Leaderboard

Popular Content

Showing content with the highest reputation on 12/26/2024 in all areas

-

4 points

-

4 points

-

3 points

-

Merry Christmas to all. And Happy New Year, when we get there next week. This is the last week before loin-girding starts in earnest!3 points

-

Ironic...I have a 2021 return lying on my desk to be prepared next.3 points

-

^^^^^^ Yep. I can see a lot of calls coming regarding the additional payment everyone is getting and when will mine come..... Tom Longview, TX3 points

-

The first thing is that the anchor that presented this did not tell viewers that IRS would be sending payments automatically, and I really don't want to have to waste time on questions and conversations again to prove that they already got it and aren't entitled to more!3 points

-

The Happiest of Holidays to everyone. I feel as though you all are family and I look forward to spending some precious time with you. Always take the high road!3 points

-

I have three senior couples that I do that for, and I've done their work for almost 40 years now and consider them friends too.2 points

-

2 points

-

2 points

-

1 point

-

As I heard on msm tv today, IRS has determined that about 1 million people that were entitled to the third EIP did not claim or receive the payment of up to $1,400. The article below say IRS is making the payments automatically to the bank account it has on file or to the address of record if direct deposit information isn't available or if that method fails. Anyone who hasn't actually filed their 2021 return should do so by 4/15/25 to claim any portion of the EIP they may be due. https://www.cnn.com/2024/12/24/business/irs-tax-payments-recovery-rebate-credit/index.html1 point

-

I would have a stack of papers to shred. When it hit an inch, I put it out for shredding.1 point

-

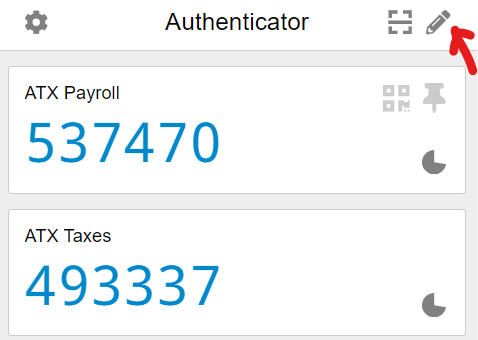

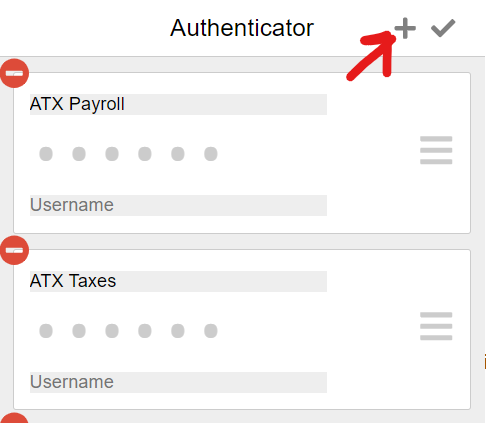

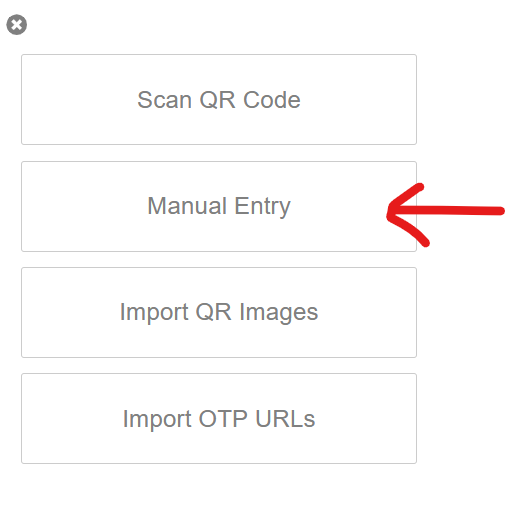

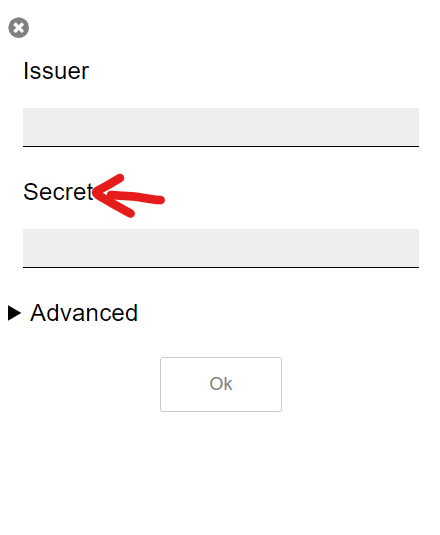

Yeah, I need my phone in order to log into my email and my accounting program. What I worry about is dropping my phone1 point

-

My Grandson, who works IT for a large Insurance Co; showed me his phone yesterday. He has pages of authenticator codes. It's a good thing he is young. I guess I should be able to handle two. He said that his scenario is what is ahead for all of us.1 point

-

1 point

-

My favorite is when the download the PDF of their brokerage 1099 and instead of sending me the PDF they print it out NOT ROTATED to landscape, so it's tiny. That's just stupid.1 point

-

I have two clients that insist on coming to see me, usually bearing small gifts, but their returns are very simple. One client has a very complex return but still wants to visit when it's completed to review. She does upload documents to the portal. I get documents (scan to my laptop) at one client couple in assisted living and deliver the returns when completed. All others are on my time table. I have a poster wit my office hours - likely you all have seen it, too, but it's real for me: Open most days about 9 or 10. Occasionally as early as 7, but SOME DAYS as late as 12 or 1. We close about 5:30 or 6 and occasionally about 4 or 5, BUT sometimes as late as 11 or 12. Some days or afternoons, we aren't here at all and lately I've been here all the time EXCEPT when I'm someplace else. The latter timing was very appropriate when I was training for spring marathons over 12 years. It was so great to go out for my runs in the middle of the day for a break!1 point

-

I do the returns for about a dozen clients while they wait. It's actually very enjoyable and I enjoy talking with them as I do the returns. I could totally see the benefits of going that route but I can't imagine doing a complicated return that way. Most of my clients it is a system of drop off today and pickup in two days. How many people actually pick up / drop off for clients? Most evenings I have a few stops to make on my way home from work. Senior clients LOVE having that service.1 point

-

1 point

-

I had a WC auditor come audit my tiny payroll which included my kids at the time. I remember him asking me what they did with their money. I told him I didn't ask me other employees what they did with their money so why would I ask them. He just rolled his eyes.1 point

-

I'd rather that, than the ones who open the docs with a chainsaw - half the docs are ripped to shreds!1 point

-

You don't have the type of clients I have. It takes me that long just to sort most of my clients' docs, longer if I have to open the envelopes. Why, oh why, can't they at least open their mail? Especially annoying are the ones where you have to fold this flap first, tear here, tear there, tear your hair out.1 point

-

Doing returns in front of the client makes a clean desk mandatory. You can't have a scrap of paper with another client's info on your desk when someone else is sitting there. Maybe we all should schedule one in-person client a week to force us to clean up those desks (like when company's coming). You have to be careful when you have a monitor for the client's viewing. When I worked at Block, any client notes you wrote last year came up when you opened that client. One preparer had written "This client is a PIA," and that's the first thing that showed on the screen.1 point

-

I'w afraid I would get distracted and overlook something or make a mistake. I need the extra time to double check everything1 point

-

So you prepare most of your tax returns while your clients are sitting there and following along? I don't think I could do that1 point

-

Client comes in.. by appt.. they bring their docs.. I prepare the returns.. they follow along on their own screen.. print out, signed, efiled.. i give them their docs back and their copy.. desk ready for next client!1 point

-

I agree, my desk tends to look a bit messy. Once in awhile I even loose things on my desk1 point

-

I don't believe you are a tax preparer with a desk that clean!!!!!!!!!!!!! Mine has not been that clean since the day I put the desk in the office. Tom Longview, TX1 point

-

1 point

-

1 point

-

Geez, and I thought I was the bees knees with my single new curved 32 inch monitor. I just can't keep up with the youth of today!1 point

-

1 point

-

1 point