Leaderboard

Popular Content

Showing content with the highest reputation on 01/11/2023 in Posts

-

6 points

-

I Agree the 30% Backup withholding applies if recipient refuses to submit a W-9. However, hard to collect the Backup Withholding from a recipient when it was a one-off service and payment was already issued prior to having the mess of providing the 1099NEC etc that is dumped in your lap on January 28th... Just Sayin..4 points

-

The service provider could report the income in 2022 or 2023 depending of the accounting method, but your client can only issue the 1099 for the year in which the money was paid, as Bulldog Tom said.3 points

-

3 points

-

Yes, just scroll down a full screen (in ATX). Under Conversions From Traditional, SEP, or SIMPLE.... 2 lines more has a checkbox to Check box if qualified charitable distribution (QCD) and enter qualified charitable distribution amount. Over the years I am constantly finding how many screens have so much more to see if one just scrolls up or down. For such a relatively inexpensive program (despite some faults and less than stellar support), I really think ATX has so many features, more than I know how to manage even after 26 years with it. It pays to just browse around sometimes, something I'm trying to instill in the office admin at church with the membership database.3 points

-

The SS payments are included in arriving at the adjusted gross income. A percentage of the SS benefits may be taxable but all depends on other income. If there is no other income from the mother, then not taxable.3 points

-

"When the Advocate’s report went to press in mid-December 2022, the IRS had reduced those backlogs to 1 million original individual returns, 1.5 million original business returns, and 1.5 million amended returns. By Dec. 23, the IRS had further reduced its unprocessed paper backlog of original individual returns to about 400,000 and original business returns to about 1 million." According to Nina Olson, the former Taxpayer Advocate, the overall situation isn't quite as positive because there are Millions more returns in Suspense waiting for a live person to resolve processing problems.2 points

-

It is supposed to, however for years I just printed and mailed black & white laser printed copies with no problems. Now I efile thru a third party.2 points

-

Let the online services have the headaches! My W2s are mailed and filed. Done. Next year I won't even bother trying SSA Business Services Online.2 points

-

We have our clients bring the instruction letter to the fiduciary and/or the check stub and/or the letter from the fiduciary. One of them, somewhere, says something pertinent. When I was a church Treasurer, I always made sure donors got those fiduciary letters for their records. They say something on the order of "here's $2,000 from the IRA of John Smith made out to First Parish Church Temple of the Blessed Heart."2 points

-

I downloaded and have it all up and running. The only niche was the prior year clients were not showing when using the last year data screen. Had to select build EIN/Name from 2021 and all was well afterword. Only other hiccup I had was my secure file pro or drake portals would not let me access it. A few small steps on the account management page and again, all is well. Hope you all have a prosperous tax season.2 points

-

It doesn't matter whether it's one QCD Distribution or six QCD Distribution. My 1099 R from Charles Schwab doesn't give any indication of how many or how much.2 points

-

1099s are for payments made regardless of accounting method of payer or recipient. Tom Longview, TX2 points

-

My client is splitting his between three charities. It will be interesting to see what his 1099 looks like. He consulted me about this several months ago and has it clearly documented.2 points

-

1 point

-

I tried to sign in the middle of January which I consider to be timely. Even the IRS uses text to send Pin numbers to you.1 point

-

1 point

-

1 point

-

1 point

-

This is correct. I have done two of these without incident and did not file form 8832 just the 2553. Just to note. Both were filed timely and no late election was involved.1 point

-

@grandmabee You have 75 days from its inception to file 8832 and or 2553 for it to be timely. Should you file beyond this time then follow retro relief route.1 point

-

Sure am glad I asked the question. Margaret can you access the QCD screen from the 1009-R entry form ? That will solve the problem I am sure.1 point

-

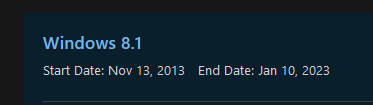

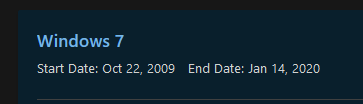

Filing cabinets and first line enforcers... That is the "rub" of my part of this thread, many are doing things which put them, and the clients, at risk, via the e records rules. I have some awful first hand experience in this area, as I have shared before. Person had my software on their computer. (Convicted tax fraudster, preparing returns for others and taking fake refunds for them.) Feds searched/inspected the computers, found my software, and asked what part I had in the situation. The convicted party, while they could, made death threats against me and mine if I even spoke to the officials investigating. I think I already asked here, and most clients do not ask things about how secure their data is kept (IIRC, it was a topic which should now be for anyone not using at least Windows 10). I ask those questions (now).1 point

-

The IRS notes at the bottom of notices if they've been replaced by a later notice or if this is replacing an earlier notice. Otherwise, the IRS just keeps piling on regulations for us tax preparers to follow. Remember that some documentation actually belongs to the IRS; we're just the IRS's filing cabinets. So, the IRS has the legal ability to drop in unannounced to view certain things, such as Forms 8879.1 point

-

Does WISP supersede 97-22 (and the like)? The ones where e record POTENTIAL or actual loss requires notification to the IRS? (Potential is the issue as it can easily be argued a computer change means there is potential for data loss, so a letter to the IRS is mandated. Same for a power outage. This is, unless the holder checks all required data, one by one, after a computer move or power loss.) How about the requirement to agree to "inspection" at any time? (The one no one should ever agree to IMO!) That is what I am always hoping to hear, that 97-22 (etc.) has been updated/replaced by something less onerous. My suspicion is there is no reason for the IRS to make the rule less impactful, so they haven't. -- While maybe not for tax data, there are localities (Local PTB) who have delved into data retention, such as requiring data to be kept under the liable person's control, and IIRC, WITHIN their jurisdiction (no commercial online backup likely would meet this).1 point

-

Lion. Thank you for the above. It appears nothing has changed since I dug into it heavily a decade or two ago. If the references, like the one above, included all of the relevant information (I shared above), I doubt anyone would stop keeping paper. I did not (then) find any issues where something like a fire, theft, or accidental loss required anything of the keeper of paper records as far as proactive notification of loss. I say all of this as I am on the lookout for a good looking enough (SWMBO vetoed metal) tall 4 drawer file cabinet for my office/grandaughter room... 4 years is my data cycle. Current is in a drawer next to me, the 4 prior are in the dedicated cabinet. The drawers get labeled for shred date, then the empty one is used for the data no longer current.1 point

-

1 point

-

It will be interesting. What is the fiduciary? I split mine among 4 charities in the past. The 1099R from Fidelity just showed the full distributed amount with no tax withheld. I entered the QCD on the worksheet and QCD showed up in the right place. I do have a second amount from a 403(b) in TIAA-CREF so the total distributed was higher than the taxable amount.1 point

-

1 point

-

I believe that IRA trustees have pushed back against any requirement that they determine whether the contribution is to a qualified charity - and they have no way of knowing if the beneficiary received anything of value in return for the donation.1 point

-

Box 7 could be used if the fiduciary issued two separate 1099Rs, just like they issued separate checks. And if the check is payable to the charity, and clears the bank, I would think that is pretty indicative that it reached the charity. Banks have gotten pretty cautious about cashing checks for people that are not made out to people. At least they have around here.1 point

-

Yes, ATX has the place to indicate QCD and the amount of the distribution that was donated. As my church's treasurer we have received several checks from the fiduciary, some stating purpose but not that it was a QCD. The donor indicated via email. I have my church donation sent to me made payable to the church and I deliver it. I have had the others mailed directly to the charities. None of the checks indicated QCD. I have the acknowledgement letters and report the total of the distributions on the 1099R data entry screen. I ask those clients who may have given QCD amounts for copies of the acknowledgements 'to be sure I indicate the correct amount of the distribution that is not taxable.'1 point

-

I don't think there's a box on the 1099R to indicate a qualified contribution. (Box 7 won't do it because there is no room for the dollar amount.) At any rate, typically the fiduciary sends the CLIENT the check, payable to the charity, and cannot know if the client ever turned it over to the charity. In UltraTax you enter the 1099R as usual and below there is a screen to enter the Qualified distribution and amount. It enters QCD to the left and subtracts the amount from taxable income. Does ATX have a code line for this?1 point

-

Good Question. I have a client donating in excess of $30,000 this year; his entire RMC. Strange that they wouldn't have a code as these seem to be becoming more popular. Document! Document! Document!1 point

-

It hasn't shown up on my own 1099 or on the 1099s of several clients who also make QCDs. I make copies of the fiduciary QCD Documents including the checks, plus the charities usually indicate on their acknowledgement letter that it's a distribution from an IRA.1 point

-

With the current Congressional threat to the IRS's funding, I think we'll see a later date, such as the third week or even fourth week of January. But my crystal ball is broken.1 point

-

I am waiting to see the IRS response to this one. Gonna get some popcorn and see what happens when a company pushes back on the IRS. Hasn't happened in a while. Tom Longview, TX1 point

-

The W9 should answer that question if the vendor filled it out correctly. In box 3 on Form W9, if they check LLC, then they are supposed to tell you how the LLC is taxed in the area to the right by putting in a "C" "S" or "P". My rule of thumb has been if they don't fill it out correctly, they get a 1099. Tom Longview, TX1 point

-

Years ago one of China's leaders stated that the US had gotten away from "making things" to pushing paper around. China's leadership, for all it flaws, is noted for its no-nonsense, see-things-as-they-are approach, so it made me think. So much wealth in this country is derived from stock options, swaps, derivatives, stock shorting, straddles, and now NFTs and cryptocurrency. How does any of that improve anyone's life, except for those on the winning end of those trades? Most of us have clients with brokerage statements that are dozens of pages of buys, sells, buys, sell, buy again, margins. All this paper amounts to nothing productive. Maybe China had a point. Note that the country has banned crypto.1 point

-

I have been trying to login off and on for over a week. I enter my user name and password then I'm asked to request an authentication code be sent to my email which I do. The email doesn't arrive for 2-3 days and, of course, is invalid by the time I get it. I tried to call today but I was number 76 in the queue..........1 point

-

1 point

-

Tracy Alloway (Bloomberg and the Odd Lots Podcast which is AMAZING) made a really good comparison of crypto with Beanie Baby dolls. Beanie Babies had someone who distributed / sold a price sheet that everyone used to price them as if it was their real value. Prices just kept going up and nobody really questioned it because it was on the list. If someone said that Beanie Baby wasn't worth $30, they could point to the list. Crypto had a price list but turned out it was all manipulated just as much as the Beanie Baby list. FTX was buying on one board and selling on another to themselves at higher and higher prices to justify getting more and more loans on their worthless asset. They bid a coin they owned almost all of up to over $50 each (total value of $9.6b) and now it's priced at $.87 ($300m) and has a value of $0. Warren Buffet said that if you owned all of the Bitcoin in the world and offered them to him for a total price of $25 he'd decline.1 point

-

I don't know what it is. I think I have a handle on what a NFT is, but the "coins" are not something I can't get behind yet. Maybe someday, but right now I am not there. The IRS seems to say it is "property of some kind", and they have some rules on how to handle transactions involving virtual stuff, so I am going to follow that. Tom Longview, TX1 point

-

At the risk of being censored for political commentary..... I think the cryptoverse wants regulation so they can peddle their risky investments and say they are complying with the regulators. It will give a shady investment some kind of legitimacy. Blockchain is a very interesting technology and how it gets used will be in ways I can't even imagine. I think it is one of the coolest things humans have thought of in the last couple of decades. But cryptocurrencies (the offshoot of blockchain technology) are not assets or currencies or securities or property of any kind yet. Just my opinion, you don't have to agree. Tom Longview, TX1 point

-

Long ago, clerking for a local tractor sales repair outfit, I composed a collection letter which mentioned some of the above lines plus others I created. Hot into writing at the time (no best-sellers emerged), I considered mine a friendly-browbeating masterpiece. A fellow colleague from our nearby competitor later called; praising it highly and asking permission to use it. Quite pleased, I agreed. Next month he called back: "We got a better letter than yours." (Their customers didn't pay well, but neither did they.) A rough, camo-collar guy who sold scrap iron but was also known to pack an iron, had penciled on his notebook-paper statement: I WANT MY MONEY Paid the same day received. BB1 point

-

We don't have a website. Just a Facebook page. My appointment book lives on my desk along with my computer glasses. (And a lot of other junk).1 point

-

1 point

-

1 point

-

Texting Scenario: Client: Can I make an appointment? Me: Yes, when? Client: Let me ask my husband Me: (Waiting) Client: How about the ____? Me: What time? Client: Let me ask my husband Me: (Waiting) Client: How about _______? Me: Fine And on and on it goes.......I HATE it! Bear in mind that I have over 200 1040 clients!1 point

-

Personally, I think that too many people, clients included, rely on their phones for all of their information. I just cringe when they come in with all of their banking info; bookkeeping, etc on their phone. I rarely read email on my phone, just check it occasionally to get rid of all the junk. I am a firm believer in PCs with external hard drive or USB backups. Just my old-fashioned thinking. I would be lost without my phone, but I consider it to be more of a personal friend than a business friend. I keep it updated with my business information simply because there are so many who do not and will not contact you in any other way. More of my time is wasted in texting for appointments and/or tax questions; than in any other portion of my business.1 point