Leaderboard

Popular Content

Showing content with the highest reputation on 04/07/2024 in all areas

-

Years ago, I used direct debit, and the IRS took the money twice. One phone call and they immediately acknowledged, but it took them 10 weeks to refund the 'double dip'. LONG ago, and I'm certain it's fixed, but I've never used it since. I have an instruction sheet with instructions for direct pay for Fed and State, and I pay a client who is retired to come in 4 times a year and phone all my clients who have estimated payments reminding them of the same. Clients love it, and it's a 'touch' in the off season time. I print vouchers when I do the tax return for folks who want to send checks, and we keep a spreadsheet of 'estimated payment' clients. My son is getting ready to go to college, and he says he's going to take over my business someday. When that happens (or when he changes his mind and I sell my business), he can move the estimated payment system into this century ... my retired client might be tired of making the phone calls by then ;).6 points

-

I tell them they can lower the amount if they want, but to write it down on the list I gave them &/or make a copy. I push DirectPay and the state equivalent, because they get instant confirmation. I tell them to save the confirmation AND to send it to me each time they pay an estimate. That way I have amounts and dates. If I haven't gotten 3 confirmations from a client by December, I remind them and adjust their 4Q amount if needed. I also strongly suggest the 4Q be paid by 15 December (instead of 15 January the next year) so when they look for all their 2024 expenses, that 4Q shows up as 2024.4 points

-

I give my clients a memo with dates and estimated amounts for the four quarterly payments. I print the vouchers for them and even give them envelopes with the address printed. That's it for me. They're on their own the rest of the year. I remind them to make photo copies of both check and voucher. If they want to do direct payments, they're on their own. But I remind them to get some kind of printed confirmation.4 points

-

The computer I bought a few months ago is Win11 and besides not being able to move my taskbar location to the right side of the screen where I've had it since Win8, 11 is still buggy. For example, I have my taskbar set to hide so I can have that screen space, but it won't stay hidden, so I have to restart Windows Explorer to make it hide again, which of course closes all of my file explorer windows. They also really want you to login in with a microsoft.com account instead of a local account, and to use OneDrive. I changed my account type to local and I think I've disable OneDrive, for the most part.4 points

-

Yes, I have client initial or sign everything. And the state of Ohio also has a disclosure statement that must be checked: Check this box to indicate taxpayer has read the disclosure statement(s) related to the direct deposit option selected. The Ohio Department of Taxation is not respnsible for the misapplication of a direct deposit refund into a checking, savings, IRA or 529 College Advantage account that is caused by the error, negligence, or malfeasance on the part of the taxpayer, electronic filer, financial institution, or any of their agents.3 points

-

I just had this conversation with a client yesterday. I question if they understand the MLPs they are in and what a 1256 Straddle is and why that needs a separate form and yes, I do have to charge you for each K-1 and yes the K-1 shows a loss as well as the 1099B. I have been with this client for a long time. They at the beginning of their retirement and really scared that they will not have enough in the retirement piggy bank to live out the rest of their lives. It is the first time I have spoken out about the investments they are in - it used to be a lot simpler (4-5 mutual funds and a couple of stocks). This year the broker churned their investments to the tune of 44 trades and 2 K-1s for MLPs that were held for less than 60 days. I could not hold my tongue this time. Tom Longview, TX3 points

-

Never had a problem with Drake. In fact, I endorse direct debits for estimated taxes instead of relying on voucher coupons for that purpose. My experience with the coupons has been very bad due to the clients. When reviewing for the succeeding year, the conversations go something like this: Frog: "Did you mail in the payments with the coupons I sent you? What about June 15th? Client: "uh, no. Took the kids to Disney World." Frog: "What about September 15th? Client: "uh, no. Our lawnmower broke down and we had to buy a Cub Cadet." Frog: "What about January 15th? Client: "no way. Had to pay credit cards for all those Christmas presents." Frog: "Sorry to hear all that. Looks like you will have to pay (again) this year." Client: "OMG!! Don't tell me that!!! You've got to do something to help me....."3 points

-

That is also my practice. In this case the client will continue to mail in his payments on a quarterly basis. He has a daughter that lives close by with a POA that will assist him. Thank you for all your replies!3 points

-

I have quite a few clients that use direct debit. Never had any problems. They like better because they don't have to remember to do it.3 points

-

has worked fine with the few clients I've tried it. And as you mention, they have been older clients; younger ones I've pointed them towards Direct Pay. Just had another instance of client's check going missing--the 1040-ES arrived but not the 1040-V. Even though elderly, I think he is savvy enough with the computer to use direct pay going forward. We have a serious problem in my area with stolen checks, including those dropped off inside the Post Office.3 points

-

I had a recently widowed client several years ago with an investment account and so, so many st transactions that had never happened when spouse was alive. I believed the client was being taken advantage of and suggested that she interview a couple of other investment firms to ask how they would manage her account. She swapped brokers within months. Sometimes you just have speak up to alert folks to the possible ramifications of what is happening. It is then their decision to do nothing or take a more active interest. Horse to water, etc.2 points

-

That was my thought. Never done a Solo 401K so watching this thread to see how to record it in ATX. I have my popcorn out ..... Tom Longview, TX2 points

-

We have to be careful with comments on clients' investments. I tell the client do not tell your advisor that your accountant thinks this is a terrible investment (learned the hard way). But I will speak my piece on Limited Partnerships and Publicly Traded Partnerships that brokers buy for a client without running it past them first and with no regard for the tax preparation consequences. I just told a client with what should be a simple return that last year their broker had invested $3,500 of their money in a PTP that generated a -$400 loss and about $1,000 worth of tax forms. Another PTP they owned had $30 income but about 20 entries on the K-1.2 points

-

For businesses, the first year is priced at $61. It then doubles to $122 for the second year and then doubles again in year three to $244. If you enter into the ESU program in year two, you’ll have to pay for year one as well since the ESUs are cumulative. On Wednesday, Microsoft updated its Windows IT Pro Blog post to note that the pricing listed applies to commercial organizations only and that details of consumer pricing “will be shared at a later date.” https://www.theverge.com/2024/4/3/24120093/microsoft-windows-10-extended-security-updates-price2 points

-

No, only the label for line 9 is unclear to you. Perhaps it should read "contributions made through and by employment". The instructions for line 9 are very clear. It says this line should include all contributions made by the employer AND by employee through a cafeteria plan. When the employee contributes through a cafeteria plan offered by the employer, the employer has the funds and acts in the capacity of agent to remit those funds to the HSA on behalf of the employee.2 points

-

When ATX barks at me about that, I just put a 0 in the employee contribution line (it will accept that) because the employee/employer contributions through the W2 (code W) all count the same, as mentioned above. Enter a '0' and the error will go away.2 points

-

I am considering direct debits of estimated tax payments for some older clients. Has anyone here had any issues using direct debits for that purpose? It seems like there has been some discussion here before but my search came up empty. Thank you for any comments you might have!1 point

-

So no Schedule C, I guess. My most recent clergy has no outside income either. I suggest you group as logically as you can. It seems odd to need many more lines outside of parsonage expenses.1 point

-

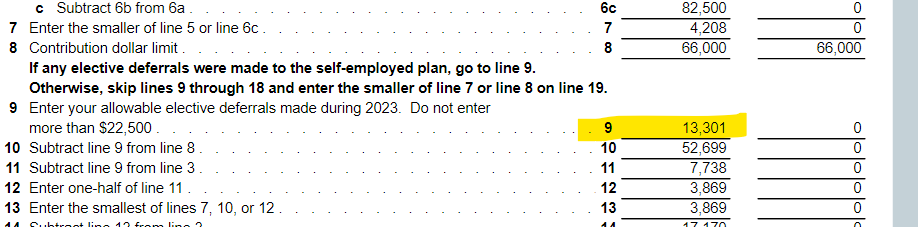

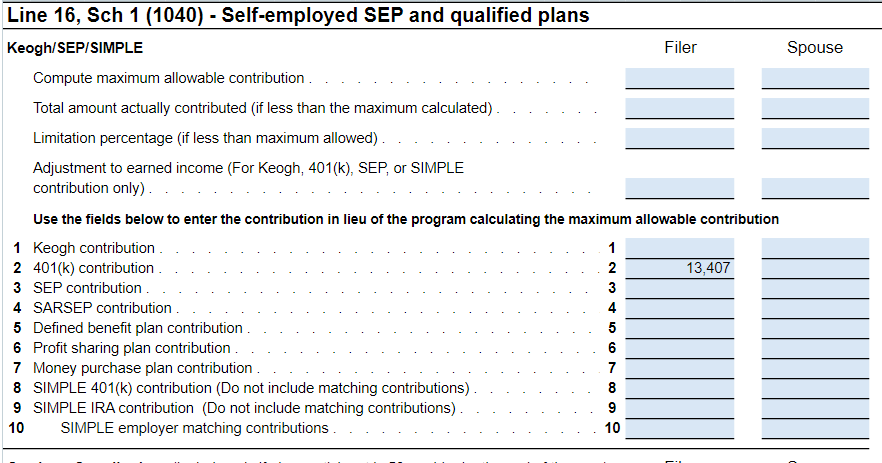

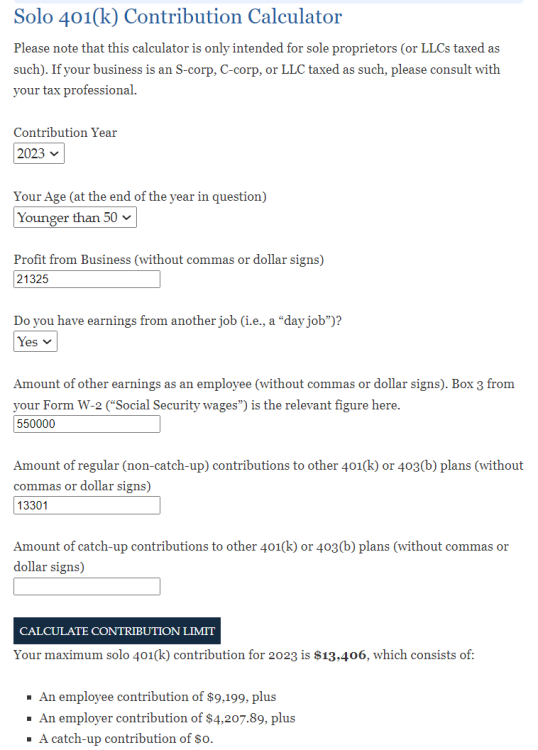

I believe this is accounted for in this area. ATX actually auto generates line 9 straight from the W2, box 12, Code D & E. But I tried putting in a ROTH 401k elective deferreal into the W2 data entry and it did NOT add to this amount so I'm even more baffled. Thanks @Abby Normal As you can see, this matches my own calculation. Given this is the line (Line 16, Sch 1) is where you're supposed to put the SOLO 401k contributions, this only way I can see inputting it correctly without an override is to manually do the math myself and add it here. If someone else figures it out, I'm all ears!1 point

-

Like Catherine, I always use the Transaction Summary from Drake and have the client sign. One time client yelled and screamed at me when there direct deposit was rejected. When I told them they would have to wait for a check in the mail they demanded that I give them the money because they needed it for a down payment on a car. I pointed out that they had signed the transaction summary verifying the bank info was correct and t hey told me they didn't read it first and it was all my fault. Needless to say they became ex-clients at that point.1 point

-

1 point

-

It's been too long since I've done one, but that's calculating a SEP. There's no 25% limit on 401ks, except on the employer portion.1 point

-

It's not really a safe harbor - for off-campus housing it's also the maximum - students living in a lavish penthouse cannot use the full actual costs, only the COA allowance. (For on-campus housing, you can use actual costs, if higher.) See https://www.law.cornell.edu/uscode/text/26/529#e_3_B_ii1 point

-

I also leave the amounts blank on the vouchers in case they want to change the payment amount.1 point

-

If he has a daughter who assists him, you might ask her to use DirectPay and your state equivalent. Instant confirmation.1 point

-

There's a current discussion in the Drake subforum here that touches on it. It works well, but there is no confirmation number or record without logging onto the IRS account or verifying through bank activity. I've used direct pay for the balance due but not for estimates. I really don't want that level of responsibility for clients' payments.1 point

-

So we can use the school estimate for living expenses as opposed to actual costs when looking at a distribution from a 529 plan to see if it was used for living expenses when at school (like a safe harbor) ? I had not heard that. Tom Longview, TX1 point

-

Under the FAFSA Simplification Act of 2020, which went into effect for the 2023-2024 school year, schools are required to compute a Cost of Attendance (COA) for each category of student (broken down into components), and must publish these on their website (it was optional before, though many did publish it). Note that schools may (but are not required to) adjust the published COA on a case-by-case basis for special or unusual circumstances, so the taxpayer may be able to obtain a different COA for their specific situation from the school (be sure to get it in writing). Also, under the new law, the "room and board" component was renamed to "living expenses", which may also be listed as "food and housing".1 point

-

Drake has an entire separate signature page for bank information. Very glad for that; it has caught some major client errors (not all) beforehand.1 point

-

1 point

-

Admittedly, I'm not the biggest fan of mutual funds to begin with. I have seen a trend this year: High income bracket taxpayers are receiving 1099-DIV statements showing an increased investment in Bond funds. Bond funds are usually high-levered, and are ALWAYS producing non-qualifying dividends. Are they so wise an investment that their return should outweigh the tax implications, as that is sometimes the case? I doubt it. The last year or two have seen interest rates rising, and that causes bond values to crash. The only explanation i have is that they are so hard for stockbrokers to sell that the commissions have created incentive for the stockbrokers. Unfortunately, for many of my clients, they simply trust their investment advisors to do what is best for them. Is this subject worthy of comment?0 points