Leaderboard

Popular Content

Showing content with the highest reputation on 03/31/2020 in Posts

-

A problem we see is that some will see "penalty free" but they hear "tax free" and then they don't even read the part about paying the tax over three years because in their mind, it is tax free. And those are the ones that don't give us the 1099R "because it is not taxable.... just like the ones who don't think their distribution needs to be included on the return because "I already paid tax on it". Yes, we tell them, they withheld some tax, but it IS INCLUDED!4 points

-

It's so much easier when dealing over the telephone or via email or more and more via text (I hate to text) to tell a client to look at Worksheet XY and see the top line is $1234 but the bottom line is $0, so none of your "whatever" was taxed, but yes I did include it, didn't forget it. Even more important when the top line is $1234 but the bottom line, or line 12 that transfers to Sch 1 line 99, is NOT $1234 and NOT $0 but something altogether different, such as $567. They're sure you put the wrong number in or left off a form, because they don't see the number they're looking for on the two-page 1040. The worksheets tell them why, without trying to talk them through the math over the phone. Profx can print all the worksheets run together, so 21 worksheets can print on 4 pages or so, a small price to pay to save me time answering their questions later. I've even had clients work it out themselves, because everything is labeled with directions, such as "transfer this total to line __ on Sch _ " or "to worksheet __." That matches the directions on the return, such as "see worksheet __ line _" or something like that. I've had clients call to tell me how proud they were to have figured it out themselves, a much more pleasant phone call than, "I though my SS isn't supposed to get taxed." I've dumped a few obscure worksheets out of client copies over the years. But, I want each client to have everything they need to take to a new preparer. Or, to go home and show their spouse or grown children that I did a good job for them.4 points

-

Came in as email from the Philly IRS liaison:4 points

-

I'm doubting everything now! Too many tax and business law changes during tax season to keep everything in the right compartments in my brain.3 points

-

If you marry someone and you happen to know his/her name and date of birth, you can get a divorce whether they are alive in cabo verde or dead in La Patagonia. All the court will do is to publish it on a local newspaper and voila you are free to remarry in 30 days after the decree.3 points

-

Yes! That's exactly what I enter in Drake's program using screen DD2, and I do have it entered as Q&A. The program will print a page that has signature boxes at the bottom.3 points

-

I have clients sign statements too and a page from Drake's program with notes I've entered that has signature lines. The statements I use were shared here last year by our member, Ringers, and I slightly modified them mostly for my own formatting. If anyone wants them, here they are in Word that should allow for your own modifications. Let me know if there's something wrong in them. 2019 Cert-Child Credit or Other Dep Credit.docx 2019 Cert-Amer Opportunity Credit.docx3 points

-

This is stupid, stupid, stupid. How many of our clients are going to raid their 401k's and then get the shock of a big tax bill. And they are going to raid the account and the worst possible time, when the value of the account is incredibly low. Locking in losses forever, paying taxes on the money, and not having a chance to recover those losses or additional earnings. I cannot believe how incredibly stupid our leaders are sometimes. How will our population ever learn how to use these accounts properly when every time there is an economic downturn, the government basically tells the population to treat their retirement accounts like a piggy bank. STUPID, STUPID, STUPID. Off my soapbox now. Tom Modesto, CA2 points

-

When things are less hectic, or if it becomes a serious nuisance, feel free to reach out... send me a private message (if you can) and we'll get things straightened out!2 points

-

2 points

-

You also have the option of documenting your verbal inquiries and your clients answers.2 points

-

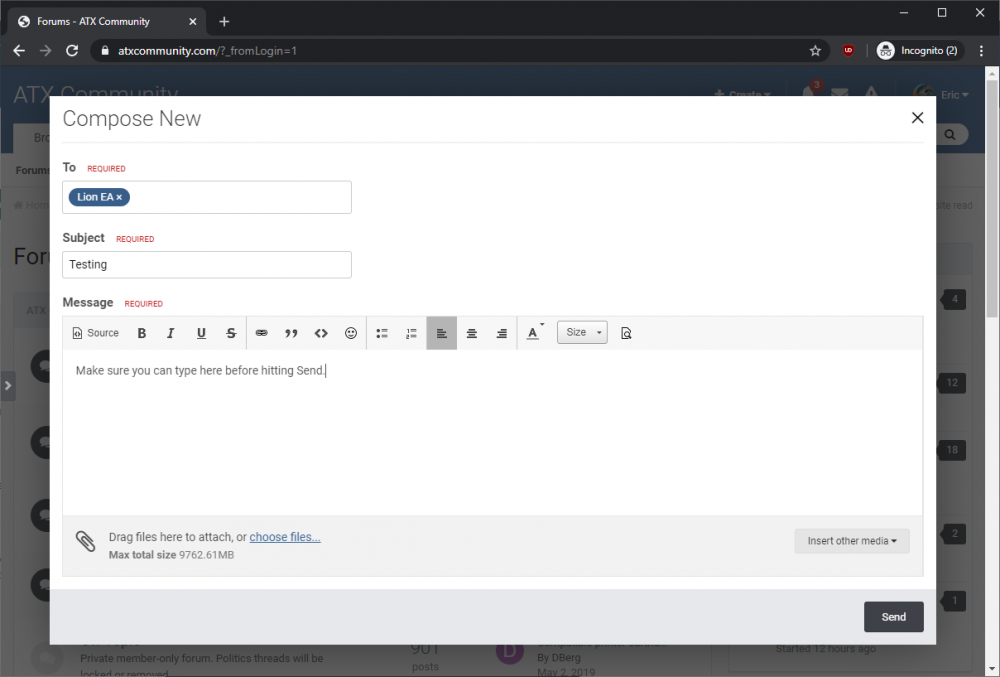

It's almost certainly not related to Chrome in general--it's a popular browser and there aren't any other reports of similar issues form other people using Chrome. The software that runs this site is complex, though, and there are lots of different ways that third party applications, browser plugins, etc could cause this site to behave incorrectly that wouldn't necessarily affect something like consuming media/browsing news sites. First, I saw that you posted many times in that thread, although I've cleaned up the test replies just now. I even signed in using your account (something only the Site Admin can do) and was able to post there, and send a message to Judy without any problem... so the issue is most likely not with your account itself. I did notice that there can sometimes be a slight delay before the content editor opens when sending a private message... if you try to fill in a name and subject and hit send before the editor opens, the message will not be sent. All three fields (To, Subject, Message) must be filled out before it can be sent or else you'll be reminded that required fields have not been filled. See image below. Second, if that's not the issue, the very next thing you should try is a password reset so that you know what your password is for this site. Then try logging in with Edge or Firefox (or IE if you must) to see if you can reproduce the issues. I'm suggesting this not because I think it's a Chrome problem, but because we need to remove variables from the equation to narrow down where the problem is. If you have problems in Chrome but not Firefox or Edge, and we know the problem isn't a Chrome problem, then we know it's a Chrome *configuration* problem, or a Chrome Plugin problem, or a third party (security?) application that is affecting Chrome. If all else fails, we can try to set up a remote desktop thing so I can watch you reproduce the problems, and seeing it might provide additional context. If you like, I could check out other areas like antivirus software or browser plugins to see if there is anything likely to be problematic installed/running.2 points

-

I have researched this before, and although I don't have at my hands any reference, I found that the person who cannot find their spouse can file as HOH or single, depending on their circumstances. That the IRS no longer will consider them married if there have been attempts to find and cannot find the person and therefore cannot get divorced.2 points

-

For future reference, here are also some instructions for resetting chrome to mostly default settings if you have a particularly pesky browser-related issue that could be related to a misbehaving extension or something else that you're otherwise unable to pinpoint: https://support.google.com/chrome/answer/3296214?hl=en2 points

-

I think printing all the worksheets confuses the client. I've been in the habit of printing the "1040 reconciliation worksheet" in UT, which is the old familiar 1040 because it doesn't bunch all types of income and deductions together (especially last year). I just got a call from a client who was confused by it, when I thought it was less confusing. I don't think anyone but a tax pro could follow a taxable Soc Security worksheet, or taxable state refund, or AMT worksheets when they aren't subject to AMT. I do print ones like the Q dividends and cap gains worksheet so they can see that they saved money and the QBI deduction worksheet so they can see why they are not getting the full 20 percent. Ever get a client who self-prepared last year with TurboTax and brings you 88 pages of gobbledeegook from last year's return when all they had a couple of W2s and maybe bank interest? I just don't think more is better, unless you really charge a lot and want clients to think they got their money's worth.2 points

-

This is from stimulus Q and A from various websites: What if my income is higher in 2020? You do not have to pay the government back. Technically a person’s 2020 income is what qualifies them for the payment. Since no one knows their total 2020 income yet, the government is using tax returns from 2019 and 2018 to figure out who qualifies for a check. If you get a payment and then your 2020 income is higher and thus merits a reduced payment or no payment, the money does not have to be paid back.2 points

-

Maybe you are thinking of head of household if they are separated for longer than six months. Everything that I have found says they have to file jointly or separately, unless they live in a state that allows for legal separation and they have done that. I researched this years ago, when someone tried to file single, because a wedding in Vegas didn't count. She found that it actually did count when there was no divorce or annullment.2 points

-

Any body know if the additional unemployment will be taxable next year? This may or may not create another problem. I see all kinds of things happening on the 2020 tax return. Time to retire? I am rethinking my date.2 points

-

I went here and the offer just popped up: https://taxna.wolterskluwer.com/coronavirus-covid-191 point

-

I relied on Section 6428(e)(1). Tony Nitti of RubinBrown taught a two-hour webinar to 5,000 tax preparers this afternoon and stated the following: Basic Structure: Adds new Section 6428 to the Code Section 6428(a): Individuals are entitled to a refundable credit on their 2020 tax return. (See Section 6428(b) for refundable status). But in many cases, the taxpayer will receive an “advance payment” against the credit in the coming months. This advance payment is NOT taxable. When the taxpayer files their 2020 tax return, the advance payment will be “trued up” with the credit; but only in a taxpayer friendly direction. If the advance payment is LESS than the “actual credit” the taxpayer is entitled to the full credit on the 2020 return, less the advance payment; i.e., the taxpayer will receive the extra benefit. If the advance payment is MORE than the “actual credit” the taxpayer is entitled to on the 2020 tax return, however, there is no mechanism for the taxpayer to either: Report the excess advance payment as income, or Repay the excess advance payment as is required with the premium tax credit. What happens in 2020? When a taxpayer files their 2020 return, a refundable credit will be computed using the same metrics and thresholds as the advance payment. Section 6428(e)(1): the credit is reduced –but not below zero –by the advance payments received by the taxpayer. Section 6428(e)(2): If an advance payment was made to a joint return and in 2020 they are no longer joint, half of the advance payment is treated as having been made to each spouse.1 point

-

Yes, I am getting my EA, and am proficient in farms, small businesses and trucking. Still have a lot to learn. I got it from a PwC conference call today at about the Covid tax updates. I will track it down tonight once my phone stops ringing. TB1 point

-

Here are links to IRS site for the draft of Form 7200 and its instructions. Link to CARES Act: Employee Retention Credit FAQs put up by the U.S. Senate's Finance Committee1 point

-

Thanx, Eric. Yes, the box opens, I type in a Message and To and Subject and hit Send and Subject disappears so box just sits there without Sending. I put the Subject back in, and it disappears again. It happens a small percentage of the time, but was happening ALL the times I tried to message Judy and Catherine and when I tried to post on that one thread and fewer times when posting to other threads. I seem to be able to Post and Message most of the time now. I also get kicked out of this site about half the times a message will not Send or Post. I get a screen that says it cannot load; after doing some other things, I log back on. Catherine said that she's NOT been kicked off over the last week. All of these things have been going on since the middle of last week. I have been doing nothing except preparing taxes, reading/posting on tax sites, and sending/receiving email via Outlook. I brought this up in case others were having problems. But, if I'm the only one, I'll research it after I get more tax returns off my desk. Thank you for all you do, Eric.1 point

-

Well, that is good to know. Thanks for the update.1 point

-

I got an email from Ky Society of CPAs on Ky legislation. Yes originally Interest was not included because it needed to be waived by legislation. A new bill has passed and is waiting on Governor's signature to include the waiver of interest until July 15. I'm not sure if it's official yet but I think it's coming.1 point

-

If you can't find the person to serve them legal papers to separate, it's sort of hard to legally separate. It's still possible. Realty though is that this client could just go to the next preparer and inform them they are single and file that way. Also, I've personally never inspected someone's divorce papers to assure the IRS that they are legally divorced.1 point

-

I have my clients sign a certification statement, which I found online and modified for my purposes.1 point

-

1 point

-

Agree with Abby Normal. If you lend me the money to pay my employees, then forgive the loan to the extent I actually pay them, I'll take that option over a tax credit every single time.1 point

-

The EIDL loans are going to be a HUGE benefit to many small business clients. I spent most of today coordinating among 4 clients as we learned about the process. Part of this program provides significant financial assistance which is initially a loan but much of it is forgivable (essentially converting it into a grant). I suspect many accountants and tax preparers may also benefit greatly from this program. Abby Normal just provided the link in the previous post. Take a look at it and you'll probably conclude that many of your clients need to be on this right now. The banks are useless at this point, but the simple 4-page application enables the client to get into the queue and possibly gets them a $10,000 grant right out of the box regardless of creditworthiness. (I know, it seems too good to be true but these are unusual times). This program undoubtedly will be abused by some, but it has the potential to stave of many small business bankruptcies and facilitate a faster recovery. I predict you'll gain the undying gratitude of some clients by simply directing them to this site.1 point

-

Here's the link if you want to share it with your clients: https://covid19relief.sba.gov/#/1 point

-

I completed the SBA loan application middle of the night last night . It was a very quick process .1 point

-

1 point

-

It's all three of those. We'll be reconciling these checks on next year's tax returns. The Tax Preparer Full Employment Law.1 point

-

The class that I attended Friday said that they will not have to pay it back. The instructor was Tom Gorczynski and he is way smarter than me. I just keep reading and have other classes still to take. It's a good thing that I don't have any tax returns to file.1 point

-

Calm down, everyone, and back away from the keyboard if you feel the urge to attack another member here. Tom was venting some frustration, and we're all going to have some added frustration or stress as we try our best to help clients that are in financial difficulty. This topic already has some valuable information and insight that others may find helpful. Keep the ideas flowing. We're going to need them.1 point

-

The catch in structuring as a loan instead of a penalty free withdrawal under this new provision, if for some reason the employee does not return to work and can not pay it back in that year, then the employee ends up with a taxable deemed distribution all in one tax year instead of being taxable over the longer three year spread.1 point

-

There are all kinds of options during this crisis that are not normally available. I understand Tom's point, and would hope that the increased unemployment would enable most people to navigate this difficult time without going so far in debt that they will never see daylight again. On the other hand, trying to navigate what is available and how to apply for it is often EXTREMELY confusing, and the people who need the most helpful often lack the resources or education to be able to figure out what is available to them.1 point

-

When clients call (which is not as often as they should) I tell them we should look at the cost of various sources of money. 401(k) withdrawals will cost them at their marginal tax rate, including their rate three years from now if they spread out the taxes; but could cost nothing if they can budget for repayment. Unemployment benefits are a VERY good deal now. Cash advances on a credit card can be pricey, but they should look at the rates (and not assume cash advance rates are as low as purchase rates). New options for SE individuals have opened up via state and federal governments, including unemployment benefits. Home equity loan &/or line of credit. Borrow from parents. Look at all possible sources of income and compare costs.1 point

-

The unemployment boost of $600 per week, no waiting period, should be able to cover most of what is missing from payroll for a lot of those folks. That is $15 per hour for a 40 hour week on top of what they would normally get from their state. I am not heartless about this, but this situation is temporary and congress did something to take care of the massive layoffs. I can't agree with this one, no matter how hard I try to see the compassion that others do. It is long term damage to these people's financial health. We are just going to have to disagree (respectfully) on this one. Tom Modesto, CA1 point

-

I had signed up for the NAEA message board, getting daily summaries, some time ago. I rarely look, and have never bothered to respond. Well, I responded to one and let me warn you all to stay away from that group! First off, any response seems to reset your daily summary to an email with every. bleeping. message. posted - and I could find no way to reset that (ended up unsubscribing completely). Then, the board seems to be full of full-of-themselves persnickety nit-pickers who have NO concept of taking facts and circumstances and doing the best you can do with the information at hand. Stay here, where we fuss at each other in love, and understand that we're all trying to do our best for our clients, not trying to prove how we can out-cite everyone else. Jeezle louizle I love you guys and just got my nose rubbed in how much. And Rita - there are some folks over on another board who could use some of your hugs. Just sayin'!1 point

-

When I became an EA I signed up for the NAEA. You were required to be a member of the state affiliated group and every year I'd get a letter about their state meeting about 2 weeks before the event and long after it was full and signing up was impossible. The first year of that happening I thought about how I had only become a member 4-5 months prior so maybe it was a one-off. Second year, well that's odd. Third year I decided it had to have been intentional. I wasn't getting any mailings except that one when it was way too late to attend.1 point

-

persnickety... placing too much emphasis on trivial or minor details; fussy......requiring a particularly precise or careful approach1 point

-

Thanks for the warning Catherine! I have been getting the summary email, but have not had time to really look at it to see if there was anything of interest there (I would rather spend my time on this board!) and now I won't bother.1 point

-

Isn't that against the Geneva Conventions against cruel and unusual punishment?1 point

-

Been there, done that. I still lurk/read. And, sometimes one of the cites is exactly what I was looking for. (Also, you can learn what speaker you might want to take a class from and what speaker you definitely would not!) But, NO sense of humor and no patience for us preparers who are trying our best, like you say.1 point

-

1. You file an unemployment claim with your state. 2. You do not need to be a wage earner with an employment history 3. These benefits are being paid with federal dollars 4. Your state's Employment Department will decide based on federal guidelines1 point

-

From Tax Foundation - State Legislative Responses to COVID-19: https://taxfoundation.org/state-tax-coronavirus-covid19/?fbclid=IwAR05E2ch588Qce0JTQB7HZBXp_2I7UavjzGQMxhYWWwgnJGcC2LoM4scTRY1 point

-

For the banks, I print the filing copy from Drake that only gives the necessary form that the bank wants to see. The big one is always for the client as they are entitled to everything that was used to complete the return meaning all worksheets; etc.1 point