Leaderboard

Popular Content

Showing content with the highest reputation on 03/22/2016 in Posts

-

7 points

-

You folks are way too generous. The site consumes about 10-12% of the CPU on my server, and donations generally cover about 1/3 of my annual hosting bill. I think I may use part of the donations to buy a model rocket for my kids for Easter, along with electronics bits and pieces to build a fancy launch controller. 4 years old might be a little too young to learn the basics of microcontroller programming, but we can start with circuits, switches, and lighting up LEDs7 points

-

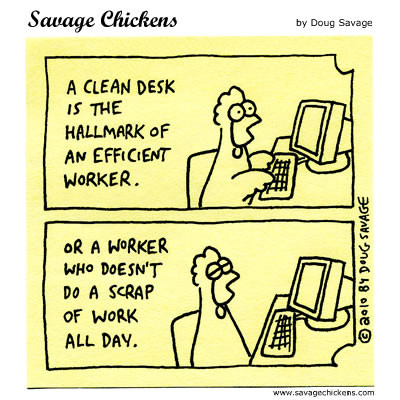

When my wife is in her cleaning mode, she is not allowed to clean anything in my office that is more than 12 inches off the floor.6 points

-

I should take a picture of my desk for comparison. At least I think there's a desk under all the crap.6 points

-

Any female younger than me is a girl. I'll be 80 next month.5 points

-

5 points

-

My point - my husband is a neat desk freak and I am 180 degrees opposite. I have to have everything in reach and I do know what is in each pile. I've tried neatness and it just doesn't work for me. So glad to know I am not alone out here!5 points

-

Lion's desk looks better messy than mine does when it is cleaned off.5 points

-

Great to know you are both out there, one of the features that makes this place special. While I only do a handful of simple S Corps where something might come up, may I offer in return that I can fix your watch or bicycle, and cook you a 5 alarm chili.5 points

-

5 points

-

New client never heard of deducting medical insurance premiums on Sch A. I questioned this during the review of their 2014 return. No medical expense deductions and the cost of their insurance premiums exceed the 10% floor. 2015 expenses are even higher previous preparer didn't tell them this. So they say. These folks have rental property and don't know what a depreciation schedule is. Depreciation shows on Sch E on 2014 return but they don't know what it is being depreciated. Previous preparer did not provide the depreciation schedule and there is no form 4562 in their return. Next one, guy comes into my office with a handwritten 2014 return that he prepared himself. Took the wrong education credit and screwed himself out of about 1500.00. Has a kid in school first year so AOC. He leaves happy and I have a 2014 return to amend. All good so far. Same guy calls and says he is preparing return for a friend and doesn't understand the ACA and where or how to input the information (hand written paper return again). I blow him out of the water with all the different ACA calculations, form 8965, 8962 and the formula for determining affordability using the poverty level calculation. Of course, the went through it quick and technical. He says "I think I'm in over my head". Me - Yep you are fixing to blow another hole in your foot. Now he wants to pay me to get his butt out of a jamb with his friend. Yes, I will charge accordingly. But the nerve of some people! (This is a good place for the head banger emoticon)4 points

-

4 points

-

I just turned 70 Sunday and, frankly, prefer to be considered a woman. Kind of a respect thing to me... Meanwhile, good for you for continuing to practice your profession. That is inspiration. I am training for a marathon now, ran 18 miles last Saturday with 20 this coming Saturday. I do hope to inspire women and girls alike.4 points

-

Here are some things I can help with: I do A LOT of construction tax and accounting. Any bookkeeping questions. Quickbooks. S-Corps. Simple explanation for how to read a balance sheet and the importance of retained earnings. Easy to understand explanations for filling out Sch L and M-1 adjustments. How to make sure your client's business tax return will reconcile to the client's financial statements. I am very grateful for your support and hope I can reciprocate.4 points

-

4 points

-

I do have to keep the stacks separate, not let papers from one client slip into another stack. And, you should see the stacks on my floor with the cross-leaved clients when I have to get everything out of site for a client's arrival. My 2015 TTB and JK Lasser are on top of the printer that doesn't work, because I haven't cleaned out my bookshelves to make room for the current year. I have reading glasses all over with at least two pairs on my desk and another in my briefcase and maybe one on a bookcase. And, that picture showed just the client end of my L-shaped desk that was once a computer hutch, but I needed the space and took the hutch off so I could spread out more. And, the file cabinet that I just cleaned off since a client's coming now.3 points

-

3 points

-

Years ago, I hired a girl to work in my office and had to be out of town for a couple of days. When I got back to my office, my desk was neat as a pin and the girl was sitting at her desk with a big smile on her face. I almost had a heart attack.3 points

-

If a cluttered desk is a sign of a cluttered mind, what is the sign of an empty desk?3 points

-

Years ago I had a girlfriend who was a massage therapist. When I would pick her up she would say "I have to go home and wash the people off me". Maybe that could apply to our profession. I always wonder how some people's documents become so colorful with paint splash design. PS. Never did get a massage out of her....and I did her tax return!2 points

-

One of these days, the IRS will catch on, that as long as income and withholding statements are not verified BEFORE issuing refunds, there will be fraud. I don't for the life of me, understand this "pay now, ask questions later" mentality of the government. Give employers until the end of January to file W2s, give the IRS until the end of Feb to verify them, and start filing returns in March. Can you imagine the fraud that would be put to bed if they did this simple thing?2 points

-

2 points

-

I totally agree with Catherine!! Eric, could you post what your annual hosting bill is? Don't be shy. My gift may be too small, once I have some numbers to use for consideration.2 points

-

IRS Dragon small business card dragon (mine has blue crystal eyes)2 points

-

I have one that's over $6,000 with large amounts of SS withholding. It pisses me off that I just had to fax all of their 1099's and W-2s to the IRS just now. My client's freaked out, because they got the letter from the IRS and I don't blame them. Their return was accepted on 2/25. Why didn't the IRS just check the 1099's that they should have received. It's not abnormal for people to have SS withholding. Now it will take them weeks to look at the fax to see that the return was correct and they stressed out old people that are already stressed enough. Not to mention making me an even bitchier person than I already am these days.2 points

-

2 points

-

Yeah, we know. We know how to handle it. You've seen the letters in the software. We also have clients who cannot read. Why are we yelling? Feb 19 is more than three weeks ago. So is Feb 29. So, if these were your clients, they'd be allowed to call you. And you could yell at them.2 points

-

2 points

-

You are correct. He's outta luck in this instance. Consecutive is too part of the equation. If the person had a two month gap, then was covered, then had another two month gap he would escape the penalty for one of the two month gaps. If he has a four month gap in a calendar year, he's outta luck. If the only four month gap is two months at the end of one year and two months at the beginning of the next year, he'd skate on the earlier year.2 points

-

Does he have a large refund? The IRS is holding my 5-digit refunds, it seems. Eventually, they will come. I just tell them that questioning it makes the IRS more suspicious, and they leave me alone...2 points

-

The desk at my home office looks like one of those post-tornado pictures from the midwest. AT the office, though, I have my dragons, my tax interview sheet folders, a pen, and a penknife that needs to be cleaned after using it yesterday to slice cheese for a snack. All the mess is in the drawers, since MA made it illegal to leave *anything* out at *any* time unless it is actively being worked on. But the drawers have cross-leaved stacks and I have to be very careful closing one of them since it's all up so high....2 points

-

There is no "usual." I donate the amount I think represents the amount of help I have received. Eric has been resistant, at times, to us contributing, but we simply ignore that and donate what we feel is appropriate.2 points

-

2 points

-

Still, looks fairly neat to me, all papers, folders, and cups geometrically correct. Where's the magnifying glass, or do you not need one?2 points

-

2 points

-

The forms 1095-A & 1095-B are the gospel documents for the taxpayer having coverage. The taxpayer may not have received all the forms yet. If he states that he had coverage all year, I would do like RitaB said. The IRS will not be doing any verification. They have put out information that if you receive a 1095 after the return is complete, and the return is not accurate, no steps need to be taken.2 points

-

Have you donated lately? If not, please donate some money so that we have this lovely site up and running. Eric will appreciate that we appreciate his efforts. If you cannot donate during tax season, do you think it is easier for you to donate in November or December?1 point

-

From my cite (instructions to Form 8965), pages 9 and 10, how you can avoid SRP by entering Code B in Part III, has nothing to do with marketplace: Short coverage gap (code “B”). You generally can claim a coverage exemption for yourself or another member of your tax household for each month of a gap in coverage of less than 3 consecutive months. If an individual had more than one short coverage gap during the year, the individual is exempt only for the month(s) in the first gap. If an individual had a gap of 3 months or more, the individual isn't exempt for any of those months. For example, if an individual had coverage for every month in the year except February and March, the individual is exempt for those 2 months. However, if an individual had coverage for every month in the year except February, March, and April, the individual isn't exempt for any of those months. Example—multiple gaps in coverage. Colton had coverage for every month except February, March, October, and November. Colton is eligible for the short coverage gap exemption only for February and March. Example—gaps in coverage for partial months. Fred has minimum essential coverage except for the period April 5 through July 25. An individual is treated as having coverage for any month in which he or she has coverage for at least 1 day of the month. As a result, Fred has minimum essential coverage in April and July and is eligible for the short coverage gap exemption for May and June. Continuous coverage gap straddles more than one taxable year. If you do not have minimum essential coverage for a continuous period that begins in one taxable year and ends in the next, for purposes of applying the short coverage gap rules to the first taxable year, the months in the second taxable year included in the continuous period are not counted. For purposes of applying the short coverage gap rules to the second year, the months in the first taxable year are counted. Example—Continuous coverage gap straddles more than one taxable year. Fran, an unmarried taxpayer with no dependents, has minimum essential coverage from January 1 through October 31, 2015. Fran is without coverage until February 1, 2016. On her tax return for 2015, November and December of 2015 are treated as a short coverage gap. On her 2016 tax return, November and December of 2015 are included in the continuous period that includes January 2016. The continuous period for 2016 is not less than 3 months, and therefore January is not part of a short coverage gap. To claim this coverage exemption, enter code “B” in Part III, column (c), and identify the months to which the exemption applies as described under Columns (d) - (p)—Calendar Months, later.1 point

-

Catherine, I was going to give a like to your post, but we don't have a button "I like your first line". I am sorry to hear that your computer is giving you hard time during tax season. I hope you catch up soon.1 point

-

1098T forms can show either amounts received or amounts billed. The financial transcript shows the amount paid by the student, and that is the amount I always use. I don't think IRS matches these forms since the school has the option of reporting billed or received. If the $9k is in box 2, then that is the amount billed. I think the student can use the amount paid.1 point

-

Hmmm, maybe had you hired a woman, things just might maybe have been different. The girl was surely aiming to please.1 point

-

I have a student whose return was accepted 2/12/16. He still does not have his refund. I think that it is because he is claiming himself, and getting refundable AOC, the IRS is checking a little harder. I have told him that. But since he is a student and self-supporting, he could really use that money. But as far as I am aware, there is nothing that anyone can do to cause the IRS to release a refund until they are ready.1 point

-

This is a very valuable resource and we have two kind of people and two formulas that we can follow. 1.- I charge an average of $80 for regular returns (not complex ones). I would suggest that amount for every 200 clients. 2.- I take a ruler and I measure my heart and I assign a dollar amount to each inch of my heart. I compare both amount and I donate which is bigger. Other people will donate whatever amount is smaller, but that up to you. Joking aside, I think it is very hard to answer this question: "I donated last week. What $ range is the usual?" Keep in mind that we don't mind if you change your mind and donate again keeping in mind the formulas above. My mind is tired now.1 point

-

Correct. As a matter of fact, whoever was next to his bed that day (for the hours he lived in 2015) can take the dependency for 12 months provided they are blood related.1 point

-

Jack, Part III of Form 8965 seems to indicate a person can get an exemption without going to the Marketplace. Part I seems to be for Marketplace granted exemptions. My original post doesn't apply for my client but it seems an exemption could apply to some without going to the Marketplace.1 point

-

My experience on this has been small differences. I do as cbslee, just override the accumulated depreciation.1 point

-

I did some reading at NC Dept of Revenue and searched around for info. My understanding is that, in any case, the fiduciary (and not the beneficiary) has the responsibility for reporting any applicable income to NC. I'm reading the instructions for form D407A. It looks like the beneficiary is only required to report whatever distributions are on the K-1, as usual. Also, see "Kimberly Rice Kaestner 1992 Family Trust vs. North Carolina Department of Revenue". The law that says out of state trusts have to pay tax to NC because a beneficiary lives in NC was decided to be unconstitutional by the Wake County NC Superior Court, but only for that one case. NC DOR is expected to appeal.1 point

-

Will keep that in mind although I usually manage to bludgeon my way through them eventually.1 point

-

<<<<<<The forms 1095-A & 1095-B are the gospel documents for the taxpayer having coverage.>>>>>> How many of these forms have you seen where the information is incorrect? Such as no individual covered in the "person covered" section. I have seen quite a few. Good thing the IRS isn't verifying these forms. If they were, God only knows what kind of a mess folks would be in.1 point

.jpg.f947b3d3d190450b9ec7ad889fae3356.jpg)