Leaderboard

Popular Content

Showing content with the highest reputation on 03/03/2020 in Posts

-

Hey, Everybody, we're all good. Lots of hail but the tornadoes missed us! Thanks for checking!13 points

-

Killer tornado system (at least 5 dead) tracked between Monterey and Clarkrange Tennessee over the night. This is dangerously close to where Rita lives. We would like to hear from Rita to make sure she is O.K.9 points

-

Thank you, I believe it's turning out to be much worse than we thought at daylight. A town 35 miles away lost at least 19. I was awakened at 2:30 by hail, and wondered if two baby calves would be ok. The entire herd came out of the woods at daylight. We are very fortunate and thankful.9 points

-

6 points

-

I'm glad to hear that, Rita Sad about the loss of your Tennessee neighbors.5 points

-

go to schedule D and their is tab for sale of residence. If no 1099-S issued and under the reporting amount you can skip it BUT I always report it to be on the safe side. Clients don't always bring in the 1099-s2 points

-

Personally, unless there were real payroll actions taken before Dec 31, I would not create a payroll now.2 points

-

1 point

-

The payroll W2's must have been timely filed to SSA (i.e. 1/31/2020) for it to qualify for QBI.1 point

-

1 point

-

Even though you are not in a disaster area (and since you are in DC I would beg to differ - I think that is a HUGE disaster) you can take out money to loan to a child, parent or other dependent for their disaster in another part of the country. I believe there is only a brief window of time that this is available, and that you are not forced to stop contributing to your 401(k) the way you ordinarily are if you take a hardship withdrawal. I don't know all of the details.1 point

-

Most Ohio returns have 4 returns. Fed, State, School District, and if applicable, city tax.1 point

-

Um, nevermind. I stumbled around some more and found it, just not or where I expected. Carry on.1 point

-

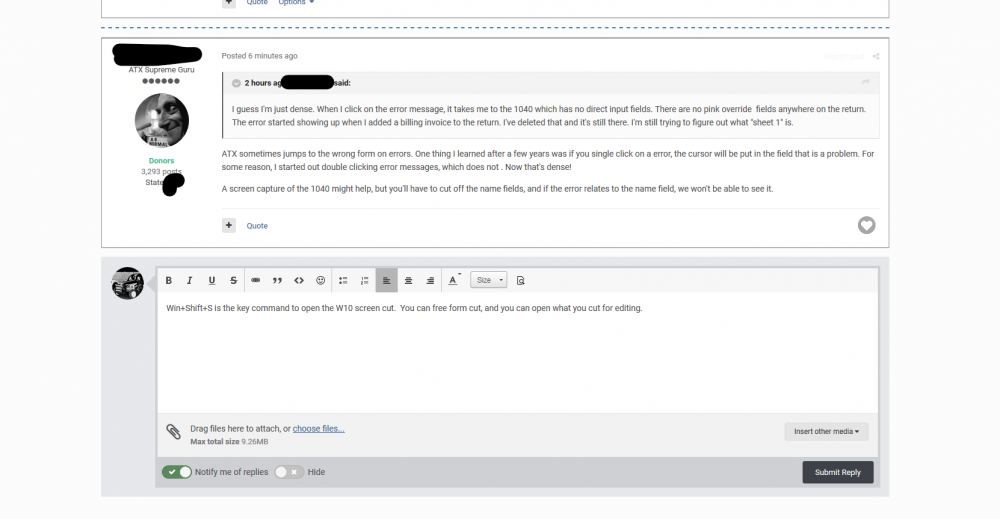

Look for a pink field which is the sign of an estimate. You may have accidentally pressed the F4 key.1 point

-

Looking at some of this, client is a US S corporation. It appears that a corporation would have to file the T2. I didn't see anything about an income amount threshold for filing. I would like to think my client would not be required to file but I'd like to see some reference for supporting that.1 point

-

It is not a wierd error... it is a wierd character that you have entered on the form. Look carefully and you will find it... delete it and you will be ok. It could be a space or a period.1 point

-

That's not what Judy is saying. The way that you started your original post is correct. You contribute assets in exchange for stock, so the assets that you contribute are recorded on the S Corp Balance Sheet. One issue that can be a tax trap for the unwary is if the S Corp assumes liabilities in excess of the assets value, taxable gain can be triggered.1 point

-

Sent using the entity's EIN - but there was NO tax structure chosen at the time the EIN was assigned. So it was like a Sch C sending out 1099s. And yes, I got a retainer and did nothing until the check cleared. Although these are good clients I generally would not worry about. They got really bad advice from people who *claimed* to be specialists in non-profit law *and* taxation.1 point

-

David, you are on the right track. The LLC is a disregarded entity and so this is treated as a sec 351 transfer where assets and liabilities are exhanged for the corporate stock. You will need to determine the ending balance sheet at 12/31/18 to do that. This article from The Tax Advisor explains the process more fully, and has cites if you want them: https://www.thetaxadviser.com/issues/2013/dec/casestudy-dec2013.html1 point

-

Life insurance DEATH PROCEEDS are not taxable to an estate on Form 1041 (which calculates income tax) except for certain interest earned from date of death to the date benefits are paid. A form 1099-INT will be issued for that. As others have said, it is an entry on Form 706 but we probably don't have any clients now which exceed the threshold. (In the olden days, yes, it came into play when the threshold was $650K.) Perhaps Max was thinking about the proceeds of a policy which is CASH SURRENDERED, and it exceeded basis. For that situation, a 1099-R would be issued for the taxable income portion and it would be reported on Line 8, Other Income. This might be a situation that could occur in certain trusts where the trustee cashed in the policy. You have to differentiate between the two types of payouts.1 point

-

I agree, it's gotta be an input item, but I've poured though the details, and just can't find it! Well, thanks for so much in depth analysis. I really, really appreciate it. This whole thing made me do an impromptu refresher course on DDB, HY/MQ Conventions, and the sorts.1 point

-

Logically it doesn't make sense to reduce the QBI income if it was already reduced at the entity level. Example: S-Corp K-1 box 1: $30k, and SEHI is obviously already included in this as it's a deduction on the 1120S return. Payroll $50k (with $10k being SEHI) 1040 would show $50k payroll + $30k Sch E,pg2, Less $10k SEHI. (Payroll shows $10k more income from SEHI, then SEHI deduction nets it to zero because the deduction was already taken on the 1120S return,) If you then take the $30k Sub-S profit and reduce it AGAIN with the SEHI, you're reducing the profits of the Sub-S twice. Now let's take that same example above except pretend the the profit of the company is ZERO. S-Corp K-1 box 1: $0k, and SEHI is obviously already included in this as it's a deduction on the 1120S return. Payroll $50k (with $10k being SEHI) 1040 would show $50k payroll + $0k Sch E,pg2, Less $10k SEHI. (Payroll shows $10k more income from SEHI, then SEHI deduction nets it to zero because the deduction was already taken on the 1120S return,). Does this mean the QBI is Negative $10k? So if you have other business that are profitable you lose $10k of them for QBI purposes? That just doesn't even make sense. It totally makes sense for the Sch C filers to reduce QBI for self-employee health insurance since it's not included on the Schedule C, but not the S-corp.1 point

-

I share similar sentiments to Abby. I have found ATX support has improved tremendously from where it was just a few years ago.1 point

-

1 point