Leaderboard

Popular Content

Showing content with the highest reputation on 04/15/2025 in all areas

-

8 points

-

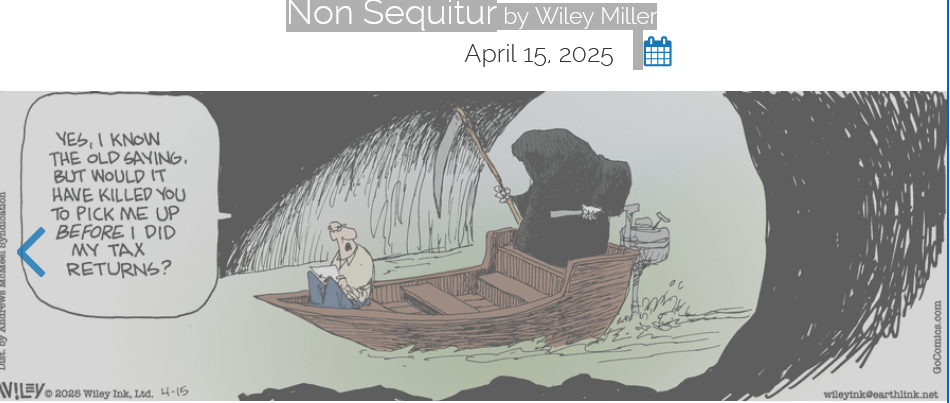

This is me but with a bottle of Chardonnay and wearing my flannel pants and I'm never coming out.5 points

-

Ditto but it was $4 and on depreciation. Total difference on a long list of assets; he hand-calculated and I used software. Of course it made no change to tax. I later suggested he find someone closer to home and to my very great relief he did. Any engineer is a potential royal PITA client and treated (and priced) as such until such time (rare) as they prove otherwise. Engineers don't know the difference between precise and accurate. They are related but not identical. While I know the IRS truncates, I cannot stop myself from rounding "properly" - as rounding is different from truncating.5 points

-

I spent an hour of my life that I will never get back debating rounding with an engineer. He wanted to know why his calculation of interest income differed by $2 from what was on his return. After I told him it was due to rounding, he asked if I rounded first, then added, or added first and then rounded. He proceeded to lecture me on why I should add all the interest first and then round. I explained how the software required that each 1099 had to be entered separately and would not allow me to enter the cents, so I had to round first. And how $2 did not change the amount of tax owed. He insisted I add $2 to his interest amount. Luckily he did not come back the next year.4 points

-

I notified two on 3/15 their returns were done. Radio silence. Since I no longer have a filter, today I sent a text to each "24 hours and counting." It's on them but I want the files out of my office. One replied "Oh. Sorry. I'm in France." The other called and said "what does that mean? I need to come pay you?" Then, I had another come to pick up and I wish I could show you all his check. Pay to the order of said one hundred fifty and zero. The next line was blank. It wasn't signed. I said "give me your checkbook! Here's how you write a check!" I wish my IRA didn't tank last week. I wish I was full retirement age. It's time to be done with all of this.4 points

-

you put your right foot in, you take your right foot out, you put your right foot in, and you shake it all about! good grief.4 points

-

to describe what yesterday was like. Today I want to hide under the desk. What is wrong with people?3 points

-

A lawyer would probably be talking statute of limitations. I'm thinking no penalties on taxpayer's reporting of item missing from a filed return, just interest--but that may just be the way things should work.3 points

-

100% agree! I've heard this termed "the midwit problem" with people who are reasonably smart & competent in their own areas of expertise mistakenly thinking that makes them smart & competent in every area. When they do it with tax returns, we get huge messes to clean up, for clients who will question and nit-pick over every bleeping line on the return. Charge accordingly, with pre-payment required.3 points

-

I usually only work a half day today. Take tomorrow off. Back on Thursday but I probably won't get much done. Fridays off the rest of the year. Semi-retired the rest of the year.3 points

-

3 points

-

3 points

-

https://obliviousinvestor.com/solo-401k-contribution-calculator/3 points

-

The rounding issue reminds me of the spreadsheet days of ATX. Most ALL calculations did NOT round, but "display" was globally set to zero decimal places. I had a client get a "nastygram"(TM Catherine, IIRC) over EIC when AGI was shown as yadda 50, but was actually yadda 49.70. Took forever to track down. I never entered cents after that, and any calculations that could produce decimals, were edited to include =round(x,n)!2 points

-

2 points

-

Engineers know more about anything than anybody about any subject. Some of the worst returns I've had to clean up have been self-prepared by Engineers who knew everything.2 points

-

2 points

-

2 points

-

Today may be worse !!!! But hey.... its the last day !! You can take a few weeks off then hit the extensions !!!! Get the booze ready for the after season party !!!!2 points

-

2 points

-

2 points

-

Almost all of my (rare) posts start with "I don't often chime in, but I appreciate your knowledge." At least once a day during tax season, I tell myself that I have no business doing taxes because I'm no longer qualified. Times have changed. Laws have changed and I took the wrong classes to try to stay up to date. I've done this for 38 years and I'm good at it. Until the weird thing hits my desk and I wonder if I'm smart enough to figure it out. It's April 14 and I'm on the edge. But you're not alone and you're not stupid. If you are? Then so am I. I can't wait for this time tomorrow.....2 points

-

The instant I think a client is not being truthful, they become an ex-client. That's a hard red line for me.2 points

-

For reference, this home based business does use water, including a steamer table that uses quite a bit.2 points

-

2 points

-

The IRS instructions tell us to round like we learned in school, up from .50 AND down. However, the IRS truncates numbers at the decimal point, essentially rounding DOWN ONLY. They make the rules, but they do NOT follow them!2 points

-

I'm getting old and spicy, and now, when people tell me something preposterous (or give me some crazy tax rule they 'know'), I look them straight in the eye and say, 'Did your hairdresser tell you that'? Stops them cold. Literally. You should try it. They look at me dumbfounded for a minute, then they usually chuckle, and then they remember that it's a 'fantasy tax scenario', and we never speak of it again. You have to be over 50 to pull this off, but I've now made the cut, and I use it every time.2 points

-

I went through my client list and gave everyone a 1 to 5 rating. 1's being clients that are a joy to work with, 2 and 3 room for improvement, 4's skating on thin ice but being given one more chance and 5's will be receiving an email to make other arrangements next year. 1's were over 50%, and 4-5 less than 10% but a source of excess frustration.1 point

-

I think that's really strange, because usually if there's a FTHB credit and a 5405 required, the efile will reject (in my experience ... having clients who didn't tell me they took said credit and needed to pay it back).1 point

-

I have a client (one shareholder S Corp and his personal return) who has been behind. In late 2024, we completed 2020 and 2021. Had to be paper filed. I haven't heard from him since but now the busy season is over, I'll remind him to get me the 2022 and 2023 quickly so we can get 2024 before the extension due date. We'll see.1 point

-

1 point

-

This Tax Advisor Article should be helpful where they discuss the meaning of a"Limited Partner" in name only: I give the law firm high marks for creativity but after you read this article you should file an extension and you will need to have a serious discussion with your client . https://www.thetaxadviser.com/issues/2024/may/limited-partners-and-self-employment-tax-a-new-test/1 point

-

1 point

-

1 point

-

@Patti in Upstate NY exactly. Mom is insufferable. Owns the S-Corp. Love the kids who get the K-1s. 4 total returns. @Sara EA Slowly raising the Corp and Mom. She is starting to notice. Afraid if I raise her too much she will tell the kids. Tom Longview, TX1 point

-

Examples copied from Forbes: "The extension payment date for taxpayers who log into the IRS website is showing as incorrect. While payment should be made by April 15, 2025, taxpayers who log in to pay see an April 22, 2025, due date. The site says, "Your payment is due on April 22, 2025, regradless of filing for an extension." (Yes, the 'regradless' typo is on the IRS site, too)." "Errors appear in other spots on the website, too, including misidentifying the amended tax form as Form 104X (it's Form 1040X) that was recently “filled” instead of “filed.” "Account holders report that previously filed and processed tax forms (for tax years 2022 and 2023) are showing as now being processed even though those returns have already been processed. (I verified the errors by logging into my account.)" "One tax professional reported that the installment agreement option for making payments over five years (for a total of 60 months) only allowed taxpayers to make payments for five months." "The errors have been reported to the IRS. In a statement issued to Forbes, Scott Artman, CPA, the CEO of the National Association of Tax Professionals (NATP), the largest nonprofit organization that serves individuals specializing in tax preparation, noted, “Tax professionals rely on accurate, timely guidance from the IRS, especially in the final days leading up to the deadline. As soon as this issue was confirmed, we brought it to the IRS’s attention and have been assured that it has been communicated to the appropriate internal teams with a request for prompt resolution. We are hopeful the IRS will address the issue quickly to avoid any confusion for taxpayers and preparers." We already have enough chaos and uncertainty1 point

-

Conspiracy theorists with the highest credentials who spoke on condition of anonomy claim the workers who were forced back to the office are sabotaging the end of tax season in their final days before exercising their buyouts. No one is available to confirm or deny these rumors. Film at 11. Tom Longview, TX1 point

-

Good thing there is a handy supply of paper right there to document your business purpose... Tom Longview, TX1 point

-

1 point

-

With all the poking and prodding going on in IRS systems, I'm afraid we may have another crash like 2018. Or even worse, they don't pick up the software generated withdrawal authorizations. I was planning on having everything submitted today but some clients can't seem to get their (*&^ together and get signed forms back.1 point

-

A client walks through the livingroom to get to the OIH, but we can't use the sq' of the LR as part of OIH. Regular and exclusive. My clients can use my hall bath, but it's not part of my OIH, so I wouldn't allocate the bathroom part of my water to my OIH. I keep changing sides on this. Probably 'cause I'm too sleepy to read the code.1 point

-

Without water, how does a client flush the toilet when they go to the restroom? Just asking for a friend. Tom Longview, TX1 point

-

I thought it was so preposterous I didn't even go into the other methods. There has to be concern as to whether such an expense is ordinary/necessary, and also whether we are being told the truth.1 point

-

You referred to the code once, then I asked about it. In your response to that question, you referred to a pub, not the code. Based on your answer, your conclusion, "Bottom line, water is not a cost of using a OIH so it is not allocable", doesn't logically flow from your premises. How much gas is used as an ordinary and necessary expense in a home office? Most of a house's gas is used to heat water for showers and laundry, to cook, and to heat the rest of the house 8760 hours a year compared to 2000 hours the home office is used. Yet the gas is allocated based on floor space. A 150 sq ft office in a 3000 sq ft home doesn't use 5% of the gas, yet 5% gets allocated to it. Same with electricity. How much electricity is used by the washer, dryer, oven, fridge, kids gaming computers, etc compared to a home office. Stop taking water & sewer on your clients' home offices if you want, but please don't choose this hill to die on. Unless something like a pool was involved, the irs has not disallowed water & sewer deduction for a home office, so why would you?1 point

-

And if he parks it at the house (commuting) or uses it to haul his daughter's furniture to her new apartment or stops at the grocery store on the way home or...he still better have a log to document biz/farm vs personal/commuting use.1 point

-

1 point

-

This discussion is now to the point where I have a huge smile on my face1 point

-

How do you know what the business is? They could be dog groomers, hairdresser, art / pottery classes. You are making lots of assumptions.1 point

-

This. If someone needs to make a few payments to get paid up for the year and don't want to do an official payment plan, I give them a few blank 1040-V forms and they mail them in with payment. The IRS will eventually bill them for interest owed. It's never been a problem.1 point

-

1 point