Leaderboard

Popular Content

Showing content with the highest reputation on 02/20/2019 in all areas

-

2 points

-

2 points

-

My take is contributions to an IRA reduce gross income from wages and not from business related activities. The income from any pass thru entities is used to calculated QBI on the 1040 as the starting point. The plans on line 7, 8 & 9 of the worksheet I posted are all items relating to self-employment or from a pass thru. The business income from the partnership is entered on line 6 of the 1040, the IRA contributions are an adjustment to that income. Remember the QBI is a below the line adjustment that is entered after the standard or itemized deduction. The QBI is calculated as I said earlier by deducting the items on the worksheet and then the 20% is deducted from the lesser of taxable income or QBI. Better stated, the IRA is a personal contribution not related to business activities which is why it is not included in the QBI calculation. Again, I think we are all way overthinking this process thus leading to additional confusion. I'm not pointing at anyone and am including myself as well. GGRNY made a statement about simple IRA's. They are part of line 8 of the worksheet because they have some connection to the business activity. I hope I have helped here and not added any more confusion.2 points

-

Excess capital losses die with the decedent. I had one where over 320k was lost. You can claim the 3k against ordinary income.2 points

-

1 point

-

Is this ATX? I've never seen an error to remove the 8962 and I've filed plenty over 401%. You need the 8962 to repay the APTC.1 point

-

Wow, thanks for all your input! I just got back to this. I agree with @Terry D. Clients like this are why I drink. Not really. Fine wine is the reason I drink... I'll prepare the return as is. I'll deal with insolvency on the date the debt was cancelled. And I should get a snapshot of the insolvency on the date of the sale in case that is the date of forgiven debt... if it is forgiven... if the 1099C is ever issued. I feel like a dagger is coming at me. I don't own this. I don't own this. I don't own this. Ok, I'm ok. breathe..... Those worksheets are a beautiful thing, aren't they? Thanks. So. Much.1 point

-

1 point

-

Yeah, I know the IRA/401/etc. is controversial, but your reply answers my question. Thanks again. P.S. I have a large-scale rentals client who may help solve the three-page debate raging below. He's so tight that if it costs him more than twenty bucks, he'll take it to the Supreme Court.1 point

-

No. the SE-related items come into play in calculating QBI at the beginning. Once taxpayers' AGI is in the phase-out range, then wages or wages/assets enter the calculation to re-calculate QBI.1 point

-

Do an insolvency calculation immediately before the sale to see if you can exclude when the 1099C comes. I think this is covered in one of the pubs. Something in the back of my head says the adjusted basis of the property may not exceed the amount of the debt cancelled. But don't quote me on that, I don't have time to make sure I am right. Tom Modesto, CA1 point

-

Only thing I see is prepare the return from the Hud1 which should show all of the terms of the sale. If the clients get a 1099C, then amend. Client's like this drive me crazy. Explain to them upfront what the possibilities are, maybe make notes to give them to CYA.1 point

-

And I don't think they can be carried over by surviving spouse. I know NOL can't, not sure about capital loss.1 point

-

I don't know about extra time, but I have my own Vanguard and Fidelity 1099s. I did get one TD about a week ago, but that's it. I've done 68 returns so far on track for my usual 110 by the end of the month. But surprisingly I've gotten none in the mail Tuesday after the long weekend. I would have expected at least a half dozen.1 point

-

The estate paid the expenses in 2018 so will deduct them in 2018. (Just like if you didn't pay the house taxes for two years and then paid them all at once, you would deduct them in the year paid, not the year incurred.) Taxes and legal fees and the like are deducted from estate income. Things like maintenance and utilities are also deducted from income, subject to the 2% AGI limitation (yes, estates still get that as far as I know). If the estate had no income, the whole thing is moot. When the estate closes it passes on "excess deductions on termination" (expenses it couldn't take because it had no income) to the beneficiaries, who can no longer use them on their Sch A misc deductions.1 point

-

Client appointments are as usual, or maybe a bit lighter. Drop offs are down somewhat. I think one culprit is the brokerages. I have not seen a single consolidated 1099 from Wells Fargo, Schwab, TD, Fidelity, etc yet. I thought they had to mail them by Feb 15, but some got extensions until the end of Feb. Did they all get extra time this year?1 point

-

Lynn is correct. When the estate return is marked final, the entire loss flows through to the beneficiaries. They can use it to offset cap gains on their personal returns and then up to $3k per year until used. What is lost with the TCJA is their ability to use estate expenses (attorney, probate, notice, tax prep fees etc). These used to flow through on the K1 and the beneficiaries could add them to their Sch A Misc 2% deductions. That category is now gone.1 point

-

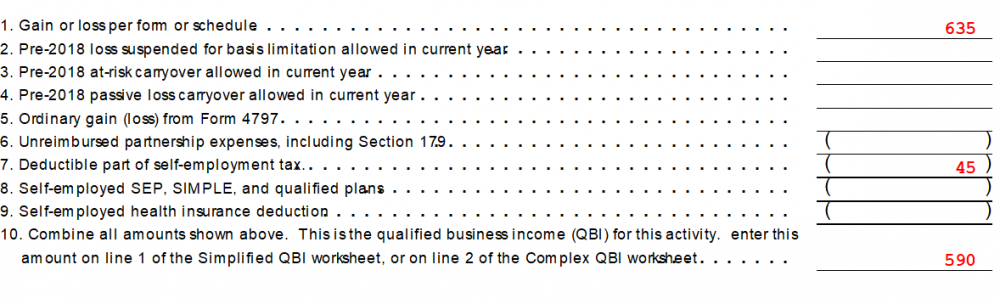

A snip of the worksheet from Drake is attached. This is for a client that has a Sch C business. Line items 6 thru 9 show the deductible items from QBI. I don't see anything here regarding IRA's. So, I agree with PaulH if the commercial software is not deducting IRA deductions then I won't be adjusting them either. Why Drake does provide overriding capability, they do not provide a line with the words other deductions to enter anything. I think we all are way over thinking this at times and are our own world worst enemies. Trust me I'm including myself in the group as this QBI stuff has made me crazy.1 point

-

The 1041should gave ‘initial’ , ‘final’ boxes to check in the section just below the address on the first page. When prepping the k-1’s they too should have a ‘final’ box to check.1 point

-

When I first started, I made attempts that weren't working, so I posted them on AutoHotkey forums and the related reddit, and strangers were more than willing to help me fix my code. Some of the code I copied from them, I still don't fully understand, but basic scripts like having je= type my (Joe's) email address, ad= typing my street address are so easy to write and great time savers and eliminate typos as well. Last year I wrote one to type my ATX password. I don't even know what my password is anymore, but I can look it up in my script, or just run in it notepad.1 point

-

Thanks! I have tried to call ATX a number of times and don't seem to get through to anyone. If all I need to do is change my information in the Preparer/ERO tab that will be easy to do. Thanks again.1 point

-

The regs (page 198) say "deductions such as the deductible portion of the tax on self-employment income under section 164(f), the self-employed health insurance deduction under section 162(l), and the deduction for contributions to qualified retirement plans under section 404 are considered attributable to a trade or business to the extent that the individual’s gross income from the trade or business is taken into account in calculating the allowable deduction, on a proportionate basis to the gross income received from the trade or business." So if Schedule C is the only earned income, then its gross income is taken into account in calculating the IRA deduction, and it sounds to me like the traditional IRA deduction is "attributable to the trade or business". Having said that, I probably won't be subtracting IRA deductions from QBI if the commercial software developers don't do it. So far I haven't had to file one, and I'm hoping for more clarification before I need to decide.1 point

-

I am inclined to agree with GGRNY. IRA's will be accounted for in the limitation on taxable income, but not the original calculation of QBI unless somehow connected to the business. But I could be wrong.1 point

-

I believe you have to reduce the QBI income only for simple IRAs because these retirement plans are put in place in direct connection with a small business. Same goes for SEP & Solo 401ks. Traditional and ROTH IRA contributions can be made by anyone, regardless of self employment status so that's why I don't believe these are part of the QBI equation. Many of the regulations use the term "effectively connected income" or "in relation to QBI" so the way I'm applying this is if it's related, connected or stemming from the qualified business income in some capacity, it's probably a factor in determining the QBI amount.1 point

-

I'm not convinced anybody really knows. I read the regs to say that if Schedule C is the only source of earned income that makes an IRA deduction possible, it should be subtracted from QBI. But I see lots of opinions on the net that say don't subtract an IRA, and workpapers from Drake and Turbotax that apparently don't subtract an IRA. The IRS says (1040 instructions and Pub 535) subtractions from QBI include but are not limited to SEP, SIMPLE, 401K, but doesn't address traditional IRAs. ATX seems to be stalling, and I won't be surprised if the worksheet that finally comes out (if it ever does) doesn't address the issue, but instead makes you list the subtractions with no help from them.1 point

-

I guess Abby they figure dead men tell no tales. Now we know where they recoup those mileage depreciation losses.1 point