD was giving full credit for all taxes paid to DE. Life is easier now because no software I ever used would handle a separate return for only one of the taxpayers on a joint federal return.

-

I've never done a MFS, except for those occasional couples who keep everything separate, usually very rich, so I don't need a program to split it. Besides, I could split most returns in less than 20 minutes, and, as long as I'm getting paid for that, I'm good.