Leaderboard

Popular Content

Showing content with the highest reputation on 03/21/2023 in Posts

-

I Agree Catherine! I upgraded to the Final QuickBooks Accountant Pro 2021 (Desktop Version) last Fall. It works great, No subscription fees etc. No Nagging Critical Upgrade Notice. The only caveat I found that I had available with the previous version was that you could open a 2nd company at the same time. I found this very helpful with my Intercompany Transactions, but not a game changer of going subscription version for the 50 entities I do the accounting for. I will use excel or green ledger paper first before going subscription mode.2 points

-

Either Consulting Income on a 1099NEC or wages on a W2. If they are in CA, I would go W2 because of AB5, but that horse may have left the barn if you are looking at 2022 tax return. Tom Longview, TX2 points

-

If the bookkeeping entries are recording(accruing) the payable each year or pay period, then the expense on the 2022 P&L should be the 2022 expense for the year based on the 2022 payroll deferral amount or percentage. Then, in the balance sheet accounts, when cash is expended in payment of that liability, the cash account and the payable are both decreased. The liability balance on the balance sheet at 12/31/22 should be the amount of 2022 deferral that has not yet been funded that will be paid in 2023. The 2022 1120S should be deducting the 2022 deferral.2 points

-

2 points

-

I am having the same problems as Schiralli, and I, too, have followed the memory configuration changes (had my IT guy do it), but it still crashes (8 times yesterday) in the middle of returns. Literally 'blip' and it's gone ... no warning. Other times, I get the 'program needs to shut down' and can use Abby's trick of shutting it down with task manager and restarting. If it 'blips' and is gone, I have to reboot my entire machine. I'm now running 2 machines because I can't have anything open other than ATX. I really like the way the ATX program works, but I hate this part of it. Grrr. 2013 was an AWFUL year in terms of the software. This one ranks second in my book.2 points

-

I used ChatGPT to write my price increase letter and my firing letter this year. I was agonizing over writing them, procrastinating, writing in my head but not on paper, etc. I told ChatGPT what I wanted, and BOOM in seconds I had what I needed and could finally move on.2 points

-

I agree with this observation. I have had my last 6 computers custom built without any crapware by my computer guy - for 25 years now. If anything goes wrong, he can fix it because he built it. I also have it go in for 'spa treatment' every fall before the season to be sure nothing has sneaked in or is causing problems. It may be a coincidence but I think my program has crashed fewer than 5 times in all the years I've been using ATX since 1996 tax year. And I cannot even remember the last time. (Now I've probably hexed myself, right?)2 points

-

"As of March 25, 2023, we are updating how you sign up for and access a Business Services Online (BSO) account for the following services: What does this mean for you? On March 25, 2023, current and new BSO users, wishing to use the above services, will use SSA’s Public Credentialing and Authentication Process (eAccess) to access employer services. The first time a visitor goes to the employer webpage after March 25, 2023, they will be redirected to the Social Security Sign In page to start the authentication and registration process. BSO users will need a separate Social Security online account, for example, a my Social Security account that was created before September 18, 2021, or have an existing Login.gov or ID.me account. If you do not have a Social Security online account or a Login.gov or ID.me account, you will need to create one from our Social Security Sign in page. This is a new requirement to access BSO employer services. Once the credentialing and authentication process has been completed, current BSO User ID(s) will be associated with your new credential. Frequently asked questions Can I sign in with my personal my Social Security account username and password? Yes. If you have created a my Social Security account prior to September 18, 2021, you can use the username and password to sign in once redirected from the employer webpage. The username and password will be associated with your BSO User ID. Are there any actions I can take prior to March 25, 2023? If you don’t already have an existing Login.gov or ID.me account, you can create one now. Please note your account will not be associated with your BSO User ID(s) before March 25th. You will need to visit our site after that date to complete the process. Why am I being asked additional identity proofing questions after I create my account? Social Security uses different levels of security depending on the sensitivity of the information being accessed. These additional levels of security are to ensure your information is protected. '1 point

-

Shout out - is what SO means BTW (by the way). (I'm UTD (up to date) with my texting skills with 2 young daughters.) Remember when we had one big schedule E and we could just fill in the blanks and not have to go from one input page to another to another to another to another. It just sucks when you have multiple properties.1 point

-

The first time you start Task Manager it's in 'Fewer details' mode. Click on the link at the bottom that says "More details,' if you haven't already. Also, Services is the best place to change tasks from automatically starting to manual starting.1 point

-

Any file is 'binary' because computers are all 1's and 0's. Just type a note, print it to PDF and attach it.1 point

-

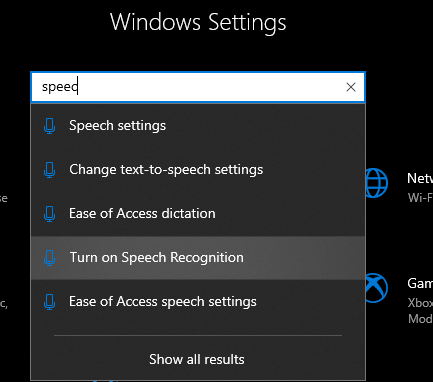

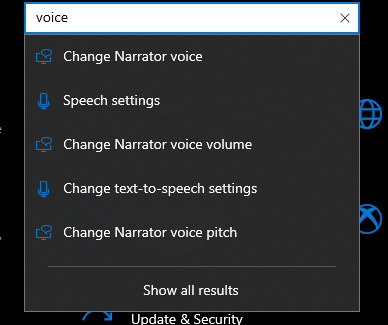

I know outlook has a dictate button that I have used in the past. I could swear windows 10 and 11 both have built in Text to Speech. (but that could be just for screen reading) In settings look for Speech or Voice Activation (not sure which one of these will work), but like with any speech to text the more you use it the better it becomes. Or so am I told.1 point

-

I've not tested this in a very long time, but Dragon has been around since the start. https://www.nuance.com/dragon.html1 point

-

And, why not? It's the next step in technology to aid in your work. Media outlets have been discovered using AI to write articles. Some would edit the articles and some under pressure of a deadline would just let it rip.1 point

-

If it's a brand name computer, it may have come preloaded with a ton of crapware that starts automatically. This is why I always build PCs from scratch with only windows on it.1 point

-

Don't hold your breath. The company overhauled the entire program using the Raven database in 2013 for the 2012 tax year, so the company has had 10 years to fix this.1 point

-

No, 2011 was the last year ATX was a compiled spreadsheet. The 2012 ATX Program was rewritten using a poorly selected shareware database called "Raven".1 point

-

Some tax preparers are using something called ChatGPT to help them write professional emails or text responses.1 point

-

I don't think it's necessary to attach anything, and I don't think the IRS will even notice the attachment. The taxpayer will get a 5498 and so will the IRS. It will show the rollover.1 point

-

Shhhhhh....that is our little secret that we don't want to get into the ears of the IRS. Tom Longview, TX1 point

-

It absolutely stinks, but not as bad as when someone takes 31 trips to Goodwill and you have to complete Form 8283 (which I hate with the power of 10,000 suns). I took some advice a few years ago from Abby, I think, (sorry if I'm remembering incorrectly) and sometimes use a 12.31.__ date and combine them all. Blech.1 point

-

We come into the mix at about 45 seconds, but watch the whole two minutes.1 point

-

Actuaries are the math people without the personality to be economists. Or even undertakers!1 point

-

Trust me, economists have LESS personality than accountants. They don't call it the Dismal Science for no reason.1 point

-

I once heard us described as math people without enough personality to be economists. Not sure I've ever met an economist, so I can't vouch for accuracy.1 point

-

For storage (such as retirement) paper rules (or failing paper, PDF's on multiple machines/storage methods). Computers fail. Internet connections fail. Servers fail. You cannot meet the IRS regs by "hoping" you can access the needed data. It is interesting to discuss the "ownership" of things. I agree, the data is the property of whomever created it. It should be something the creator has ability to retain. Thus, printing (or creating PDF) records is suggested, since there is no way to guarantee electronic data can be "used" by other software. The software and resources which can be used to manipulate said data? That is usually licensed for use, with no transfer of ownership. Even if the licensee wants to allow others to use their license "just to view" the data, the other party, such as an accountant, is likely going to need a license of their own, since they are benefiting from the software - even though they are not manipulating the data. I actually get this type of question often. Such as "I am the only one using the software so I want to install it on every machine I own" (did the computer company give you each machine?). Or even more applicable, "Can my accountant use my license?" (The accountant, unless manipulating the data, needs your reports, not the software". Going back to the beginning, software was ruled to be copyrighted, in the same manner as a book. Meaning copies (yes kids, software was formerly distributed on hard media!) were not allowed unless the copyright holder gave permission. In my case, our model for our non payroll programs has recently changed to buy once. No ongoing support is included, but is available on a pay per use basis. No one has needed to pay for support yet, but we have been doing this for 40 years, so the software does self support... We do watch for multiple installs, and do terminate licenses for those who fail to comply after several gentle reminders. For Payroll, it is an annual license. When the license expires, no more new data can be entered, but access to existing data is not stopped. Same as above, we can catch those who "share" their license.1 point

-

Yup, and I'm going to make sure I have the last non-subscription version and then turn off all updates. If need be, I'll move to Medlin Accounting or even green ledger sheets. If I have to pay monthly for access to my own data, it's not mine. Ain't happenin' but that's me. You decide what's best for you.1 point

-

I'm sticking with the desktop version and never moving to the subscription model. I'll go back to green ledger paper first.1 point

-

My biggest biz client received a letter he didn't pay his 943 last year. The thing is, he's not a farm! (Paychex files his Forms 941 and copies us on them.) Moreover, the report that was supposedly missing was for the year that had just ended and wouldn't be due for another month. No further communication from the IRS at all, no correction letter. At least Paychex knew those erroneous letters were circulating, so I could calm down my client. Yes, again, I do not think the IRS's right hand knows what its left hand is doing.1 point

-

OMG - I just have to share this continued mess up by NYS I tried to set up an account for my client. When I put in my email address it told me I already had an account. Hmmmm - interesting. So I clicked on the button that said they would send me info regarding this account I already have. And it came back to me addressed to my client. And they gave me the username. When I went to log in again with the username they gave me - it was entirely someone else's information that I have never helped set up an account for that my email should in no way be associated with. So somehow NYS has mixed up me, my client, and a stranger into a big ball of NYS wax.0 points