Leaderboard

Popular Content

Showing content with the highest reputation on 03/14/2017 in Posts

-

11 points

-

7 points

-

7 points

-

I have been awake since 3:18 am, and I have realized that a nice glass of wine, yes, one, interferes with my sleep, so yes, the only solution is to drink it with my lunch per diem.7 points

-

7 points

-

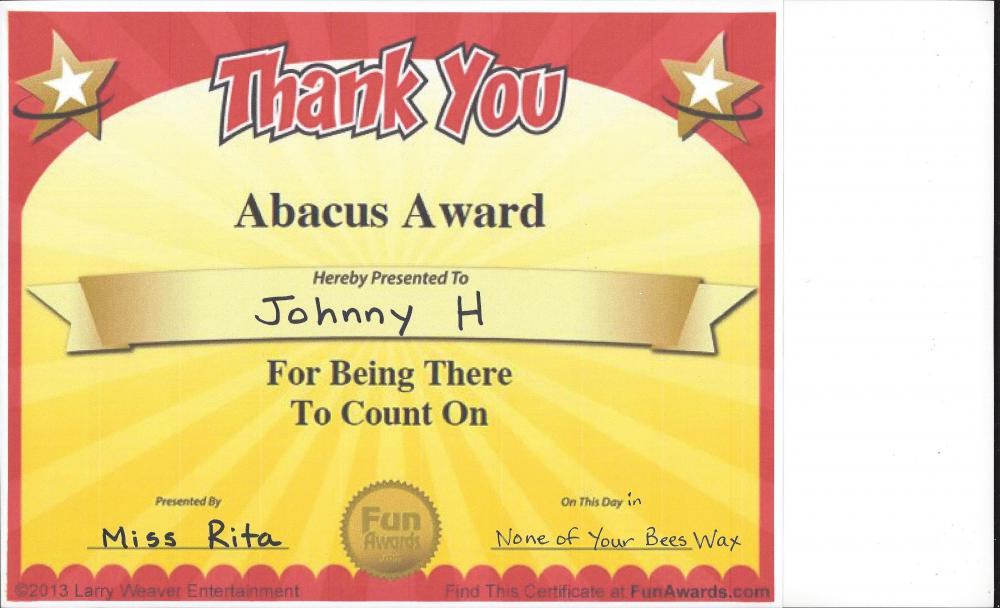

I still cherish those fond memories of being the oldest student in Rita's math class. She was a tough task master, even making me memorize all the digits of Pi, which I can proudly say I still know today and can recite them at the drop of a hat.6 points

-

6 points

-

6 points

-

And we can celebrate Tau Day in late June! Vi Hart explaining Tau: Vi Hart on Tau (link to you tube video)5 points

-

Thanks Miss Rita. I lost my original. It's so great to have a duplicate. Bet I was the only student you ever had who was older than the teacher.5 points

-

4 points

-

Hah, Rita, I'll bet you have grilled salmon, fresh asparagus, chocolate mousse and some nice wine in there as opposed to my meager bowl of oatmeal. Well, I do put chia and flax seeds in it and blueberries with the almond milk and cinnamon but I have to fix it every day.4 points

-

Here is what my barber is saying: https://www.irs.gov/pub/irs-utl/23-Is this Deductible.pdf4 points

-

4 points

-

Deb: Needless to say, you are right, but you will not be doing those returns in the future. Send them a note next year, "Call me when you need me" Because the preparer that is giving them the "Nurse's Meals" is also giving the "Fireman's and Policeman's Meal's" deductions as well. Not withstanding the fake $14k Sch C so you can claim the full EITC.. Rich3 points

-

3 points

-

3 points

-

There is nothing to add to the farm building. The $100,000 would be used to replace or repair the building and then reduce basis in the building by the remainder. Since he neither replaced, repaired nor has basis, it is all income to the farmer.3 points

-

With that many returns (and their type) to prepare by yourself, you must be the meanest preparer of PA!!!!3 points

-

If that's what they're using, well, regardless of what they're using, explain that "a person's tax home is the city or general vicinity where his or her primary place of business or work is located, regardless of the location of the individual's residence," and ask them if they are traveling away from their tax home. No, they're not.3 points

-

3 points

-

Just today I got a phone message at home from the IRS, which is suing me for unpaid taxes. All reports say those calls have subsided since they shut down six call centers in India in Sept or Oct. A colleague got a text with the same message. Just like with the drug lords, when a group gets arrested others are standing by to take over the territory. This scam and the others mentioned in this thread are all trying to trick people into thinking they have to pay for this or that to comply with some law or another. Only works when they target law-abiding folks. We must all be renegades.3 points

-

Is she renting a room in his house, half his house, what? Or, is she his girlfriend who moved in with him and is sharing expenses? I'm sure there's a joke in there someplace about personal use, but I won't go there.2 points

-

One year Pi day was on a Thursday and our pastor at the time, in appreciation for our choir, brought several pies to rehearsal and made a wonderful poster of thanks. Best Pi day ever! We did have to wait until after rehearsal to eat, though. Tough to sing with food mouth (singers know what I mean).2 points

-

Sorry, this does sound like a mess! The nondependent son could be covered under parent's plan up to age 26 even though he was eligible for an employer's plan, and you are correct that this does mean that he wasn't eligible to receive the PTC on his insurance through a Marketplace. Since you say that he isn't a dependent, is working, and is eligible for his own insurance, I'll assume for purposes of preparing the 8962 that this son is NOT part of the tax family, that his MAGI is not included in the household income. Next, you are also correct that the 1095-A amounts must be between the parents and the nondependent son under the special situation #4 reason described in the 8962 instructions. I do think you have to use a corrected amount for the SLCSP, and I don't know how to get that for someone in CA. If you are preparing this son's return, maybe try to work out how best to allocate to minimize the tax impact of their errors. You must be consistent in applying the allocation across all amounts for that month or months, and the percentage agreed on can be changed for other months. I don't know how you will explain that you are using a different amount than is shown for the SLCSP amounts before allocating. I haven't had that situation. Would you attach a statement of explanation? Lastly, for the dependent son that worked part-time, if he is required to file a return (filing for other than to recover withholding) you will have to include his MAGI on the 8962 because it sounds like he is part of the tax household. If parents do have to include his income, it may further reduce the amount of PTC they are finally allowed!! You are right, it is a mess. Sorry, I don't think I helped you, only confirmed that you are on the right track.2 points

-

Yes! And it is about this time of year that I start fighting burn out. Well maybe it is actually spring fever!2 points

-

Deb, Someone may be reading them in this direction....2106 instructions-overnight...Still doesn't make it right. stastandard meal allowance. Instead of actual cost, you may be able to claim the standard meal allowance for your daily meals and incidental expenses (M&IE) while away from your tax home overnight. Under this method, instead of keeping records of your actual meal expenses, you deduct a specified amount, depending on where you travel. However, you must still keep records to prove the time, place, and business purpose of your travel.2 points

-

Forget the qualifying relative test for now. I think you need to go back and look at the qualifying child rules for the daughter for 2016. If you look at the 7 tests for QC, they are: Must not be able to be claimed by anyone else, including self Joint return test Citizen or resident test Relationship test Member of household for > 1/2 the year Age test: - must be under 19 and younger than taxpayer claiming - under 24 & a student at least 5 mos of year and younger than TP claiming - any age and permanently and totally disabled. Means can't engage in gainful activity because of physical or mental condition AND doctor has determined that the condition will last continuously for at least a year or will lead to person's death. This is pretty much a given if the person is already getting SSI. Support test - dependent must not provide over 1/2 of own support For those that are permanently and totally disabled, Sec 152(c)(3)(B ) covers the age requirement, basically saying that age is not a factor for meeting the requirements of the age test in determining if one is a qualifying child if permanently and totally disabled. It does not matter when she became disabled; she will meet the age test. Notice that income isn't directly one of the QC tests but support is. If the daughter is truly disabled, then the income test (like is used in determining QRs) doesn't matter, but what does matter is how much support she provided for herself vs how much the mom provided. If you look at the support worksheet, line 1 is "funds available at the beginning plus taxable and nontaxable income, plus amounts borrowed, plus amounts in savings. You'll include the $5600 of CD as savings because its really just cash, but don't include its redemption as income or you'll be counting it twice. Add in the SSI and anything else daughter has as the starting point. You just have to work through the numbers and find out how much of that daughter spent on herself vs how much mom provided. If daughter banked all resources and didn't spend one penny on herself and mom provided all, or more than 1/2, then mom can claim her as a qualifying child.2 points

-

2 points

-

We've always taken losses on houses in estates. Usually, just for the amount of the expenses of sale, because if it sells within a year or so, the best proof of value is the sales price, assuming arms-length deal.2 points

-

Were they "open for business"? If not, organizational costs and start-up costs to be amortized, right?1 point

-

At $135,000 I would take a hard look at. I see two issues, first would the corporation need to file amended returns if the tax is paid at the corp level. Secondly if the shareholders claim the refund is there an assignment of income issue. I believe you are off the hook on the first issue. Per Reg 1.446-1(c)(ii) "under an accrual method, income is to be included for the taxable year when all the events have occurred that fix the right to receive the income and the amount of the income can be determined with reasonable accuracy". The second issue opens a can of worms tried by case law where reference is given to Reg § 1.6012-2 Corporations required to make returns of income; which states "A corporation is not in existence after it ceases business and dissolves, retaining no assets, whether or not under State law it may thereafter be treated as continuing as a corporation for certain limited purposes connected with winding up its affairs, such as for the purpose of suing and being sued. If the corporation has valuable claims for which it will bring suit during this period, it has retained assets and therefore continues in existence." There are a number of cases you can look at. "SIGURD N. HERSLOFF, 46 TC 545". In this case, it was determined that an asset award due to a dissolved corp. was not taxable to the corp. but to the surviving share holders. The opinion reads: "Considering anew the issue in this case, we are of the opinion that since both dissolved corporations had ceased business, were without assets, were not being operated by the newly appointed trustees, the dissolved corporations must be regarded as fully liquidated and no longer in existence for tax purposes. Accordingly, we hold that the Commissioner erred as was alleged by petitioners in their assignment of error previously set forth herein." Here are a couple more cases you might look at: Beauty Acquisition Corp. v. Commissioner, TC Memo 1995-87 is a case where the IRS failed to prove "the corporation has valuable claims for which it will bring suit during this period". Therefore the income was not taxable to the corp. JAMES PORO, 39 TC 641 where a lawsuit asserting a claim of the corporation was started several years after distribution of all corporate assets and was filed in the name of trustees in dissolution of the corporation, the Tax Court held that the claim was asserted on behalf of the shareholders, rather than the corporation. Thus, the corporation was not subject to tax on the collection of the claim I think you have a strong case in favor of reporting the refund to the shareholder. I would discuss the regs and case law with him, and document that discussion. One thing that is certain is the corp. did not bring suit against any valuable claim per Reg § 1.6012-2.1 point

-

It's not a simple return. You must have all the information to support insolvency. There is a lot of liability on the line for just marking the box and sending in. Only time it might be considered simple if a bankruptcy is involved.1 point

-

I'm not looking to jinx anything here, but ATX has worked very well this season. I haven't run into any issues with the program and I'm happy with all that ATX offers.1 point

-

Only separated parents when the custodial parent release the dependent to the other parent can one be HH without the child being his/her dependent. Deb is correct.1 point

-

Ctrl+P is your friend. I never look for little printer icons in any program. They're all different and in different places, but good ole Ctrl+p works every time! And, no, you can't customize the ATX tool bar/ribbon thingy or whatever the */%& they call it these days.1 point

-

1 point

-

As I said before... if it is your permanently disabled child, he/she can make millions and you can claim him/her as long as he/she didn't provide more than 50% of her own support. By the way child means at least son and daughter, regardless of age.1 point

-

1 point

-

1 point

-

Next up in the junk mail, you must purchase new employment law posters from us or you are not in compliance and will be subject to penalties!!!!!!!1 point

-

You would think the more successful, the smarter people would be and understand this basic tax tenet of the more you make the more you pay. My particular client is quite ignorant of this fact. She's a real estate agent with good income, paid off rentals, a pension, and husband with 2 pensions, and she runs all over town getting the best deals on 100K CDs. I admire her fortitude when I see her 1099INTs. But no tax withheld on anything other than $300 on one of the pensions. Total income 165K. So I explain every year and it never sinks in. I know her over 25 years. Calls me about every new crazy investment scam she hears about. So I've given up other than to just tell her the tax bill and listen to her rant and rave. Just so you know the outspoken person she is, when she met my wife for the first time she said to her "I don't see him with a blonde." I won't tell you my wife's answer. She called again yesterday answering my question about a missing bank interest that she didn't give me this year. She said the bank told her the interest was under $600 so it's not taxable. Whatever, I have no time for this, I'm just adding it in, one less phone call for me when she gets the deficiency notice. But she also laughed and said to me, "you know, I like your thinking on the implants, I might go for them this year". Her husband has one foot out the door so I don't doubt she'll go ahead and try to deduct it for this year. I'm bracing for a rough 2018 for me. I should tell her to read some of Dr. Seuss' quotes.1 point

-

Your subject's funnier than mine (by the way, I like your Dr. Seuss quote very much), but regarding estimated tax I once inherited a new bank president as a client. I'd done his predecessor(a smart, reasonable man)'s return and he recommended me. The first year everything went swimmingly 'cause even though he made scads of dough he paid heavy estimates. Second year, same income, but, he had decided to forego the estimates (told me this a month before the deadline) and just go with the bank's withholdings. Highly P.O.ed at me and my projected high tax due, he asked "Why?" Told him "Well, see; if you make so much money then you're gonna have to pay so much tax and you did and you did not pay your estimates like you did last year. You still have all that paid-for rent property." He said "Well, so what? I've got banker friends who make the same as I do and they pay nothing; why should I?" I reply "Each case is different - your friends may or may not have things you do or do not have which can either help or hurt you." To no avail; he -- the town's leading financial wizard, advisor, analyst -- decamped and went off to, supposedly, greener and tax-free pastures. It's an odd thing; I've noticed over the years that the more money people make (usually starting around $100K) and the ego expands, the less tax they expect to pay -- as if success will or should provide an escape unavailable to mere mortals.1 point

-

Ha! This place can be satire, vaudeville, slapstick, schtick, and hilarity all rolled into one. Not to mention the therapy value that comes along with it.1 point

-

I am sorry Joan! The second hardest thing I have ever had to do in my life was put down my best friend. I will not give you any false hope of a brighter day soon. It took me 20 years to learn to love another one the way I loved that one. Grief is different for all of us. But it is very real and needs to be dealt with. You will stumble through the rest of tax season and then you need to take some very serious time for reflection. And as Lynn says, bask in the memories. You owe that to Sweetie Pie - and you owe that to Joan. May God bless you in the most unimaginable ways!1 point

-

Yesterday PIA client who calls me all year as if I were her brother has a 35K tax bill because she refuses to pay estimated tax reasoning that "something might change this year." No itemized deductions, but she asks me if her $30K implants she is getting this year will be deductible. I said no, unless maybe if you were an exotic dancer, it's really cosmetic. She argued with me back and forth for a few minutes until she said, "but I need them to eat." Then I realized she was talking about her teeth. At least we both had a good laugh.1 point