easytax

Members-

Posts

626 -

Joined

-

Last visited

-

Days Won

18

Everything posted by easytax

-

I tried ebay today (http://www.ebay.com/itm/Lot-10-20pcs-1G-1GB-Wholesale-Bulk-Credit-Card-USB-Flash-Drive-Blank-DIY-Memory/131909804747?_trksid=p2047675.c100005.m1851&_trkparms=aid%3D222007%26algo%3DSIC.MBE%26ao%3D2%26asc%3D38530%26meid%3Dc8dbbcd84e00400c9c5c073a282a0a74%26pid%3D100005%26rk%3D2%26rkt%3D6%26sd%3D261728681842 ) to check if a better price than I had found before. Found they went up a bit from my test buy some months ago (closer to $3 each in lots of 20). However you can still find some good drives for less than $2 each in small lots, just not the credit card type ones (regular type USB). Try an ebay.com search and there are a lot of players. The original ones I purchased were from a China source and I had to wait 2-3 weeks but planning ahead is my thing when possible. I was very happy with price, quality, shipping (no charge, etc.) and wanted to check for things such as "embedded" malware (I am paranoid when it comes to things such as this for client use) and such. All checked good and I am happy (except for small price increase found today). I will look again once I get closer to moving clients fully to this type delivery.

-

Consider going the other way --- no discount for PDF --- higher price for paper copy (realistic too - paper, toner, drum for printer, attachments (paper clips, etc.) along with time collating, checking all printed, etc.) A nice USB 2mb drive that looks like a credit card can be had for about $2.00 in small quantities (less than 50) - which is probably well below the PRINTING cost without including the time spent. Majority of mine are PDF (encrypted - check out www.PDFill.com for a good/easy encrypt tool). After this year I should be all USB drives (as soon as I run out of in-house supply of CD-s and covers, etc.). Since I do 99% computer with a few drop-offs this works very well for me. Also the clients appreciate NOT having the paper to file and have expressed that they (clients) are going away from CD's too; so the USB (credit card style) drives work great. By the way, yes you can get the USB drives as small as a thumb finger nail size - BUT - easy for client to lose -- whereas the credit card size is easier to keep. Enjoy the tax season!

-

It all is in the perspective ---- I have two clients that all they do is chat === phone === but a VERY different business than taxes. They make excellent dollars and set own hours, etc. with a very restrictive/different cliental. They enjoy "chatting" but it is definitely not for everyone.

-

Another IRS Update webinar Dec. 13, 2016 from Stakeholders --- does NOT mention this but possibly they will have more info then???? Here is the PDF from the email: Richard Furlong Sr. Stakeholder Liaison Internal Revenue Service 2016TaxLawUpdatesWebinar 112816.pdf

-

Rita, Is the following -- why -- you really are not worrying about this -- right now? That IS YOU -- right? //// Nov 26 (Reuters) - A lottery ticket sold in Tennessee had the winning numbers for a $421 million Powerball jackpot, one of the biggest on record, officials said after Saturday's draw. The winning numbers selected were 17, 19, 21, 37, 44, with the Powerball 16. No one as yet had stepped forward to claim the prize, which grew in size since Sept. 17, the last time anyone matched all six numbers. The jackpot soared from $403 million to a reported $420.9 million on Saturday due to a spate of late ticket-buying. The prize is paid out over 30 years, with the option of a lump sum payment, which officials said would add up to about $254.7 million.

-

-

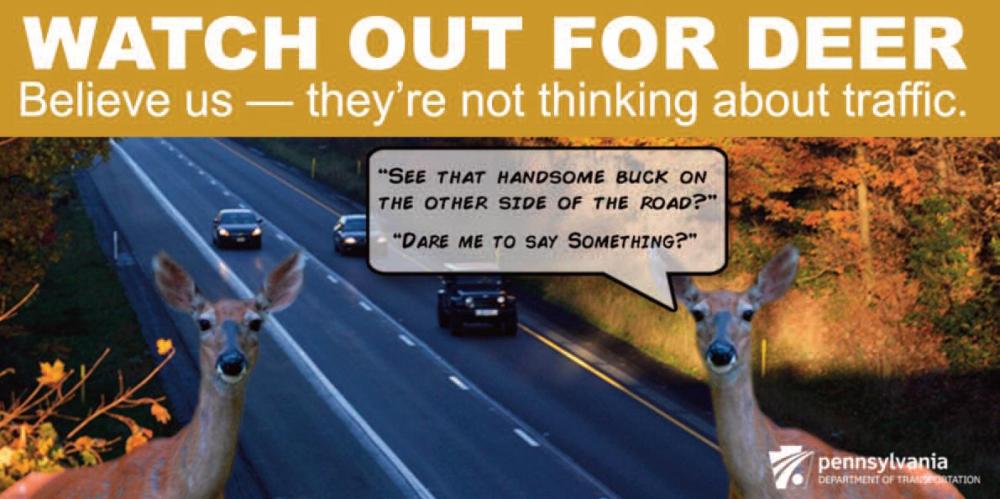

Happy Thanksgiving !!! to all, be Blessed and enjoy family, friends and even your enemies (it will drive them crazy). and REMEMBER -- watch those deer:

-

You are on the best path (I7, 16 gig ram, 1 TB hard drive. Not sure yet about win 10 but we seem to be going there anyway (computers in general) The "bit better" might be things such as SSD (basically a hard drive that does not move) but they do add some expense (getting less expensive as time goes on). Many of the folks I know have gone to SSD for the initial drive (where operating system resides) for the quicker boot-up. Some have gone to SSD for "storage" but many still use the basic hard drives. 1 TB hard drive is good but depending on how many records, etc. you keep, perhaps 2 or even 3 TB (they can be had for not all that much more at times) might serve you well too. If you want to keep the system for a while and want the continued quickness consider possibly going up to 24 or 32 gig ram. Many programs can use the ram for normal operation and do not need to access the "hard drive" as often - so more ram the better and the easier access for your system. By the way, will you be using a 64 bit or 32 bit system --- 64 will operate a bit faster (you may not notice but the computer will). Pricing seems about right ---- make sure you also have a good graphics card (multiple monitor availability) and that the card will "stand-up" to heavy use --- some systems offered have good spec's all around but fall short with the graphics. Many are integrated (means a built-in part of the mother board) which uses YOUR ram not there own). This basically means your 16 gig ram might only have 8 or 12 gigs available for your processing while the balance is used for graphic, etc. Another reason for higher ram needed to perform best, in some systems. As processors change (a lot sometimes) go to the Intel site and review the specs. Some I5 might be as good as an I7 and son on. Also CNET.com has good tutorials on spec'ing computers. I use them as "I know enough to make problems for myself" but do not use that knowledge enough to always remember what-is-what; so I relearn as needed. If you can understand and do taxes, computers are "different" but not nearly as exasperating as government regulations (close maybe - your call). Have a good Thanksgiving and even better holidays to come!

-

Here is the notice on this from the ATX site: 1040 MeF Shutdown/Cutover Schedule IRS has announced that they will stop accepting returns and delivering acks at 11:59am EST Wednesday November 30, 2016. Included in this announcement are e-files for Tax Years 2013, 2014 and 2015. Accordingly, state acknowledgements must be uploaded to IRS by those respective agencies prior to that time. To ensure that we comply with these deadlines and allow ample processing time, the following process will be observed for both TaxWise and ATX submissions: Individual returns (both Federal and State) for Processing Year 2016 will not be accepted after 11:59 p.m.EST on Tuesday November 29th. Not all state agencies process returns in “real-time”, so we are allowing sufficient time for the agencies to post their acknowledgements for pick-up. After the cutoff time, the Electronic Filing Center (EFC) will not accept Individual Returns (Federal and State) until IRS comes back online in January 2017 with the exact date to be announced at a later time. Customers may continue picking up acknowledgements from the EFC through mid-December. 1040 efile open date has not been officially announced. At that time, current year 2016 returns plus 2015 and 2014 prior year returns will be efileable. Business MeF Shutdown/Cutover Schedule IRS will release the dates in early December; as a reference, last year's cutover occurred the week of Christmas. ATX EFC stops sending efiles a day or two before the IRS official cutover date. Acks not retrieved by the cutover date will be available when IRS reopens in early January. Business efile open date has not been announced. At that time, current year 2016 returns plus 2015 and 2014 prior year returns will be efileable.

-

SaraEA, Business has been around for more than 30 years plus (outside regular legal community) - around much longer with just some "legal" providers doing this type business. A good company (they are regulated) is usually as Illmas has shown does NOT treat this as a loan (just an advance against POSSIBLE settlement dollars). Yes the "charges" are high and typically clients are actually "pushed" to NOT USE this financing source if they have ANYOTHER type of monies available because of the high charges. The clients attorneys' are typically involved as they must supply a lot of information on the suit for the advancement company to consider Before the case is accepted. SaraEA, As you seem to like new ideas and information - I am will PM you some OLD LINKS to my web page describing some of the business. (NOTE: I am out of this because of some medical things, but got involved 20 + years ago).

-

Second (and Subsequent) Year Installment Agreements

easytax replied to RitaB's topic in General Chat

Rita, Did you already have your written authorization to share the clients information with her????? I ask this for three reasons --- want to keep you around for your knowledge; want to keep you available to "hug" clients (yours or mine) in the future; and also as a genuine question in thinking about who (other than actual client) we can "officially" and safely share information with (even basics) such as this --- without formal authorization to "protect" ourselves. Be well, have a GREAT Thanksgiving and keep on "hugging" and giving .... -

Just some FYI. Received this today (10/08/2016) from: KCC Class Action Services <[email protected]> CLAIM ID: 10527616 If you paid the IRS a fee to obtain or renew your Preparer Tax Identification Number (PTIN), a class action lawsuit may affect your rights. Tax return preparers filed this lawsuit against the United States claiming that they have been wrongfully required to pay PTIN fees set by the Internal Revenue Service (IRS) in 2010 at $64.25 and $63, and in November 2015 at $50. The lawsuit, Steele v. United States, Case No. 1:14-cv-1523-RCL, is pending in the U.S. District Court for the District of Columbia. The Court decided this lawsuit should be a class action on behalf of a “Class,” or group of people that could include you. There is no money available now and no guarantee that there will be. Are you included? IRS records indicate that you paid to obtain or renew your PTIN on or after September 30, 2010. The Class includes everyone that paid a PTIN application or renewal fee on or after September 30, 2010. What is this lawsuit about? The lawsuit claims that Congress has not authorized the IRS to charge fees for the application for or renewal of a PTIN. The complaint also alleges that if the Court decides that the IRS does have the authority to charge a fee for the application for or renewal of a PTIN, the fees charged by the IRS are excessive. The lawsuit seeks to prevent the IRS from charging PTIN fees, seeks the recovery of either all PTIN fees paid or the excessive portion of the PTIN fees, and challenges the annual PTIN filing requirements. The United States denies these claims and contends that the IRS has authority to charge the amounts it has charged for the application for and renewal of PTINs. The Court has not decided who is right. The lawyers for the Class will have to prove their claims in Court. Who represents you? The Court has appointed Motley Rice LLC to represent the Class as “Class Counsel.” Three other firms are also serving as counsel. You don’t have to pay Class Counsel or anyone else to participate. If Class Counsel obtains money or benefits for the Class, they will ask the Court for an award of fees and costs, which will be paid out of any money recovered for the Class. What are your options? If you are a Class Member, you have a right to stay in the Class or be excluded from the lawsuit. OPTION 1. Do nothing. Stay in the lawsuit. If you do nothing, you are choosing to stay in the Class. You will be legally bound by all orders and judgments of the Court, and you won’t be able to sue the United States for the claims made in this lawsuit. If money or benefits are obtained, you will be able to obtain a share. There is no guarantee that the lawsuit will be successful. OPTION 2. Exclude yourself from the lawsuit. Alternatively, you have the right to not be part of this lawsuit by excluding yourself or “opting out” of the Class. If you exclude yourself, you cannot get any money from this lawsuit if any is obtained, but you will keep your right to separately sue the United States over the legal issues in this case. If you do not wish to stay in the Class, you must send a letter to the address below postmarked by December 7, 2016, saying that you want to be excluded from Steele v. United States, Case No. 1:14-cv-1523-RCL. You must include your name, address, telephone number, email address, and signature. If you choose this option, you should talk to a lawyer soon because your claims may be subject to a statute of limitations which sets a deadline for filing the lawsuit within a certain period of time. How do I find out more about this lawsuit? For a detailed notice and other documents about this lawsuit and your rights, go to www.PTINClassAction.com, call 1-866-483-8621, write to PTIN Fees Class Action Administrator, PO Box 30245, College Station, TX 77842-3245, or call Class Counsel at 1-800-447-4645. 1-866-483-8621 OR www.PTINClassAction.com

-

- 2

-

-

On the "scams" about owing taxes, etc.. Here is a url for an article about "India Call Centers" taking in (this case alone) $150 K daily (55 M - yearly) "collecting IRS taxes. Doesn't matter to them if they REALLY WERE OWED OR NOT, collections were good regardless. They did good business and had numerous floors of offices and affiliates to get the needed information (U.S. based and others). http://www.msn.com/en-us/money/companies/fake-call-centers-in-india-scam-americans-of-millions/ar-BBx4xsM?li=BBnb7Kz

-

So you are saying I should get a newer model????

-

Here is the URL for the article: http://www.msn.com/en-us/money/retirement/irs-eases-a-costly-tax-pitfall-for-retirement-savers/ar-BBw19wz?li=BBnbfcN Here is the gist (paraphrased): Savers moving money from a 401(k)to an IRA, or from one IRA to another, were allowed only 60 days to have those funds in their possession before depositing them into the next retirement account. Those who missed that window generally owed taxes on the full amount and, if they were under age 59½, an additional penalty on top of that. To avoid that huge risk, many financial advisers suggested doing a direct transfer instead of taking the money yourself. New guidance from the IRS (https://www.irs.gov/pub/irs-drop/rp-16-47.pdf) says taxpayers can avoid the dire tax treatment in certain circumstances, including if they lost the distribution check or deposited it into an account they mistakenly thought was a qualified retirement account. This caused not only taxes and penalties but saw the affected sums lose their tax-advantaged status. There is/was a costly appeals process that few offenders followed up on. The new guidance goes into effect immediately. It allows savers to make a written self-certification on why they missed the window. Among other acceptable circumstances listed: The taxpayer’s principal residence was severely damaged. A member of the taxpayer’s family died. The taxpayer or a family member was seriously ill. A postal error occurred. This relief doesn’t change the best practice when it comes to rolling over 401(k) and IRA funds. It’s still best to do the transfer directly, from financial institution to financial institution, without taking possession of the money.

-

- 3

-

-

I do NOT do or handle trusts so am asking for "knowledge" sake. Are not the trust and the beneficiary two different entities? If so, then the trust owing or doing any taxable things would be separate from the beneficiary? That they both happened in the same year does not negate the two occurrences being for different entities? The end result that goes to the beneficiary would be after trust does what the trust needs to do to "do the right thing"? Again, I am curious and do not know if these are correct questions or not. Either way, THANKS for information.

-

Agree with the part about getting a "good" attorney involved. Given the statement "Aunt asked my client to split her proceeds equally with 2 other cousins" is probably not (I also am NOT an attorney, etc.. -- so get one for certification) binding as a will. If the will states, then it may work as suggested. If will is different, then should the recipient cousin get the money, she would be "gifting" the other cousins -- (????). Devil (and taxes) are in the WRITTEN details. Nice of the first cousin to be willing to do what the aunt asked, but legally -- even if she disclaims a portion of the inheritance --- it is NOT specified that that disclaiming would be to the other cousins -- that is (probably, maybe) in the will as the residual, etc. estate, etc. Will dictates (in writing, etc.) -- wishes (verbal, etc.) mean nothing (legally) only muddy things.

-

Agree with both --- however --- given it is August --- CO is beautiful state to be married in --- even with a three week waiting (/s) they will make the time table. With their apparent reasoning to "have the situation - their way" regardless of government rules, they might be a "client - of poor recourse". Save headaches and let them do what they want --- but with someone else fighting the future IRS notices, etc..

-

Think positive AND look for a place that had a murder or (even better) multiple incidents ---- condition seems to be good in many BUT price is typically very below comp. value.

-

7/29 is finally here. No more Win10 upgrade shennanigans (hopefully)

easytax replied to Abby Normal's topic in General Chat

After all the pushing and then finally have the folks here tell us about the "do not disturb program" so Win 10 try's stop ///// I decided to do an upgrade .... Lo and behold --- I can NOT, as the installer states my display is not Win 10 compatible and see supplier, etc. Go figure Enjoy the warm season. -

Keep it going thru July 4th! HOPE THERE ISN'T ANYONE ON MY E-MAIL LIST THAT WON'T ....... KEEP THIS GOING. Let' s get this started ,NOW! So it will be out there on the fourth! I PLEDGE ALLEGIANCE TO THE FLAG, OF THE UNITED STATES OF AMERICA , AND TO THE REPUBLIC, FOR WHICH IT STANDS, ONE NATION UNDER GOD, INDIVISIBLE, WITH LIBERTY AND JUSTICE FOR ALL! KEEP IT LIT!!KEEP IT LIT! For all of our other military personnel, where ever they may be. Please Support all of the troops defending our Country. And God Bless our Military Who are protecting our Country for our Freedom. Thanks to them, and their sacrifices, we can celebrate the 4th of July. We must never forget who gets the credit for the freedoms we have, Of which we should be eternally grateful. I watched the flag pass by one day. It fluttered in the breeze. A young Marine saluted it, And then he stood at ease. I looked at him in uniform; So young, so tall, so proud. With hair cut square and eyes alert, He'd stand out in any crowd. I thought how many men like him Had fallen through the years. How many died on foreign soil; How many mothers' tears? How many pilots' planes shot down? How many died at sea? How many foxholes were soldiers' graves? NO, FREEDOM ISN'T FREE ! I heard the sound of Taps one night, When everything was still. I listened to the bugler play And felt a sudden chill. I wondered just how many times That Taps had meant 'Amen.' When a flag had draped a coffin Of a brother or a friend. I thought of all the children, Of the mothers and the wives, Of fathers, sons and husbands With interrupted lives. I thought about a graveyard At the bottom of the sea. Of unmarked graves in Arlington . NO FREEDOM ISN'T FREE Enjoy Your Freedom And God Bless Our Troops. When you receive this, Please stop for a moment And say a prayer for our servicemen. Of all the gifts you could give a U.S. Soldier, prayer is the very best one. THANK YOU .........

-

/s BUT THEY are God and can do everything ...... at least --- what their lobby says (maybe because they write the law wording too???) Sore spot for me as I do believe strongly in tax education and having to stay abreast/ahead of what changes ----- but attorneys only need to keep CE's etc. for attorney things and still get to be "ALL" to everyone and everything. (yes, a good attorney usually only does what they should/might have ACTUAL training to do --- BUT ALL get a pass on most else, because of them writing law, etc.) Hence we can not "legally" basically issue or do something attorneys have clerks do and do not really require knowledge or thought (no insult intended to clerks, etc.) but attorneys CAN state tax law even without actually knowing tax law, etc.. rant over --- have a GREAT day.

-

When you purchased your 2011 system, it sounds like you were VERY smart and did the top spec's that were far above the current needs for that day/time. Continue with that thinking and you should be fine. Heavy on the RAM, highest processor with "game type" speed and highest bit reasonably available. Yes the SSD for both storage and initial boot. The thought on OS --- (mine) which may be at odds with most thoughts is to go with WIN 10. Several reasons -- WIN 7 is going out (still good for probably 3-6 years but going anyway); so a new system with the most current OS that should (hopefully - given MS wanting to keep growing money) with all NEW things bring written for WIN 10 and such should serve you well. Also, since this is a "slower" time for you, you can learn the new OS easier and also make sure all the "programs" you want to use are functionable and available (or find replacements, etc.), when you are NOT pushed to "get-er-done". Others will have more ideas, but that is my 1 1/2 cents worth. Be well, enjoy the sun and keep on forming! (this forum at least) --

-

Sounds like a perfect place to mention ---- have this in your engagement letter or at least as part of the policy you share with the client --- I will keep documents until you pick them up //// up to 3-4-5 whatever years and then destroy them /// this protects you should they then come back complaining ---"I did not know; was not informed, etc.. In today's society -- protection is the way to think ---- (again, an enemy is less likely to harm you -- because you do not normally let them close /// while a friend, family will -- because of who they are --- they have access).

-

Curious here??? Transfer is mentioned --- not gifting /// would that be an automatic "thing" or would gift tax (forms at least) have to be filed ---- if no forms, was it a gift??? Also, second transfer was for a stipulated amount --- would that not be the "basis" now? Also, same question; was gifted if no forms, etc.?? Even with forms, I thought (yes, I could be wrong) that even if the FMV was as an example, say 325K but the sale to child was 212K with the gift tax forms showing the gift of 113K, that the basis would still be 212K if/when child later sold property???? Second part/// if gift tax not filed, is there a limit of "later" filing that might correct or make it a "gift"? I know, statute of limitations does not start until gift tax is filed (for gift tax purposes), just not clear if gift tax filing can be done in arrears, etc.. NOTE: Gift tax not my usual and definitely not strong point; so asking both for knowledge and possible need for client correction on my part. Thanks in advance.