Leaderboard

Popular Content

Showing content with the highest reputation on 02/17/2022 in Posts

-

I had a client bring in a notebook today with the clear pages that each tax doc was inserted. So I have to pull them all out and copy and then yes he wants them back into the clear jackets and put back into the notebook. They think they are being helpful, helpful would be clients who open the enveloped and throw them away.5 points

-

I saw a TV commercial for this. How many clients will get these and not tell us?! This seems like nightmare tracking unless the credit card issuer will be providing the detailed reporting for the tax returns.3 points

-

Given the price increases I have observed the last few months and the the fact that most of the Fortune 500 are making record profits, that is not apparently happening.3 points

-

I never enter EINs for interest and dividends. If it's not required, I save the keystrokes.3 points

-

This is one of my pet peeves. These institutions reduce their expenses by not having to mail bills, statements and other documents. I have never been offered a bonus, a discount, a credit or any kind of reduction in my bill for agreeing to electronic receipt!3 points

-

This year it's also Autism Awareness Day, Easter Monday, National Animal Crackers Day, National Linemen Appreciation Day (wires, not sports), and National Velociraptor Awareness Day. The way things are going, I'll be Animal Crackers cuckoo for Cocopuffs after this season is over.3 points

-

Some people suck at "computer things." I have clients that just give me their login info so I can download it for them. And I don't mind that one bit, because I have clients who print their 1099s in portrait mode when they should be in landscape, making them hard to work with. Why they just can't save the download is beyond me.3 points

-

My client went through the Tax Organizer very carefully and answered every question, filled in every box. Then she taped her supporting documents to the back of the related page of the organizer. Next she took her multi page Brokerage 1099 which had been 3 hole punched and carefully inserted bread bag twist ties through each hole and bound the brokerage statement pages all together. She actually is a very nice person, but I have no words to explain this . . . . .2 points

-

2 points

-

2 points

-

2 points

-

The appreciation should be taxable the same way that if you leave your money (collected from Card Rewards) and they earn interest, you pay taxes on that interest. It is interesting to see that you should have basis on the bitcoin the same way you have basis when you cash the rewards and leave it in your checking account, (you pay taxes only on the interest).2 points

-

2 points

-

Thanks, here is the link from the IRS: https://www.irs.gov/pub/irs-pdf/i1040gi.pdf Instructions are on page 232 points

-

Yes, there is a statement you must attach with certain wording.2 points

-

The PPP tax-exempt income increases stockholder's basis. It should be shown as an increase to Other Adjustments Account and doesn't add to AAA. Ordinarily the distribution would reduce AAA but not below -0- (losses can), and then any distribution not offsetting AAA would then reduce OAA. Did the distribution exceed basis?2 points

-

2 points

-

I’m currently filing a return that I’ve informed the client that he no longer has a filing requirement, but he wants to continue due to ID theft. I only charge a minimal amount.2 points

-

Yeah I have a client that every year receives an email telling him that his 1099 is available. Does he download and forward it to me? No!2 points

-

I cannot believe the number of places that require the taxpayers to print off their own 1099s. I have several that are already filed and then come in and say that they just got another letter and/or need to print something off and then they expect ME to drop everything and print it off for them because they conduct all of their business on their phones. I actually cried real tears this morning and now my rant is over. Besides that, MY phone crashed on the latest update and all I can use it for is a phone. (Well, I guess that makes sense) but many of my clients make appointments on the phone on my business page.2 points

-

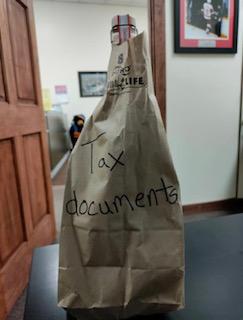

I've not heard, but I am hoping for another month. Cuts down on the first timers "you're getting an extension, I get one for myself, here is a paper sack to breathe into..." talk. Which takes time. Bags are cost of business. But time is gold. I have a stack waiting on either 8606 or 8915-F. Two partnerships that probably don't need K-2 or K-3 (and I know there's some relief or other coming so I'm probably good). I know some hate for the season to be extended, and if I felt that way, I'd just carry on as usual like the due date is April 15. It would still be a PITA because nobody has time to notify dozens of stragglers, so I understand both views here. My view is more important to me because, you know, me.2 points

-

And here is example of the statement: https://ttlc.intuit.com/community/business-taxes/discussion/re-2020-schedule-c-self-employed-how-to-report-ppp-received/01/2478497/highlight/true1 point

-

Yes, do that then if expenses are included in col a, lines 2 or 4 of the M-2. That is what the instructions say to do.1 point

-

I know some states have extended their due date for filing returns. Has anyone read/heard of any potential federal extension? I'm hoping if that is the decision the government is moving toward, they make the announcement sooner versus later so we can plan accordingly. It's only mid-February and this tax season already feels way too long.1 point

-

That's why I hedged with 'might.' I suspect my credit union appreciates me saving them money and in turn, I appreciate them not charging me any fees, or very low fees, and giving me low interest rates on loans and credit cards.1 point

-

Not I, but others on other forums report filing some. Does anyone really believe that someone opens up attachments to efiles at the IRS? You could attach any PDF and it will be fine.1 point

-

you need to put it on Sch K (Page 3 of 1120S line 16B the amount that is forgiven. ATX program has been fixed to populate M1 Line 5a and M2 line 3 (Other additions)1 point

-

Well, I much prefer downloading all of my documents for numerous reasons. It saves paper, ink, fuel and time. It's better for the environment. It saves me having to scan it and then shred it. A downloaded PDF is much preferable to a scanned PDF. I get my documents sooner and don't have to worry about them being delivered to the wrong address. I get neighbors mail from time to time. And I don't mind that it saves the company money, because that means they might not increase any fees they charge.1 point

-

When you go to a lot of financial sites, a pop-up shows you agree to receive everything electronically. You have to uncheck it, but first you have to notice it. I don't think all these places require clients to print their own, but defaults them to that place. And then there are the banks that charge you for a paper statement (the same ones paying .0000001 percent on savings).1 point

-

Maybe it was a DC holiday that sometimes falls on the Monday when tax season is supposed to end? And maybe they got rid of or moved that holiday? Just found it! Emancipation Day is April 16th, and sometimes that extends tax season by a day, when the 16th is a Sunday or a Monday. https://www.timeanddate.com/holidays/us/emancipation-day-dc1 point

-

I have a client that has not had a filing requirement for years. He wants their joint tax return filed so that if something happens to him, his wife has a record of the returns that were filed and doesn't have to worry about something coming up after he is gone. Like Joan, I charge a minimal fee and do what he wants.1 point

-

1 point

-

Hi @Yardley CPA I have a client that works in NY, but lives in FL for her own convenience, not the employers. I only file an IT-203 and allocate 100% of the W-2 income from the NY job to the NYS amt column pm IT-203. Another client of mine work in NYC, but come Covid, he worked remotely in NJ the entire year. All wages were still allocated to NY earnings despite his lack of physical presence in NY. I think IT-203B is meant for W-2 jobs where some of the wages are earned inside NY and some are earned outside NY, the deciding factor being necessity. Meaning the wages earned outside NY and are not allocated to NYS because it was necessary for them to be outside of NY to perform the job. I agree with your assessment of the convenience test. I was confusion about the NJ/ Penn reference in relation to NY so if I misunderstood the question, I'm sorry for a pointless reply.1 point

-

1 point

-

1 point

-

1 point

-

Had a grown child (parent had been my client, not grown child) call me frantic, because in her mother's (now deceased) retirement community apartment that "the kids" were cleaning out there were multiple IRS letters that said she hadn't reported her winnings from Mohegan Sun a few years before she died. But mother had stopped coming to me a couple years prior to her winnings, apologizing but saying she really didn't have to file any longer. "The kids" had already divvied up mom's bank accounts and things. How were they going to pay for that, the GC whined. I no longer knew mom's tax situation, but if she'd been filing returns it might've been past the SOL. No longer my problem. So, make sure your non-filer clients didn't take up gambling as a retirement hobby!1 point

-

Final 1120-S Instructions for 2021 "Column (d). Other Adjustments Account The other adjustments account is adjusted for tax-exempt income (and related expenses) and federal taxes attributable to a C corporation tax year. After these adjustments are made, the account is reduced for any distributions made during the year. See Distributions, later. Tip PPP loans. An S corporation should include tax-exempt income from the forgiveness of PPP loans in column (d) on line 3 of the Schedule M-2. An S corporation should report expenses paid this year with proceeds from PPP loans that were forgiven this year in column (d) on line 5 of the Schedule M-2. If column (a) on line 2 or line 4 of the Schedule M-2 includes expenses paid with proceeds from forgiven PPP loans, an S corporation should report that amount in column (a) on line 3 and in column (d) on line 5 of the Schedule M-2. If column (a) on line 1 of the Schedule M-2 includes expenses that were paid in a prior year with proceeds from PPP loans that were forgiven this year, an S corporation should report that amount in column (a) on line 3 and in column (d) on line 5 of the Schedule M-2."1 point

-

Years ago, when People's Bank started online banking, they offered a nickel for every online transaction, maybe for a year. I made some money paying all my bills online and transferring between my savings and checking accounts, probably for direct deposits, too. And, I saved monthly fees for decades by having direct deposit (you could also eliminate monthly fees by keeping a certain balance and maybe another option or two). But more recently, People's added a $3 paper statement charge, so I now download my monthly statements also to avoid that charge.0 points