-

Posts

7,727 -

Joined

-

Last visited

-

Days Won

510

Everything posted by Catherine

-

Well one huge problem here is that we, as tax pros, can tell people "have $X withheld and you'll be fine" but that does NOT translate into anything useful for this new W4. An iterative process - fill it out this way, see what the first paycheck looks like, fill out a NEW W4, see what the 2nd paycheck looks like, is both way more than most folks are willing to do and needlessly work-heavy for the PR dept too. There *should* be a way for a taxpayer to say "$X per paycheck" and be done. My personal feeling is that there should be ZERO withholding, and everyone should just send in quarterly checks. That will make them think *very* carefully about what/who they vote for! Yes, it's hard for some folks (less so under the TCJA). That's part of being a grownup. But it also would get the employers OUT of the tax business and back IN to the business of running a business and dealing with other employee concerns (where they should be active).

-

We generally tell clients (when they bother to ask) what their annual tax liability was for the past year. We can also help them divvy it up between a married couple, and (barring bonuses, stock options and other perturbations), tell them "tell your employer you want $X withheld for the feds every pay period." The employer can figure out how to do that. I hope!

-

I have almost entirely given up using my MIT alumni email, since many servers have decided the entire domain is spam; the messages never get through to me OR to my spam filter. They just disappear. Very aggravating; too many online logins are tied to *that* email address. So I set it up to forward all emails to yet another address I have. Grrr! Rant over.

-

One (former!) client, some years ago, just about went ballistic on a $4 difference between their depreciation calculations and mine - in several thousand dollars total. Nitwits. (Mine were correct; duh, lol.)

-

If they are expecting werewolves, silver might be advisable.

-

THAT is the key; make it too much of a hassle so they go to the next place, hoping for an easier score.

-

Merry Christmas to all my friends here!

- 11 replies

-

- 10

-

-

Or, asked him to call back once he sobers up!

-

@TAXMAN - very glad to have been of help! Didn't give you their "toll-free" number 'cuz it used to be only good in-state. Online it still says "toll free in Massachusetts" so better to just use the real number. No practitioner priority line for the state.

-

That's a good one and I don't have an answer off-hand. I'd call MassDOR on this one; the number is (617) 887-6367.

-

I saw the email this morning. It's another impetus for me to get my new computer configured!

-

We have flocks of them in our area these last several years. They're huge!

-

Happy Thanksgiving to all my friends here!

- 1 reply

-

- 6

-

-

As always, we each do what is right for our client base, prior actions, and general practice considerations. What is also probably true is that most of us under-charge for our work. I am always gob-smacked when a new client comes in and I see what they paid the prior year. One new 2018 client, whom we charged about $500, showed prior year bill for the same difficulty return (and it was not done right!) over $1,500!

-

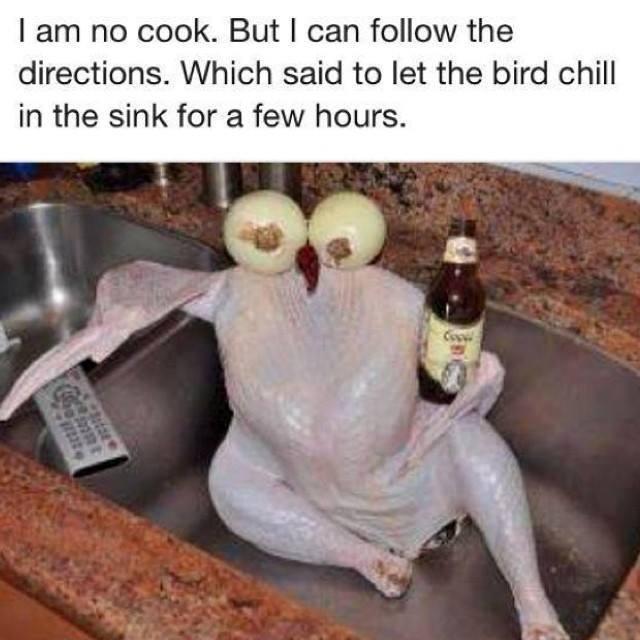

That is pretty much the key, I think. If there is a subsidy, you're SOL. No subsidy, you're OK. We don't have a big crowd for dinner (just for dessert) and I couldn't get a turkey breast small enough! They only had big whole birds and a couple of 10+ pound breasts; too large. So we're having a pork loin. And cornbread stuffing. Because stuffing. And for the turkey people:

-

For those who had not heard: EA Benita Greer-Myers passed away from cancer. She was not on this forum, but was very active in several other newsgroups and tax forums online. She worked for the IRS for many years and was later in private practice, and knew her stuff cold. On top of that, she was a terrific person. More details when available.

-

This sounds to me like installment sale; read the rules on installment sales. There can be different types of gain. Depreciation recapture (ordinary income) is taxed in the year of sale (even if there was less cash paid than depr recap'd, which can be nasty). You'll need to calculate gross profit percentages and capital gain deferrals.

-

I hope that isn't chocolate for the weiner dogs! Chocolate is poison to them. Perhaps they are having hot cider, instead.

-

My first thought, on seeing the topic and intro, was joy to hear from Kerry/Monkeyman and to hear about William Tasker. That quickly turned to sorrow on hearing the sad news. He was a wonderful man, and has been greatly missed by us ATX users. Now he will be even more missed. Thank you, Kerry, for letting us know the news. And pop in here from time to time yourself, and say hello. We have happy memories of you, as well, and you should know we stand as your friends still.

-

If her motive is profit, my answer would be yes. I successfully got a "no change" on a partnership audit, because of years of regular losses. They partners ARE in it for a profit motive. They're just really bad business-people. That first part IS in the IRS regs, and the second part is NOT. I think the main part of my argument was simply that incompetence does not preclude profit motive, and was able to show that motive as well as (futile) steps taken to improve. That's a long-winded way of stating the simple fact that several years of losses does not, prima facie, constitute lack of profit motive. If, however, she still skates professionally "because she loves it" and would do so even if never paid, then you have a hobby. If she is working on her standing to open a school, then you're in a gray area; does she have profit motive for what she is doing currently?

-

You're missing one GIF of hot cocoa.

-

First is kinda true. Second is true. Third is *dangerously* false! Use Form 982 to show insolvency**. What is really nasty is when the companies delay long enough on sending those 1099-Cs that the taxpayer is no longer insolvent, and then they have a tax problem. **I always show corrections to income leaving $1 taxable income; that way the detail pages transmit. That may not be the case with Form 982; it's been a while. That may be a paper-file only form, in which case the IRS will indeed have all the detail pages. Whether they notice/pay attention... that's another story!

-

Ed Slott's information is top-notch.

-

Drake said they want all individual returns by - iirc - 6pm that day.

-

And a lot of times, those QDRO assets get split and re-titled - in which case, the ex will get her own 1099-R and your client's has none of the ex's distribution. Or, shouldn't have.