Leaderboard

Popular Content

Showing content with the highest reputation on 01/04/2020 in all areas

-

Lion, perhaps if you clear your browser history it will make a difference ?1 point

-

Interesting. My view is the same in both Firefox and Chrome. You must save a screenshot and then share that file as an attachment. Once you've uploaded the attachment, within the attachment there will be clickable "+" and a trashcan. Clicking on the "+" within the attachment will insert it into your post where the cursor is positioned at the time. There is a pinned post with more about attachments that is in the "Help" section.1 point

-

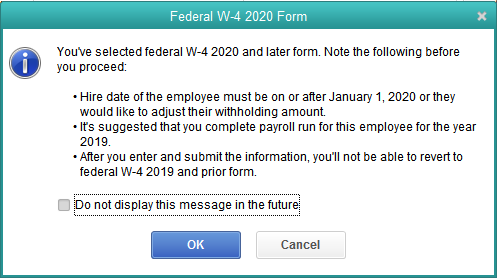

If only those who have to follow the rules made the rules... we would put ourselves out of work because the rules would be simple enough for most to actually follow. If my tax prepare is unwilling to help me with a tax form (which the W4 is), then I would be looking for another preparer. But, that person is me, and I am not about to fire me, yet . The IRS tells employers to direct the employee to the IRS tools, so that advice is not wrong. Not really the best advice, but not wrong. I can see it now, and it has happened (Carnac speaking). Employer helps employee. Employee ends up owing. Employee gripes at preparer as to why they owe. They shop for another preparer, none who can magically make a refund out of a mess. Preparer then, rightly so, directs the employee to the employer, wo was giving tax advice. Still a Catch-22. Still, my lowly opinion, the preparer is the only accurate (if not proper) place to review stub(s) and W4 for proper withholding to meet whatever magic figure the employee and preparer come up with for the annual withholding. This has happened in my own extended family, surprise bill with tax return, and no one claims to be responsible. So, for employers, they already have direction to follow, give the suggested notices and suggested information the tax agencies provide. The IRS suggested notice is reasonably well done this time.1 point

-

And furthermore...: If the employee's too stupid to figure it out AND the employer's not supposed to be allowed into the fray at all under any circumstances AND I (for sure) don't want to do it THEN who the heck will be filling it out? If it's you, then it's practically a given that the employee is going to ask the employer for help first. So, when the employer comes to you with it and asks what to do about it - Am I to understand that you're going to tell him to send the employee to you AND you (the tax expert in question) are going to tell the employee that he must fill it out because you are obligated NOT to give him any "tax or legal advice" (plus he owes you 50 bucks)? Won't he/she think you're nuts? How are you going to help him without helping him? Just thought of some sweet revenge: I'm going to tell them to call the IRS toll-free number for advice and there'll be a short () wait on hold. Should be quite a bit of fun when they finally get through.1 point

-

1 point

-

I have one client that requires a new W4 EVERY January- it seems to be the only way we get current addresses for his employees.1 point

-

Happy New Year to everyone here! I started the year with a nasty cold that turned into bronchitis, but that is getting better. All my tax season letters (that go by mail) are out today. The electronic ones will go maybe tomorrow or Saturday. It begins again!1 point

-

Everything I have read is they can keep their current W4 however they want to make any changes they have to use the new one.1 point

-

This forum, this site, is invaluable to me. I've come to highly depend upon those who give of their time and expertise and answer the many questions that are posted here. I also appreciate all that is involved in technically allowing it to happen. I gladly contribute. While I'm not looking for any recognition of my contribution, I personally do not feel the "Donor" tag is inappropriate. If the decision is made to remove it fine. If the decision is made to keep it, in my opinion it should reflect donors from the current calendar year. Maybe the Donor tag is reset on 1/1 each year? Again...just some thoughts to consider and obviously there are many scenario's that a "reset" would not be beneficial....especially to those who donate late in the year. Eric...can the "Donate" designation be reset on the one year anniversary of the donation?1 point

-

I hadn't considered that, thank you for pointing it out. I'll give this some thought... I'm not going to make any changes hastily, and will probably look to you folks for feedback before doing anything.1 point

-

Personally, I don't like the donor label at all. I wish it would go away. Not my site, so not my call, but I would not want anyone to feel uncomfortable that they are not a donor. I usually give one time per year, and when that label came about, it was a few months before I hit the button. I felt kinda weird as one of the regulars on the board without a donor designation. I believe Eric knows how I feel about him and his work, and I would be willing to give more if he ever asked. He hasn't, I give something every year, I have no idea how that stacks up to the giving of others and I don't care. Eric has my contact info and could PM me if he thought I was slacking on what I give, and I would not be offended if he did. He has never said what it takes to run the site nor made a suggestion on what each of us should give to keep it going. That is his choice and I respect it. Just my 2 cents. Tom Modesto, CA1 point

-

Eric, All of us benefit from this forum and we should be more thankful to you. I am voting for yearly "donors" pin decorations.1 point

-

No, they don't expire. I believe it says Active because it's basically treated as a subscription... but since you're not really receiving anything in return for the subscription (aside from my gratitude!), I don't take any actions to "deactivate" the subscription. Pacun sent his recommendation a month ago, but I felt like it would seem like a money grab so I didn't do it.1 point

-

Even if you don't install a bunch of prior years of ATX on your new computer, I'd copy all the prior years' data to the new computer and create new backups of the data. Then you can install those years if ever needed.1 point

-

Agree 99.99% on getting a new computer vs updrading to the lastest OS. Here is my current step up: Computer 1: 2006 to 2010 ( in storage) Computer 2: 2010 to 2014 (in storage) Computer 3: 2014 to 2018 (will keep on hand, SSD) Computer 4: 2016 to 2019 (brand new Dell XPS business machine with an SSD)1 point

-

1 point

-

1 point

-

Besides third party software compatibility, another consideration is the age of your computer and its hardware, drivers, and peripherals, and whether or not all of those will be compatible and fully functional after an upgrade. I don't ever upgrade the OS of an existing, older computer for this reason but will try using older printers or scanners with subsequent newer computers.1 point

-

ALL PROGRAMS make changes to the registry but not all of them need to be removed and reinstalled. Before you upgrade, run the pre-upgrade tools and you will see where you will have issues. I was going to pay $199 to have a Windows 10 license for the upgrade. I added another 1K and I got a nice DELL computer that is fast. I don't like to upgrade per se because of other lingering issues. I went to the old computer, backed up all my returns and all other stuff and I installed ATX 2018 on the new one and restored the back up. I will then install ATX 2019 and I should be OK. If people lost their tax return copies for 2017 or before, 1-800-829-1040 or if they are nice clients, I will boot up my windows 7 machine and connect with centronics to my printer.1 point

-

Happy, Health, and Prosperous New Year! Mine didn't start out healthy. We were visiting the grandkids from Christmas Day, and they were all sick. Of course, the whole family got sick. Our return home was delayed as first hubby and then I got sick. I always wanted to stay at The Inn for their New Year's Eve party, but I spent it in bed and in the bathroom for 36 hours. I could hear the music, though. And, hubby was well by then so ate and maybe drank but probably didn't dance. I seem to be taking longer to get over this "24-hour" stomach bug plus cold. I hope this is it for illnesses this year!0 points