Leaderboard

Popular Content

Showing content with the highest reputation on 01/29/2021 in Posts

-

All credit returns get additional scrutiny. The IRS "hopes" to "start" sending refunds for returns with EIC and ACTC by the first week of March. People who prepare a lot of low income returns might want to turn their phones off for awhile.4 points

-

I found the problem! I was having problems with the Drake program not starting when I clicked the desktop icons. Evidently when that happened DStart would start running and not stop. After several attempts, the apps would run the CPU up to 100% and slow everything down. I ended the DStart apps and re- installed the desktop icons for the 2 years of Drake that were the problem. Everything is running up to speed now. Thanks Abby for your suggestion. That got the ball rolling for me.4 points

-

I did some reading of instructions/etc. this year, because I have a new IT guy who bought some items for my Schedule C business that I reimbursed, so provided more than just services. My understanding, and what I did for my own company, is that everything you pay to an unincorporated person/entity that provided services to your business goes on the new Form 1099-NEC. He'll deduct his expenses on his end, and that'll lower his SE tax. If paying ONLY rent to a non-corporation, for instance, then use the old Form 1099-MISC. By the way, more state DOLs (as opposed to the IRS or state DRS/whatever your state's revenue department) flag accountable plans as an EMPLOYEE benefit and conduct employee vs IC audits. Employee vs IC has been a big issue in the northeast. I'm answering off the top of my head, because you want to get it out the door. But if you want to research, start with the instructions, the IRS Pub addressing Forms 1099, and your own research service. Or hold through the weekend in hopes of more experienced posters responding.3 points

-

Glad you got it figured out! This job is tough enough when the computers are working fine.3 points

-

This form is used when clients did not have health insurance coverage for the entire year, but did have it some of the months. Once you fill out this form you have the correct refund or balance due for the return. THE PROBLEM is when you check your return you will get an error message stating you need to check the box showing client had health coverage ALL YEAR. This is on page 3, question 92 of form CA540. Keep in mind form FTB3853 has already been completed. If you check the box the return then becomes WRONG because client did not have coverage ALL YEAR. I spoke with tech support today and they say it is because California has not completed doing updates as of now. Just sending this message so you do not have to wait on the phone for 30 minutes or more.2 points

-

When you do that it will be interesting to see how many months returns like this will be hung in"processing" status before before they are finalized?2 points

-

You can use the Get My Payment IRS page to see if the IRS sent it, but you can't see the amount. Seems to me you're far better off to take the Recovery Rebate Credit and have the IRS adjust it down, than to not claim it and hope the IRS adjusts it up.2 points

-

I agree, everything belongs on the 1099 NEC. Someone needs to advise the bookkeeper not to split up everything like that, although the accounting software that I currently use would total all of the payments no matter how many accounts were debited.2 points

-

Interesting. We've never experienced issues with the returns not opening, so never considered this step. We currently keep our notes in a word document within the client drive, so we don't need to open the return if the client calls for a reminder of what's needed.... I did start using the ATX reviewer notes last year though and found those very helpful. Our notes, if anyone reads this thread later are Open to client Open to preparer Open to Reviewer Client Conversation Notes (We're adding this for 2020) Notes for next year It sounds like I don't have an option on the letters, but do see there are multiple approaches to this and should decide which path to follow now rather than later. Thanks for all the help everyone!!!2 points

-

Thanks! I did read quite a bit last night and was leaning towards everything on the NEC since my client was not actually paying rent on the lease, just repaying what was billed to them. This is the last year for this 1099, since they have moved everything in house to cut costs.2 points

-

If it is a revocable trust, this is correct. If it is an irrevocable trust it is wrong information. An irrevocable trust must have its own TIN.2 points

-

Yes, this is the issue with respect to whether to claim the Recovery Rebate Credit or not claim it in ambiguous situations. Will the IRS computers just adjust it, or will the returns just fall into a processing black hole? Whatever happens, any delay will be the preparer's fault in the mind of the client.1 point

-

So this may mean the Jan 15, 2021 date is irrelevant at this point, I suppose.1 point

-

Abby, that did the trick! I had no idea that function existed. Thanks for the tip!1 point

-

Mine does, so maybe it's time to reset your letters to default. You do that in an open return by editing the format and going to Tools, Restore. Then save it for all future returns. My state letter defaults to saying 'will be direct deposited' too but I still have to go into both fed and state and choose that on the payment/refund tab of efile Info form.1 point

-

Part of your rollover procedures (start a list now and keep adding to it) should be to open each return as soon as it's rolled over. You want to make sure it opens without errors, and closing it creates a backup before any entries are made. We also have extensive notes in each return that we copy/paste into our engagement worksheet notes section to make sure we don't screw up the return or miss anything.1 point

-

The need for a 1041 depends on who got the 1099. The life insurance interest was paid to the trust, so if the trust's EIN is on the 1099 you'll have to file a 1041. You stated that the house was put in the trust's name. If it is sold the 1099S will also go to the trust's EIN. I agree that this looks like a grantor trust, but a 1041 is required if the trust gets any of the tax docs.1 point

-

1 point

-

I see that I have 4 DStart processes running at 24% of CPU each. The CPU is evidently running at 100% overall. Is that it?1 point

-

You need to watch the software too, for dead people. My client lived for the first payment but was in Heaven for the second payment. Software gave her $600. Although she was dying to get it, she can't take it with her. Access: denied. I have another client coming in whose husband's stimulus payment was automatically deposited while he, too was in Heaven. I don't know how I'll handle that one. I guess he won't be paying it back, though. "Come and get me..."1 point

-

Reboot! Bring up Task Manager (Ctrl+Shift+Esc) and see if you can find the task that's using up all your CPU or RAM. And if that doesn't help, call your IT person. It's good to reboot your computer at least once a week. Many programs that run all the time use more and more memory the longer they're running. How much RAM do you have?1 point

-

That would be a big, fat ZERO. I am asking for the totals and if I have to ask more than once, or if they get the answer wrong, I'm charging them! LOL1 point

-

1 point

-

Sadly till a red error, but this from the ATX message board: "Just spoke to a support rep, they are aware of this, IRS is updating their system She said , as per the IRS, the resolution is to put in all zeros into that number There will be an update shortly" per NYTaxLady1 point

-

If ATX doesn't automatically add a form 3520 section, you could create a 2nd federal letter for returns that contain that form and use that instead. Or you could have the text in any text file and copy/paste it in as needed. If you opt for the 2nd federal letter, you'll need to include the state section as well, because I doubt ATX will combine the state with a custom letter like it does with the official federal letter.1 point

-

You need to read the trust document. If the parents retained "power of appointment," meaning they could change the terms, beneficiaries, trustees, borrow against trust assets, etc.--in other words, they maintained control over the trust assets and what they did with them--this is a grantor trust and income should flow to their personal return like you plan. Some irrevocable trusts are written to be "intentionally defective" so your plan still works. The trust doc may contain that exact phrase.1 point

-

1 point

-

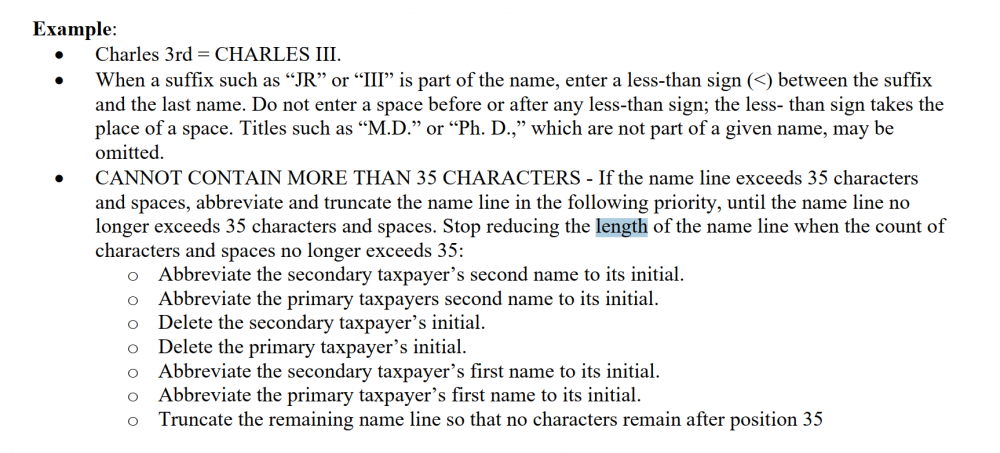

I usually take out the second or hyphenated last name... MAKE SURE you move your cursor away from that field and then try to create the efile file again. I keep cutting last name(S) until it works.1 point

-

Are you sure it is an Irrevocable Trust? If it is a Life Estate, yes it would be a Grantor Trust, which is a Revocable Living Trust.1 point

-

IRS uses the first 4 letters of the last name, so you can truncate it to allow the e-file to process. Just explain to your client the reason why.1 point

-

If logging in to the portal there is now a check box to trust this device. Selecting that by passes the second authentication. I believe this has just been added.1 point

-

1 point

-

I was just told I was blackmailing a customer because the 941 form was changed.0 points

-

The President has instructed the Treasury Dept and the IRS to immediately expedite the payment to about 8 Million taxpayers, who did not receive either the first and or the second EIP payment(s). It will be crazy trying to reconcile this activity against client questions0 points