Leaderboard

Popular Content

Showing content with the highest reputation on 04/09/2024 in all areas

-

You don't need form 1310. You can definitely request an extension by e-file. You should also be able to scan and attach the short certificate to the return itself and e-file that too. See below. For purposes of form 1310, executor is considered the "personal representative," so this return doesn't need the 1310. See below. Be sure to enter the name of the executor in the "c/o" name box in your input and change the address to that of the executor. This is what will be on the 1040. If you look at the instructions for "Who Must File" you don't need the form 1310 because son IS the personal representative of the estate, and for purpose of this form, the executor is considered the "personal representative". You should be able to scan the short certificate and attach that as a pdf for the return and e-file it. Please see the example as shown in the instructions to the 1310 below:5 points

-

You shouldn't need to paper file either if you get on it. I just efiled one where the taxpayer died in December.4 points

-

Anyone looking for a couple of CPE hours in late April, I'm presenting online. https://www.bigmarker.com/tax-practice-pro-inc1/When-1040s-Go-Wrong-Navigating-a-Tax-Train-Wreck @Lion EA saw the first presentation of this, live, last September.3 points

-

For me, this site is a place to learn, get answers, vent or commiserate, or just take a break during the day. It continues to be an invaluable resource that's been a part of my daily routine for 17 years. Eric has taken care of us from the site's inception, mostly unseen, and his work is ongoing. Soon he will migrate the forum to a new host and is waiting for us to get through the 15th before doing so. I've made a donation today and hope others here will consider that as well.2 points

-

BrewOne, no composite return; the partnership paid the PTET for this partner, so a NY return was required. I was able to finish the return, send to the TP and successfully efile the returns.2 points

-

Go into the same place you attached it and click on the icon to remove it. I think it's a red circle with a minus sign in it.2 points

-

i have a client who is 83 years old who is a business owner and is still very sharp and with it.2 points

-

Certainly, if the student isn't required to file. If the student will have to file, you have to look at the phaseout range of the AOC (above 160K MFJ, 80K other). At some point above that, the benefit to the parent will be offset by the cost to the student. Also note that the first $2000 of expenses generates a 100% credit, but the next $2000 only 25% credit, so a combined marginal rate above 25% for the student would make it not worthwhile to claim more than $2000.2 points

-

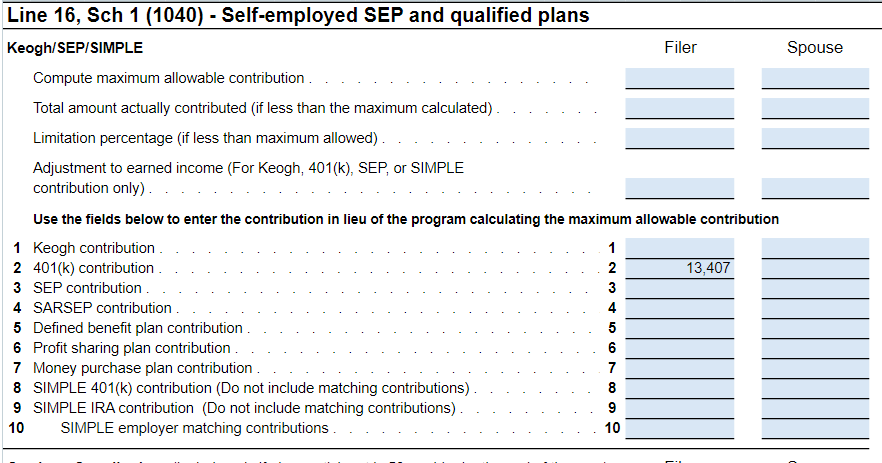

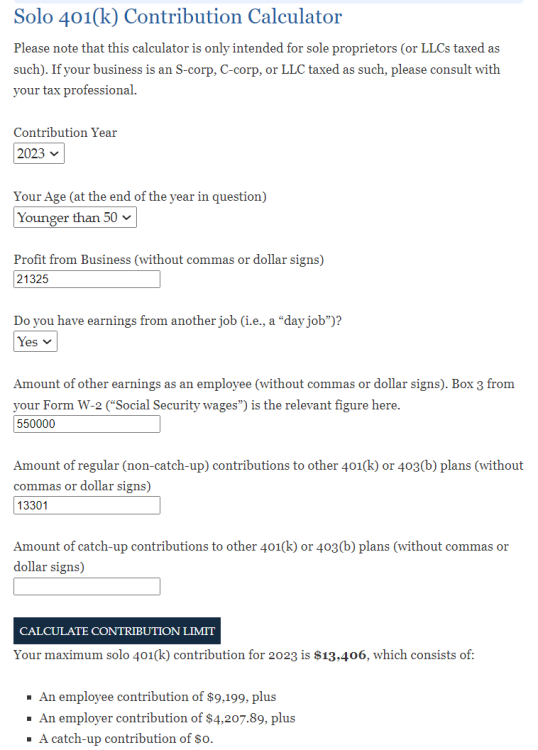

I do a separate calculation for the Solo 401(k) and keep it in the work papers file. I then enter it in the 401(k) contribution line as shown above. I haven't found any way to do it through ATX, and the complication (some of my people don't earn tons of income and still have Solo 401(k)s) of the catch-up and checking whether there is any eligibility for an 'employer' contribution, and then one guy has a day job where he defers, so there's that calculation ... I just need a spreadsheet, and then I have backup.2 points

-

If your client's daughter goes to the Americorp website, there should be an explanation for her W 2. Americorp has different programs with some strange tax rules that apply.1 point

-

My client is sharp too, just the ultimate procrastinator. His type of treatments won't cause any brain fog, but just one more thing in his day that's taking up time. I know about the cancer issues with my husband having had 3 types, 4 if we count minor skin cancer too. Throat, prostate, and TCC aggressive bladder cancer.1 point

-

Did the employee contribute his full wages to a 401(k) or 457 plan, health/dental/vision insurance, flexible spending accounts, or retirement and tax deferred savings plans? Is that even allowed?! If so, his contribution would NOT appear in Box 1 but would be taxed in Boxes 3-6.1 point

-

I think it means the return is accepted by the state / time stamped so it's like you've postmarked the envelope when mailing in a check.1 point

-

1 point

-

I agree wholeheartedly. I haven't been here much this year because it's been a crazy season for me but I always know that this is a place I can turn for good sound advice and knowledge. Thank you to Eric and to all who participate here. You are all appreciated very much. That said, I made my donation today.1 point

-

Lynn, you probably already looked, but just in case...did the pass-through entity have any kind of statement like "Composite Return has been filed for all qualified non-residents unless indicated otherwise"? I was stressing about one last year when I realized the partnership had already payed the tax.1 point

-

Speak to the wife and explain the situation and the two of you can come up with a solution. Cancer treatments can cause serious chemo brain fog as well as being 80 years old can cause brain fog. My route would be to do an extension and get a copy of the transcripts in late summer. The fact an 80 year old has a business is problematic.1 point

-

All you can do is file a zero-information federal extension. Gives him 6 months on the SOL to claim any refund, if he finally gets his docs to you next year. We are not their mommies and can't make them do anything. Nor can we allow ourselves to care more about their own taxes than they do. If he has late penalties and interest it's not your fault and there's nothing you could have done to fix it.1 point

-

I just had an extension. She never makes the estimated payments. Just one big one with the extension.1 point

-

I have a client who doesn't want to mess with making 4 different estimated payments, so I combine her estimates and she makes one payment on April 15th.1 point

-

1 point

-

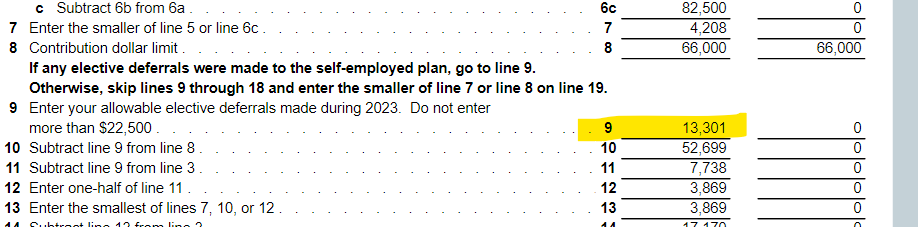

I believe this is accounted for in this area. ATX actually auto generates line 9 straight from the W2, box 12, Code D & E. But I tried putting in a ROTH 401k elective deferreal into the W2 data entry and it did NOT add to this amount so I'm even more baffled. Thanks @Abby Normal As you can see, this matches my own calculation. Given this is the line (Line 16, Sch 1) is where you're supposed to put the SOLO 401k contributions, this only way I can see inputting it correctly without an override is to manually do the math myself and add it here. If someone else figures it out, I'm all ears!1 point

-

It's been too long since I've done one, but that's calculating a SEP. There's no 25% limit on 401ks, except on the employer portion.1 point

-

The first thing to suspect when that kind of activity is going on, is a virus or other malware. This is the antivirus supplier I've used forever. https://www.eset.com/us/download/tools-and-utilities/1 point

-

1 point